agent s of f i nanc i a l i nc lu s i on

71

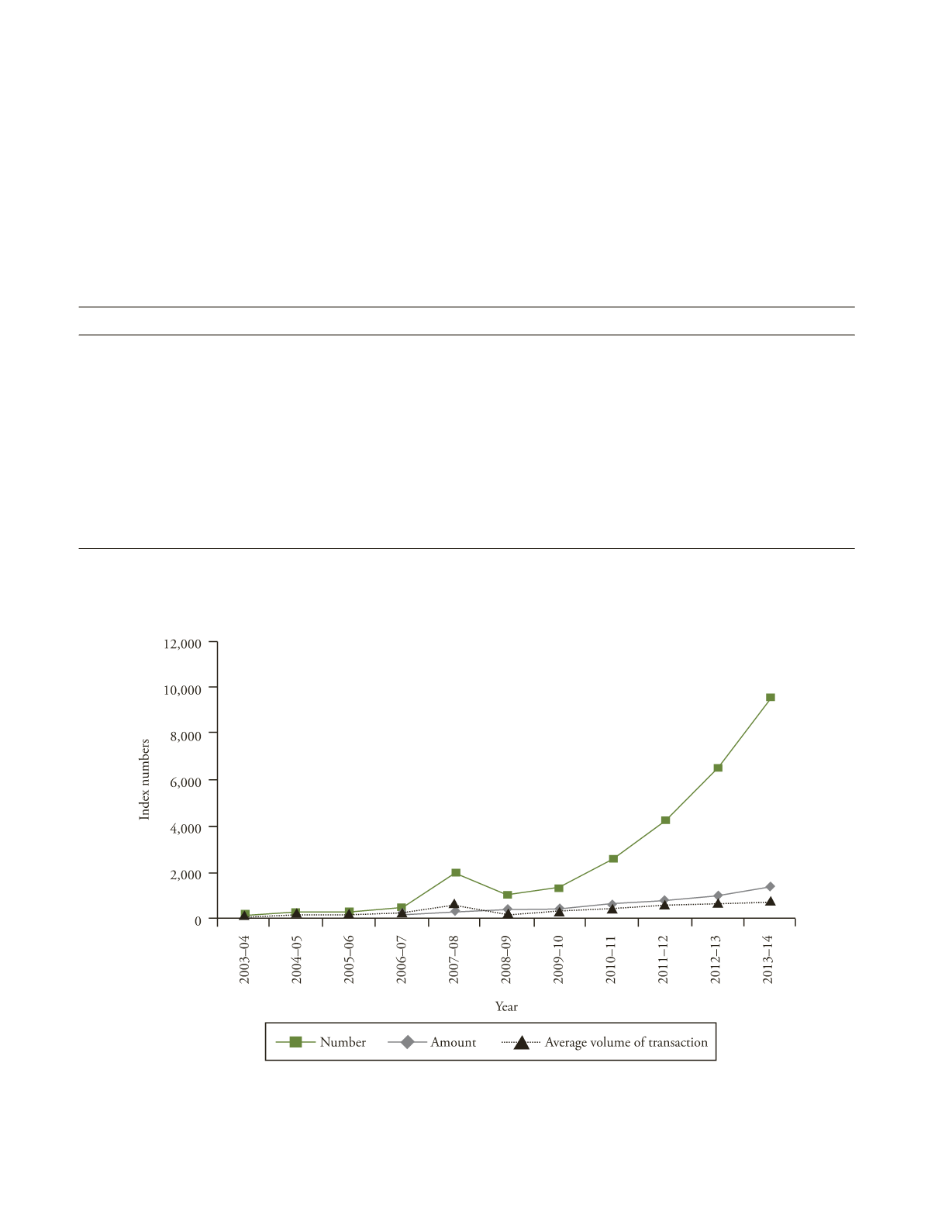

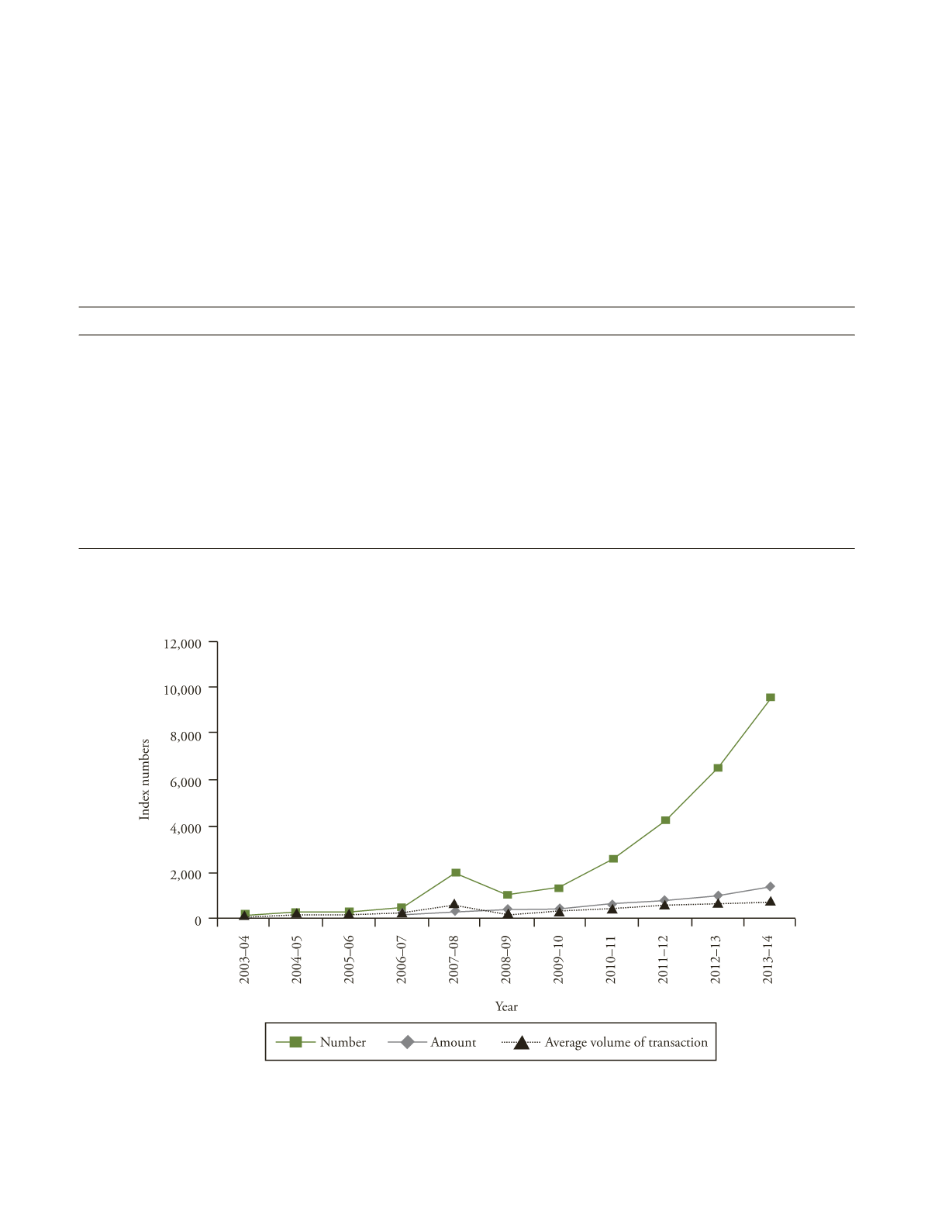

The retail electronic payment systems [comprising

Electronic Clearing Service (ECS), National Electronic

Fund Transfer (NEFT), Pre-paid Payment System (PPI),

Point of Sale (POS) Terminals/online transactions] grew

substantially during the decade 2004

–

14. The number

of transactions under retail electronic payments rose

from 167 million to 2,268 million while the volume of

transaction grew about 100 times from close to Rs. 500

billion to Rs. 50,000 billion (Table 3.4). It is evident

from Figure 3.5 that momentum of growth in transaction

T

ABLE

3.4

Progress of Retail Electronic Payments

Year

Number (million)

Amount (Rs. billion)

Average volume of transaction (Rs.)

2003–04

166.94

521.43

3,123

2004–05

228.90

1,087.50

4,751

2005–06

285.01

1,463.83

5,136

2006–07

378.71

2,356.93

6,224

2007–08

535.31

10,419.92

19,465

2008–09

667.82

5,003.22

7,492

2009–10

718.16

6,848.86

9,537

2010–11

908.59

13,086.87

14,403

2011–12

1,190.40

22,137.40

18,597

2012–13

1,624.50

33,928.30

20,885

2013–14

2,268.50

50,122.00

22,095

Source

: RBI (2012), Table No. 9A, p. S 1390; RBI (2014), Table IX.1, p. 110.

Note

: Retail electronic payments include transactions through Electronic Clearing Service (ECS), Electronic Fund Transfer/National

Electronic Funds Transfer (EFT/NEFT), and cards (debit and credit).

F

IGURE

3.5

Growth in Retail Electronic Payments

Source

: Same as Table 3.4.