197

the lending rates 6.0% plus 0.5 percentage point. NABARD (2012) writes that

“the rate of interest payable even under RIDF XVII is the Bank rate (6%). The

Bank rate has changed from 6% to 9.5% w.e.f. 13 February 2012. “However, the

RBI has allowed the state governments to pay at the previous Bank rate

plus

0.5% that is, 6.5% to NABARD till 31 March 2012. Loan disbursements from

RIDF on or after April 1, 2012 will be at 1.5% below the prevailing Bank rate”

(p.35).

Economic and Social Benefits of RIDF

Based on its monitoring arrangement, NABARD has said that, RIDF gives rise

to significant potential benefits such as (i) unlocking of sunk investment already

made by the State Governments, (ii) creation of additional irrigation potential,

(iii) generation of additional employment for the rural people, (iv) contribution

to the economic wealth of the State economy, (v) improved connectivity to

villages and marketing centres, (vi) improvements in quality of life through

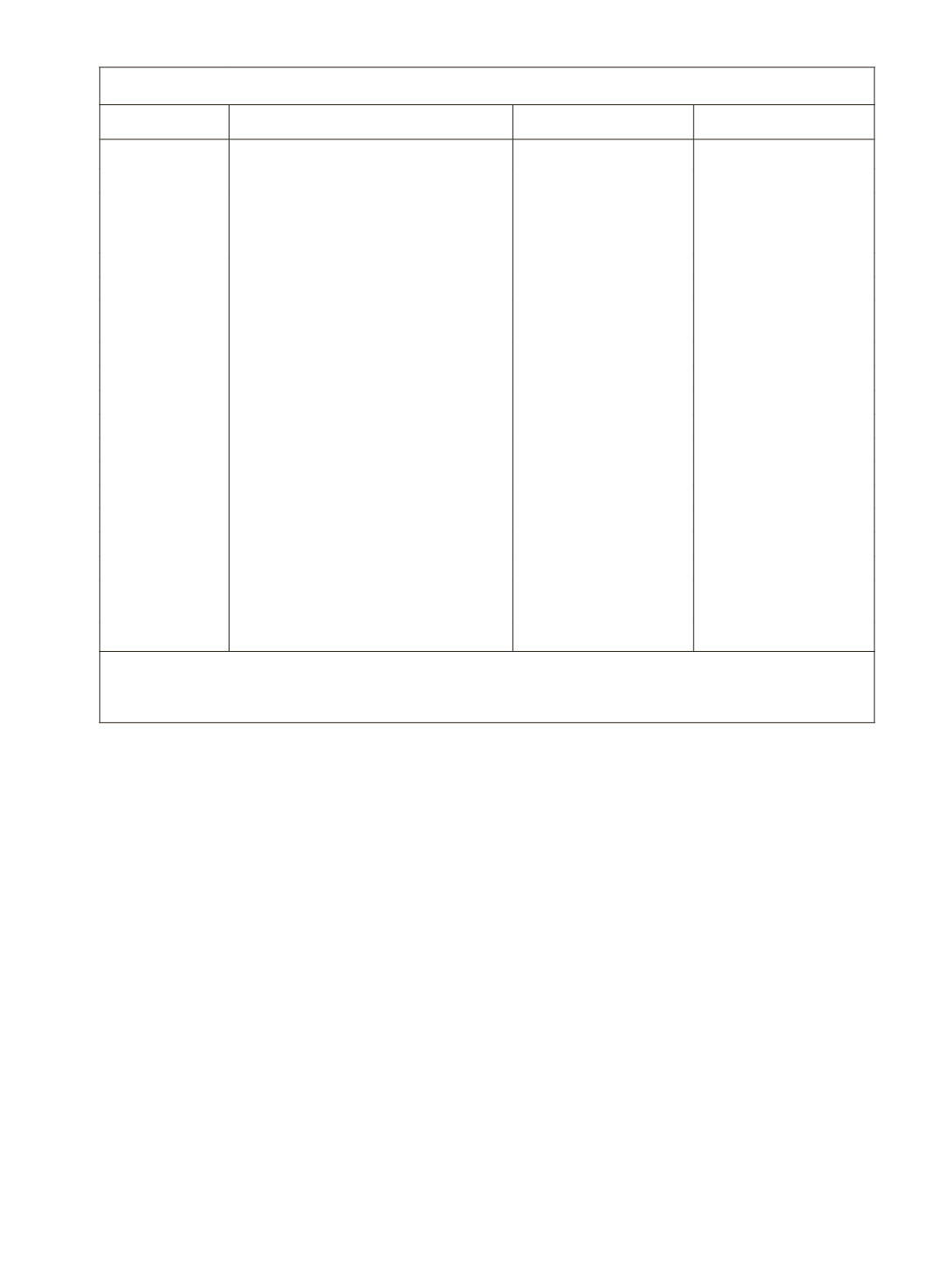

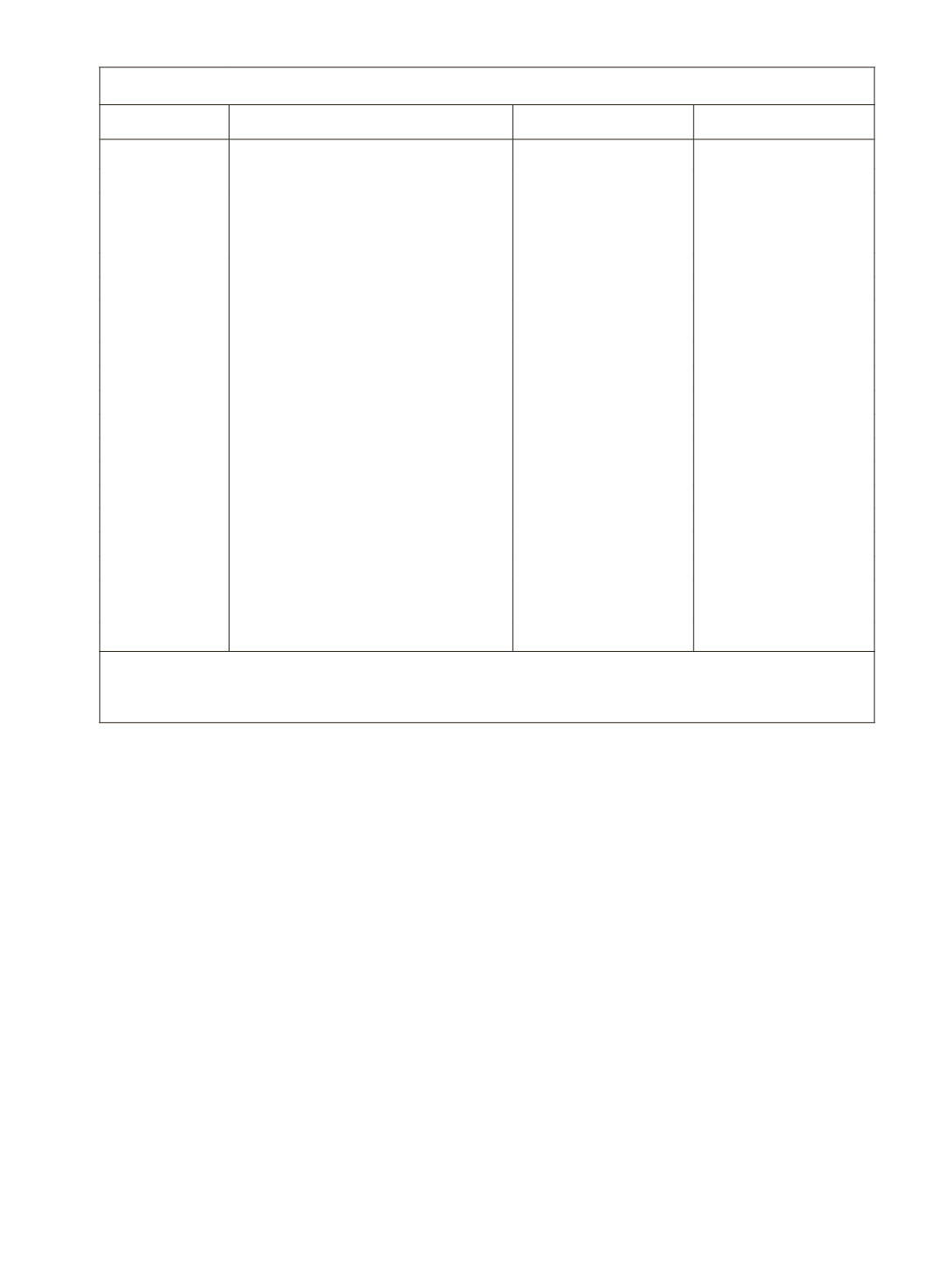

Table 6.11: Rates of Interest on RIDF Deposits and Infrastructure Lending

Year

Bank Rate & Effective from RIDF Deposit Rate

Lending Rates

1995-96

12% (9.10.1991)

12.50%

13%

1996-97

12% (9.10.1991)

12.50%

13%

1997-98

11% (16.04.1197)

10% (26.6.1997)

9% (22.10.1997)

12.0%

13%

1998-99

10.5% (19.3.1998)

11.0%

12%

1999-2000

8% (2.3.1999)

8.0% *

11.5%

2000-01

7% (2.4.2000)

8% (22.7.2000)

7.0%*

10.5%

2001-02

7% (2.3.2001)

7.0%*

8.5%

2002-03

6.25% (30.10.2002)

7.0%*

8.5%

2003-04

6% (30.4.203)

6.0%*

6.5%

2004-05

6% (30.4.203)

6.0%

6.5%

2005-06

6% (30.4.203)

6.0%

6.5%

2006-07

6% (30.4.203)

6.0%

6.5%

2007-08

6% (30.4.203)

6.0%

6.5%

2008-09

6% (30.4.203)

6.0%

6.5%

2009-10

6% (30.4.203)

6.0%

6.5%

2010-11

6% (30.4.203)

6.0%

6.5%

2011-12

9.50% (14-2-12)

9% (17-04-2012

9.0%

6.5%

2012-13

9%

9%

7.5%

@

@

1.5% below the bank Rate

* A graded system inversely proportional to the shortfall in priority sector targets.

Source:

Culled out From NABARD Annual Reports