i nc lu s i ve f i nanc e i nd i a re port 2014

82

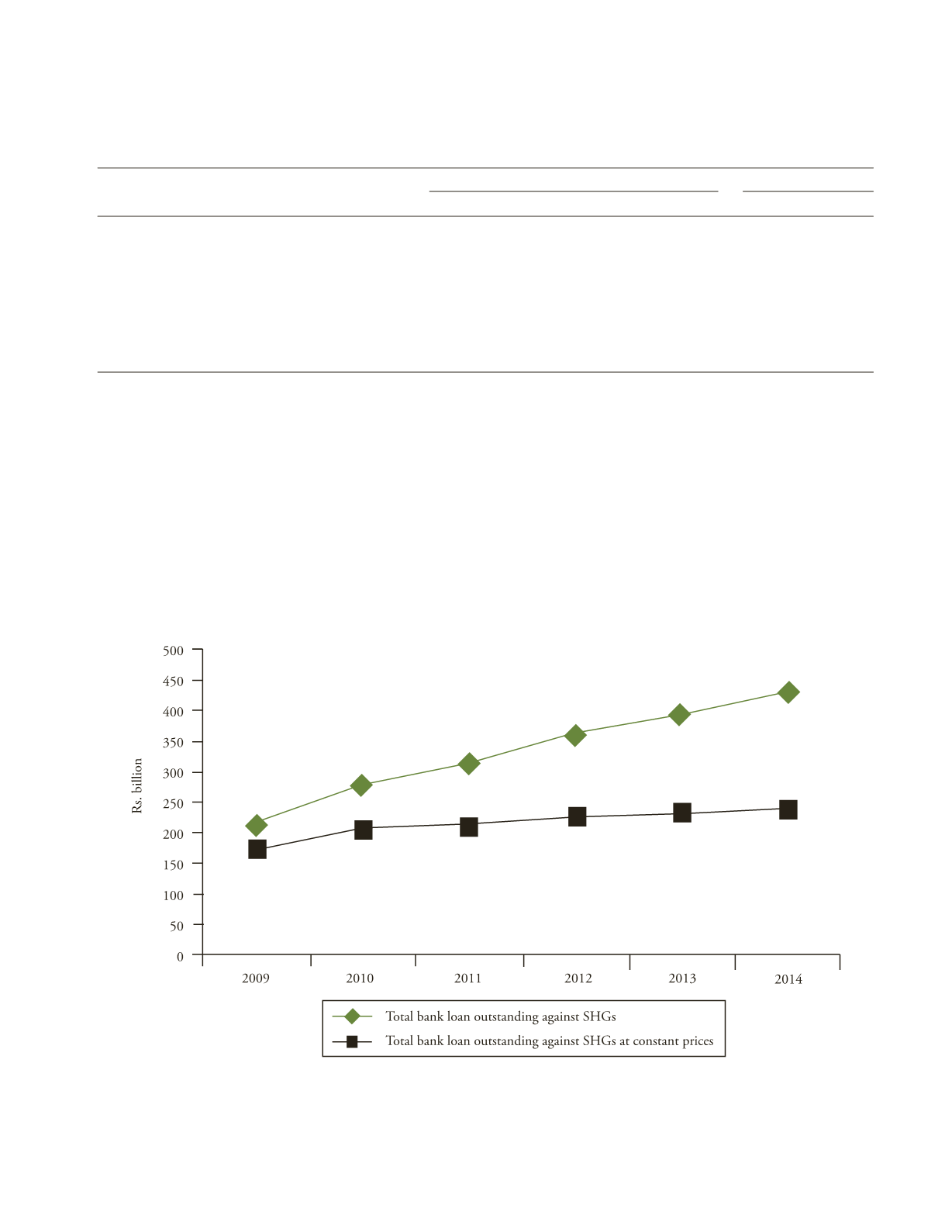

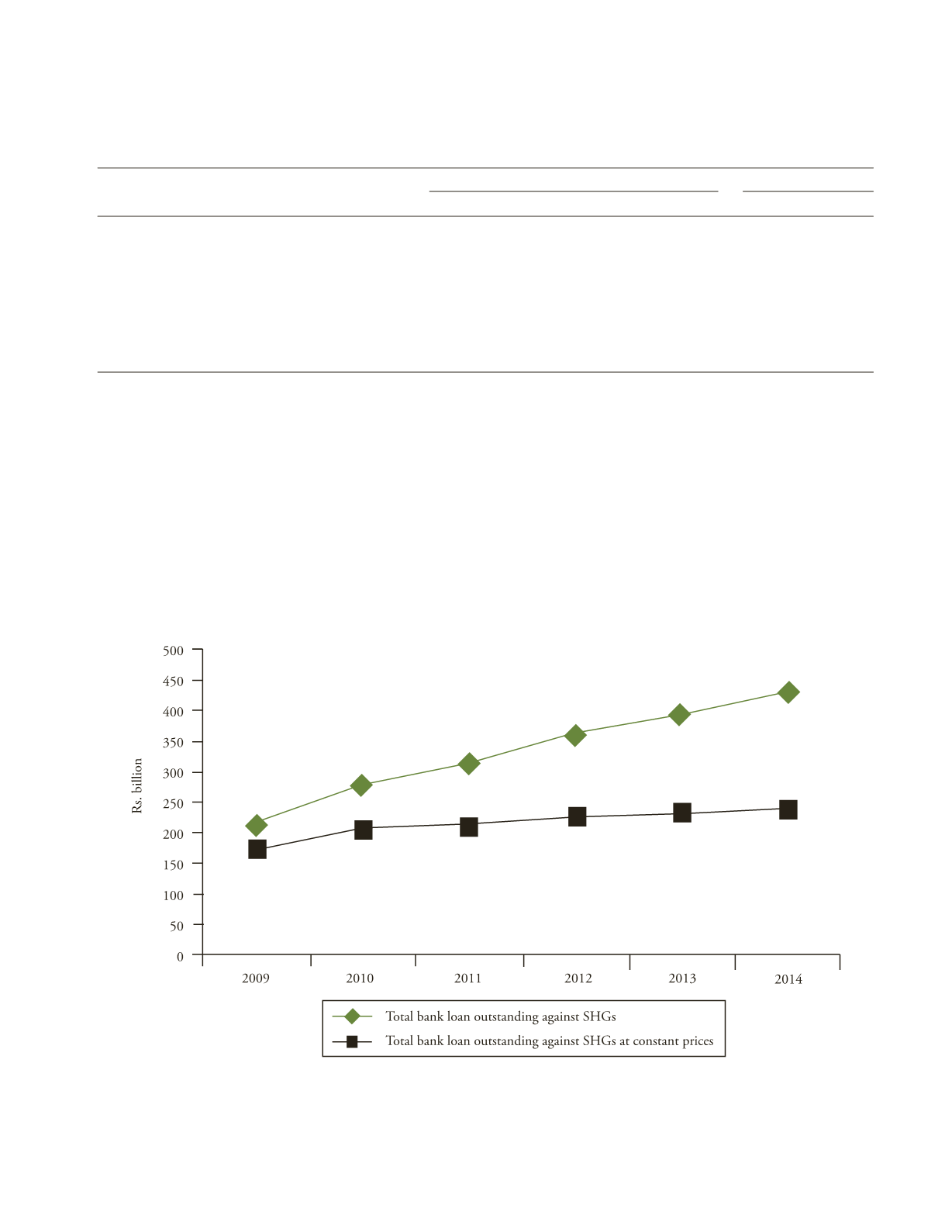

If we consider the loan outstanding from banks to

SHGs for the same period (2010–14) in real terms (Figure

4.1), the annual increase during the four years has been

less than 4 per cent from Rs. 205.7 billion to Rs. 238.1

billion, that too in a period of rising NPAs. Overall, a

clear break has set in in performance of SHGs around

2010 during which period the number of SHG clients of

the banking system have declined by 13 per cent.

4.1.2 Savings Performance

The number of SHGs savings-linked with the banking

system has grown steadily from 2007 since when records

are available, and had peaked at 7.96 million groups in

2012. The number declined to 7.3 million as at the end

of March 2013 (Figure 4.2) before increasing marginally

to 7.4 million in March 2014. The decline in the

T

ABLE

4.3

Financial Performance of SBLP

Indicator

% Change

CAGR (%)

2010–11

2011–12

2012–13

2013–14

2010–14

2006–10

Savings of SHGs with banks (Rs. billion)a

13.2

–6.7

25.4

20.5

12.4

26.9

Volume of loans disbursed to SHGs during the year#

0.7

13.7

24.5

16.7

13.5

33.8

(Rs. billion)

of which under SGSY/NRLM/other govt.

12.8

6.6

–16.5

57.7

12.2

16.25

programmes (%)

Bank loans outstanding with SHGs (Rs. billion) (a)

11.4

16.4

8.4

9.0

11.2

31.3

a

of which under SGSY/NRLM/other govt.

25.2

2.9

6.7

18.4

13.0

24.2

a

programmes (%)

Source

: NABARD (2010 to 2014).

Note

:

a

For the period 2007–10.

F

IGURE

4.1

Loan Outstanding to SHGs: Nominal and Real Terms

Source

: NABARD (2009 to 2014).