Dairy-based Livelihoods

71

However, these large dairies quickly set

up a local procurement network and some

of them offered a higher price than the

local dairies to build a local supply base in

order to save on transportation costs from

neighbouring states. Some stakeholders

mention that the lower price offered for

milk in Tamil Nadu and Maharashtra was

partially to procure low and transport to

Telangana. Farmers in Telangana are also

not sure of how long they will get such a

price for.

Even with falling milk procurement

prices in some of the states, the retail price

of milk for consumers has been increasing,

thus improving the margins for different

players in value chain (Figure 4.2). Indian

milk industry’s claim of passing on 80

per cent of consumers’ rupee to the farmers

does not hold true in most cases. Experts

mention that transportation, chilling,

pasteurising, packaging and distribution,

at best cost

`

10 to

`

12 per litre when dair-

ies operate at scale. When the consumer is

charged

`

40 per litre on an average and the

dairy farmer gets

`

23 on an average, there is

a need to study who benefits. Stakeholders

in the Round Table on smallholder dairy

farming advocated strong governance

measures for the industry for ensuring

quality and appropriate pricing, keeping

in mind the well-being of both producers

and consumers.

9. Viability of dairy farming

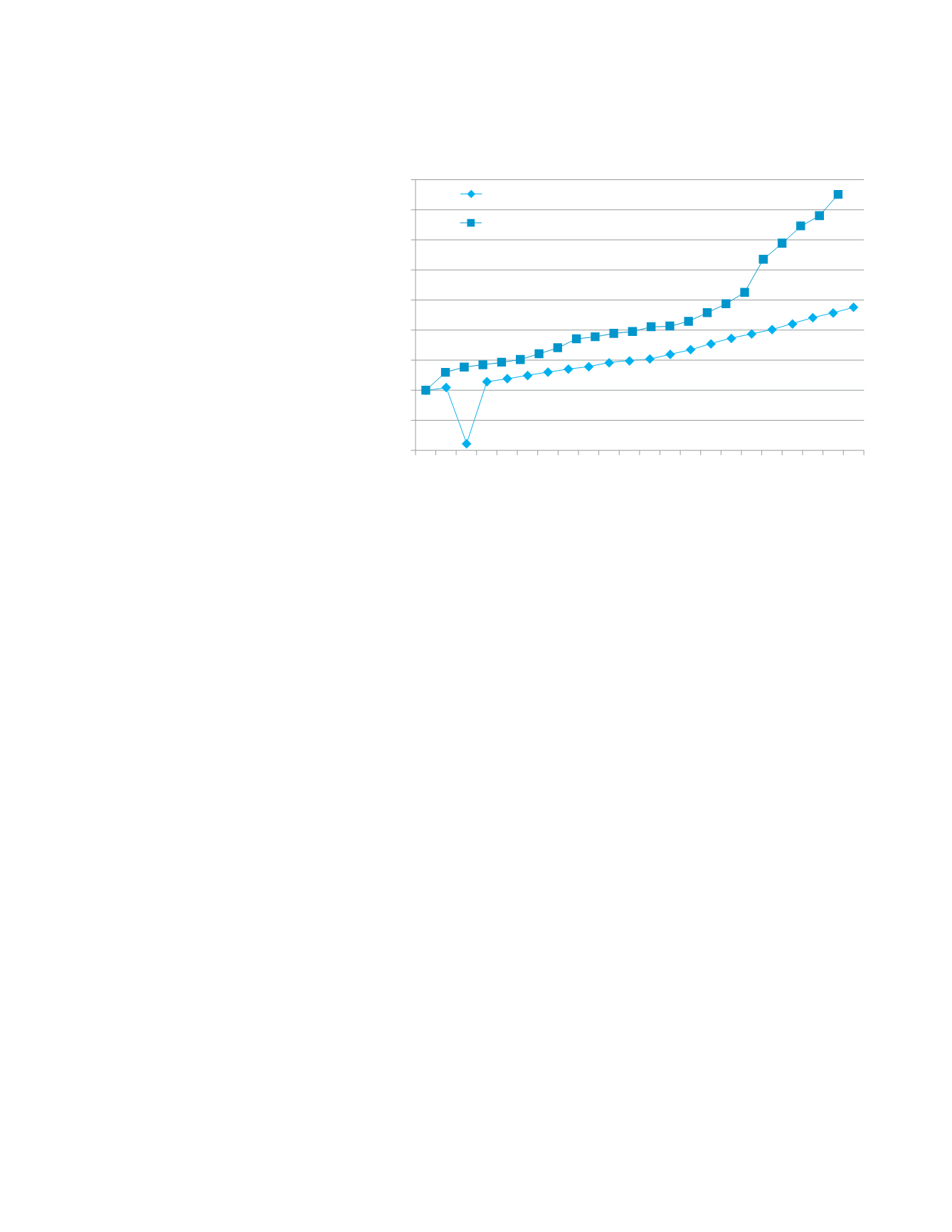

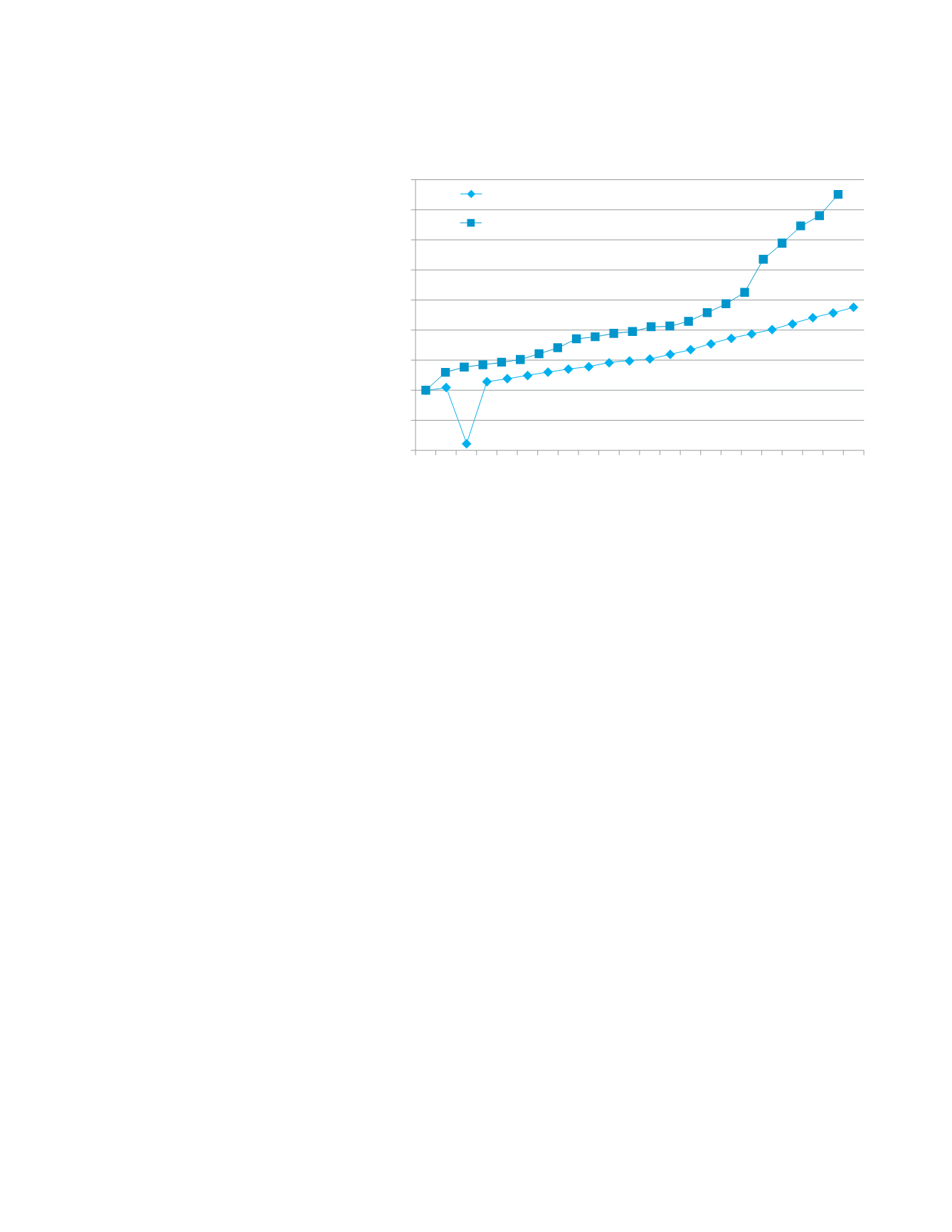

Milk production has been witnessing a

steady increase over the years. The price

of milk also registered a steady increase till

2005–06. Since 2006, the wholesale prices

of milk showed a markedly sharp increase.

Production’s response to the sharp increase

in prices has been muted and not pro-

portional. The average price increase per

annum in the twenty-one year period from

1992–93 and from 2013–14 was about 15.3

per cent whereas production registered an

increase of only 6.6 per cent. In the ten year

period between 2004 to 2014, milk prices

increased at an average of 16.1 per cent

per annum whereas production increased

by only 6.1 per cent. The lack of produc-

tion to increasing milk prices is perhaps

on account of uncertain viability of dairy

farming at farmers’ level, even at higher

prices of milk. Interactions at different lev-

els from individual farmers to small dairies

and financing institutions reveal that unless

well- managed and supported with linkages

of all kinds, dairy farming may not be remu-

nerative enough on a stand-alone basis.

Many dairy farmers find the prices being

paid for milk currently, to be unviable. Feed

cost which constitutes 60 per cent to 70

per cent of the cost of milk production has

been increasing. Labour cost also has been

increasing. Procurement prices have been

falling in some of the large milk-producing

states. With export-oriented milk process-

ing, the dairy farmers also experience the

vagaries of international trade. However,

reducing the herd size by culling less pro-

ductive animals is also not an easy option

due to the ban on beef and beef products.

Many farmers calculate the viability of

dairying on the basis of milk procurement

prices. If the value of manure and other

wastage utilised in farms is calculated, then

Figure 4.2:

Trends in milk production and prices

Source:

Index of milk production based on Department of Animal Husbandry statistics. Whole

sale price index of milk based on WPI data of CSO.

0

50

100

150

200

250

300

350

400

450

1992–93

1993–94

1994–95

1995–96

1996–97

1997–98

1998–99

1999–2000

2000–01

2001–02

2002–03

2003–04

2004–05

2005–06

2006–07

2007–08

2008–09

2009–10

2010–11

2011–12

2012–13

2013–14

Index of milk production

WPI milk