238

making it difficult to provide low cost banking services to the unbaked

poor. However, banks do not seem willing to pay reasonably to these

people from the unorganised sector. The poor BCs are paid so low that

people accept this job only if they do not have any other option and at

the very fi rst opportunity, leave the BC’s work. The BC needs to be

paid reasonably and also supported through appropriate ICT enabled

infrastructure. How do we integrate the BC model with the overall

delivery model of the banking services is another challenge for making

financial Inclusion a reality (Chakrabarty 2013, p.14)

Equally Unrealistic is the Nature of Targets Set for Financial Inclusion

Broadly, the operational definitions of financial exclusion/inclusion

‘have evolved from the underlying public policy concerns that many people,

particularly those living on low income, cannot access mainstream financial

products such as bank accounts and low cost loans, which, in turn, imposes

real costs on them—often the most vulnerable people’ [H.M. Treasury (2004)

quoted in RBI, 2008a: 296]. Based on this broad perspective, the Reserve Bank

has approached the subject of financial inclusion with concrete measures to

‘connect’ people with the banking system. Apart from the coverage of villages

with the agency banking arrangement combined with a few ‘bricks and mortar’

branches, the measures initiated include introduction of ‘no-frills’ accounts

(Table 4.47), promotion of financial literacy and responsible borrowing and

encouraging adoption of ICT solutions for achieving greater outreach as also

for reducing transaction costs (RBI, 2008: 38-39). In November 2005, banks

were advised to make available a basic banking ‘no-frills’ account with low

or nil minimum balances. Similar types of accounts, though with different

names, have been extended by banks in various other countries with the same

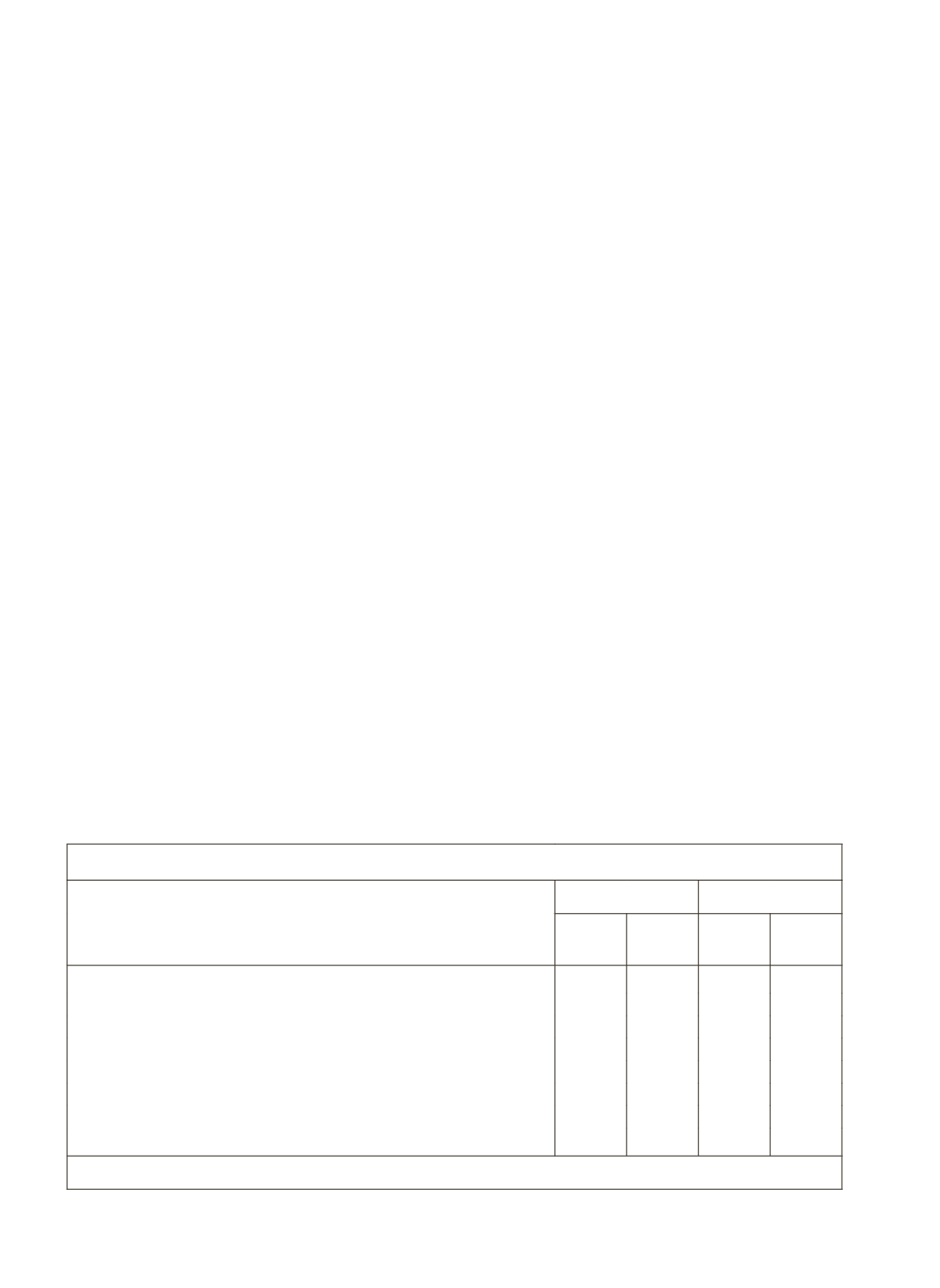

Table 9.4: Progress in No. Frill Accounts: Targets and Achievements

Parameters

Achievements

Targets

March

2010

March

2011

March

2012

March

2013

1. Number of ‘no-frills’ Accounts (NFAs) opened (in million)

49.55 74.39 109.60 153.30

2. Amount in NFAs (

`

crore)

4,895 6,566 9,311 11,323

3. Number of NFAs with Overdraft (OD) facilities (in million)

0.14 4.20 36.30 53.30

4. NFAs with OD amount outstanding (

`

crore)

9.10 199 1,446 2,228

5. Number of Kisan Credit Cards (KCC) issued (in million)

19.50 22.49 32.30 40.70

6. Amount Outstanding in KCC (

`

crore)

107,519 143,862 152,114 179,255

7. No. of General Purpose Credit Cards (GCC) issued (in million)

0.67 0.95 4.68 8.11

8. Amount outstanding in GCCs (

`

crore)

840 1,308 3,229 5,670

Source:

Chakrabarty (2011)