bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

81

better reporting standards adopted by banks by including

only operative SHG accounts.

The growth in SHG loan outstanding (9.0 per cent)

is associated with a 6 per cent decline in the number of

SHGs having outstanding loans with banks over the past

one year. This anomalous situation is apprehended to

be the result of increased non-performing assets (NPAs)

of SHG loans with banks. Indeed, as is discussed later,

NPA levels in most states have reached well in excess of

10 per cent.

Annual growth rates of the major indicators of physical

and financial progress of SBLP for the four-year period

since 2010, the year of the AP crisis, confirm the impres-

sion of stagnation and decline (Tables 4.2 and 4.3).

It is evident that both physical and financial perfor-

mance of SHGs suffered during 2010–14. In the case of

physical performance all indicators, except number of

SHGs having bank savings, experienced negative growth

as compared to the phenomenal increase during 2006–

10. There was a major deceleration in the growth rate of

SHGs receiving loans and SHGs with loan accounts. The

decline was sharper for the SGSY programme which was

winding up before lending picked up under NRLM and

other government programmes in 2013–14.

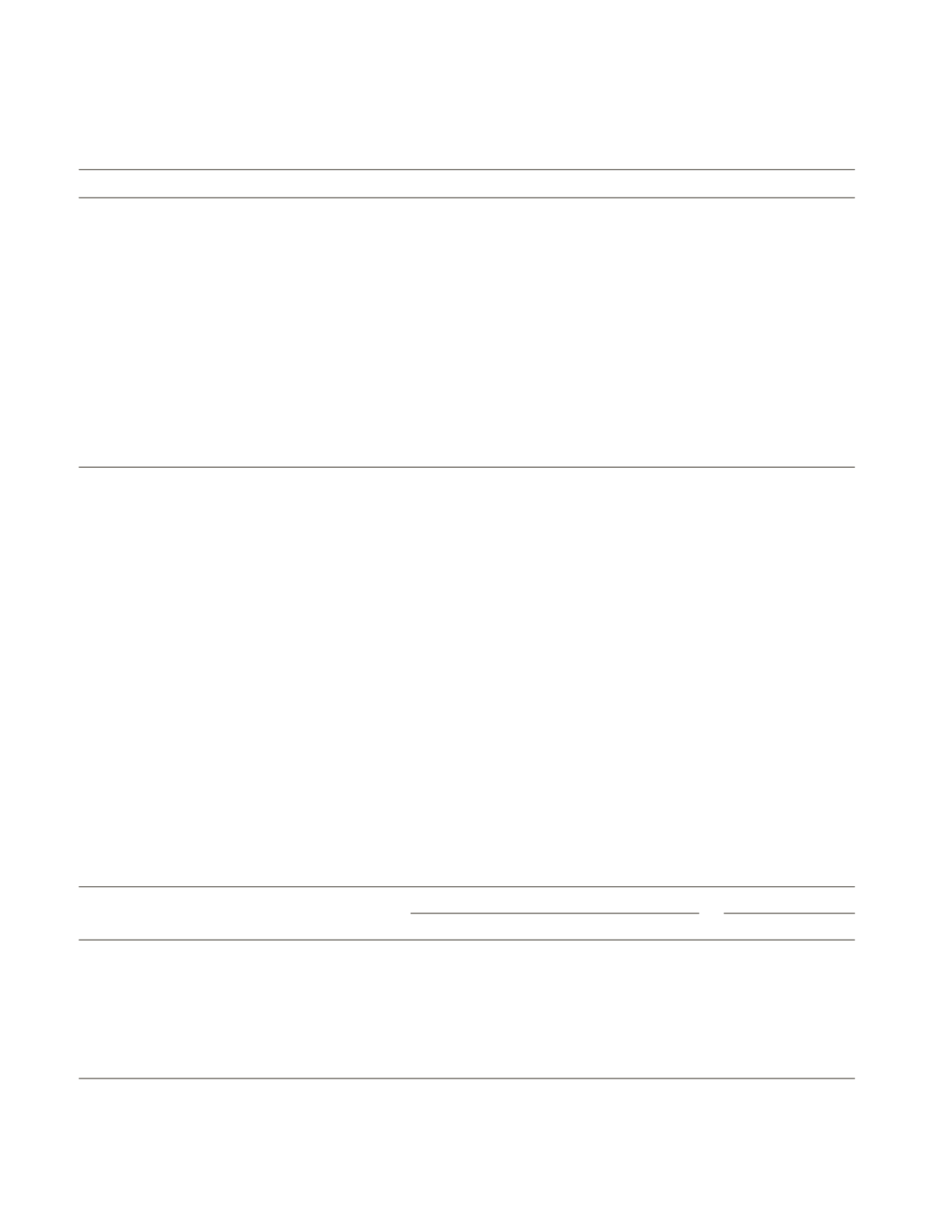

T

ABLE

4.1

Growth Trends in SHG Bank Linkage Program (SBLP)

Particulars

2010

2011

2012

2013

2014

No. of SHGs with outstanding bank loans

4,851,356

4,786,763

4,354,442

4,551,434

4,197,338

Of which in southern region

2,582,112

2,706,408

2,355,732

2,415,191

2,221,038

Share of southern region (%)

53

57

54

54

53

Share of SGSY/NRLM/Other govt. programme groups (%)

26

27

28

27

23

Share of women’s groups (%)

80

83

84

84

81

Loans disbursed to SHGs during the year (Rs. billion)

144.53

145.48

165.35

205.85

240.17

Average loan disbursed during the year per SHG (Rs.)#

91,081

121,625

144,048

168,754

175,768

Total Bank loan outstanding to SHGs (Rs. billion)

280.38

312.21

363.41

393.75

429.27

Average loan outstanding per SHG (Rs.)

57,794

65,224

83,457

88,455

102,273

Incremental groups with o/s loans (million)

0.63

(-)0.06

(-)0.43

0.10

(-)0.25

Incremental loans o/s (Rs. billion)

45.9

33.53

57.22

30.35

35.52

No. of SHGs with savings accounts with banks (million)

6.95

7.46

7.96

7.32

7.42

Total Savings of SHGs with banks (Rs. billion)

61.99

70.16

65.51

82.17

98.97

Average savings of SHGs with banks (Rs.)

8,915

9,402

8,230

11,229

13,321

Source

: NABARD (2010 to 2014).

Note

: # during the year ended 31 March.

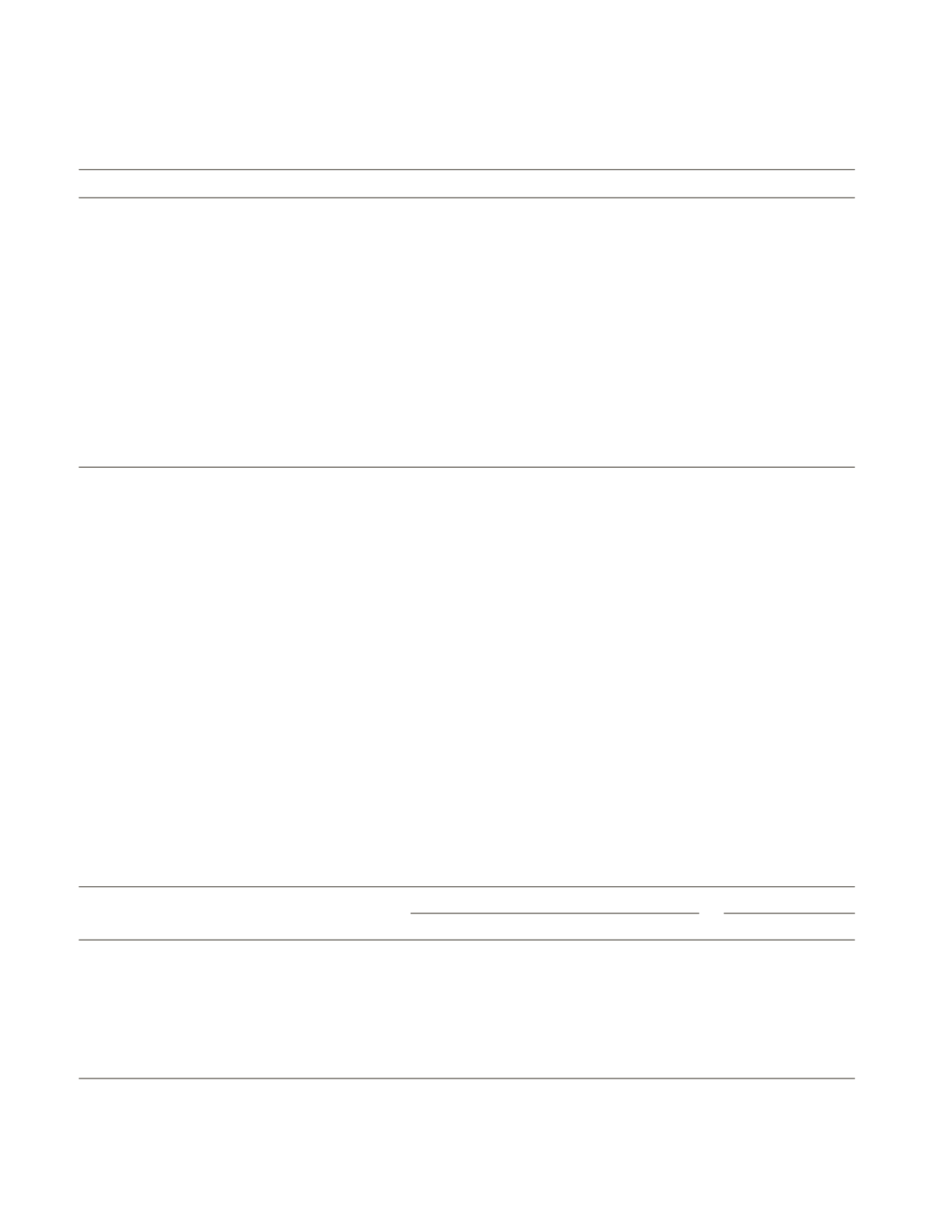

T

ABLE

4.2

Physical Performance of SBLP

Indicator

% Change

CAGR (%)

2010–11

2011–12

2012–13

2013–14

2010–14

2006–10

Number of SHGs having savings accounts with banks

7.3

6.7

–8.1

1.5

1.7

27.5

Number of SHGs receiving loans during the year

–24.6

–4

6.3

12.0

–3.7

26.4

Number of SHGs receiving loans during the year under

SGSY/NRLM/Other govt. programmes

–9.9

–12.9

–13.8

24.7

–4.1

12.8

Number of SHGs with loan outstanding

–1.3

–9

2.2

–5.7

–3.6

18.7

a

Number of SHGs with loan outstanding under

SGSY/NRLM/govt. programmes

3.3

–5.4

–1.9

9.6

1.2

21.9

a

Source

: NABARD (2010 to 2014).

Note

: For the period 2007–10.