agent s of f i nanc i a l i nc lu s i on

69

customer’s doorstep. For this it is intended to activate the

existing CSCs and build upon with their wider functions

and services provided. There are 1,26,000 CSCs,

31

out of

which only 12,000 are BCs of the banks. Thus the future

of BCs involves a mix of fixed and mobile service points

which could provide better quality and a wider range of

services in a viable manner.

PART 2

3.8 TECHNOLOGICAL DEVELOPMENT IN

FINANCIAL SERVICES SECTOR

Notwithstanding the larger social goals that drive finan-

cial inclusion, there are serious economic questions that

bother the architects who structure the edifices of inclu-

sive banking systems. Banks everywhere have started real-

izing that the costs associated with working through the

traditional brick and mortar model, especially, in remote

regions, are enormous and would continue to pose major

hurdles on the way to promoting financial inclusion.

Encouraged by the banking regulator, there has been

a constant search for viable channels and methods of

externalizing costs of intermediation which can lead up

efficiently to the last mile user of financial services. As dis-

cussed in the previous section, the multiple experiments

made with the BC/BF models have all been directed at

evolving viable and business models that could push the

reach of financial services to newer and newer sections of

population. With many of these models failing to prove

their viability in conclusive terms, the role of technol-

ogy has come to be reemphasized as a key enabler for

financial inclusion.

While reach, economy on scale and efficiency are the

major advantages of technology-led models of financial

intermediation, their fast dissemination more often than

not gets hindered by various factors ranging from policy

imperfections, infrastructural bottlenecks and incom-

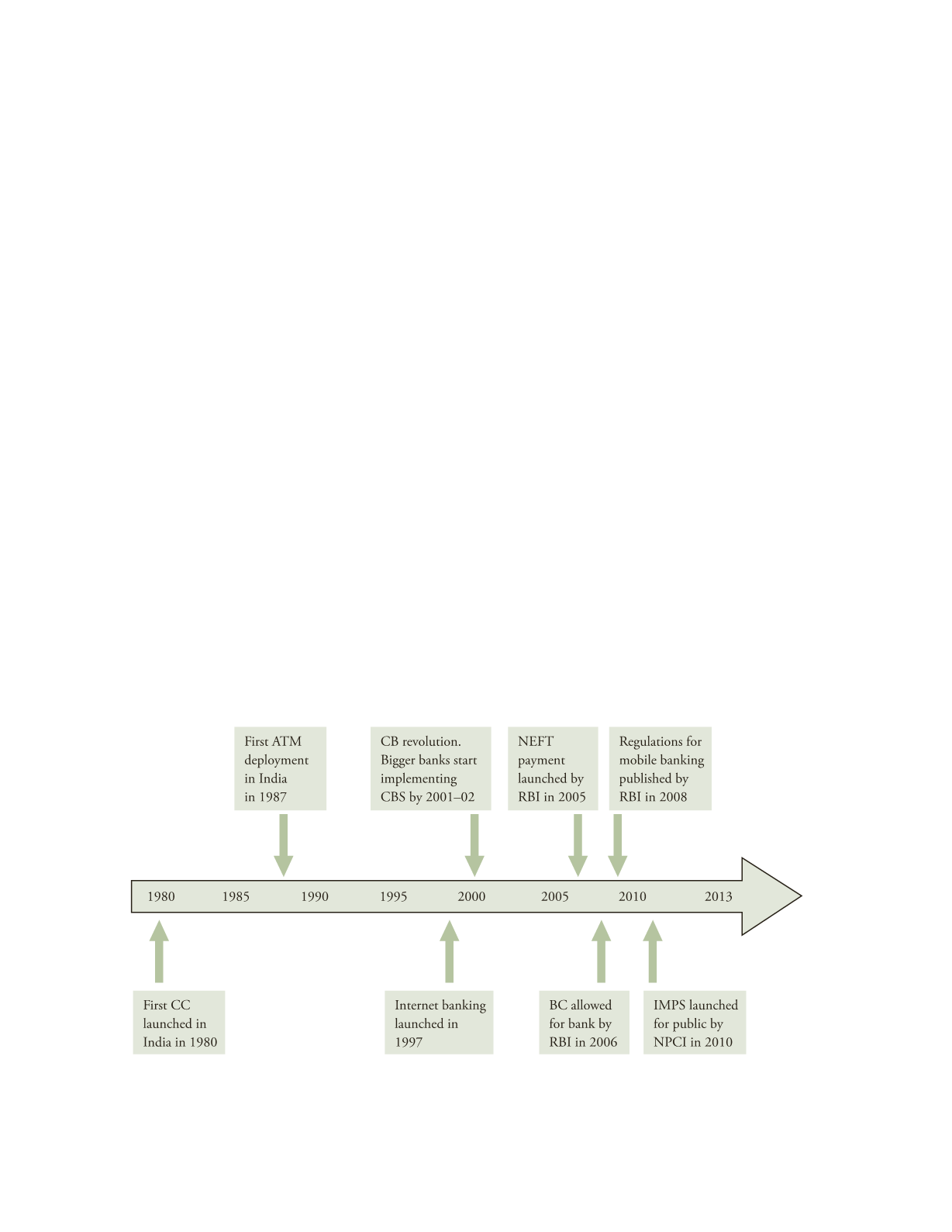

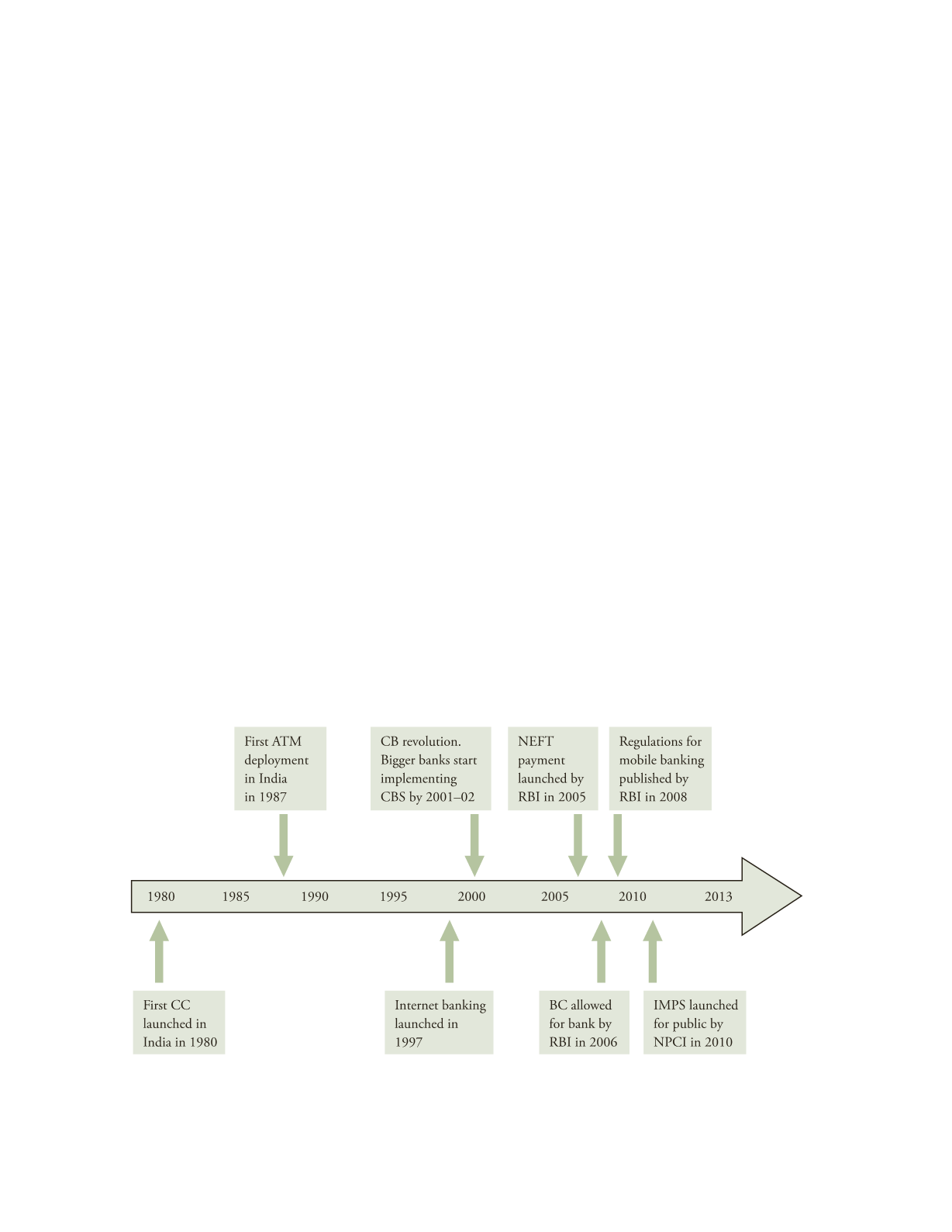

patibility with users’ values and perceptions. Figure 3.3

represents the timeline of innovation in Indian banking

and financial services since 1980, the year when the first

credit card was introduced in the country. Over a span of

about three decades between 1980 and 2014, the initial

15 years did not witness many innovations in the financial

sector. The 2000s turned out to be a highly productive

decade in terms of innovation when many revolution-

ary technological changes that drew upon information

and communication technologies were introduced. The

1980s, some would argue, marked the first phase of

‘financial inclusion’ in the country. That was the

time when foreign banks realized that more than 200

million of the middle class households of the progressively

F

IGURE

3.3

Technology Innovation in Indian Banking

Source

: Deloitte (2013, 22).