104

Fifth, it is interesting that about 20% to 24% of direct advances of

public sector banks have been to corporates with credit limits of

`

one crore

or more for agricultural operations including pre-and post-harvest activities

(Table 4.29). Incidentally, with a view to correcting the inequity involved in bank

lendings to corporates, the RBI had contemplated the shifting of such corporate

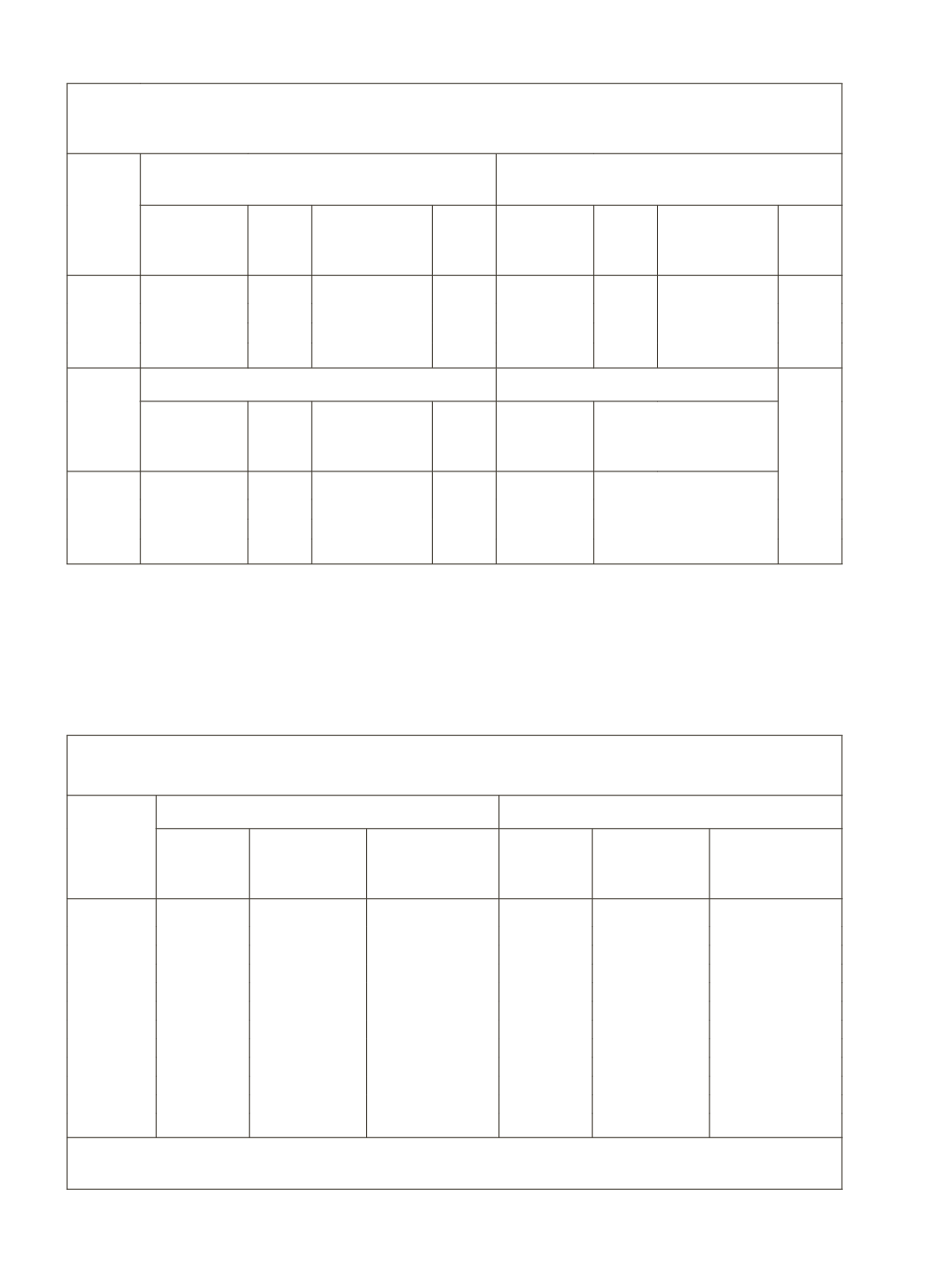

Table 4.27: Sub-Categories of Direct Advances: Amount Outstanding and

Number of Loan Accounts

(

`

Crore)

Year

Loans to Individual Farmers

Loans to Corporates, Partnership Firms,

Credit Limit upto and Above

`

1 cr.

@

No.of

Accounts

% to

Total

Balance

outstanding

(

`

lakh)

% to

Total

No.of

Accounts

% to

Total

Balance

outstanding

(

`

lakh)

% to

Total

2008 29272135

95.7

176619 76.2 278979

0.9

47395

20.5

2009 32278593

95.1

221477 79.8 546403

1.6

44939

16.2

2010 37041348

96.8

264493 78.2 663571

1.7

65203

19.3

2011 36157439

97.3

3068267 78.5 431052

1.2

691711

17.7

Year Loans Granted to Pre & Post Harvest Activities

Direct Finance Total

No.of

Accounts

% to

Total

Balance

outstanding

(

`

lakh)

% to

Total

No.of

Accounts

Balance outstanding

(

`

lakh)

2008

1048427

3.4

7626 3.3 30599541

231640

2009

1127612

3.3

11027 4.0 33952608

277443

2010

570204

1.5

8579 2.5 38275123

338275

2011

589764

1.6

146297 3.7 37178255

3906275

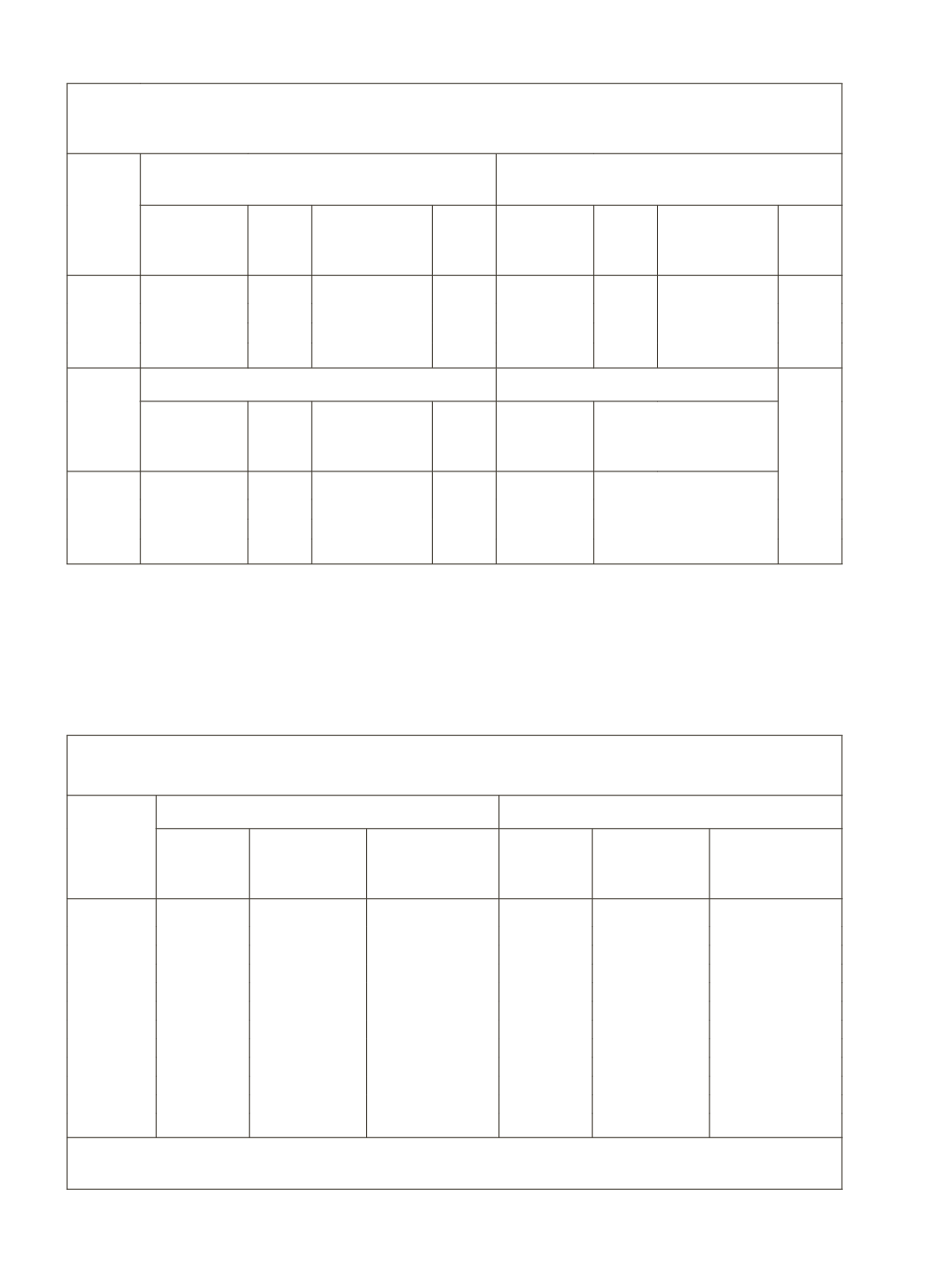

Table 4.28: Year-wise Performance under Direct Agriculture Lending By Banks

(

`

crore)

March

PSBs

Pvt Banks

Amount Year-on-Year

Growth (%)

Loans under

Direct Agri

as % to ANBC

Amount Year-on-Year

Growth (%)

Loans under

Direct Agri

as % to ANBC

2001

38003

-

11.15

2269

-

4.02

2002

44909

18.2

11.31

2533

11.6

4.02

2003

51799

15.3

10.84

5201

105.3

6.26

2004

61957

19.6

11.09

8717

67.6

7.81

2005

82613

33.3

11.52

12157

39.5

7.59

2006

111636

35.1

10.97

22317

83.6

8.96

2007

146941

31.6

11.15

28013

25.5

8.32

2008

176135

19.9

12.91

37349

33.3

10.88

2009

215635

22.4

12.73

46511

24.5

11.44

2010

265071

22.9

12.78

52112

12

11.12

2011

300084

13.2

12.03

60043

15.2

11.25

2012

366400

22.1

12.14

-

-

-

Source:

RBI (2012): [Reproduced from the M.V. Nair Committee Report on Priority Sector Lendings,

February 2012, p.9and updated from the other RBI publications].