bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

83

previous year was probably on account of the weeding

out of inactive accounts by the commercial banks. In

keeping with the observed phenomenon of stagnation,

the number of SHGs savings-linked to banks has not

picked up during the past one year.

The total savings amount seems to have picked up

momentum again in 2013 after a blip in 2012 (Figure

4.3) to reach Rs. 99 billion in 2014. SHG savings as

a proportion of bank loans outstanding to SHGs has

been steadily growing. SHG savings now constitute over

23 per cent of outstanding loans—up from a little over

20 per cent in the previous year.

This means that funding from SHG groups themselves

accounts for nearly a quarter of the SHG lending port-

folio of banks. It is also illustrative of the fact that SHGs

have emerged not only as recipients of bank loans but

also important contributors to resources being mobilized

by banks. It is widely accepted that savings deposits are

being used by banks as collateral for the loans given

to SHG members. Besides, banks have been reported

to be recovering overdue loans from savings accounts

of SHGs.

Data on state-wise performance of SHG savings with

banks is given in Appendix 4.1. While the number of

SHGs accounts increased only marginally between

March 2013 and March 2014, most of the states have

registered reasonable increases in the amount of bank

savings of SHGs. The exceptions among the major SHG

states are Karnataka, Bihar and Gujarat where there has

been a small decline in savings of SHGs. However, sub-

stantial declines have been registered in the northern and

north-eastern states both in SHG numbers and amount

of savings, a development which merits more serious

investigation.

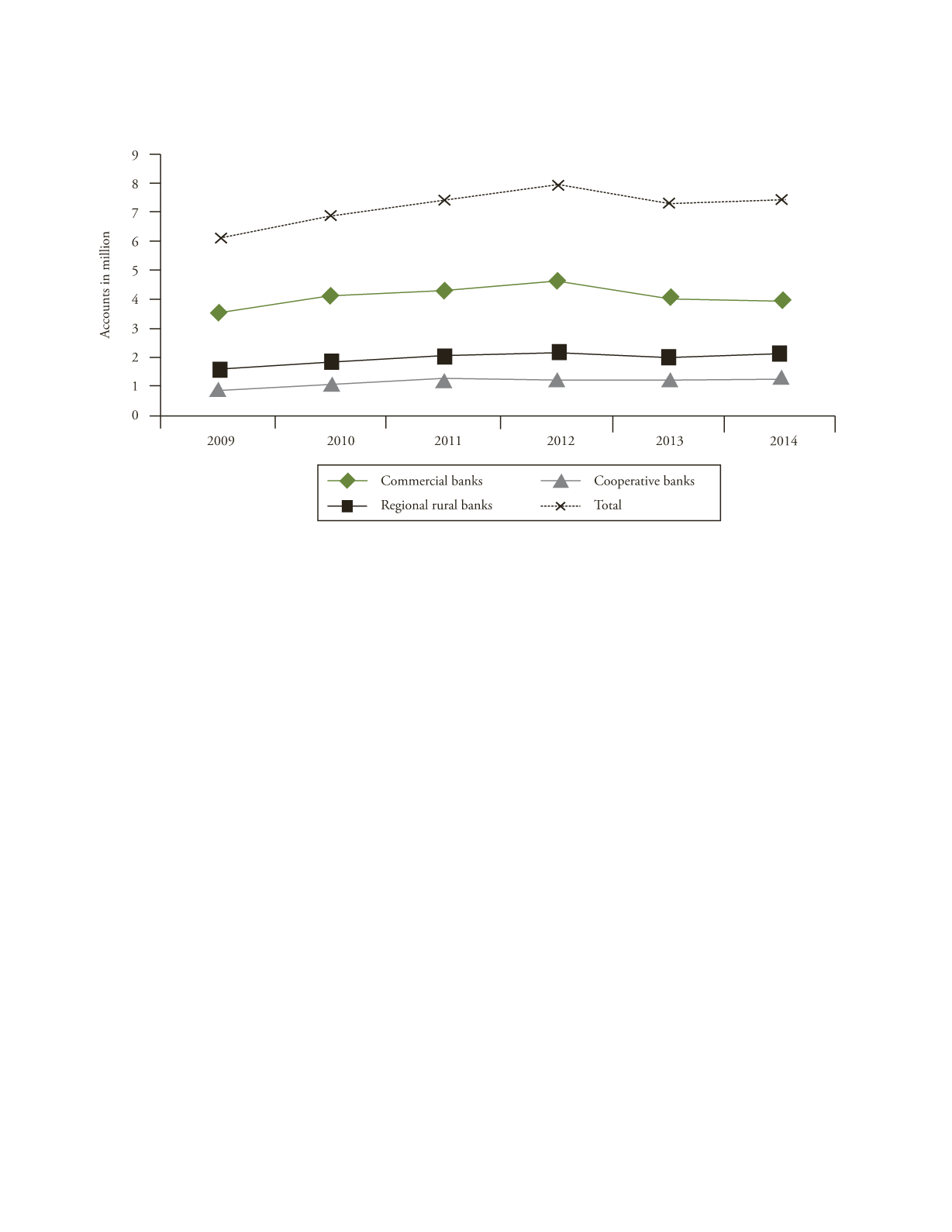

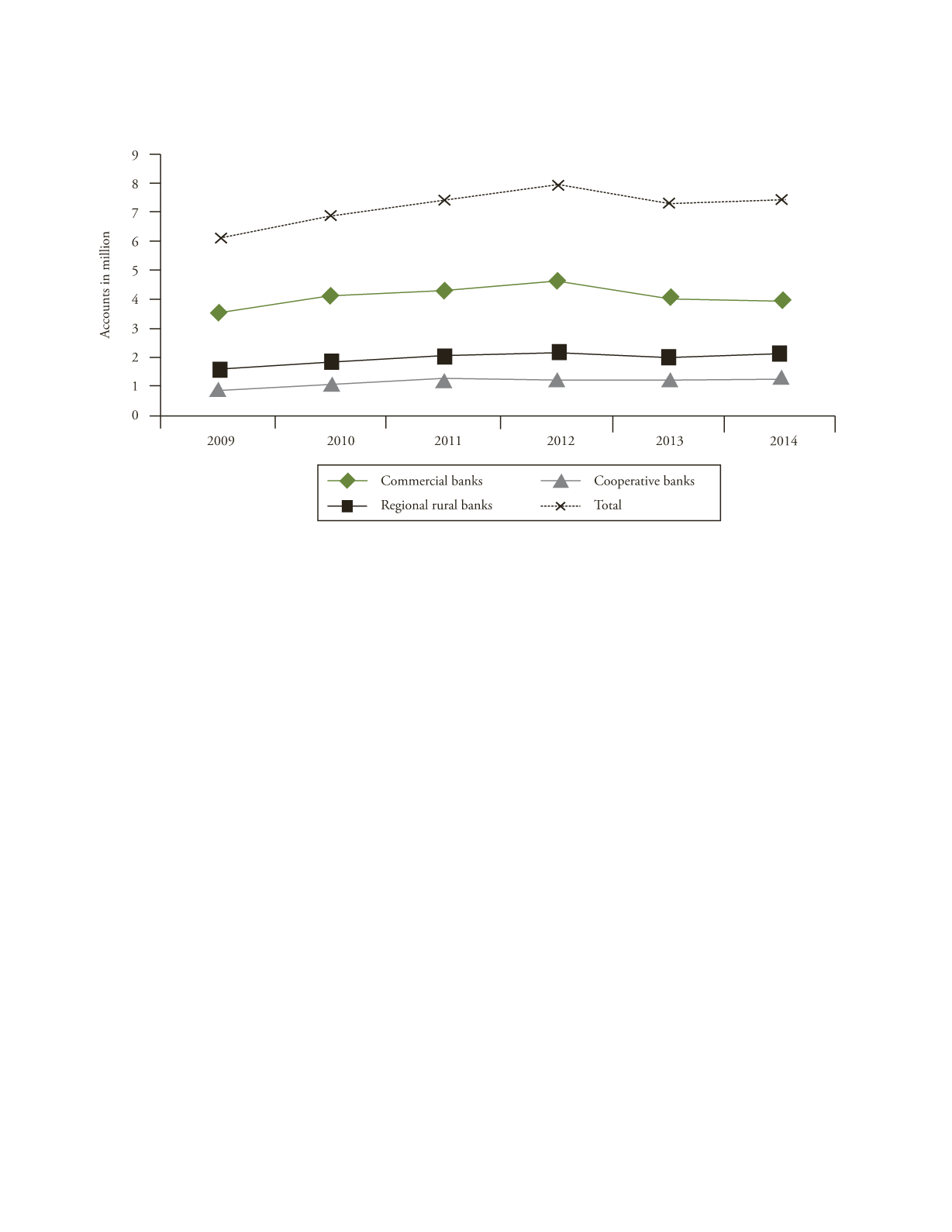

Among the financing agencies, commercial banks

continued to have the leading share (54 per cent) in the

number of SHGs with savings accounts, followed by

RRBs (28 per cent) and cooperative banks (18 per cent).

There has been no significant change over the years in the

share of these agencies (Figure 4.4).

In terms of the amount saved by SHGs as on 31 March

2014 with different agencies, 67 per cent was accounted

for by commercial banks, 20 per cent by RRBs and 13

per cent by cooperative banks (Figure 4.5 and Table 4.4).

Over the years there has been a steady increase in the

share of commercial banks, at the expense of cooperative

banks, while RRBs have roughly maintained their rela-

tive share.

F

IGURE

4.2

Number of SHGs Holding Savings Accounts 2009–2014

Source

: NABARD (2009 to 2014).