Policy and Financing Framework for Livelihoods

17

been proposed is to be examined. Data

analysis for the years 2011–15 showed that

on an average, the states spent between 35

per cent to 40 per cent on social sector pro-

grammes. If the states continued to allocate

funding at the normal current proportion

for social sector, it would have been around

40.5 per cent of their total budget as was

seen in the year 2014–15. At this level, the

incremental spending on social sector by

the states, based on the additional resources

devolution would be an increase of 0.12

per cent of GDP. But the decline in the central

government’s budget for the concerned sec-

tors is of the order of 0.24 per cent of GDP.

2

In net terms, the shifting of burden of devel-

opment programmes related to livelihoods

and social security to states is likely to result

in lesser expenditure and thus lesser develop-

ment impact, at least in the short term. Two

important schemes were spared the Finance

Minister’s axe. These are the food subsidy

scheme (under the NFSA) and the NREGS

(under NREGA). Neither of these two

schemes could be passed on to the states nor

the funding could be reduced on account

of the statutory nature of the schemes as

they are born out of central legislation. A

detailed assessment of the current position

of implementation of these two statutory

programmes is carried in the next chapter.

The Budget also mentions the key

approaches to be followed in strategising

the reforms and the consequent growth

impetus.

Economic Survey 2014–15

says,

“Wiping every tear from every eye also

requires proactive support from the govern-

ment in the formof a well-functioning, well-

targeted, leakage-proof safety net that will

provide bothminimum income and protect

against adverse shocks.” This is also true in

rural India where economic conditions for

farmers and labourers are under stress. The

policy issue, according to the

Survey

, is no

longer ‘whether’ but ‘how’ best to provide

and protect. Continuing its emphasis on

the need to achieve growth, the

Survey

states that economic growth is good for the

poor because it raises the income directly

and generates resources to invest in public

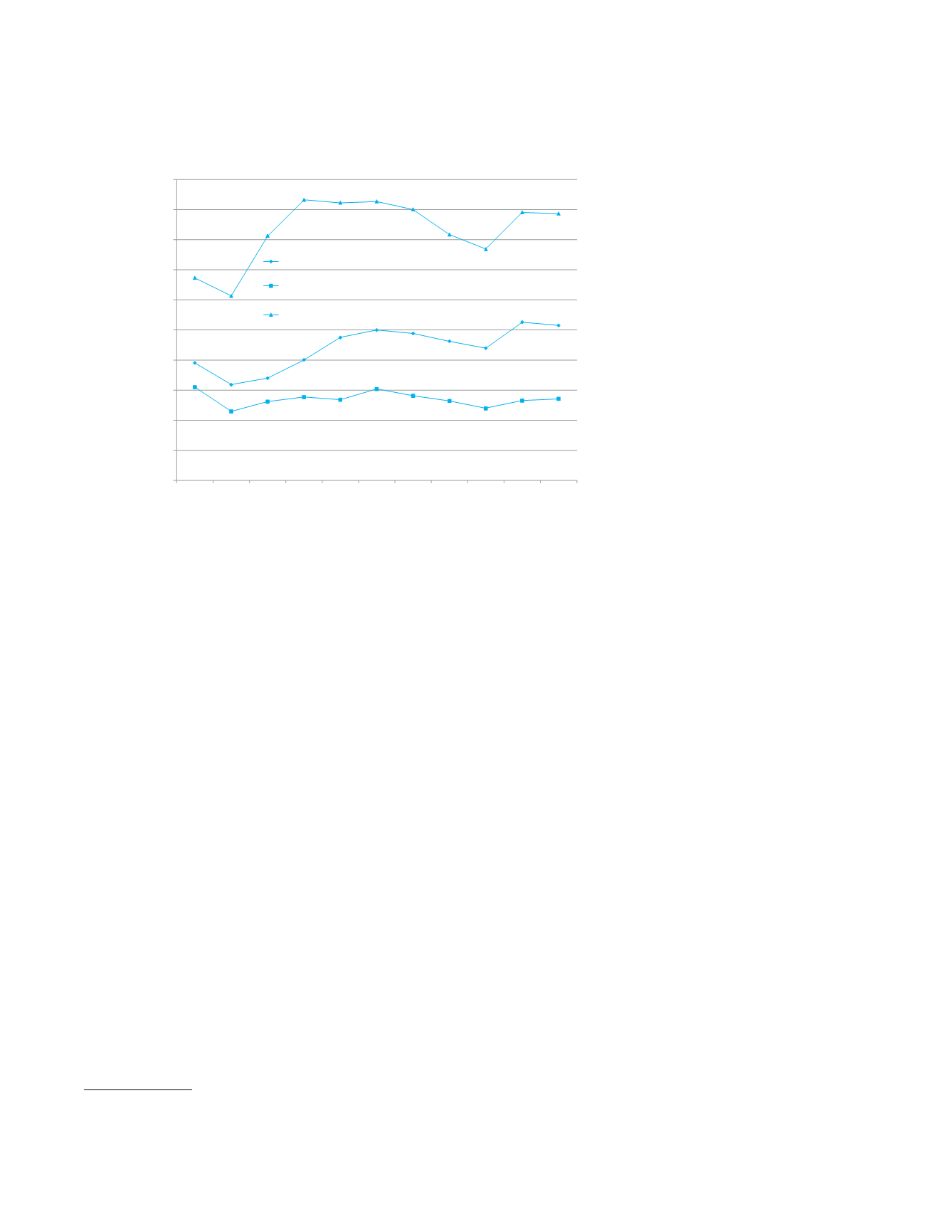

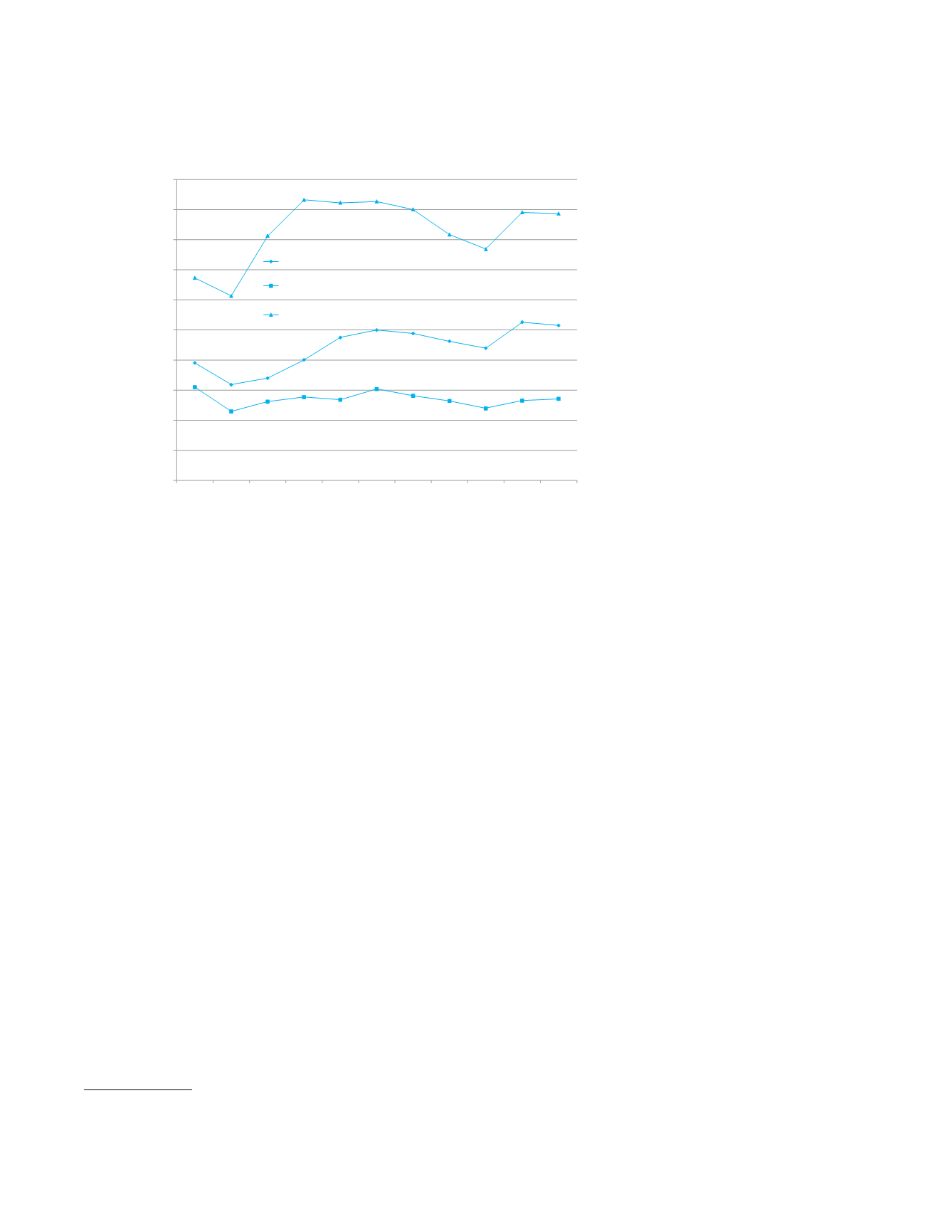

Figure 2.1:

Budget expenditure on agriculture and rural development

Source:

Authors’ working based on data from Indian Public Finance Statistics, Ministry of Finance, GoI and CSO

data on GDP.

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

1990–91

2000–01

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

Expenditure on agriculture as % of agricultural GDP

Expenditure on agriculture and rural development as % of GDP

Expenditure on agriculture & irrigation as % of agri GDP

2

Based on ‘Of Bold Strokes and Fine Prints’, Analysis

of Union Budget 2015–16, Centre for Budget and

Governance Accountability (CBGA), 2015.