203

Scheme. Besides, Personal Accident has been included in the KCC at a nominal

premium for a cover of up to

`

50,000 to the card holder for death or permanent

disability; this being a social cost, banks share a portion of the premium.

Access Achieved in the Number of Cards Issued and Flow of Credit

The growth in the number of KCCs issued has been steady at about

3% per annum. From about 76 lakh cards in March 2002, the number has

risen to 115 lakh in 2011-12, touching a little over 7% of the total number of

operational holdings in the country (Table 7.1).

Agency-wise distribution of cards suggests that about 47% have been

issued by commercial banks followed by 38% by cooperative banks and 15%

by RRBs. While the number of cards issued by banks had shown a steady

improvement until 2007-08; thereafter following the loans waiver scheme,

namely, Agricultural Debt Waiver and Debt Relief Scheme 2008, there have

been absolute declines in the numbers of cards issued by all agencies. Region-

wise, it is found that next to the southern region which has always been in the

forefront in farm-credit absorption, it is the two under banked regions, namely,

central and eastern, that have attracted the second and third best members

of KCCs issued more than 55% of the cards have been absorbed by these two

regions. In amount of loans sanctioned under KCC, the eastern region has

continued to lag behind but the central region has absorbed a relatively a high

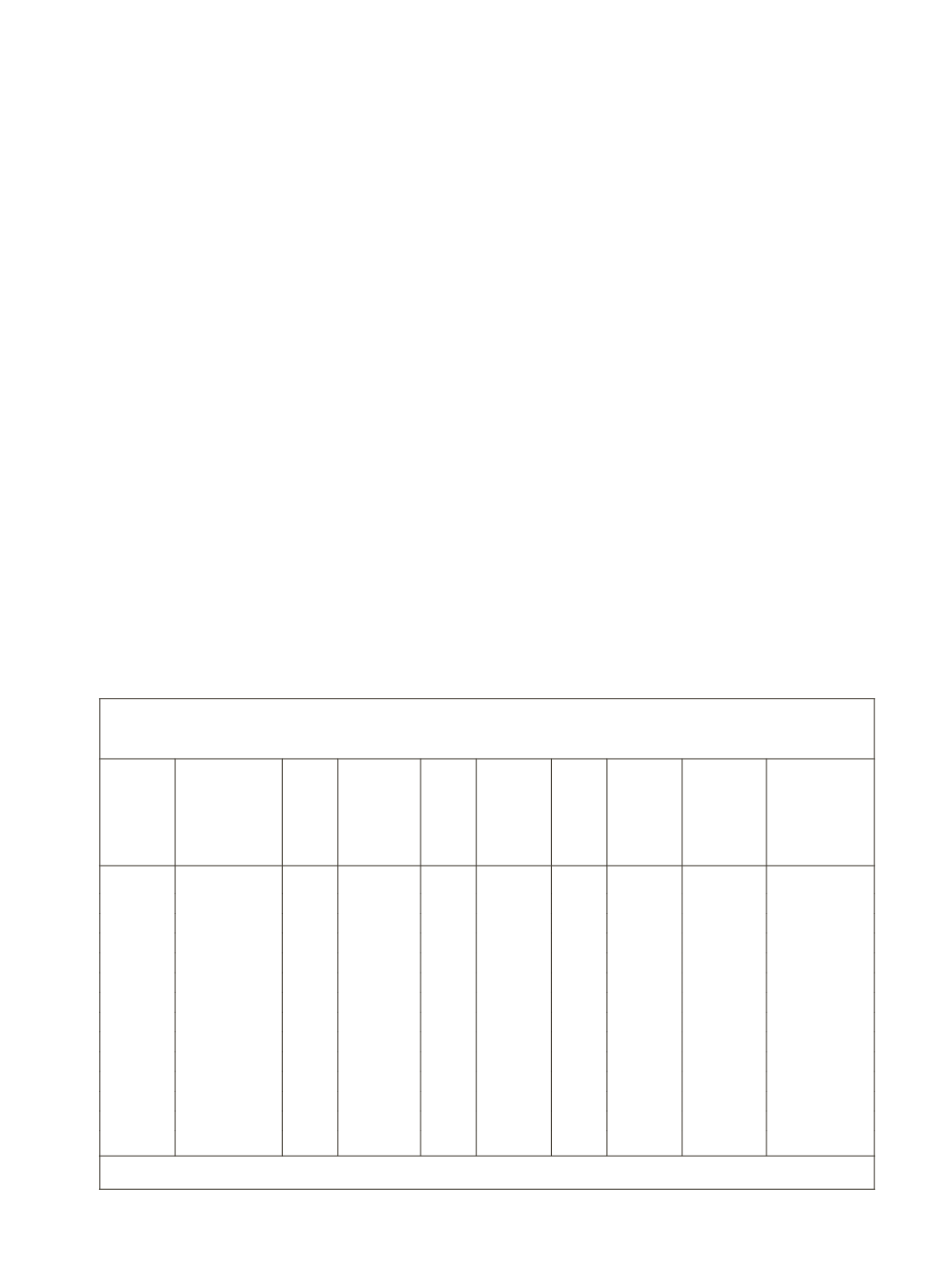

Table 7.1 : Agency-wise Kisan Credit Cards Issued

(in lakh)

Year

Cooperative

Banks

% to

Total

Regional

Rural

Banks

% to

Total

Com-

mercial

Banks

% to

Total

Total

No. of

Opera-

tional

Holdings

Percentage

of Total No.

of Cards to

Operational

Holdings

1998-99

1.56 19.9

0.06 0.8 6.22 79.3 7.84

1999-00

35.95 70.0

1.73 3.4 13.66 26.6 51.34

2000-01

56.14 64.9

6.48 7.5 23.90 27.6 86.52

2001-02

54.36 58.2

8.34 8.9 30.71 32.9 93.41

2002-03

45.79 55.6

9.64 11.7 27.00 32.8 82.43

2003-04

48.78 52.8 12.74 13.8 30.94 33.5 92.46

2004-05

35.56 36.7 17.29 17.9 43.95 45.4 96.80

2005-06

25.98 32.4 12.49 15.6 41.65 52.0 80.12 1292.22

6.2

2006-07

22.97 27.0 14.06 16.5 48.08 56.5 85.11

2007-08

20.91 24.7 17.73 20.9 46.06 54.4 84.70

2008-09

13.44 15.6 14.14 16.5 58.30 67.9 85.90

2009-10

17.50 19.4 19.50 21.6 53.10 58.9 90.10

2010-11

28.10 27.7 17.70 17.4 55.80 54.9 101.60 1377.57

7.4

2011-12

29.60 25.2 19.90 16.9 68.04 57.9 117.60

Source:

Nabard’s Annual Report, various issues.