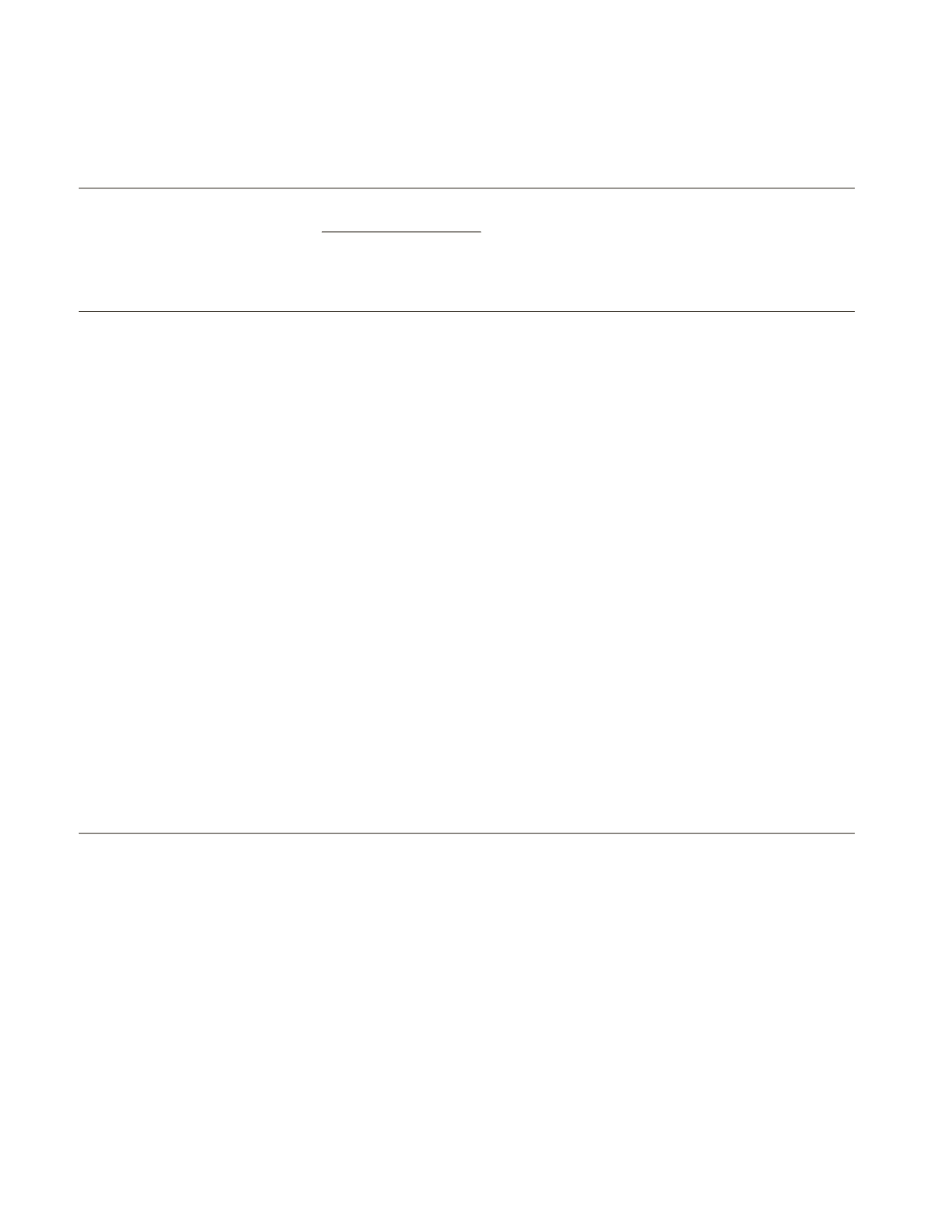

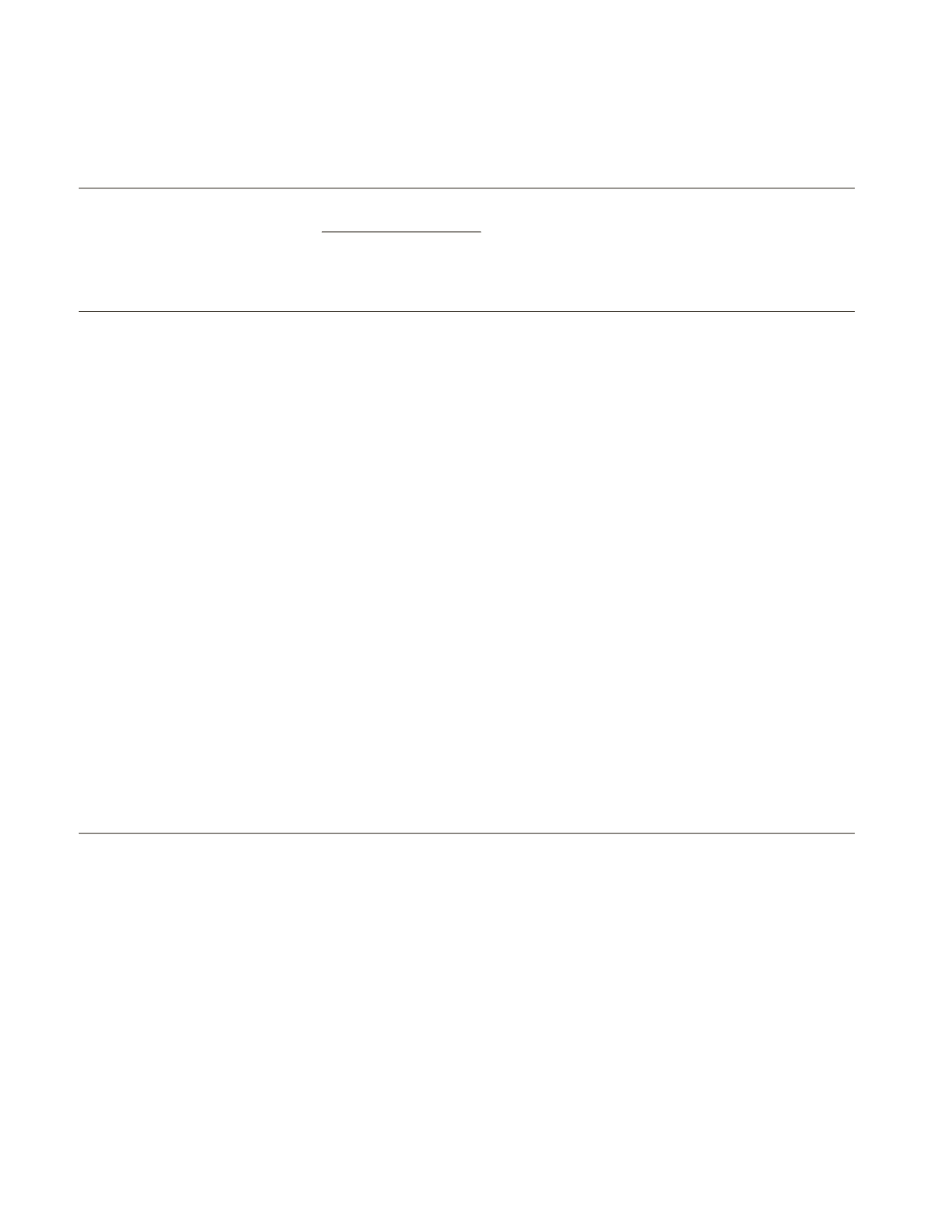

f i nanc i a l i nc lu s i on i n i nd i a

41

A

PPENDIX

2.1

Financial Inclusion Outreach of Banks—as on 31March 2014

S. No Bank

No. of villages covered with Total

No. of

No. of

No. of

No. of

population (till date)

no-frills

GCCs

KCCs

BCs

above 2000 below 2000

accounts

(in lakhs)

issued

opened

(in lakhs)

under FIP

(in lakhs)

Public Sector Banks

1.

Allahabad Bank

4912

38.69

0.037

10.46

2BCs and

2880CSPs

2.

Bank of Baroda

13,979

74.66

0.04

11.44

3.

Bank of India

4,404

14,060

107.28

22.10

6072 BCAs

4.

Canara Bank

1,624

3,860

5,484

85.46

3.89

46.24

2402

5.

Central Bank of India

4,330

6,743

11,073

92.27

5588

6.

Corporation Bank

318

1,084

1,402

21.26

0.375

7.

Dena Bank

1,238

2,190

3,428

24.55

0.22

2.95

1530CSPs

8.

IDBI

8.79

9.

Indian Overseas Bank

4,445

7,816

12,261

59.21

2456

10.

Punjab and Sind Bank

400

2,316

2,716

1.45

1.545

11.

State Bank of Bikaner and Jaipur*

1,207

1,359

2,566

18.07

0.008

6.03

1070CSPs

12.

State Bank of India

52,260

353

11423

13.

State Bank of Travancore

25.56

14.

UCO Bank

1,833

7,802

9,635

40.23

Private Banks

15.

Axis Bank

74

74000BCAs

16.

HDFC

27.5

17.

ICICI Bank

15,500

178

125BCs and

8200 CSPs

18.

YES Bank

YES

MONEY-

15400BCAs,

15BCs

YES LEAP-

35BCs

Source

:

Annual reports 2013–14 of various banks

.

Note

: *As on May 2014.