i nc lu s i ve f i nanc e i nd i a re port 2014

22

BCs, ATMs, and satellite branches. All these unbanked

villages have been covered by opening banking outlets

comprising 2,493 branches, 69,589 villages covered by

BCs with 2,332 villages covered through other modes. In

order to continue with the process of ensuring meaning-

ful access to banking services to the excluded, banks were

advised to draw up fresh three-year FIPs for 2013

–

16.

Banks were also advised to ensure that the FIPs prepared

by them were disaggregated and percolated down to the

branch level so as to ensure the involvement of all the

stakeholders in financial inclusion efforts and also to

ensure uniformity in the reporting structure under FIPs.

The focus under the new plan thus was more on the

volume of transactions in the large number of accounts

opened.

In Phase II, under the roadmap for provision of

banking outlets in unbanked villages with population

less than 2,000, about 4,90,000 unbanked villages have

been identified and allotted to banks for coverage in a

time-bound manner by 31 March 2016. RBI is closely

monitoring the progress made by the banks under the

roadmap.

By March 2014, according to reports received from

State-Level Bankers’ Committees (SLBCs), banks had

opened banking outlets in 1,83,993 unbanked villages,

comprising 7,761 branches, 1,63,187 BCs and 13,045

through other modes. However, villages covered by all

modes still only represent less than 38 per cent of total

unbanked villages. Undoubtedly the balance of smaller

and more scattered and remote villages that remain to

F

IGURE

2.1

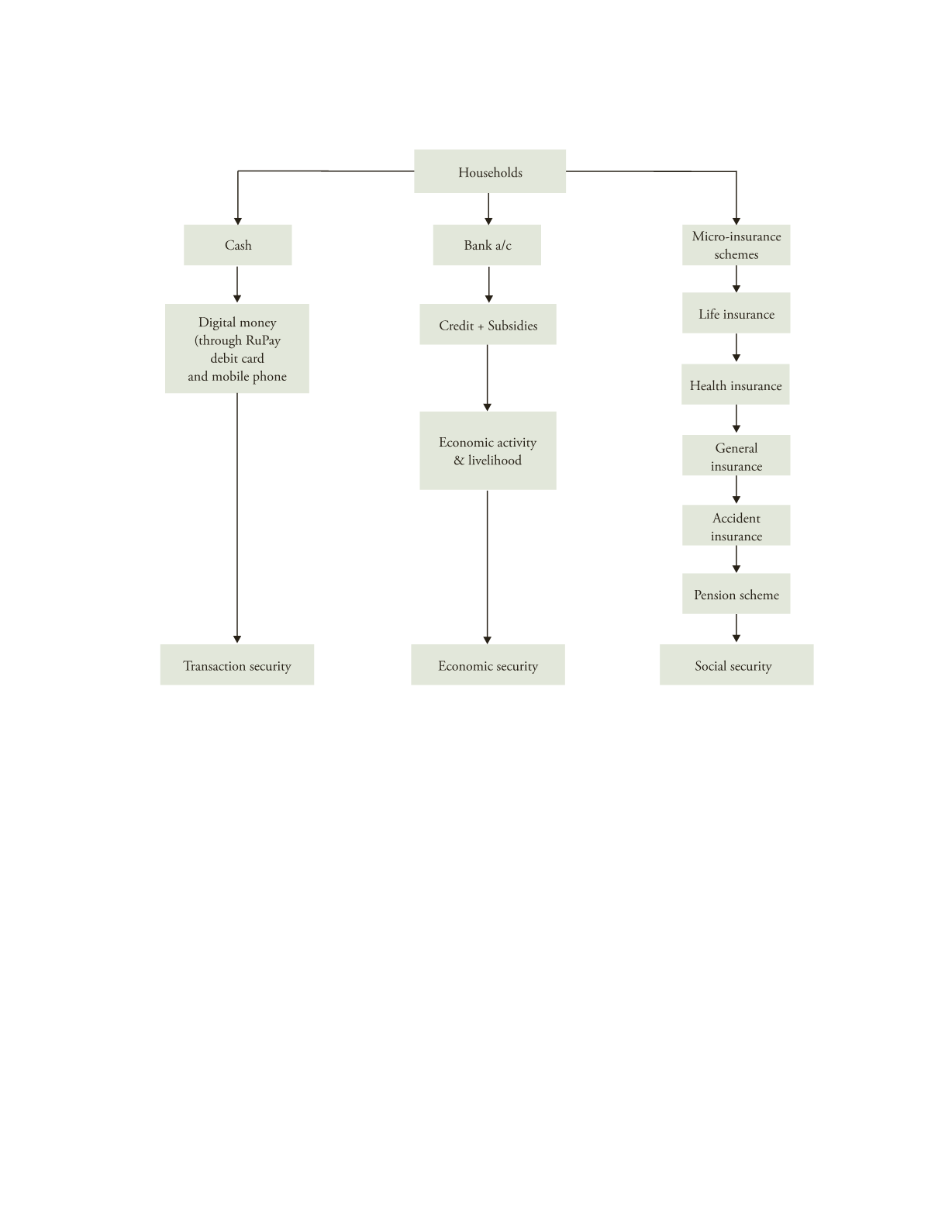

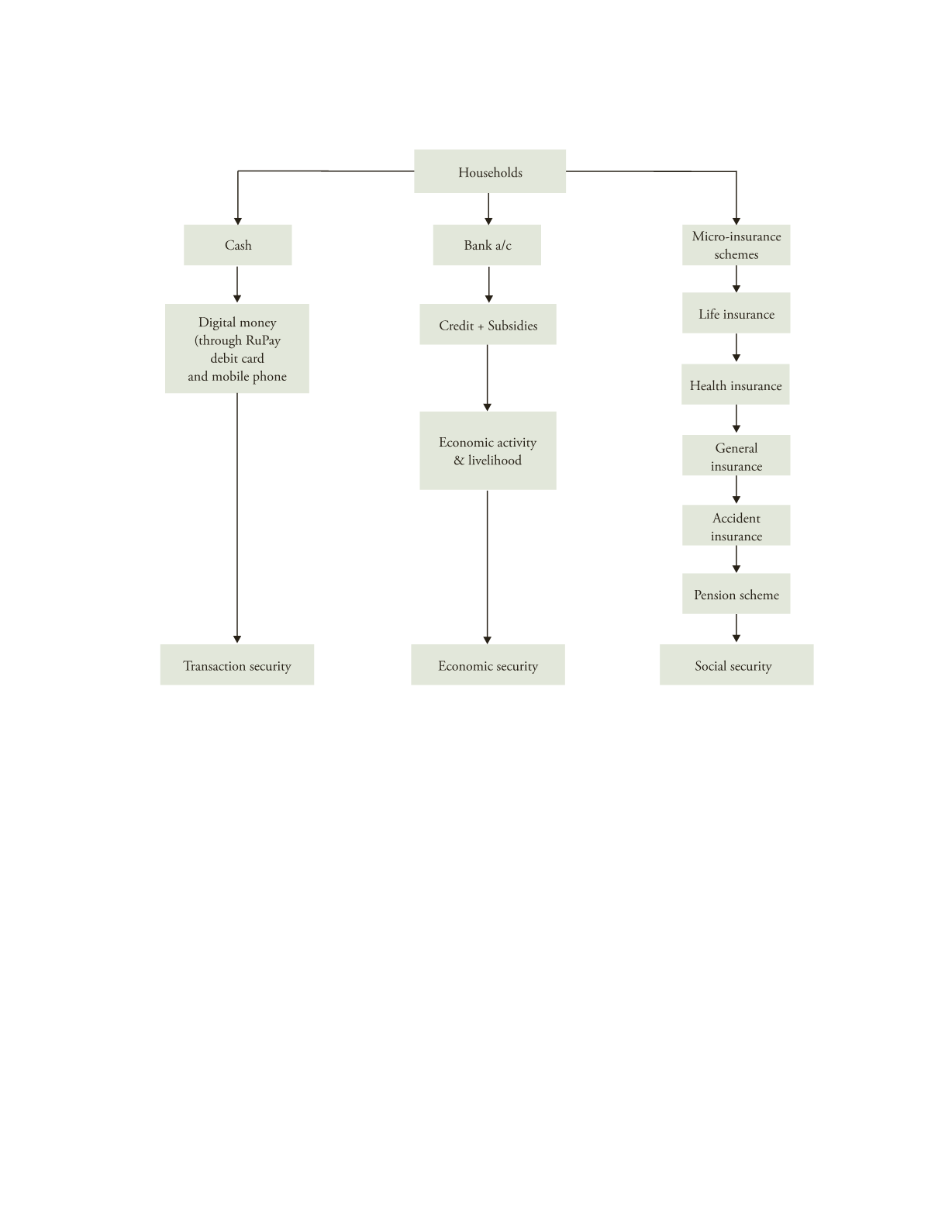

Impact of Financial Inclusion on Households

Source

: GoI (2014) Pradhan Mantri Jan-Dhan Yojana document.