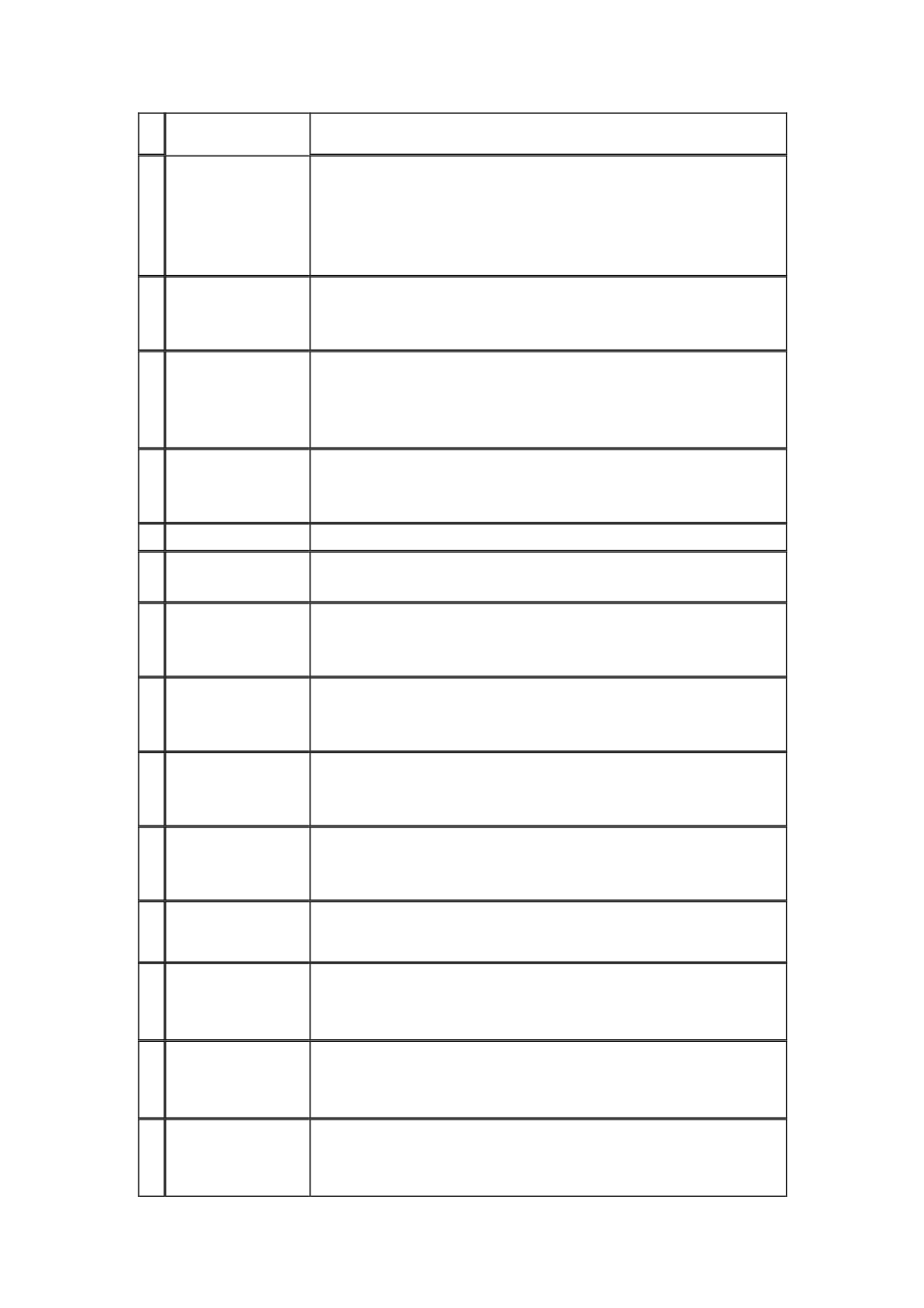

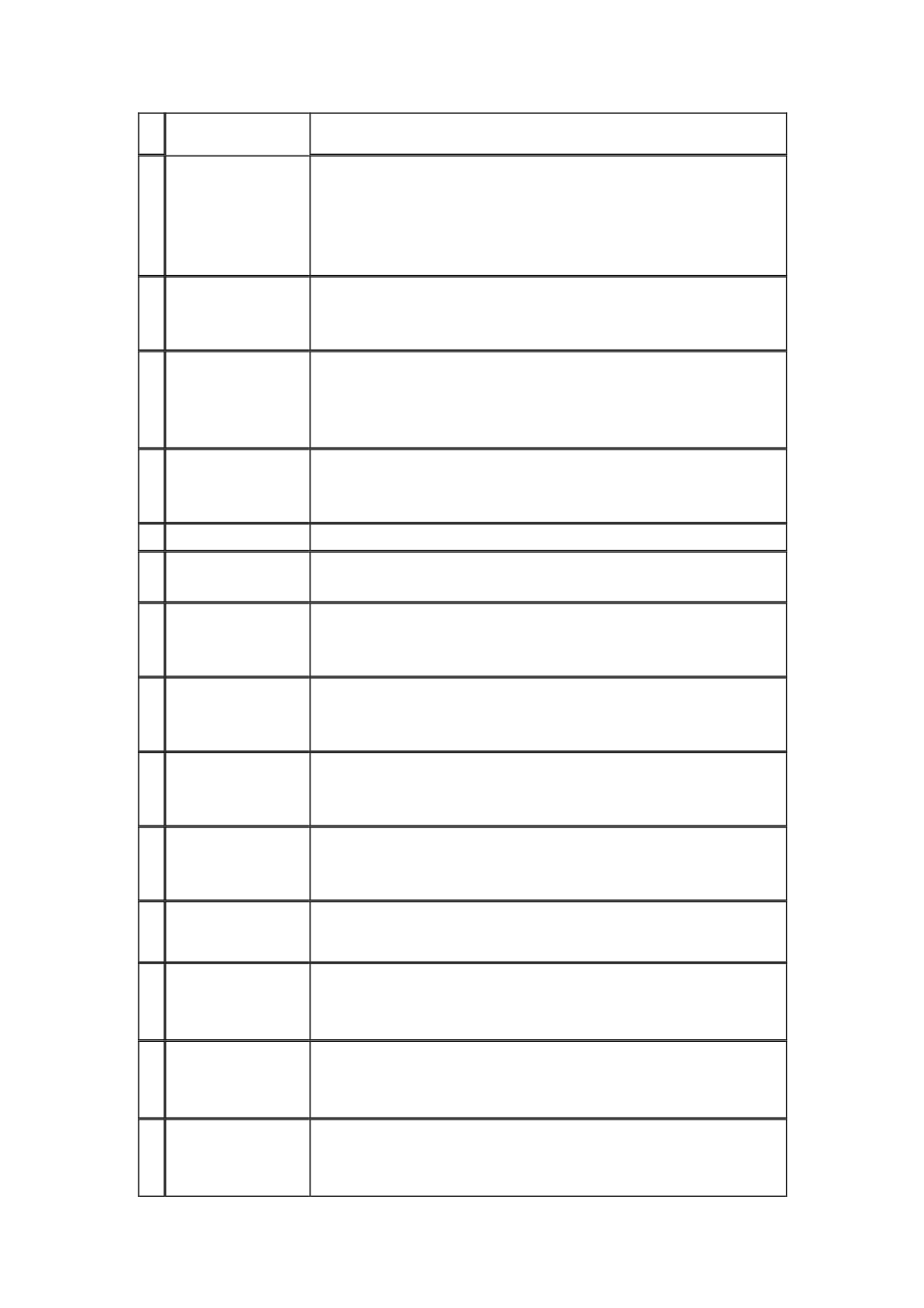

8

Sr

No

Name of the report

Brief Description

12

DOS -CCB3

PARTICULARS OF ADVANCES TO AND RECOVERIES FROM SOCIETIES VIS- A

-VIS DRAWALS FROM AND REPAYMENTS TO THE SCB UNDER SHORT-TERM

AND MEDIUM TERM CREDIT LIMITS SINCE THE DATE OF LAST INSPECTION

13

DOS -CCB5

CASH CREDITS LIMITS TO MARKETING, WEAVERS', PROCESSING,

CONSUMERS', ETC. SANCTIONED SINCE THE DATE OF LAST INSPECTION

14

DOS -CCB9

ANALYSIS OF OVERDUES UNDER LOANS, UNRENEWED CASH CREDITS AND

OVERDRAFTS AS AT THE END OF TWO PRECEEDING YEARS AND AS ON THE

DATE OF INSPECTION

15

DOS -CCB11

A. Statement of Legal Action taken by the bank against defaulters during

the last two years and as on the date of inspection

16 DOS -CCB13

MIS report for inspection

17

DOS -CCB14

DUES FROM SOCIETIES UNDER LIQUIDATION AS ON THE DATE OF

INSPECTION

18

DOS – CMA III

Bank-wise position of non-agricultural loans exceeding the prescribed

ceiling for the quarter ended ---------

19

DOS – CMA IV

Position of banks whose sector-wise exposure to non-agricultural

advances and loans exceeded the prescribed ceiling, for the quarter

20

OSC 1 - part 3 - Top

10 Depositors

Particulars of top 10 depositors accepted from other

banks/institutions/individuals as on the date of review.

21

Age wise Break up of

Branch Adjustment

Account

Age-wise break up of Branch Adjustment account

22

Unsecured

Guarantees issued by

bank

Unsecured guarantees issued by the bank

23

Sundry Debtors – 1

Sundry debtors account – 1 (Entries of large amounts (above

`1.00 lakh) pending for more than 6 months but less than 1

year)

24

Sundry Debtors – 2

Sundry debtors account – 2 (Entries of large amounts (above

`1.00 lakh) pending for more than 1 year but less than 3 years)

25

Sundry Debtors – 3

Sundry debtors account – 3 (Entries of large amounts (above

`1.00 lakh) pending for more than 3 years)