54

A Caricature Description of the Underlying Causes for the Fluctuating

Trends

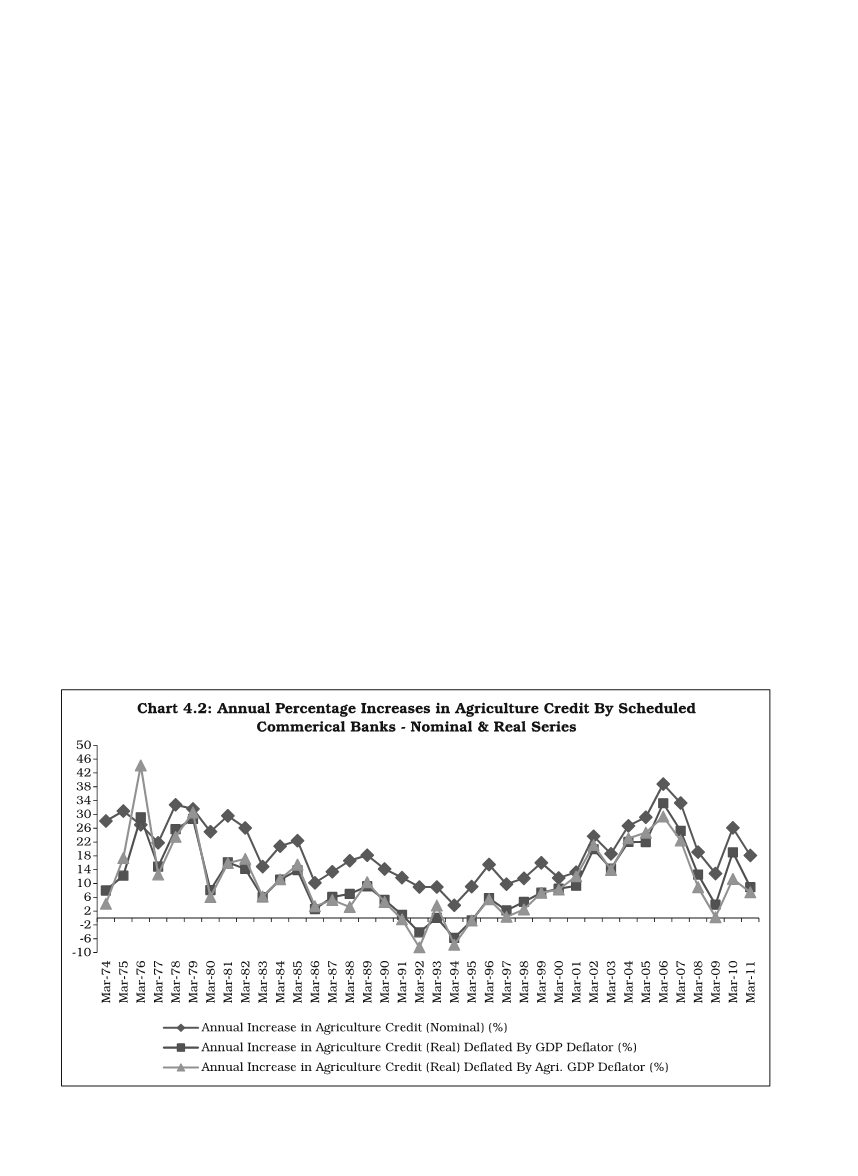

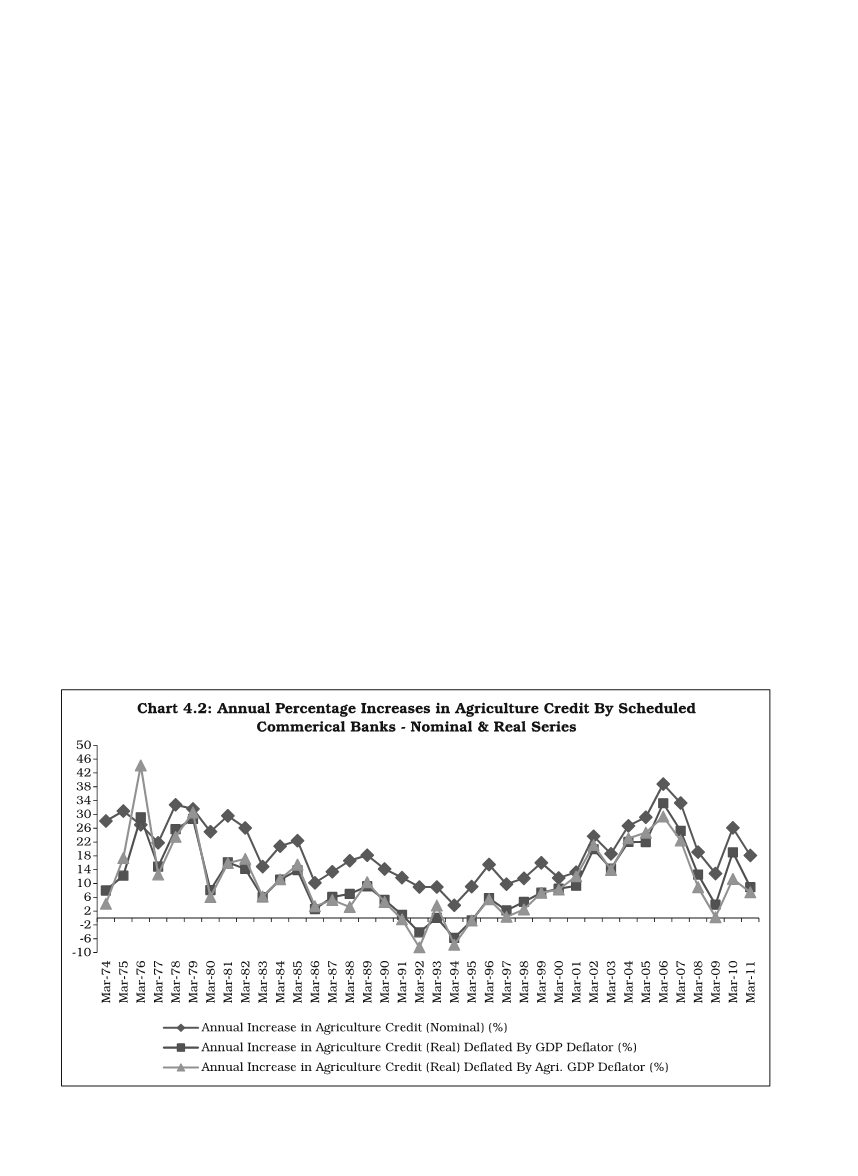

Though varied supply- and demand- side factors are found in the

fluctuating behaviour of farm credit, dominant role obviously seems to

have been played by public-policy induced supply-side factors. First, the

introduction of social control over commercial banks and bank nationalisation

in July 1967 were prompted by the earlier neglect of agriculture and other

informal sectors by the banking industry. Priority sector targets and targets for

rural banking were set which brought about sharp annual increases in bank

credit for agriculture, generally at an annual rate of 18% to 30% in nominal

terms, or 6% to 28% in

real

terms during the 1970s and 1980s (Table 4.1 and

Chart 4.2).

Secondly, thevastquantitativeprogressof commercial bankingassociated

with social control and bank nationalisation was indeed unprecedented, but the

banking system failed to imbibe the broader socio-economic distributive values

and objectives in an enduring manner. Hence, the expansion brought about with

a directed and forced pace resulted in growing problems of deterioration in the

quality of loan portfolios, erosions in productivity, efficiency and profitability,

serious management weaknesses and trade union pressures leading to over-

manning in some areas and under-staffing in others, deterioration in ‘house-

keeping’ and neglect of customer service. These institutional and organisational

disabilities gave rise to “stop and go” approaches to reaching the neglected