Dairy-based Livelihoods

55

•

Contribution of livestock, especially

dairying, to family income ranges from

20 per cent to 50 per cent and poorer the

family, greater is the contribution.

Dairying is a livelihood option for those

who hold limited land. The NSSO survey

data clearly establishes the fact that those

in livestock farming are likely to have

much less land than those engaged in crop

cultivation. In other words, dairy farming

is the key livelihood for more vulnerable

households.

II. Emerging demand–supply

imbalances

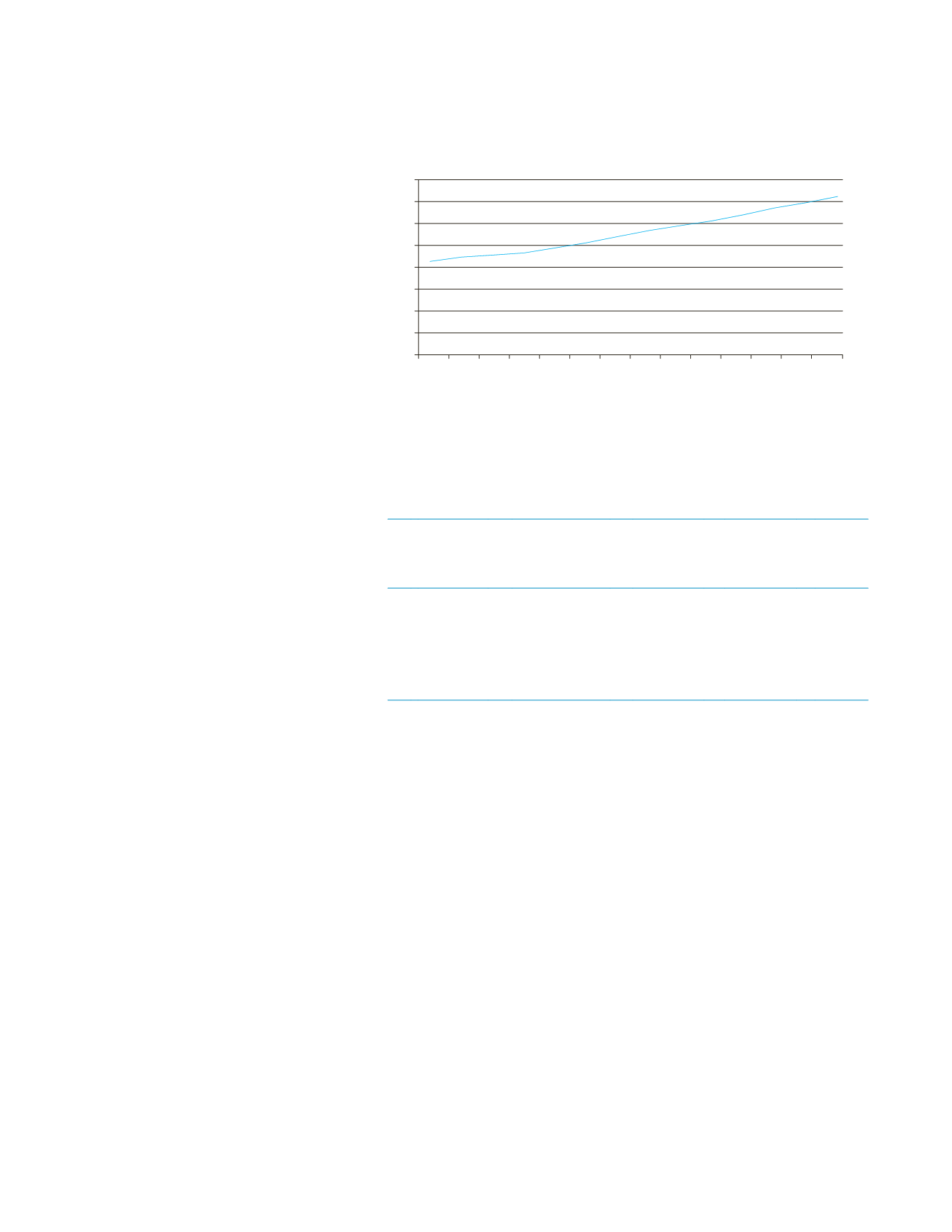

The growth rate of milk production varied

from an average of 4.3 per cent per annum

in the 1990s to 3.7 per cent per annum in the

2000s, achieving five per cent growth in the

years 2010–11 and 2011–12 but fell to 3.5

per cent and 3.9 per cent during 2012–13 and

2013–14. Buffaloes and cows contribute 51

per cent and 45 per cent of the total milk pro-

duction respectively (Figure 4.1). Production

in top milk-producing states such as Uttar

Pradesh, Andhra Pradesh and Rajasthan is

largely contributed by buffaloes’ milk. Tamil

Nadu is the largest producer of cow’s milk,

having 11 per cent share of the total cow’s

milk in the country out of which 89 per cent

is produced by cross-bred and exotic cows.

Indigenous milch cattle (48 million)

and milch buffaloes (51 million) make up

for 82 per cent of the country’s total milch

population, in contrast to the cross-bred

cows (19.5 million) at 18 per cent.

While livestock population has been

declining, milk production has been

increasing (Table 4.2). While this can be

due to improvements in the productivity

of animals and culling of non-productive

animals, there are some apprehensions that

the enhanced production figures may be

due to adulteration of milk.

Domestic demand for milk and milk

products continues to grow, spurred by

rising incomes and changing food prefer-

ences. According to the Government of

India estimates, milk demand is projected

to grow to at least 180 million tons by

2021–22. Meeting this demand from

domestic supply would require production

to grow at 5.5 per cent per annum. If India

fails to achieve substantial production

growth, the country would need to resort

to significant imports from the world mar-

ket which has the potential to cause prices

to spurt since India is a large consumer.

Hence, increasing milk production and

improving productivity of dairy farmers

to meet the projected domestic demand

is a key development challenge facing the

Indian dairy sector.

Figure 4.1:

Milk production trends

Source:

Basic Animal Husbandry and Fisheries Statistics 2014, Department of Animal Husbandry,

Ministry of Agriculture, GoI.

80.6 84.4 86.2 88.1 92.5 97.1 102.6 107.9 112.2 116.4 121.8

127.9 132.4

137.9

0

20

40

60

80

100

120

140

Milk production (Million tons)

160

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

Table 4.2:

Livestock population

S.

No. Species

Livestock census

2003 (no. in

millions)

Livestock

census 2007

(no. in

millions)

Livestock

census 2012

(no. in

millions)

Growth

rate (%)

2007–12

1.

Cattle

185.2

199.1

190.9

–4.10

2.

Buffalo

97.9

105.3

108.7

3.19

3.

Yaks

0.1

0.1

0.1

–7.64

4.

Mithuns

0.3

0.3

0.3

12.88

Total Bovines

283.4

304.8

300.0

–1.57

Source:

Annual Report 2014–15, Department of Animal Husbandry, Dairying & Fisheries; Ministry

of Agriculture, Government of India.