99

20% to 26% prevailed during the whole of the 1990s to 44% to 48% during the

latest six to seven years (Table 4.23). Year-after-year the RBI has been reporting

that the public sector banks, which are the mainstay of priority sector lendings,

have been fulfilling the 40% target except for a 0.4 percentage shortfall as on

the last Friday of March 2007 (RBI 2007, p.142). However, as stated above,

the target has been achieved because the ‘other priority sector’ advances now

constitute over 40% of the priority sector advances themselves as against

20% a decade ago; these obviously have been done at the cost of agriculture

and small-scale industries. It is thus shown that agricultural advances under

the priority sector of public sector banks have ranged from 14 to 16% of net

bank credit as per these reportings; they have never achieved the 18% target

(Table 4.24).

It is not our contention that the old definition and coverage of priority

sector deserve to be treated as immutable. It is just that the umbrella of credit

policy direction and targeting has to be used primarily for the weak and

disadvantaged sectors and sections of society whose investment and income-

earning activities are not overtly bankable and hence deserve the clutches in

the form of credit policy directives and targeting. The target had to be kept high

at 40% because the two largest sectors of the economy by employment and by

contribution to value of output, namely, agriculture and small-scale industries,

as also other informal sectors, are covered under the “priority sector”.

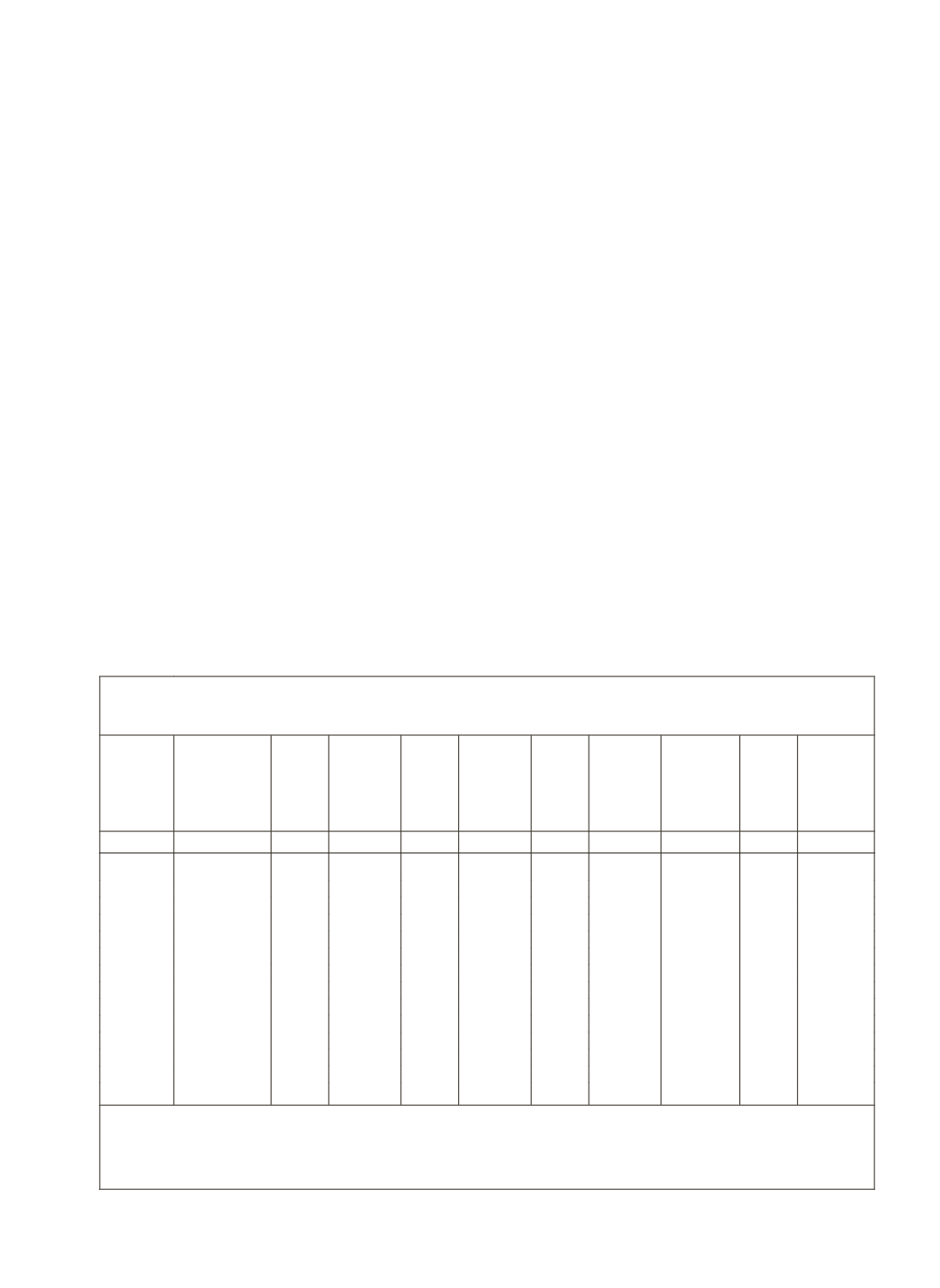

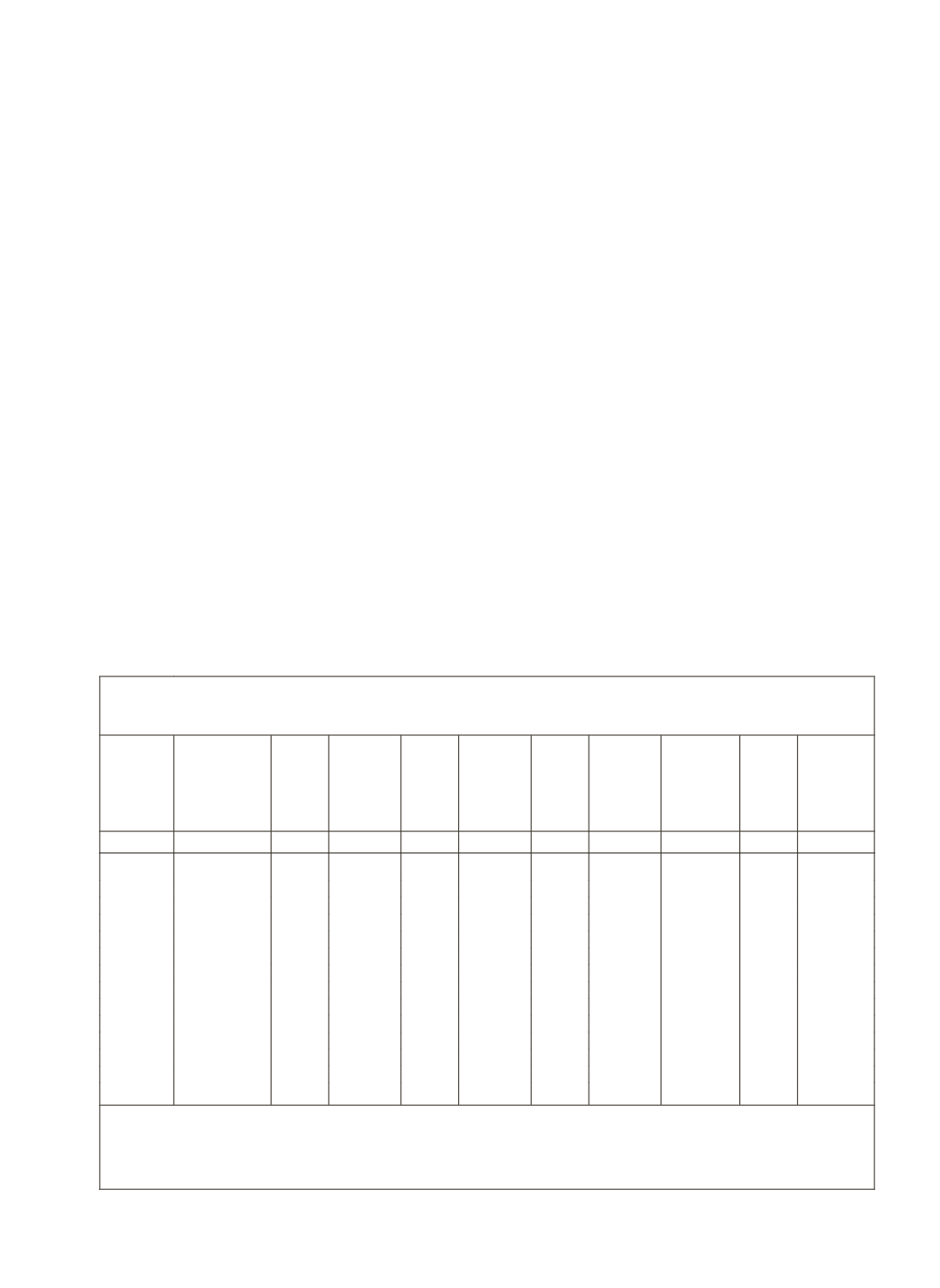

Table 4.23: Priority Sector Advances

(Rupees, crore)

Year

Agriculture % to

GNBC

SSI % to

GNBC

Others % to

GNBC

Total

Priority

Sector

% to

GNBC

Gross

Non-food

Bank

Credit

(GNBC)

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

1990-91

16750

15.0

17181

15.4

8984

8.0

[20.9]

42915

38.4

111795

1999-00

44381

10.8

52814

12.9

34632

8.4

[26.3]

131827

32.1

410267

2000-01

51922

11.0

56002

11.9

46490

9.9

[30.1]

154414

32.8

471443

2001-02

60761

11.3

57199

10.7

57299

10.7

[32.7]

175259

32.7

535745

2002-03

73518

10.8

60394

8.9

77697

11.4

[36.7]

211609

31.1

679736

2003-04

90541

11.2

65855

8.2

107438

13.3

[40.7]

263834

32.8

804824

2004-05

125250

11.8

74588

7.0

181638

17.1

[47.6]

381476

36.0

1059308

2005-06

173972

11.9

91212

6.2

245554

16.7

[48.1]

510738

34.8

1466386

2006-07

230398

12.2

117880

6.3

285864

15.2

[45.1]

634142

33.6

1884669

2007-08

275343

11.9

132698

5.7

340032

14.7

[45.4]

748073

32.3

2317515

2008-09

338656

12.4

168997

6.2

424806

15.6

[45.6]

932459

34.2

2729338

2009-10

416133

13.0

206401

6.5

469645

14.7

[43.0] 1092179

34.2

3196299

2010-11

460333

11.9

229101

5.9

549952

14.2

[44.4] 1239386

32.0

3877800

2011-12

522623

11.5

259191

5.7

617286

13.6

[44.1] 1399100

30.9

4530548

Notes:

(i) Data are provisional and relate to select banks (47 banks for 2003-04 and 52 banks from 2004-05

onwards) which account for 90% of bank credit of all scheduled commercial banks

(ii) Figures within square brackets in col.8 are percentages to total "priority sector advances" in col.9.

Source:

RBI (2012):

Handbook of Statistics on the Indian Economy

, 20011-12 (website version)