i nc lu s i ve f i nanc e i nd i a re port 2014

54

out of which 170 could not be surveyed, because of being

unreachable or unwilling, having stopped CSP work or

unhappy with it. It reported that a large proportion of

these agents were no longer offering services with about a

quarter of the CSPs being dormant and unavailable.

About 25 per cent of CSPs (215/860) were unable to

transact mainly because of technological barriers such

as poor connectivity and defective cards or devices. This

compares with Microsave’s estimates of CSP dormancy

of 22–43 per cent. 29 per cent of CSPs offered only one

product category, 23 per cent offered two products and

16 per cent offered only no-frills accounts. Median num-

ber of transactions was 14 per day and over 58 per cent of

respondents reported that they earned less than Rs. 3,000

per month and 21 per cent reported that they earned less

than Rs. 1,000 per month. The median monthly income

of CSPs was Rs. 2,735.

There was a marked difference between rural and urban

CSPs. While there was hope for a sustained business

case for CSPs in urban areas, rural CSPs had fewer

transactions and revenues and were not sustainable. It

highlighted that improving remuneration of CSPs should

be a priority and banks should provide marketing support

to increase their number and value of transactions. The

study had concluded that the business case for the CSP

network remains to be proved and that banks would need

to invest in making financial inclusion a part of their

core business.

The second round of the above CAB-CGAP survey

was conducted during September–November 2013. The

findings suggest that a substantial number of the CSPs

were untraceable and of even those found to be work-

ing a significant number had never conducted a single

transaction.

3

The team tried to contact 2,358 CSPs of

whom only 1,254 could be surveyed and of remaining

11,04, 983 were not reachable and 87 unwilling to be in-

terviewed. Thus only 53 per cent of the BC agents could

be reached with the remaining 47 per cent untraceable.

The survey also found that attrition rate of BCs ranged

between 25 and 34 per cent per annum, thereby raising

a question mark about the sustainability of the model.

Of the 860 CSPs surveyed in 2012, 15 months later

only 500 remained agents could be surveyed with 93

unreachable. Thus a minimum of 267 CSPs and up to a

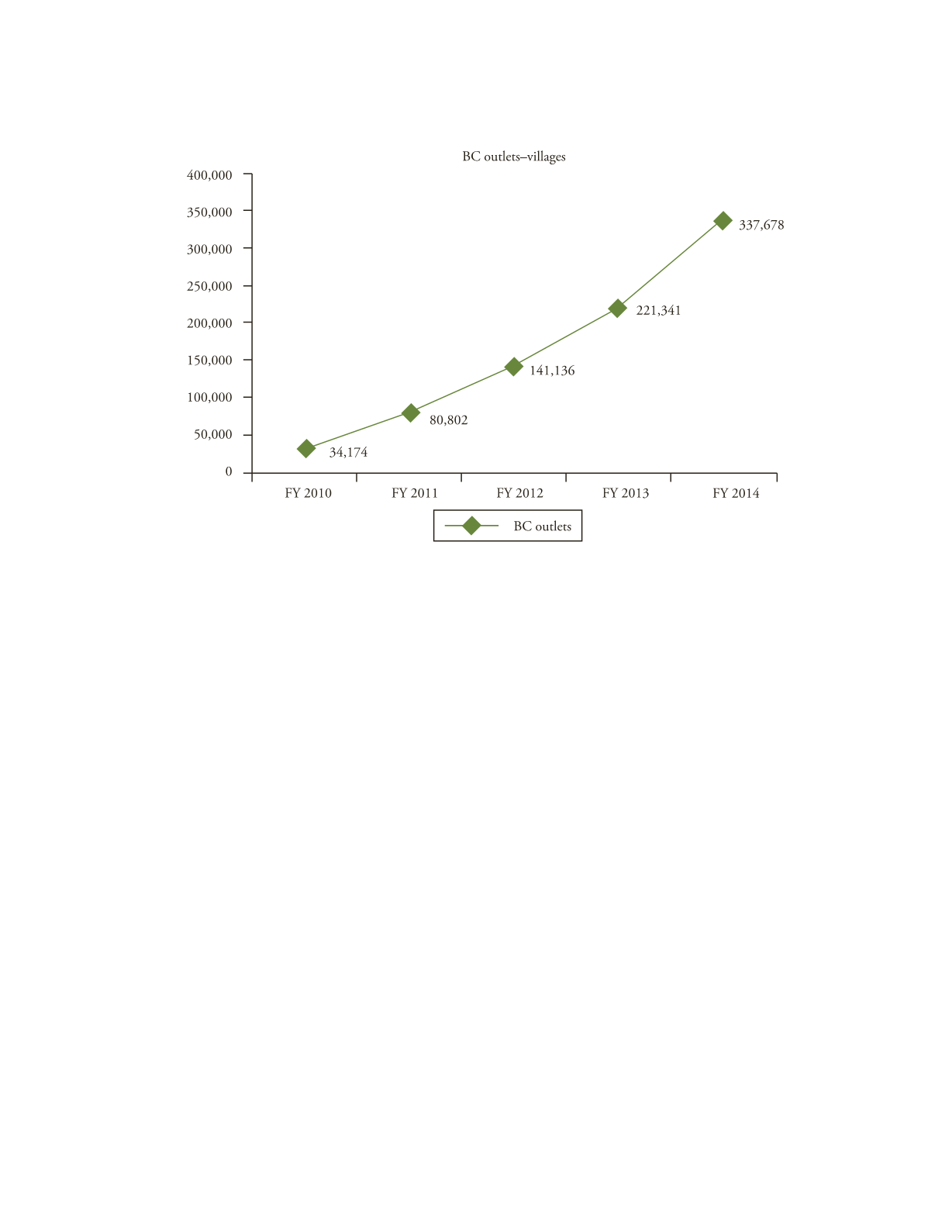

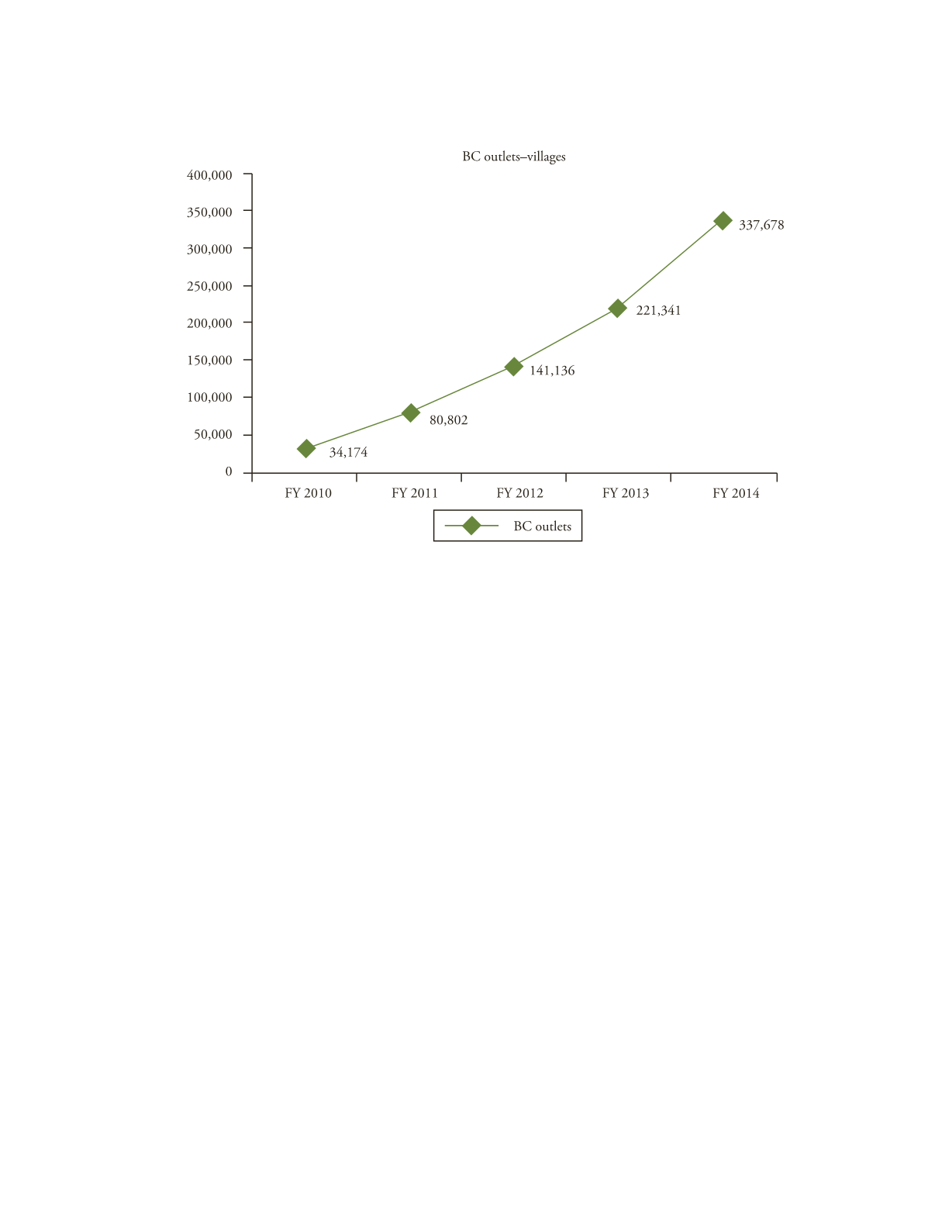

F

IGURE

3.1

India: Number of BC Outlets

Source

:

RBI Annual Report 2013–14

.