bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

89

Chhattisgarh, Maharashtra and Assam experienced con-

tinuous growth in SHG loan outstanding from 2010–11

to 2013–14.

4.3.5 Non-performing Assets

NPAs as percentage of loan outstanding were the highest

inMadhya Pradesh on 31March 2012 (22.4 per cent) and

31 March 2013 (21.2 per cent) and remained at 19.31

per cent on 31 March 2014. NPAs as percentage of loan

outstanding were the highest in Uttar Pradesh (20.07 per

cent) and the least in West Bengal (6.63 per cent) as on

31 March 2014 as compared to the national average of

6.83 per cent. NPAs in Bihar and Assam remained below

8 per cent as on 31 March 2013 and 31 March 2014 but

increased in Chhattisgarh to 12.44 per cent on 31 March

2014 from 8.19 per cent a year earlier.

Overall, the picture that emerges for the year 2013–14

in respect of the SBLP is similar to that prevailing in the

previous year which suggested a deepening of credit flow

to a more limited number of SHGs in selected regions. It

would appear that banks are lending to well-established

SHG clients in the leading states while holding back

in other states and regions where the SHG movement

does not enjoy strong institutional support. Reports con-

tinue to be received of the reluctance of banks to lend

to SHGs even of well-established SHPIs. In some states

where NRLM activity has progressed disbursements

have picked up slightly. However, the impact of the pro-

gramme in terms of financial inclusion through SHGs

is obviously limited to the districts covered. Indeed, the

weak performance in some of the relatively backward

states and in the north and north-east region, which are

virtually falling off the map, needs to be fully understood

and tackled on an urgent basis.

4.4 PERFORMANCE OF BANKS IN

SHG LENDING

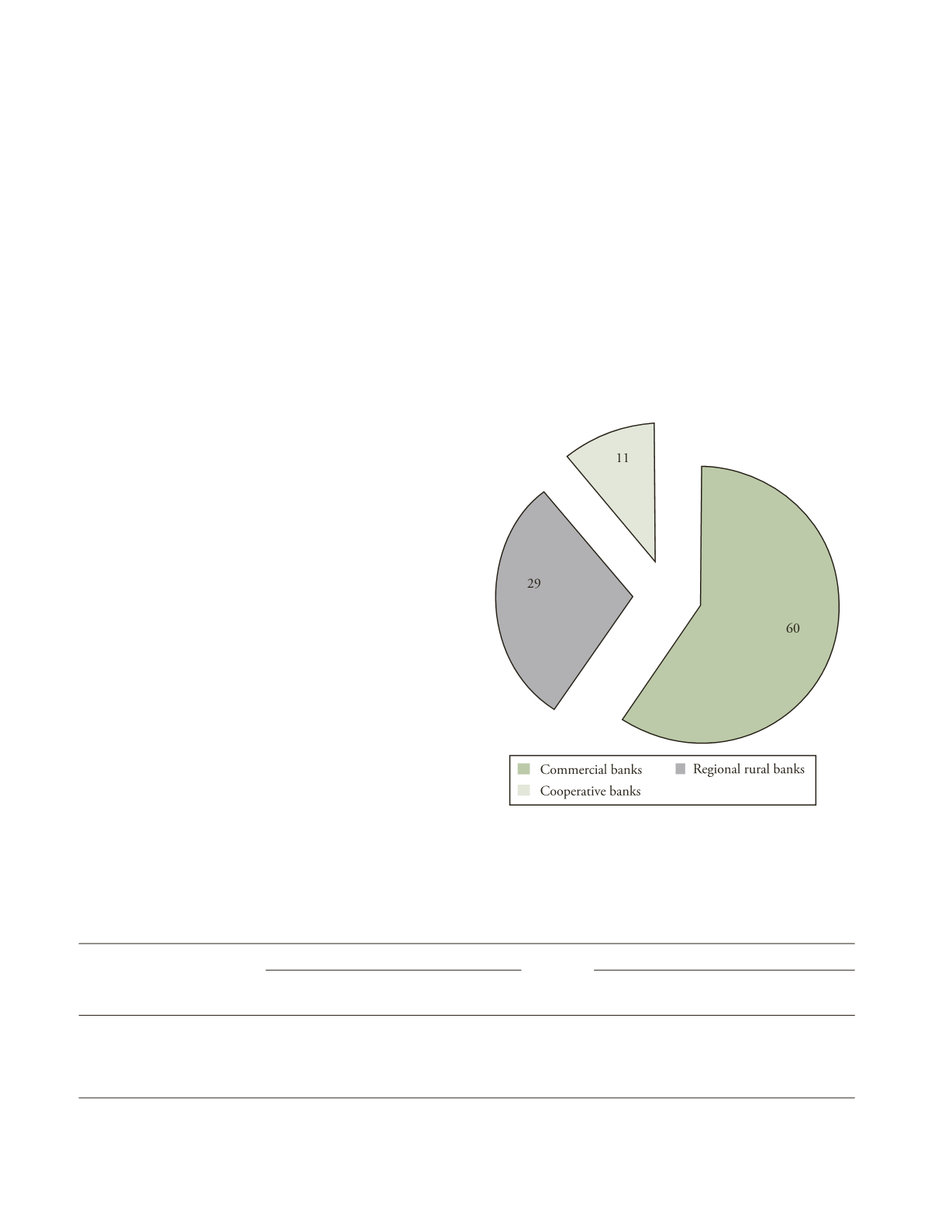

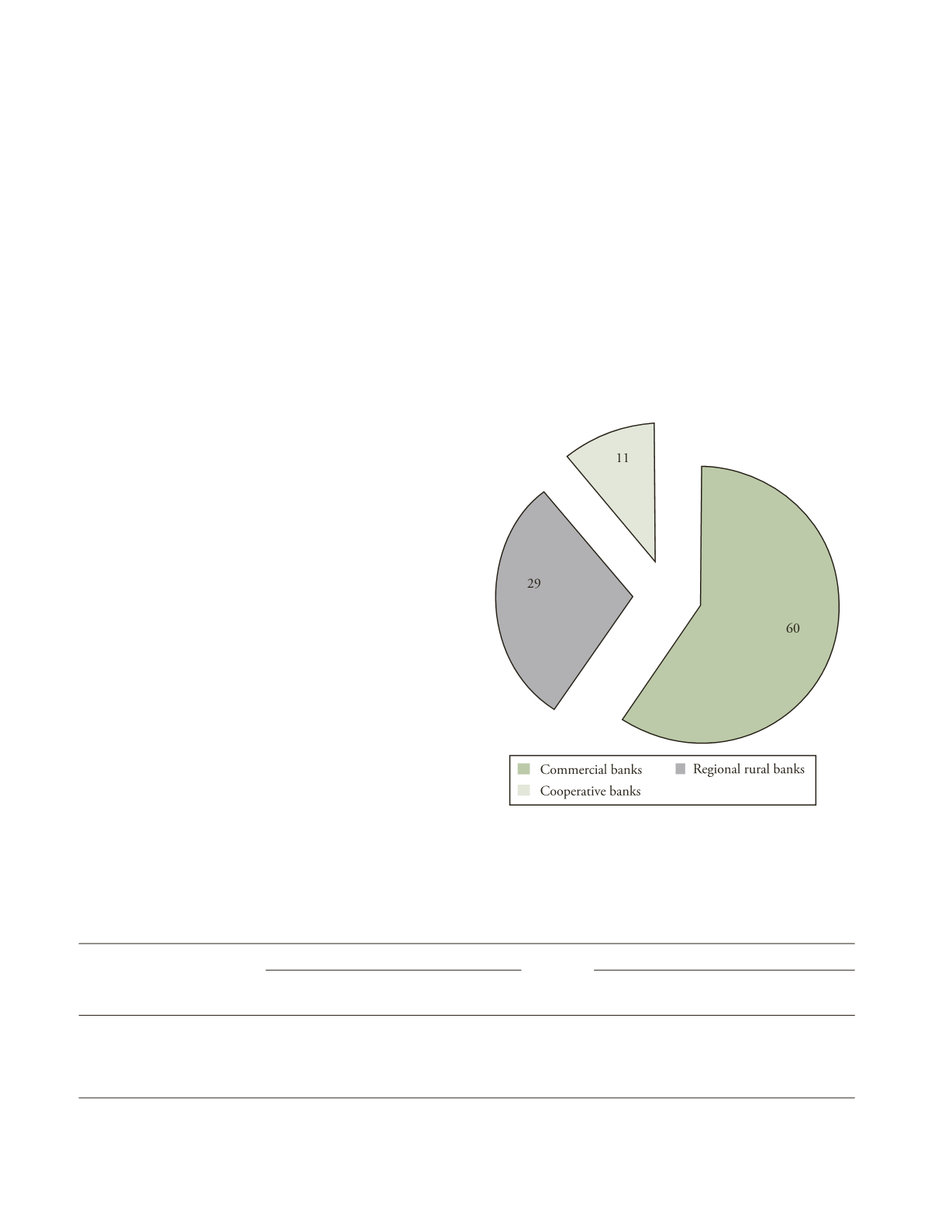

The number of SHGs with loan outstanding from banks

as on 31 March 2014 was 4.20 million, down by about

254,000 over the previous year (Table 4.9). There has

not been any change in the percentage share of difference

agencies—commercial banks (60 per cent), RRBs (29

percent), cooperative banks (11 percent) (Figure 4.6).

Thus the decline in the number of SHGs was more or

less equally shared between the different types of banks.

T

ABLE

4.9

Number of SHGs and Loan Outstanding by Agency

Banks

As on 31 March 2013

As on 31 March 2014

No. of SHGs

Loan outstanding

No. of SHGs

Loan outstanding

(Rs. billion)

(Rs. billion)

Commercial banks

2,643,971

266.4

2,501,264

293.9

Regional rural banks

1,327,367

105.2

1,227,563

110.5

Cooperative banks

480,096

22.1

468,511

24.9

Total

4,451,434

393.8

4,197,338

429.3

Source

: SHG data from NABARD (2013 and 2014).

F

IGURE

4.6

Agency-wise Distribution of Number of SHGs

with Outstanding Loans

Source

: NABARD (2014).