107

Sub-Targets for Small and Marginal Farmers

Another damage that the RBI’s new guidelines have inflected on its

own principles underlying these guidelines. The RBI has taken pleasure in

highlighting the four basic pillars/philosophy upon which these guidelines are

based; two important of these are:

“Priority sector refers to those sectors of the economy which,

though viable and creditworthy, may not get timely and adequate credit

in the absence of this special dispensation. Typically, these are small

value loans to farmers for agriculture and allied activities, micro and

small enterprises, poor people for housing, students for education and

other low income groups and weaker sections. Those sectors which are

able to get timely and adequate credit would not qualify for priority

sector status.

“Banks should lend directly to beneficiaries instead of routing

these loans through intermediaries. This will ensure better management

of risks and also reduction in transaction costs for such loans”

(Charkrabarty, October 2012, p.1821)

In the same vein, the RBI rejected the Nair Committee recommendations

for prescribing additional sub-targets for small and marginal farmers (More on

it later). It has justified it thus:

“though we have not prescribed fresh targets, the interests of

small and marginal farmers and other individuals will be taken care by

shifting the direct part of agricultural loans to corporates, partnership

firms and other institutions to indirect agriculture” (Charkrabarty,

October 2012, p.1822).

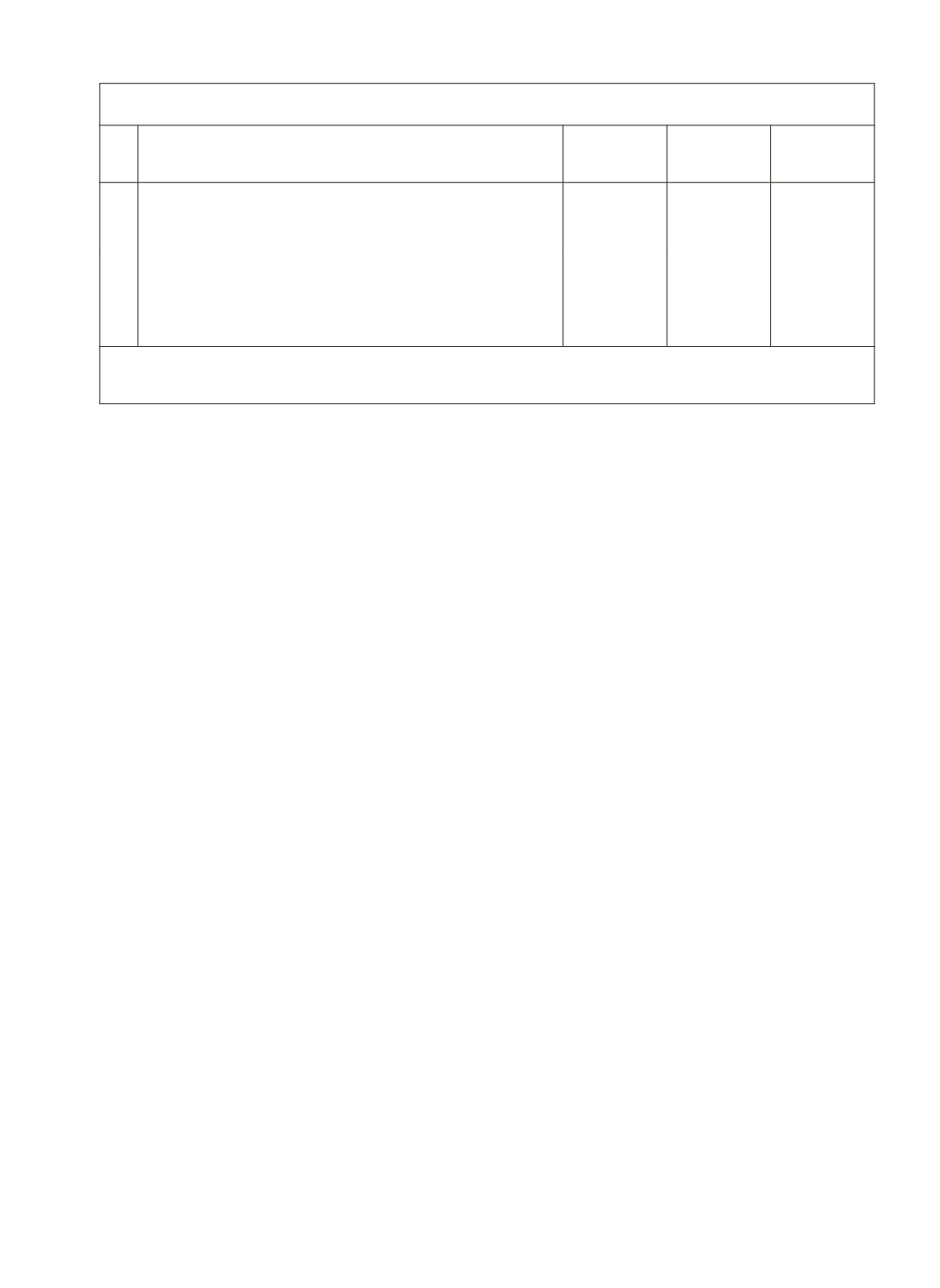

Revision of Limits for Agriculture Activities under Priority Sector

No.

Activity Description

Existing

Limits

Revised

Limits

RBI

Guidelines

1 Maximum loan against pledge / hypothecation of

agricultural produce up to 12 months [

Direct

loans to

farmers and

indirect l

oans to corporates, etc]

`

10 lakh

`

20 lakh

`

25 lakh

2 Credit for purchase and distribution of inputs for the

allied activities, dealers in drip / sprinkler irrigation

system / agricultural machinery [

Indirect

loans under RBI

guidelines]

`

40 lakh/

`

30 lakh

`

70 lakh

`

1 crore

Source:

(i) M.V. Nair Committee on

Report on Priority Sector Lendings,

February 2012 .

(ii) RBI

Guidelines on

“Priory Sector Lending – Targets and Classifications” dated July 20, 2012.