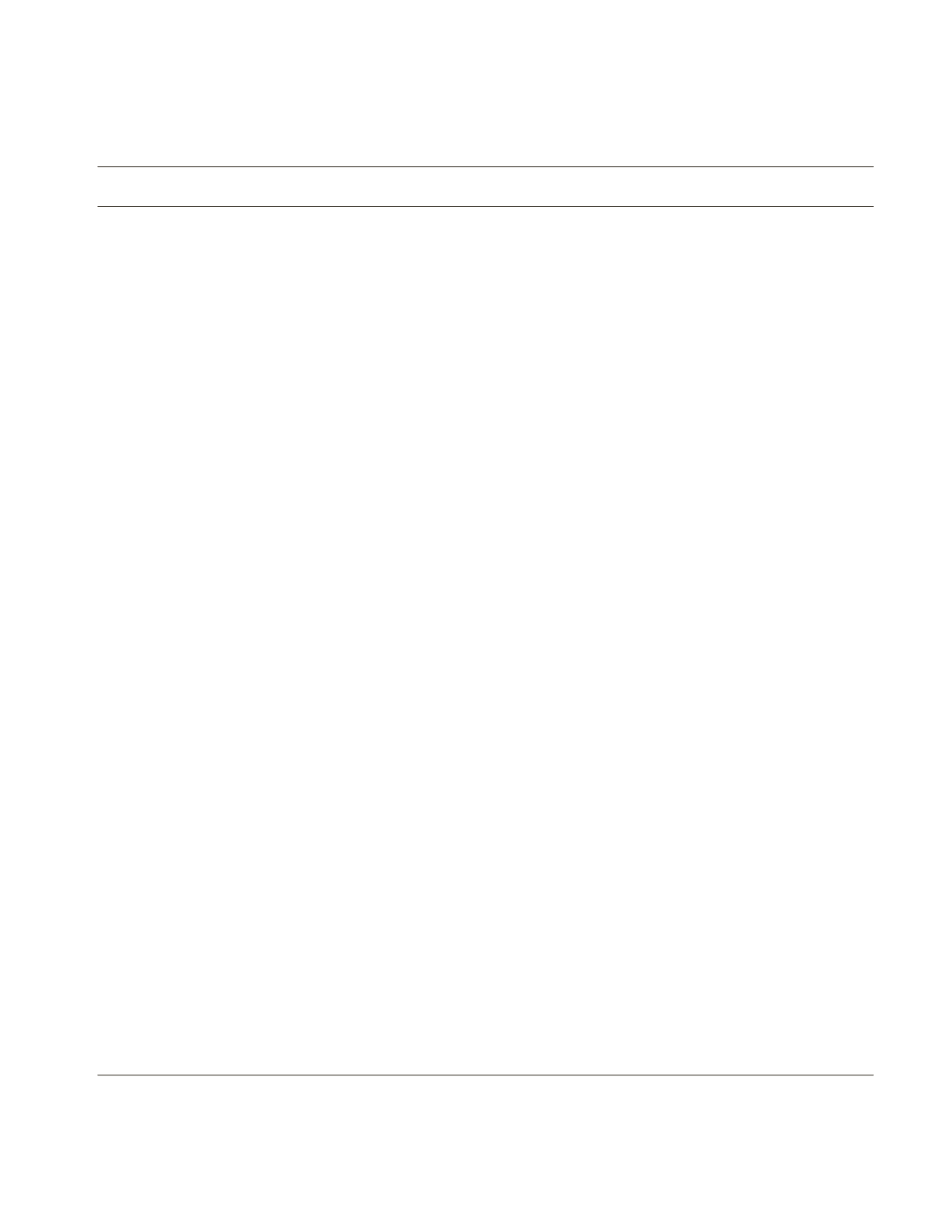

i nc lu s i ve f i nanc e i nd i a re port 2014

128

T

ABLE

5.2

Draft Guidelines for Small Banks and Payments Banks: Comparison

Specific guidelines

Small banks

Payments banks

Eligible promoters

Resident individuals/ professionals with

10 years of experience in banking and finance;

companies and societies;

NBFCs, MFIs, LABs;

(preference to banking/ financial sector

professionals, NBFCs and MFIs)

Authorized* non-bank PPI issuers

NBFCs, corporate BCs, mobile telephone companies, super-

market chains, companies, real sector cooperatives and public

sector entities;

banks (through stake in equity)

Assessment of fit

and proper status

Promoter’s past record spanning at least

5 years of sound credentials and integrity;

financial soundness and successful track record

of running business

Promoter’s past record spanning at least 5 years of sound

credentials and integrity;

financial soundness and successful track record of running

business

Scope of activities

Area of operation limited to contiguous

districts in a homogenous cluster of states/

UTs;

branch expansion needs prior RBI approval

during the initial 3 years;

no subsidiaries to undertake non-banking

financial services activities allowed;

no comingling of banking and other financial/

non-financial activities allowed

Acceptance of demand deposits (current/ savings deposits);

Deposit Insurance and Credit Guarantee Corporation of India

(DICGC) coverage extended to deposits mobilized;

maximum balance holding per customer restricted of

Rs. 100,000;

a variety of channels—branches, BCs, mobile banking, ATMs,

POS terminals—to be used for cash in and cash out;

secure internet banking is a possibility;

can function as BC of other banks for credit and other services;

no non-banking subsidiary allowed

Requirement of

capital

The minimum paid-up voting equity capital

of Rs. 100 crore;

minimum CAR of 15% (risk weighted assets)

maintained on a continuous basis

The minimum paid-up voting equity capital Rs. 100 crore;

a net worth of Rs. 100 crore to be maintained at all times;

Minimum CAR of 15% maintained on a continuous basis;

outside liabilities limited to a maximum of 20 times the

networth/paid capital and assets

Promoter

contribution

Preference for diversified shareholding;

Minimum 40% initial contribution locked in

for 5 years;

Promoter stake to be brought down to 30% in

10 years and 26% in 12 years

Preference for diversified shareholding;

minimum 40% initial contribution locked in for 5 years;

promoter stake to be brought down to 30% in 10 years and

26% in 12 years

Voting rights and

transfer/acquisition

of shares

Capped at 10 per cent; can be raised to 26% in

phases with RBI approval

Capped at 10 per cent; can be raised to 26% in phases with RBI

approval

Prudential norms

CRR and SLR as applicable to commercial

banks;

maximum loan size and investment exposure

capped at 15% of capital funds;

at least 50% of the loan portfolio to be

constituted by loans and advances of size up

to 25 lakh

Not applicable

Others

PSL targets and sub targets as applicable to

domestic SCBs;

in the initial 3 years at least 25% of the

branches to be opened in unbanked rural

centres;

technology-driven operations;

customer grievances cell

At least 25% of access points in rural centres;

fully networked and technology driven operations right at the

start;

customer grievances cell

Source

:

;

Note

:

*

Under the Payment and Settlement Systems Act, 2007.