i nc lu s i ve f i nanc e i nd i a re port 2014

12

eratives. It will be seen that the number of accounts far

exceeds the adult population of the country. This is on

account of the fact that the banking system has multiple

accounts for the same customer within the same bank as

also across banks.

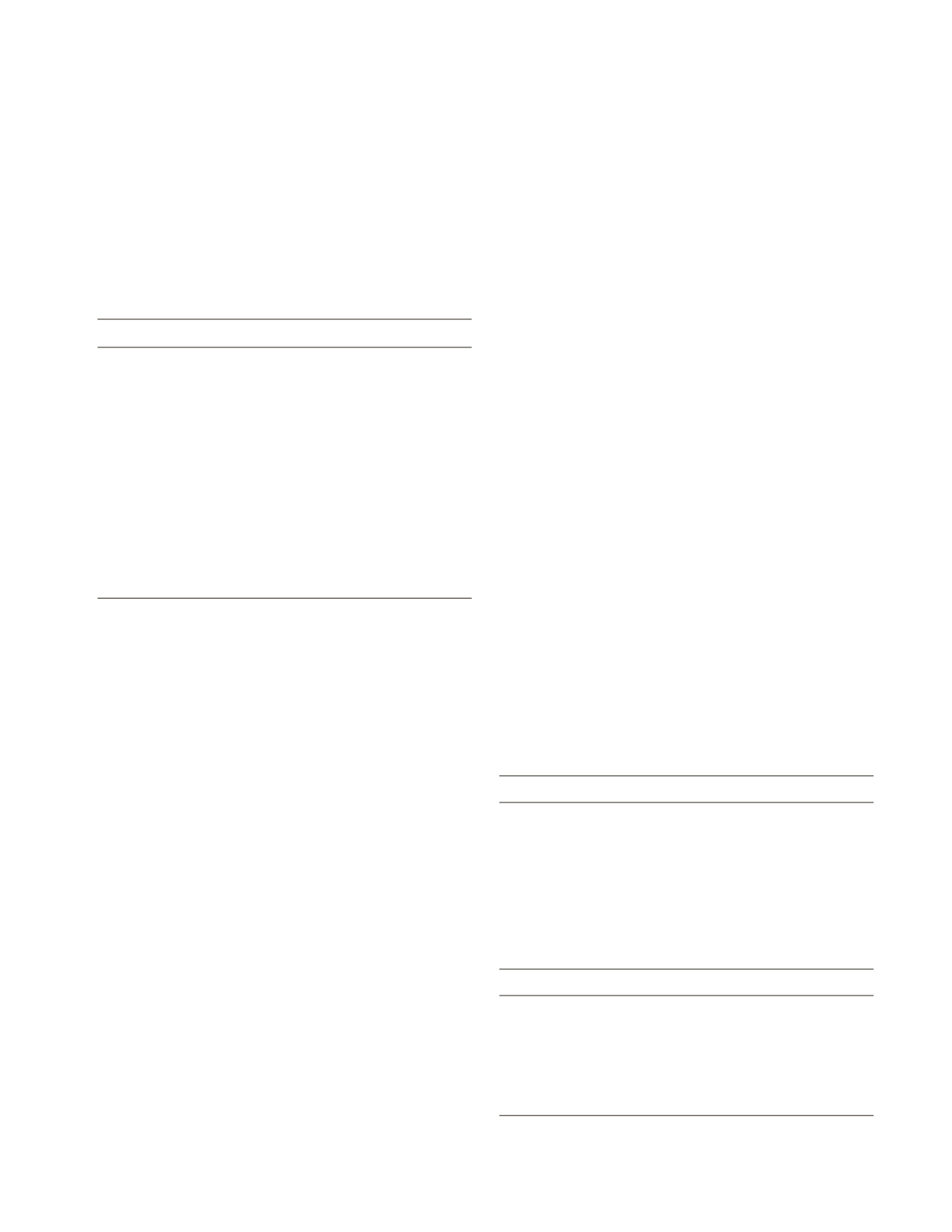

T

ABLE

1.6

Deposits and Loan Accounts with Banks and

Other Agencies

In million

No. of adults (in million)

840

No. of deposit accounts with banks (March 2012)

903

No. of BSBDA accounts with banks (March 2014)

243

No. of deposit accounts with post office

115.8

(March 2012)

No. of accounts with primary cooperatives

139.4

(March 2013)

No. of borrowers with primary cooperatives

43.08

(March 2013)

No. of loan accounts with Banks (March 2012)

130.88

No. of loan accounts with MFIs (March 2014)

27.53

No. of saving SHG members (March 2014)

96.6

No. of borrowing SHG members (March 2014)

54.6

Source

: Government of India, Census 2011 for population; RBI

(2013),

Basic Statistical Returns 2012

for banking data;

India Post

Annual Report 2013

for post office data; National Federation of

State Cooperative Banks (NAFSCOB) for data on cooperatives;

MIX Market for MFI data; and NABARD (2014) for SHG data.

If we consider only the basic savings bank deposits

accounts (BSBDAs) as contributing to financial inclusion,

we still have a total of 594.8 million savings accounts

and 256.09 million loan accounts. Set against an adult

population of 840 million according to the 2011 Census,

this would appear to be a reasonable coverage. It may be

noted that BSBD accounts under the financial inclusion

plans have gone up more than three-fold in three years

from 74.4 million as of March 2011 to 243 million as

of March 2014. Other types of deposit accounts have

registered a more nominal increase in the range of 10–20

per cent during a similar period. On the other hand,

there has been a decline in the number of loan accounts

during this period—through a decline in the borrowing

members of primary cooperatives, MFIs and SHGs.

The Mor Committee had estimated that the average

urban account holder held four bank accounts, and the

rural account holder 1.5 bank accounts.

1.5.1 Microfinance Penetration Index (MPI)

The Crisil Inclusix index provided estimates of state-wise

degree of inclusion in respect of data related to scheduled

commercial banks and RRBs. The microfinance pen-

etration index (MPI) provides estimates of the relative

share of the states in microfinance clients

28

as compared

to their share in the population. Similarly, the value of

the Microfinance Poverty Penetration Index (MPPI)

is derived by dividing the share of the state in microfi-

nance clients by the share of the state in the population

of the poor. Hence, a value more than 1 indicates that

the state’s share in microfinance clients was more than

proportional to its population, indicating better than

par performance. A score of less than 1, which is the

par value, indicates a comparatively poor performance

by the state. Similar estimates have been conducted in

earlier

Microfinance State of the Sector Reports

, with the

last exercise being carried out in 2012. State-level poverty

data for the present exercise has been taken from the

Report of Rangarajan Committee on Poverty

(Government

of India, 2014) and population data from the Census

2011. The ranking of the best and worst performing

states is given in Table 1.7. The state-level scores and

details for all the states are given in Appendix 1.2.

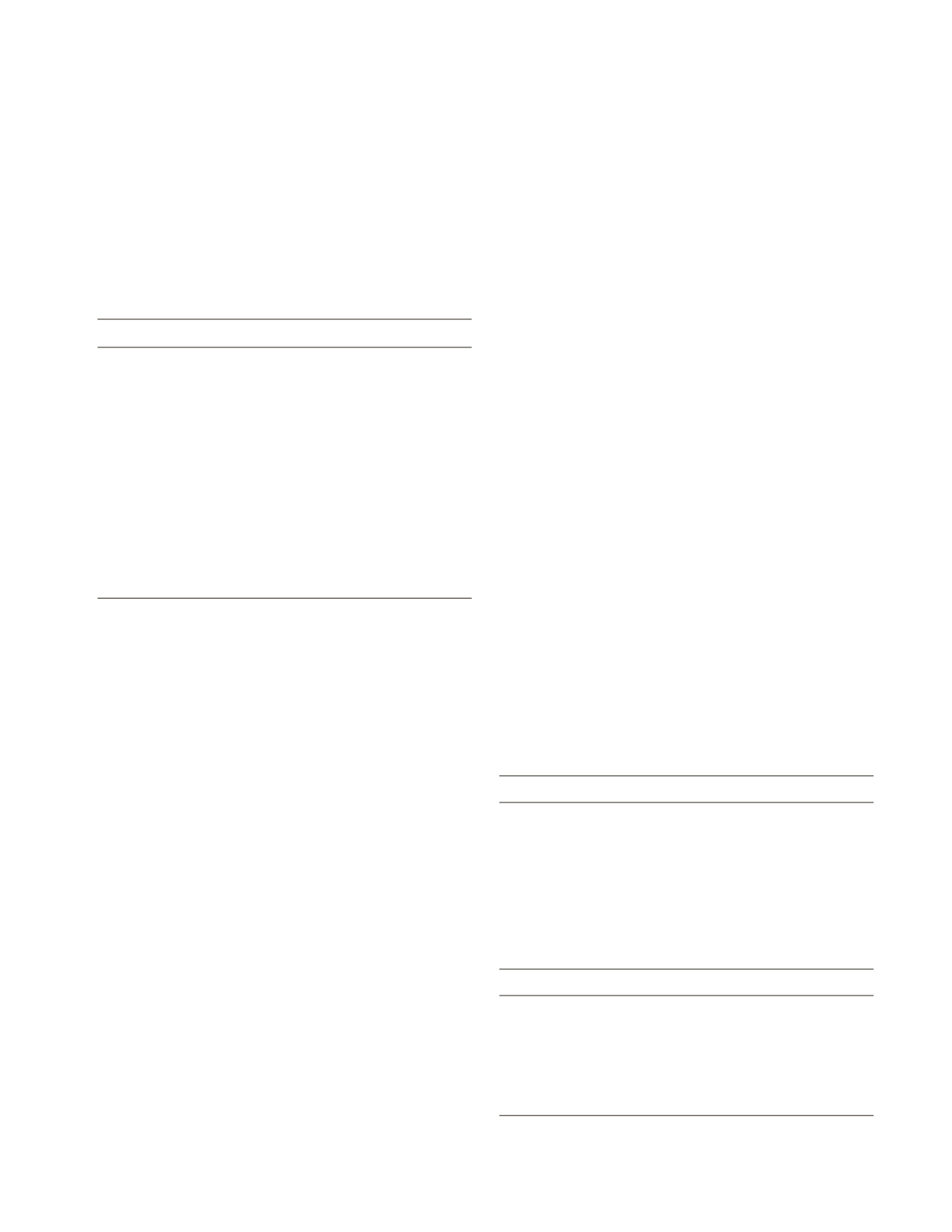

T

ABLE

1.7

Ranking of Select States based on MPI and MPPI

(31 March 2014)

Top 6 states

MPI

MPPI

Andhra Pradesh

3.38 Puducherry

10.75

Puducherry

2.87 Andhra Pradesh

7.32

Karnataka

2.27 Andaman and

3.23

Nicobar Islands

Tamil Nadu

1.91 Karnataka

3.07

West Bengal

1.54 Kerala

2.68

Odisha

1.54 Tamil Nadu

2.52

Bottom six states

MPI

MPPI

Jammu and Kashmir 0.01 Jammu and Kashmir

0.02

Mizoram

0.02 Mizoram

0.02

Lakshadweep

0.04 Lakshadweep

0.05

Arunachal Pradesh

0.06 Arunachal Pradesh

0.05

Chandigarh

0.09 Chandigarh

0.12

Nagaland

0.16 Manipur

0.19