214

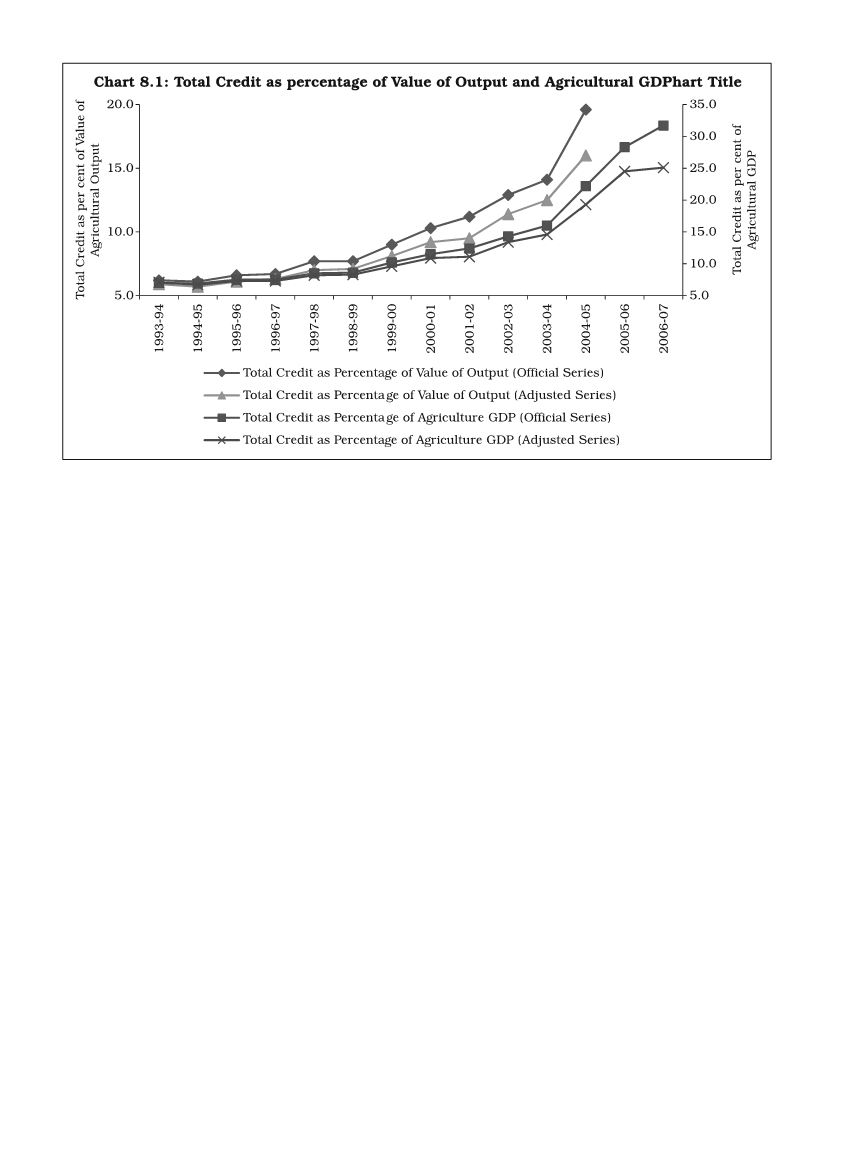

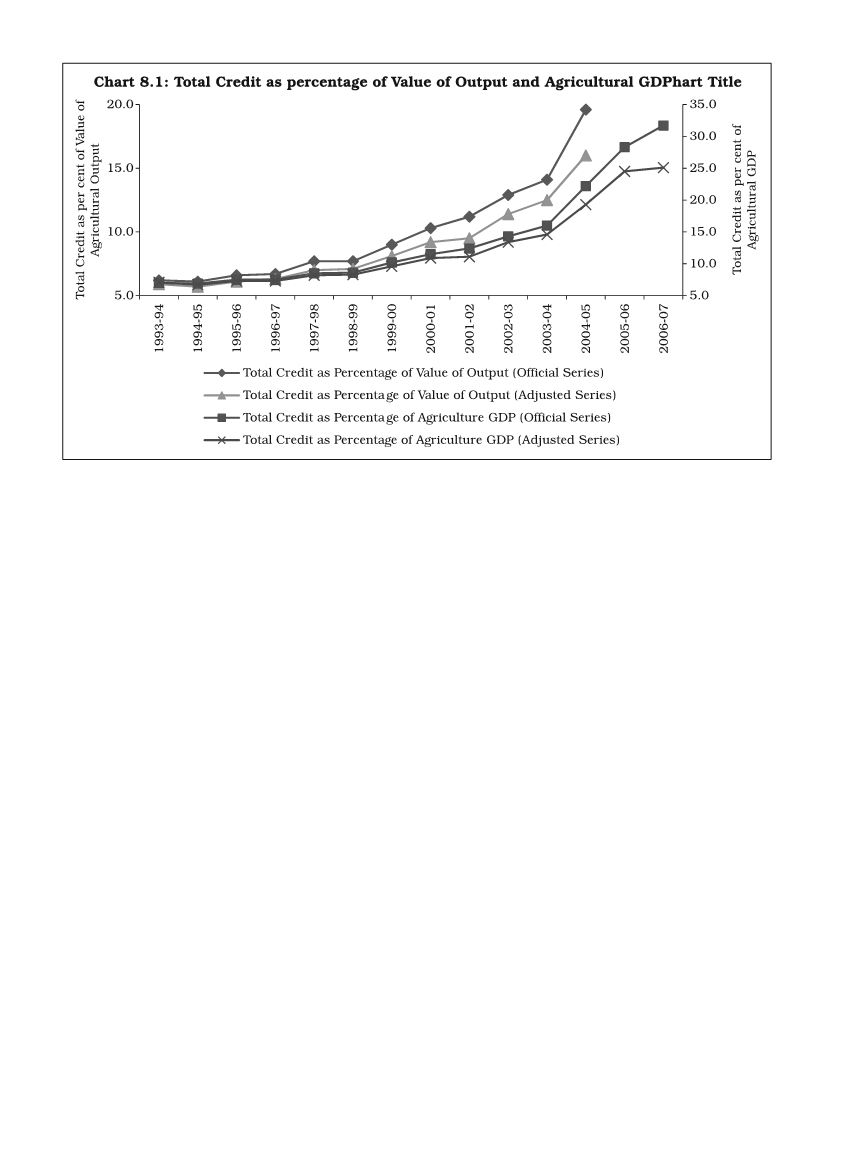

ratio for the sector, from 9.4% in 1997-98 to 27.1% 2005-06 and further to a

whopping 35%-36% in years 2009-10/2010-11.

Thereby hangs an important supply-side story of commercial banks

behaviour, to which we have made pointed reference in Chapter 4 earlier. The

three-phase behaviour of credit to GDP ratios – expansion, slowdown and

rapid rise – has been almost similar when we consider total agricultural credit

including indirect lendings (Part B of Table 8.1). When we juxtapose bank credit

to sectoral GDP ratios of all the three major sectors – agriculture, industry

and services, we find that there has hardly been any erosion in these ratios in

respect of industry and services to the extent that have occurred for agriculture

in the 1990s. While, for the services sector, the ratio has been continuously

on the uptrend, the industry ratio fell only for a brief period in the mid-1990s

and continued to rise thereafter – so much so that the industry’s credit share

at 80.5% in 2010-11 has touched more than three times the industrial sector’s

GDP share at 26.1 (Table 8.2); likewise, the services sector credit share at

50.6% has grown fast and come close to the sector’s GDP share at 56.5%. Any

detailed probing into the behaviour of these sectoral ratios is beyond the scope

of this study, but there is no doubt that the agricultural sector has received

some step-motherly treatment in the hands of the scheduled commercial

banks, which brought about the social pressure to implement the policy of

doubling of bank credit for the sector during the recent years (2004-05 and

thereafter) though such a knee-jerk reaction by government is also fraught with

many an adverse consequence (more on it later).