216

much the larger part of the increase in credit to GDP ratio has occurred in

long-term disbursements, and more so in outstandings, because of staggered

repayment schedules. Again, because the commercial banks took a back seat

in the 1990s, the sharpest fall in the ratio has occurred in long-term farm

credit outstandings (Table 8.3).

Official series for the 1990s and thereafter

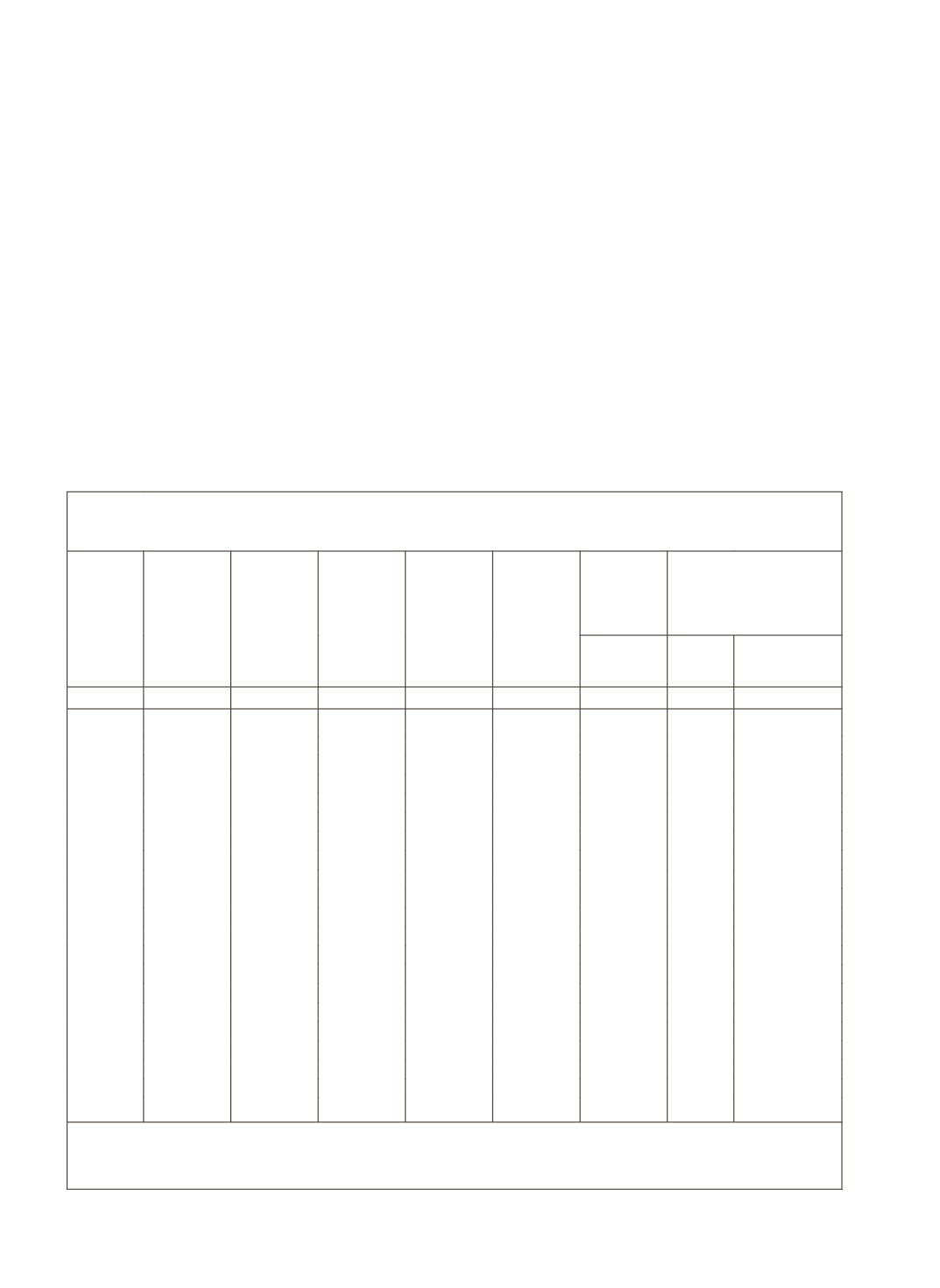

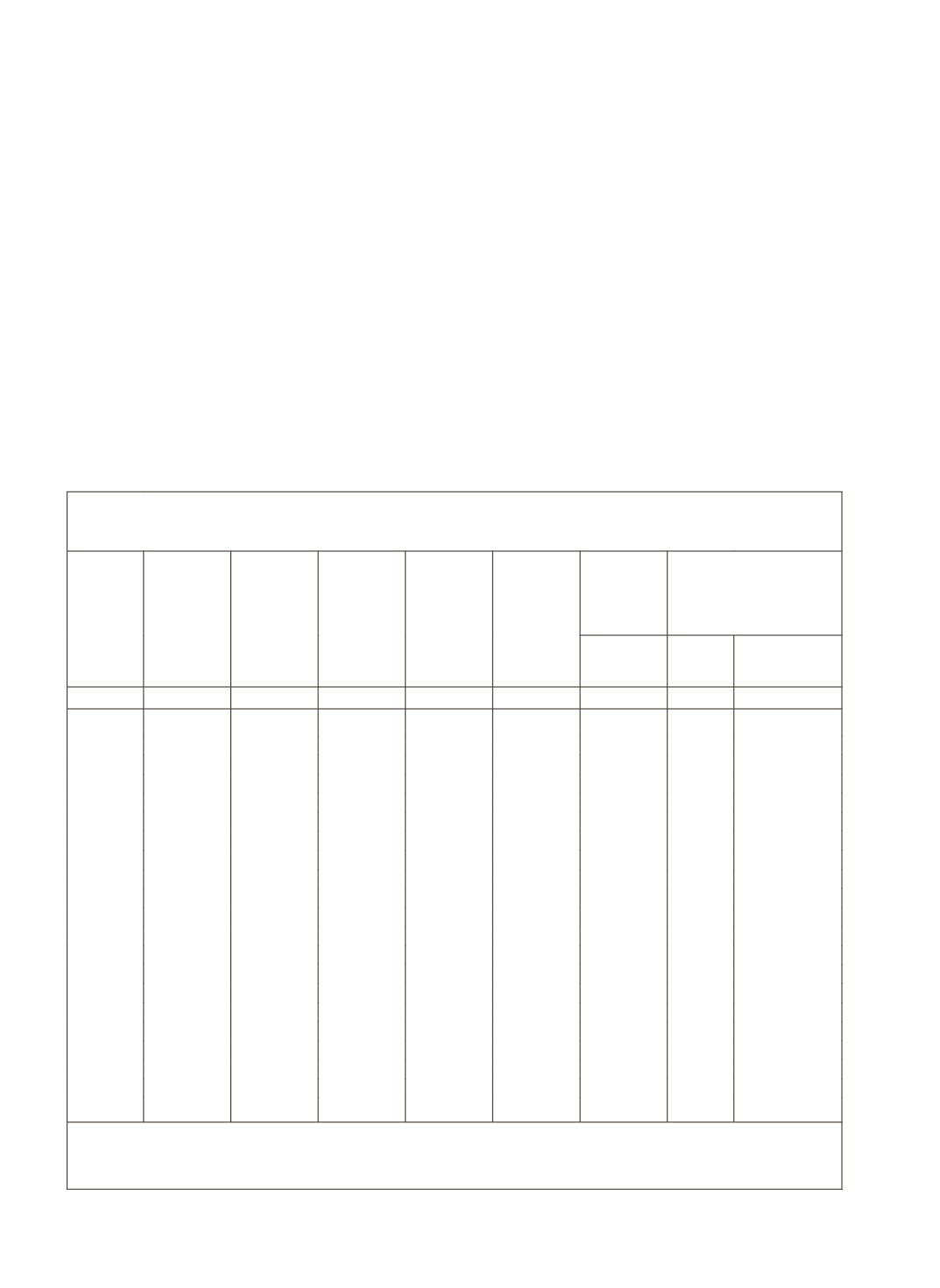

We have discussed the profiles of fresh data disseminated by NABARD

in coordination with RBI for the 1990s and thereafter, the relevant data are

presented in Table 8.4 (original series) along with the ratios displaying the

relationship between credit and real sector indicators.

The fresh credit flow data so worked out are thus related to four demand-

side indicators: gross value of gross output; sectoral GDP; inputs; and gross

capital formation. These data confirm that after 2000-01 or thereabout, there

Table 8.4: Total Ground-Level Flow of Institutional Credit for Agriculture and

Allied Activities in Relation to Output, Inputs and GDP

-

Official Series

Year

Value of

Output

of

Agriculture

and Allied

Activities

(

`

Crore)

Value of

Input of

Agriculture

and Allied

Activities

(

`

Crore)

GDP from

Agriculture

and Allied

Activities #

(

`

Crore)

Short-Term

Credit

(

`

Crore)

Total Credit

Flow (Short

and

Long Term)

(

`

Crore)

Short-Term

Credit as

Percentage

of

Total Credit Credit as

Percentage of

Value

of Input

Value of

Output

Agriculture

GDP

(1)

(2)

(3)

(4)

(5)

(7)

(8)

(9)

(10)

1991-92 210108 60361 180313

11202

5.3

6.2

1992-93 232571 64613 202219

15169

6.5

7.5

1993-94 266297 71121 234566 11271 16494

15.8

6.2

7.0

1994-95 306075 81709 270107 11932 18744

14.6

6.1

6.9

1995-96 335498 92302 293701 14525 22032

15.7

6.6

7.5

1996-97 392046 95539 353142 16998 26411

17.8

6.7

7.5

1997-98 416589 106617 374744 20640 31956

19.4

7.7

8.5

1998-99 478802 119828 430384 23903 36860

19.9

7.7

8.6

1999-00 512628 138082 455302 28965 46268

21.0

9.0

10.2

2000-01 512970 137338 460608 33314 52827

24.3

10.3

11.5

2001-02 553591 147343 498620 40509 62045

27.5

11.2

12.4

2002-03 540755 153174 485080 45586 69560

29.8

12.9

14.3

2003-04 615691 170561 544667 54977 86981

32.2

14.1

16.0

2004-05 638530 175865 565426 76062 125309

43.3

19.6

22.2

2005-06 716839 194936 637772 105350 180486

54.0

25.2

28.3

2006-07 801496 214187 722984 138455 229400

64.6

28.6

31.7

2007-08 828785 231800 836518 181393 254658

78.3

30.7

30.4

2008-09 1049121 264214 943204 210461 301908

79.7

28.8

32.0

2009-10 1199744 301056 1083514 276656 384514

91.9

32.0

35.5

2010-11 1416441 354437 1306942 335550 468291

94.7

33.1

35.8

2011-12

1465753

509040

34.7

Note:

Data are at Current Prices.

Source:

(i) Value of output, Value of inputs and GDP are from

CSO’s National Accounts Statistics 2012

and back

series (ii) For Credit flow, data see earlier Table 5.9.