204

amount of KCC loans

pari passu

with the higher numbers of credit cards. As

for the amount of credit flow under KCC, it appears interesting that despite a

growing share of crop loans in total agricultural credit, the share of credit flow

under KCC in total agricultural credit flow has tended to continuously fall until

2009-10; it has declined from 41.7% in 2001-02 to 15% in 2009-10 but only

fractionally edged up to 18% in 2011-12 (Table 7.2).

A major study which has been published probably after Bhaskaran’s

(2012) study, is a recent NABARD field research (Samantara 2010) undertaken

on a comprehensive basis covering 14 states in which a total of 1,876 KCC

holders from 178 bank branches from all the three bank agencies were selected.

The results brought out in this study too are truly illuminating and quite a

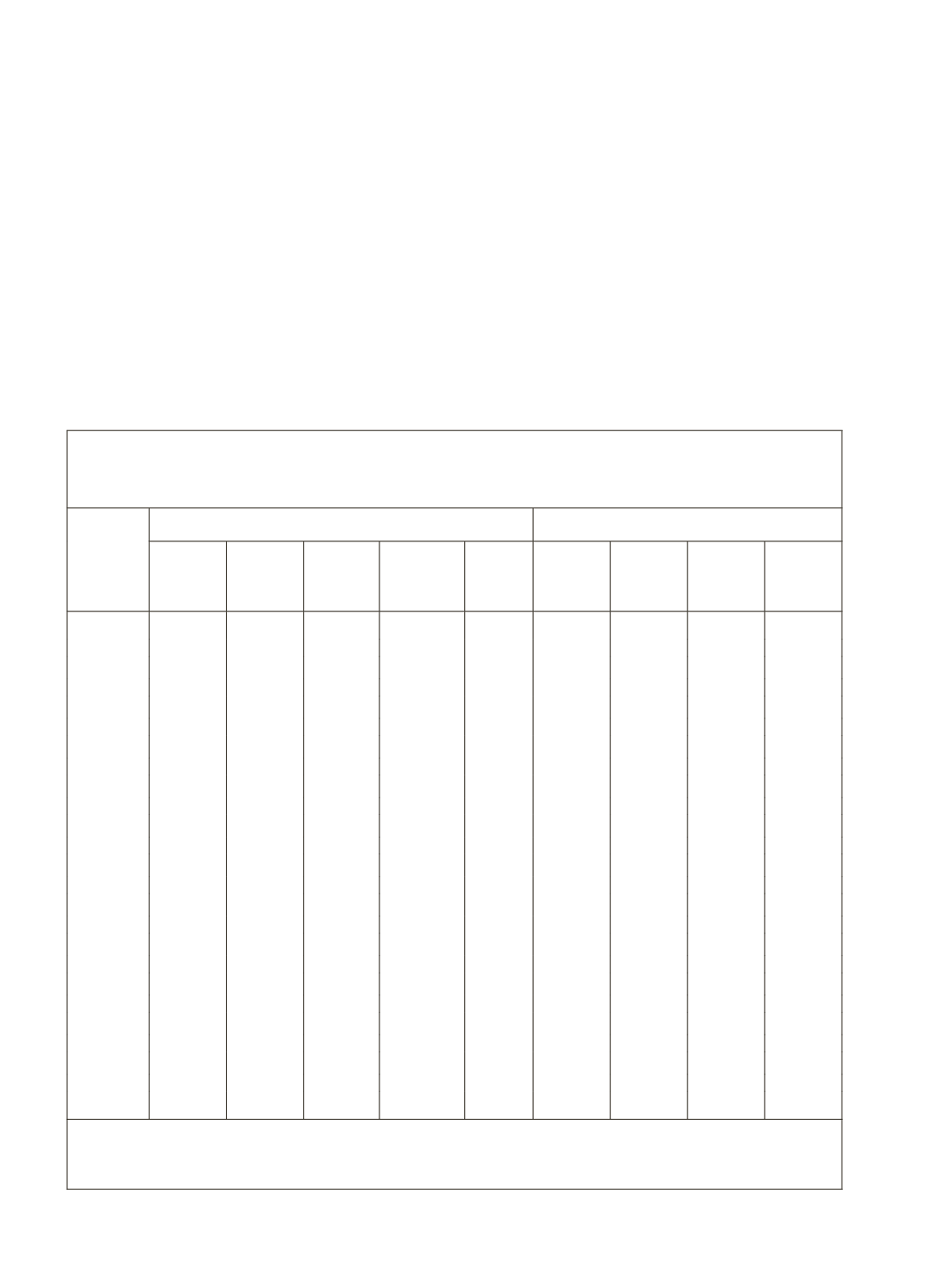

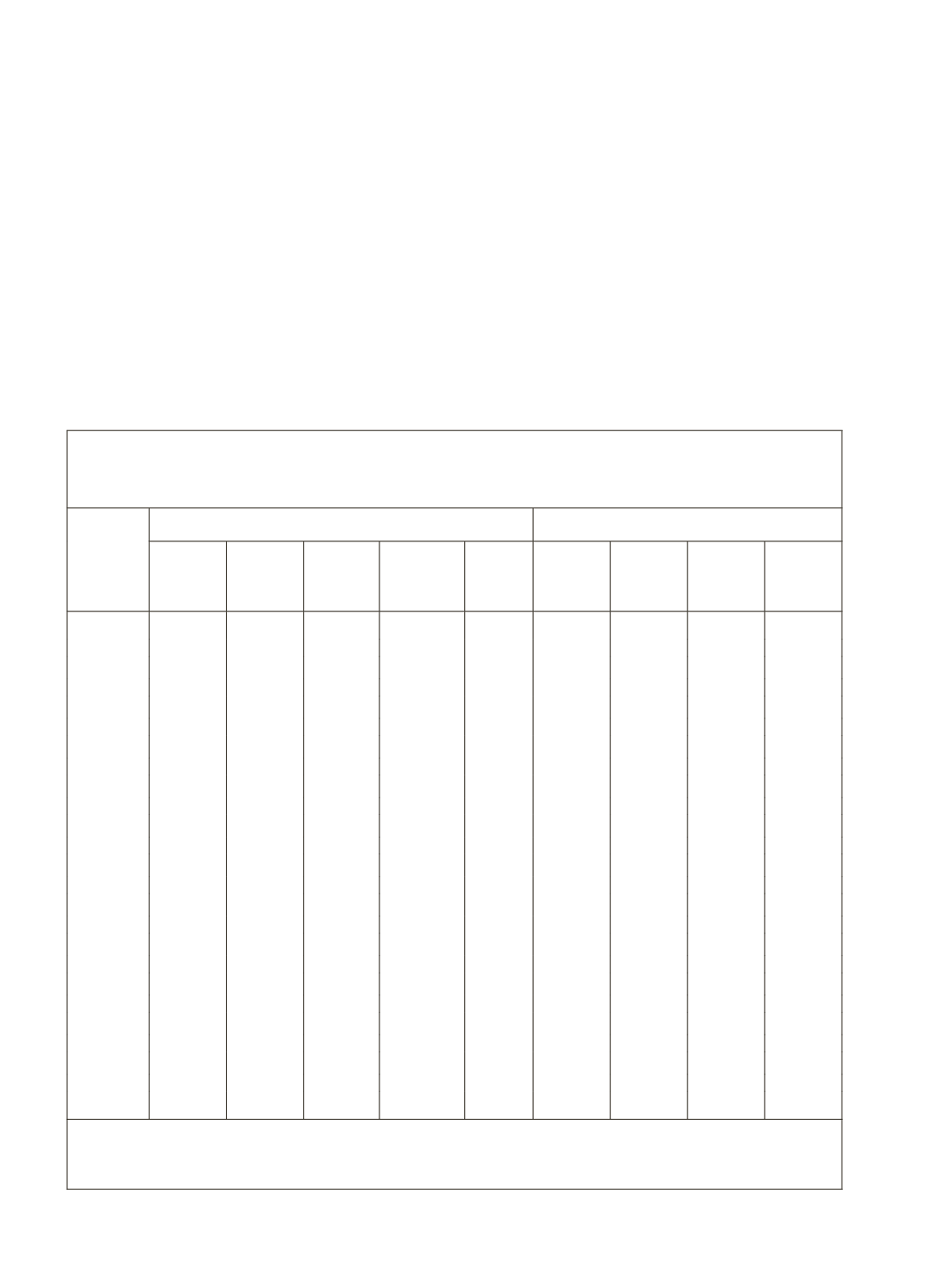

Table 7.2 : Total Flow of Credit to Agriculture and KCC Share:

2000-01 to 2010-12

(Amount in

`

Crore)

Year

Flow of Credit to Agriculture

Credit Flow under KCC

Coop-

erative

Banks

Regional

Rural

Banks

Com-

mercial

Banks

Other

Agencies

Total

Coop-

erative

Banks

Regional

Rural-

Banks

Com-

mercial

Banks

Total

2000-01 20712 4220 27807

82 52827 9412 1400 5615 16427

(45.4)

(33.2)

(20.2)

(31.1)

2001-02 23524 4854 33587

80 62045 15952 2382 7524 25858

(67.8)

(49.1)

(22.4)

(41.7)

2002-03 23636 6070 39774

80 69560 15841 2955 7481 26277

(67)

(48.7)

(18.8)

(37.8)

2003-04 26875 7581 52441

84 86981 9855 2599 9331 21785

(36.7)

(34.3)

(17.8)

(25.1)

2004-05 31231 12404 81481

193 125309 15597 3833 14756 34186

(49.9)

(30.9)

(18.1)

(27.3)

2005-06 39404 15223 125477

382 180486 20339 8583 18780 47702

(51.6)

(56.4)

(14.9)

(26.4)

2006-07 42480 20435 166485

- 229400 13141 7373 19786 40300

(30.9)

(36.1)

(11.9)

(17.6)

2007-08 48258 25312 181088

- 254658 19991 8743 19900 48634

(41.4)

(34.5)

(10.9)

(19.1)

2008-09 45966 26765 228951

226 301908 13172 7632 25865 46669

(28.7)

(28.5)

(11.3)

(15.5)

2009-10 63497 35217 285800

- 384514 7605.8 10131.7 39940.5 57678

(11.9)

(28.8)

(13.9)

(15)

2010-11 78007 44293 345877

114 468291 10719 11468 50438 72625

(13.7)

(25.9)

(14.6)

(15.5)

2011-12 86185 54239 368616

- 509040 10640 11520 69510 91670

(12.3)

(21.2)

(18.9)

(18.0)

CAGR(%)

14.0 27.3 29.2

24.9 -1.9 20.6 24.5 14.4

Note:

The figures within brackets are percentages to the total flow of credit.

Source:

RBI’s, Report on Trend and Progress of Banking in India and Nabard’s Annual Report, various

issues.