Overview: Taking Stock

9

Labour Legislation should also be reviewed

to ensure that workers get a fair deal and

‘decent work’. In case of microenterprises

and own account units, facilitating access to

markets (whether for inputs, outputs, credit

or technology) is a prime requirement and

not Subsidy Schemes that keep the enterprises

barely alive on artificial support systems.

Public finances

Government’s spending: Shifting from

subsidies to productive areas

The spending by government has, over

the last many years, shifted from non-plan

expenditure to non-productive areas. While

most of these expenditures are unavoidable,

there have been profligate tendencies in

some ill-designed large programmes. The

investments in productive capital stock have

to increase. This requires that the govern-

ment finds resources that can be invested to

boost capital formation. The high subsidy

budget carried on for several years now

is limiting the capacity for investments in

future growth and development.

Of the subsidied food, fertiliser and

oil subsidies accounted for

`

2,539 billion

in 2014–15 and the current year’s budget

rightly slashed it down by about 10 per cent

(Table 1.6). But the Food Subsidy Bill is as

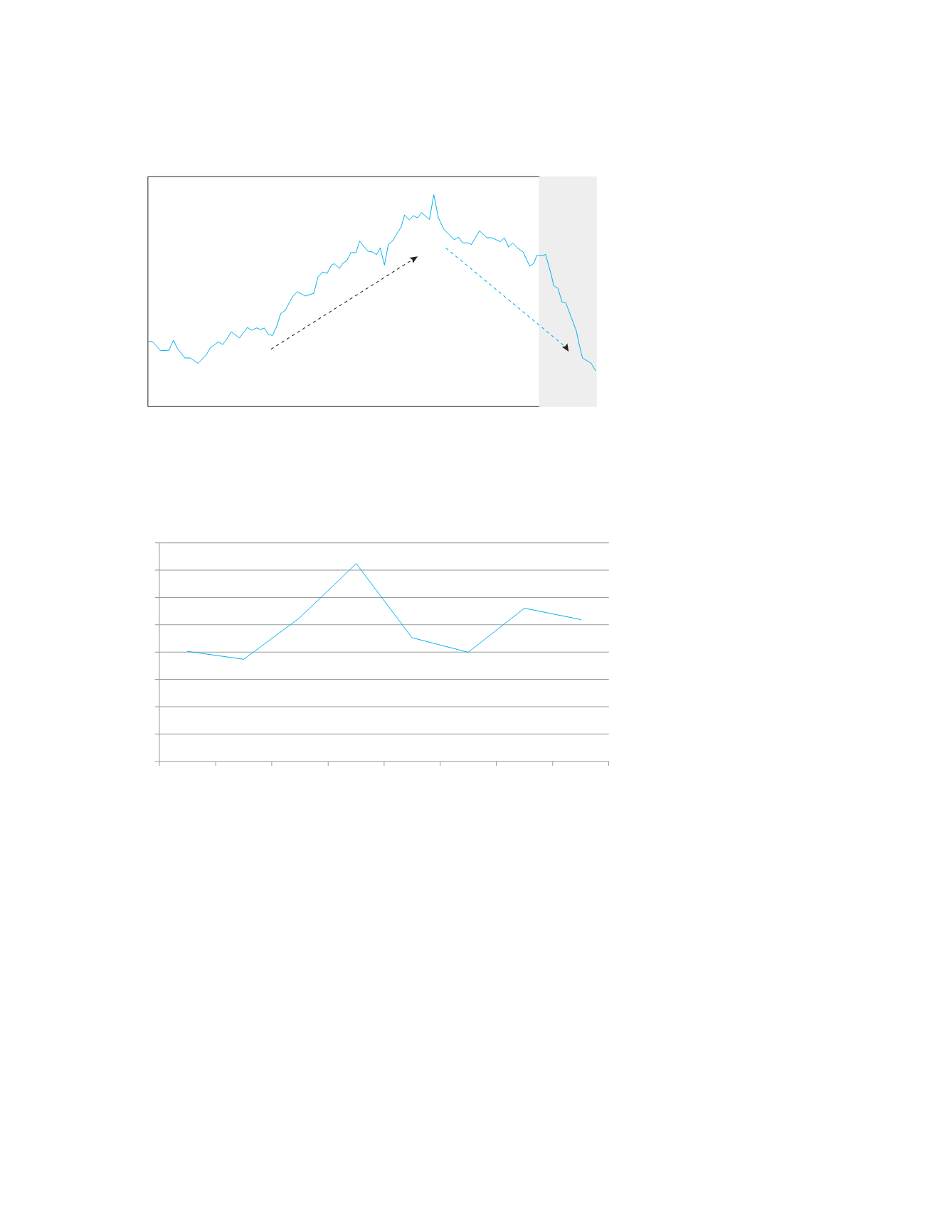

Figure 1.3:

Rural wage growth

Source:

Based on Labour Bureau data. Excerpted from

Economic Survey 2014–15

, Ministry of Finance, GoI.

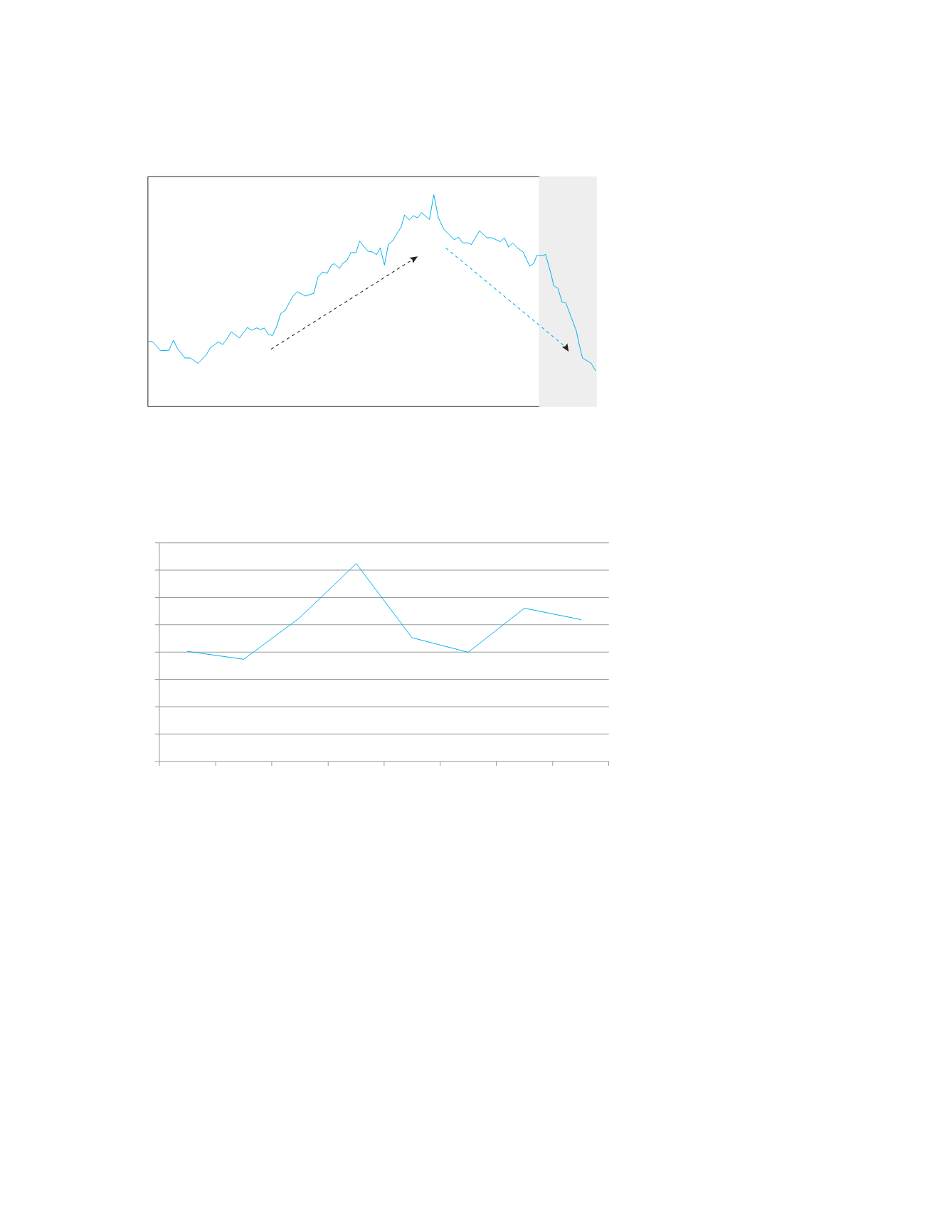

Figure 1.4:

CPI for rural labourers

Source:

Labour Bureau, GoI.

Nov–05

0

5

10

15

20

25

Nov–06

Nov–07

Nov–08

Nov–09

Nov–10

Nov–11

Nov–12

Nov–13

Nov–14

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

2006–07 2007–08 2008–09 2009–10 2010–11 2011–12 2012–13 2013–14