i nc lu s i ve f i nanc e i nd i a re port 2014

124

B

OX

5.1

A ‘Postal Bank’ for India: Hopes and Concerns

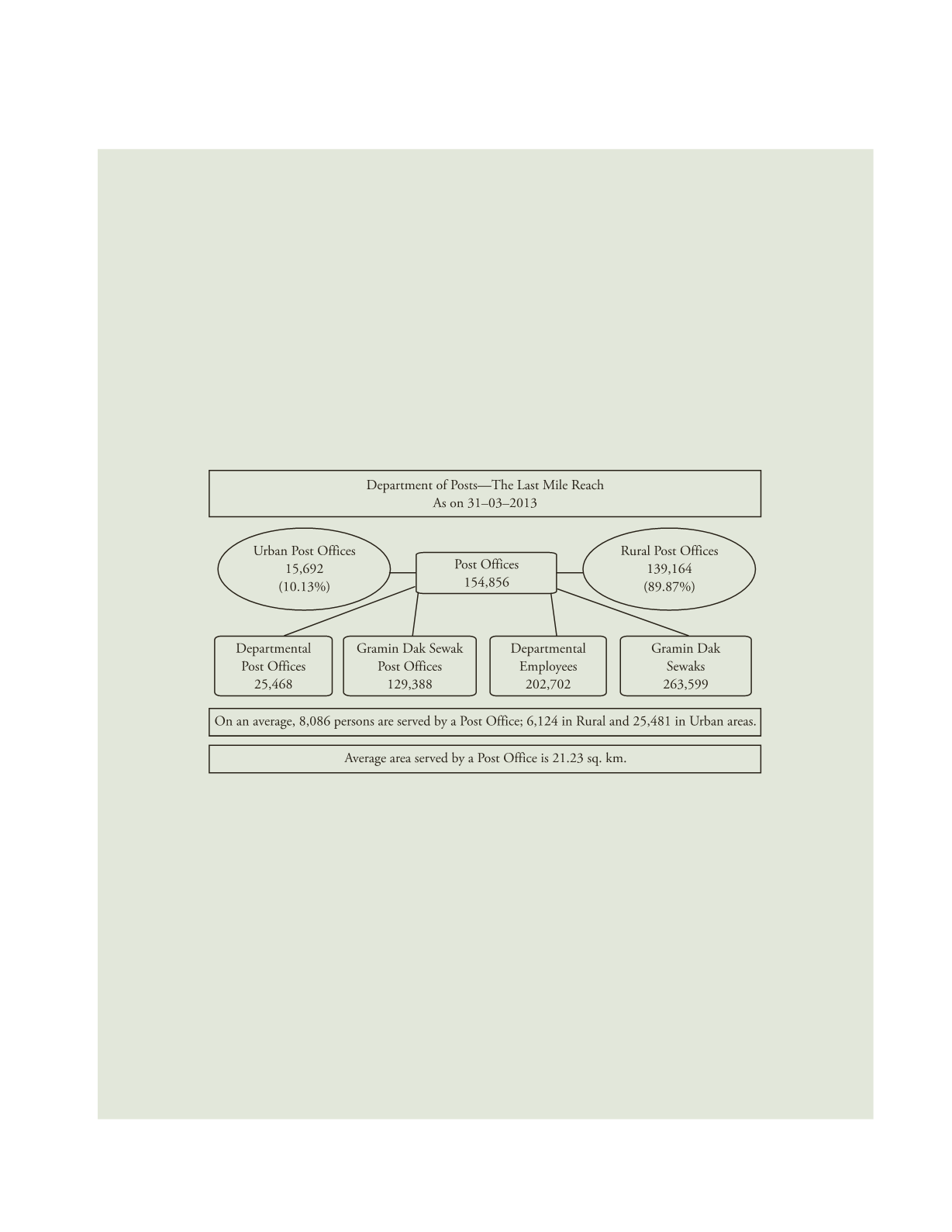

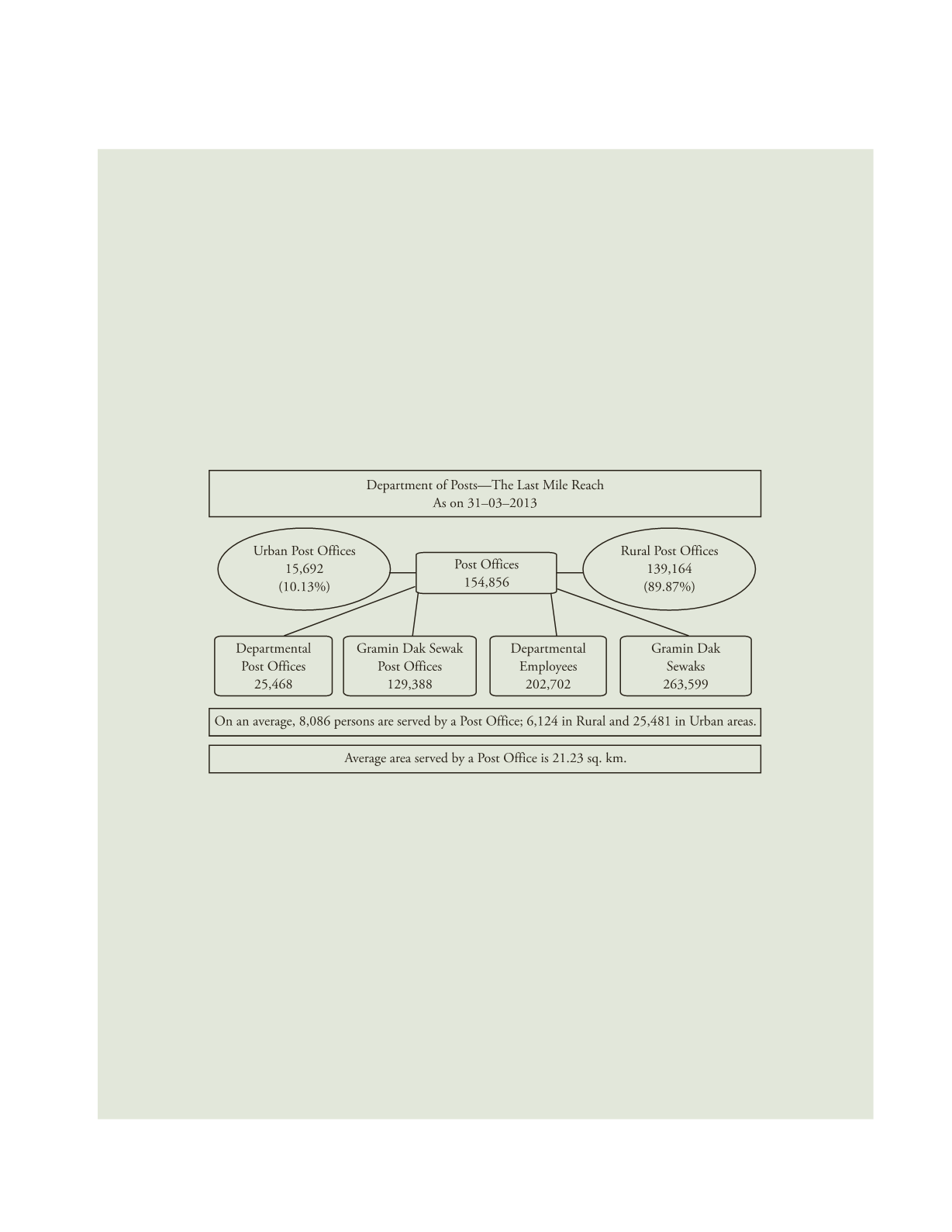

Had the Cabinet Committee of Economic Affairs approved the application of the Department of Posts in January 2014 to set up

a universal bank, the ‘Postal Bank of India’ (PBI) would have been on it way to fruition by now. Many argue that an important

opportunity was missed to leverage the over 1.3 lakh post offices (PO) to accelerate financial inclusion in rural areas. As Tarapore

(2014) put it: ‘Trying to achieve financial inclusion without a central role for India Post would be like staging

Hamlet

without the

Prince of Denmark.’

The POs acting as BCs can provide a range of financial products to the rural households including deposits, loans, insurance,

remittances, pension and government subsidies and payments. Of the total 1.55 lakh POs in the country 90 per cent are in rural

areas. This means that there is one PO every 5 km. The rural postal network includes 16 head POs, 12172 sub-POs and 126,976

branch POs.

The rural postal network has brought close to 85 million rural people into the ambit of formal financial services by opening

bank accounts for them for disbursement of social security scheme payments. As part of a special arrangement, the post offices

in the Andhra Pradesh Circle undertake Aadhaar Enabled Payment of wages/benefits under MGNREGA and other social

security schemes with the support of AP Online and the state government. For this purpose 9000 micro ATMs have been deployed

by the circle.

Source

: DoP,

Annual Report 2013–14

.

Postal life insurance and rural postal life insurance has covered about 20 million households. The Department of Posts has

embarked on an information technology modernization project. It has installed CBS in 675 post offices and opened two ATMs

under the project. The Department reportedly has spent about Rs. 5,000 crore on enhancing technology platform since 2012.

The PBI is proposed to be run as a unique model. The proposed pyramid like structure will have 150 branches at the top which

would be linked to 800 head post offices (HPO) across the country. The HPOs will be connected to sub-post offices (about 25,000)

and further downstream to branch post offices (1.39 lakh). The branch POs would cover the entire rural landscape including the

remote and the politically disturbed. The branches will be opened over the next five years and would employ 3,000 employees. Of

the total estimated capital investment of Rs. 1,800 crore, the government’s contribution is expected to be Rs. 623 crore (i.e. about

39 per cent). The rest would be raised from the market. The PBI is expected to have a turnover of over Rs. 21,000 crore in five years

with a profit of Rs.300 crore.

Concerns have been raised about the capability of the postal system to handle the large network of branches. Tarapore (2014)

suggests that a cautious and calibrated process to expansion of operations will take care of this issue. But the Bank would need

specialists skilled in managing investments to ensure viability of operation.

Source

: Department of Posts, Government of India,

Annual Report 2013–14

; Joshi (2014); Tarapore (2014);

Business Standard

(2014 ).