53

The above patterns of expansion in agricultural credit appear more

distinct in constant price credit series. As shown in Table 4.2, the real numbers

of agricultural credit grew at an average rate of 19.2% per annumbetweenMarch

1973 and March 1981 (capturing statistical benefits of low base) and at a rate

of 7.7% per annum during the whole of the 1980s. The average increase during

the first two decades after bank nationalisation in nominal terms worked out

to over 22% per annum or at 13.0% per annum in real terms which indeed had

been very impressive. As explained later, there were nearly 20-fold increases in

agricultural loan accounts during the period.

The reform period of the 1990s saw a steep decline in the growth of

agriculture credit to 10.9% per annum in nominal terms and to 2.3% per

annum in real terms. Following social pressures and a series of consequential

policy initiatives, the early part of the current 21 century saw reversal of the

trend with the farm credit growth accelerating to a high of 28.2% per annum in

nominal terms and at 22.5% in real terms. This was short-lived and prevailed

only for about five to six years, that is up to 2006-07; thereafter there has been

a reaction to high growth and the credit growth fell to 19.1% per annum in

nominal

terms and to 7.0% per annum in

real

terms. This has been the period

when terms of trade moved in favour of agriculture, which is reflected in the

vastly differential variations in overall GDP and agricultural GDP deflators.

While agricultural deflator has increased by 79% between 2004-05 and 2010-

11, overall GDP has risen by 46.5% during the same period. As a result, the

real agricultural credit based on agricultural GDP deflators shows that the

average increase during the latest four-year period turns out to be low at 7%

per annum in contrast to an average increase of 11% per annum based on

overall GDP deflator.

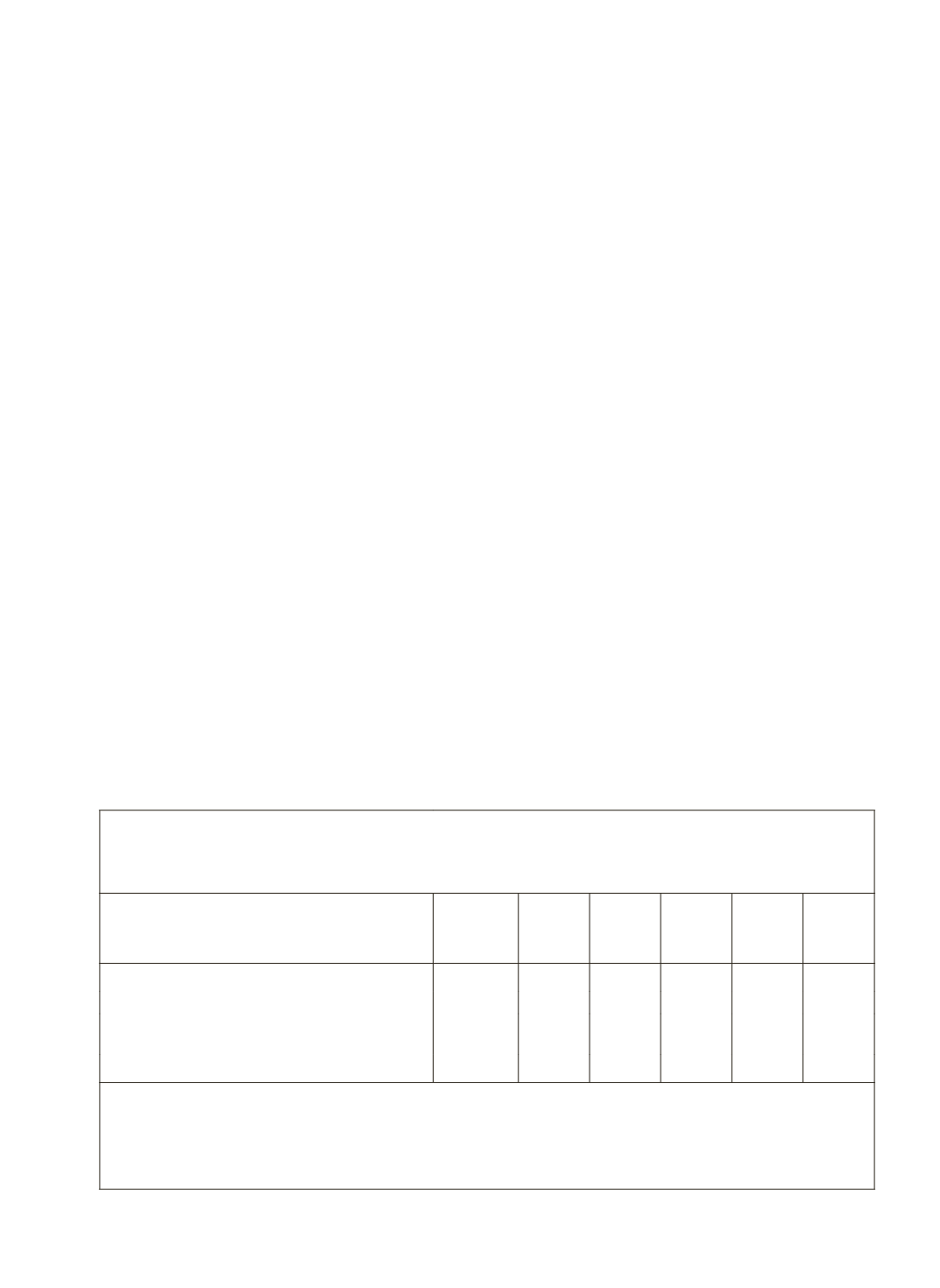

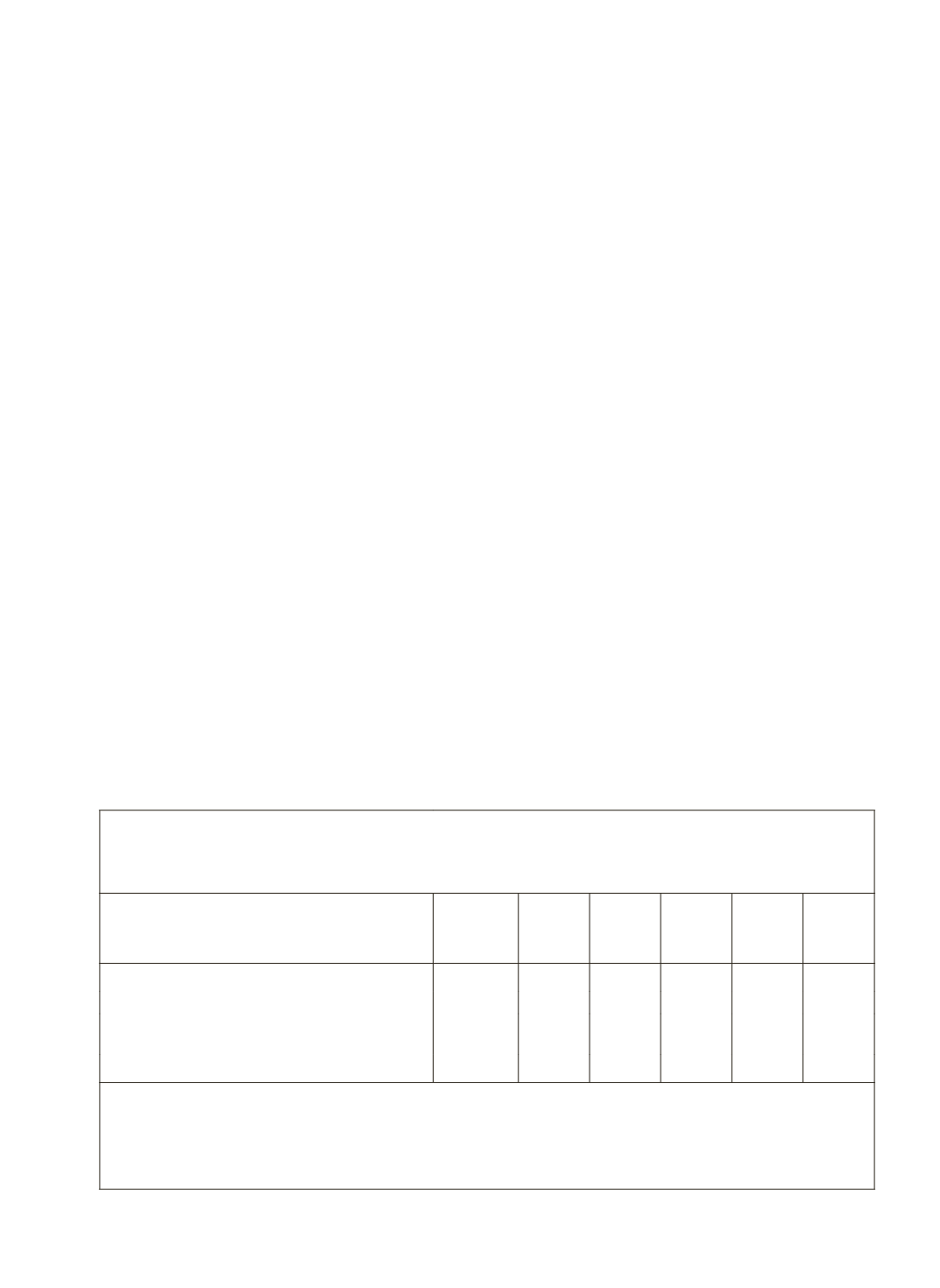

Table 4.2: Average Annual Growth Rates in Agricultural Credit of Scheduled

Commercial Banks During Certain Distinct Phases

(In Percentages Per Annum)

Credit Series

Mar-73

to

Mar-81

Mar-81

to

Mar-91

Mar-91

to

Mar-01

Mar-01

to

Mar-11

Mar-01

to

Mar-07

Mar-07

to

Mar-11

Nominal Agricultural Credit

28.4 16.9 10.9 24.7 28.2 19.1

Real Agricultural Credit

(a) Deflated by Deflators of Overall GDP at

Market Prices

17.9

7.6

2.7 18.1 22.8 11.1

(b) Deflated by Agricultural GDP Deflators

19.2

7.7

2.3 16.3 22.5 7.0

Note:

Periodisation has been done not by any statistical method of discerning structural breaks but by

visual observations and by a more potent indicator, namely, the peaks and troughs of the number of

agricultural borrowers as noted in a subsequent section.

Source:

RBI (2011),

Banking Statistics: Basic Statistical Returns of Scheduled Commercial Banks in

India, March 2011

(Vol. 40), various issues.