i nc lu s i ve f i nanc e i nd i a re port 2014

70

liberalizing India were ‘financially excluded’ due to lack

of supply of consumption credit. The new technology

of credit card provided them with hassle-free consumer

finance, which they could not access from mainstream

banks directly. About seven years later was introduced

the technology of automatic teller machines or ATM.

It took another 10 years for internet banking to be

launched. Mobile banking was the last major technology

introduction.

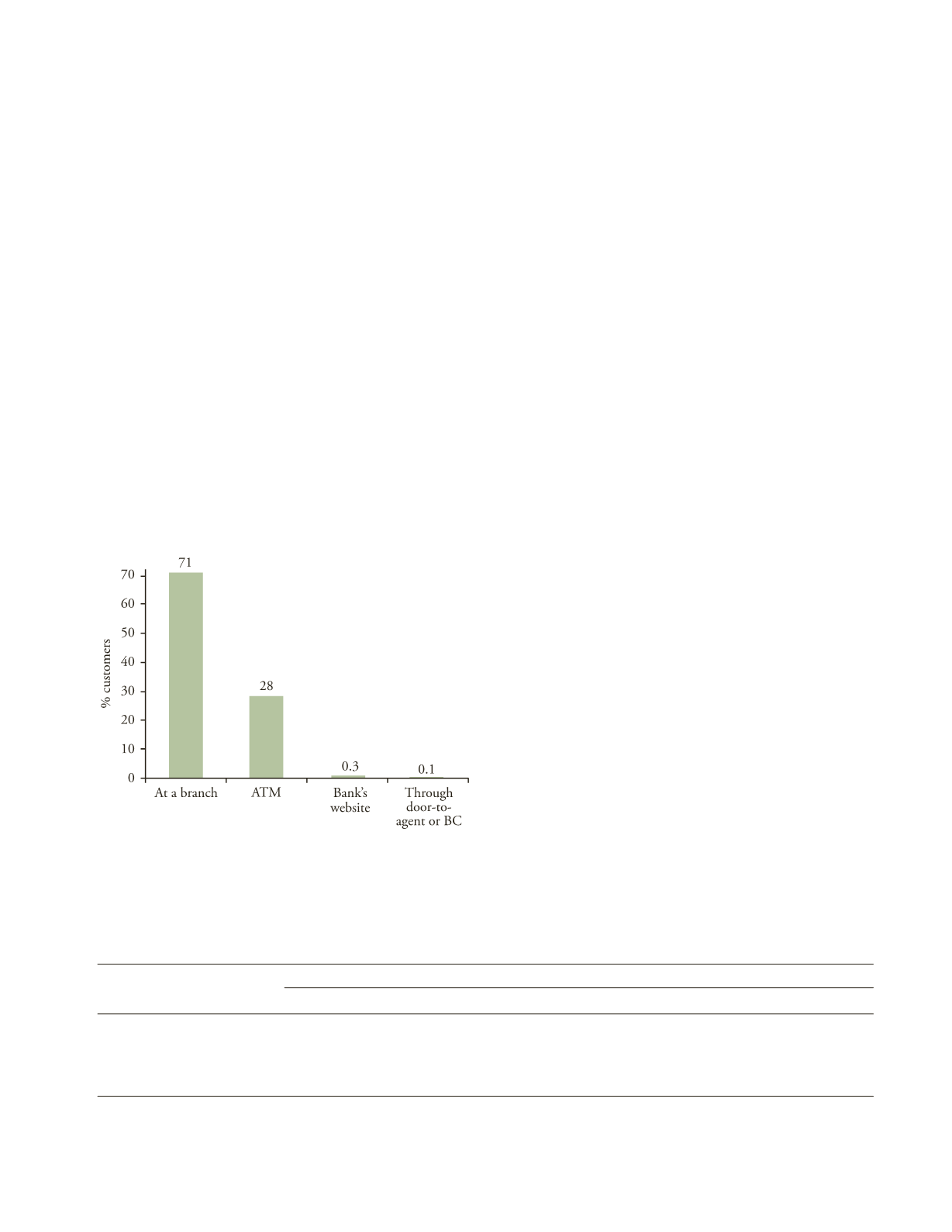

To what extent has the adoption of new technolo-

gies helped broadbase access to banking? The recent

InterMedia India Survey (2014) has made some pertinent

observations regarding the use of digital financial services

by customers. As Figure 3.4 shows a bank branch is still

the preferred place for majority of the bank custom-

ers. Interestingly, in the 28 years of its existence, ATM

technology could convince only 28 per cent of the active

customers to engage with the technology.

F

IGURE

3.4

Mode of Accessing Banking Services by Active Bank

Account Holders

Source

: InterMedia (2014).

National Payments Corporation of India (NPCI) set

up in 2009 operates the National Financial Switch (NFS)

that facilitates routing of ATM transactions through

interconnectivity between the banks’ switches thus

allowing the customers to use any ATM of a connected

bank. In June 2012 the RBI issued guidelines for non-

banking entities to set up White Label ATMs (WLA)

under the Payments and Settlement Systems Act 2007

with a view to enhance the spread of ATMs in semi

urban and rural areas where bank-owned ATMs are not

working (RBI, 2013–14). NFS has 83 direct members,

196 members, 49 RRB members and 7 WLA operators,

who together operate 1,80,494 ATMs in the country. The

WLAs operate about 4,370 ATMs, 60 per cent of which

are owned by Tata Communications Payment Solutions

Private Limited.

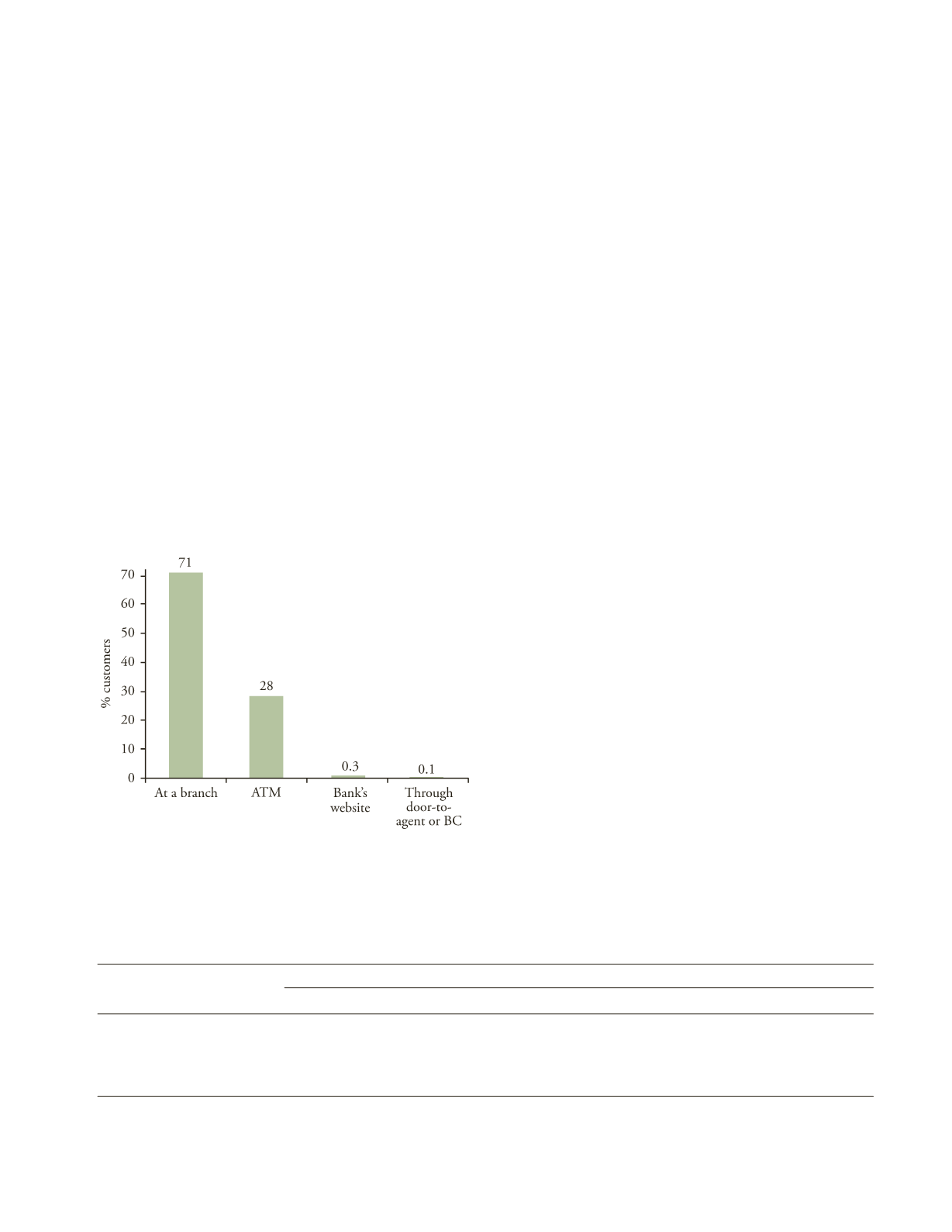

The available data suggests that banks have not found

the ATM technology viable for rural areas. Of a total of

1,60,055 ATMs in the country as of 31 March 2014 only

14 per cent (i.e., 23,334) are located in rural areas. The

metropolitan and urban areas accounted for about two-

thirds of the increase in the number of ATMs between

September 2012 and March 2014. Table 3.3 shows that

48,400 new ATMs were set up during this period by

banks across states. One of the factors that limits the us-

ability of rural ATMs for economically weaker sections is

that these machines cannot disburse smaller denomina-

tion notes.

3.8.1 Electronic Payments

It is the central bank’s vision to proactively encourage

electronic payment systems for ushering in a cashless

society and to ensure that the payment systems are safe,

efficient, interoperable, authorized, accessible, inclusive

and compliant with international standards (RBI, 2012).

T

ABLE

3.3

Growth in ATMs: 2012–14

Time period

Number of ATMs operated by

Public sector banks

Private sector banks

Foreign banks

All banks

September 2012

60,573

39,812

1,361

101,746

March 2013

69,652

43,101

1,261

114,014

September 2013

83,146

45,941

1,246

130,333

March 2014

110,424

48,467

1,164

160,055

Source: RBI (2013

–

14).