102

18% for agriculture and 40% for all sectors, effective from April 30, 2007. How

these have further distorted the quality of targets is explained in a subsequent

paragraph.

In the above respect too, the situation seems to have deteriorated in

recent years, which is reflected in two or three developments. First, the overall

percentage of priority sector advances to net bank credit has declined and finally

reached the below 40% level at 37.2%, at the end of March 2012 (Table 4.24).

Second, as shown in Table 4.25, growing numbers of banks are defaulting in

fulfilling the 40% target. It is surprising in this phase of financial inclusion,

as many as 16 public sector banks out of 27 have not fulfilled the 40% target

as against just

3

defaulting banks in 2009-10 and

7

in 2010-11. Interestingly,

such rising incidence of default is also seen amongst private sector banks and

foreign banks.

Third, the default in achieving priority sector lending target is primarily

due to the default in the 18% target for agricultural credit. As shown in Table

4.24 earlier, there has been, as is widely known, persistent default in fulfilling

the farm credit target. And within it, as displayed in Table 4.26 in respect of

public sector banks, the shortfall has been under direct agricultural credit.

While the implied target for direct agricultural credit is 13.5% of the adjusted

non-food credit (ANBC), the actual ratio for the latest year-ending March 2012

stands at 12.2%. As expected, the shortfall has been the steepest amongst

private sector banks (Table 4.25).

Fourth, even as the banks have not been able to fulfill the credit amount

target, it is significant that in recent years, the numbers of farm loan accounts

have been showing rather moderate increases ranging from 3.3% to 13.2%

in successive years (Table 4.26). Between March 2016 and March 2012, the

number of farm loan accounts with public sector banks has gone up by 70.2%,

the amount of loans outstanding has shot up by 227.4% during the same period.

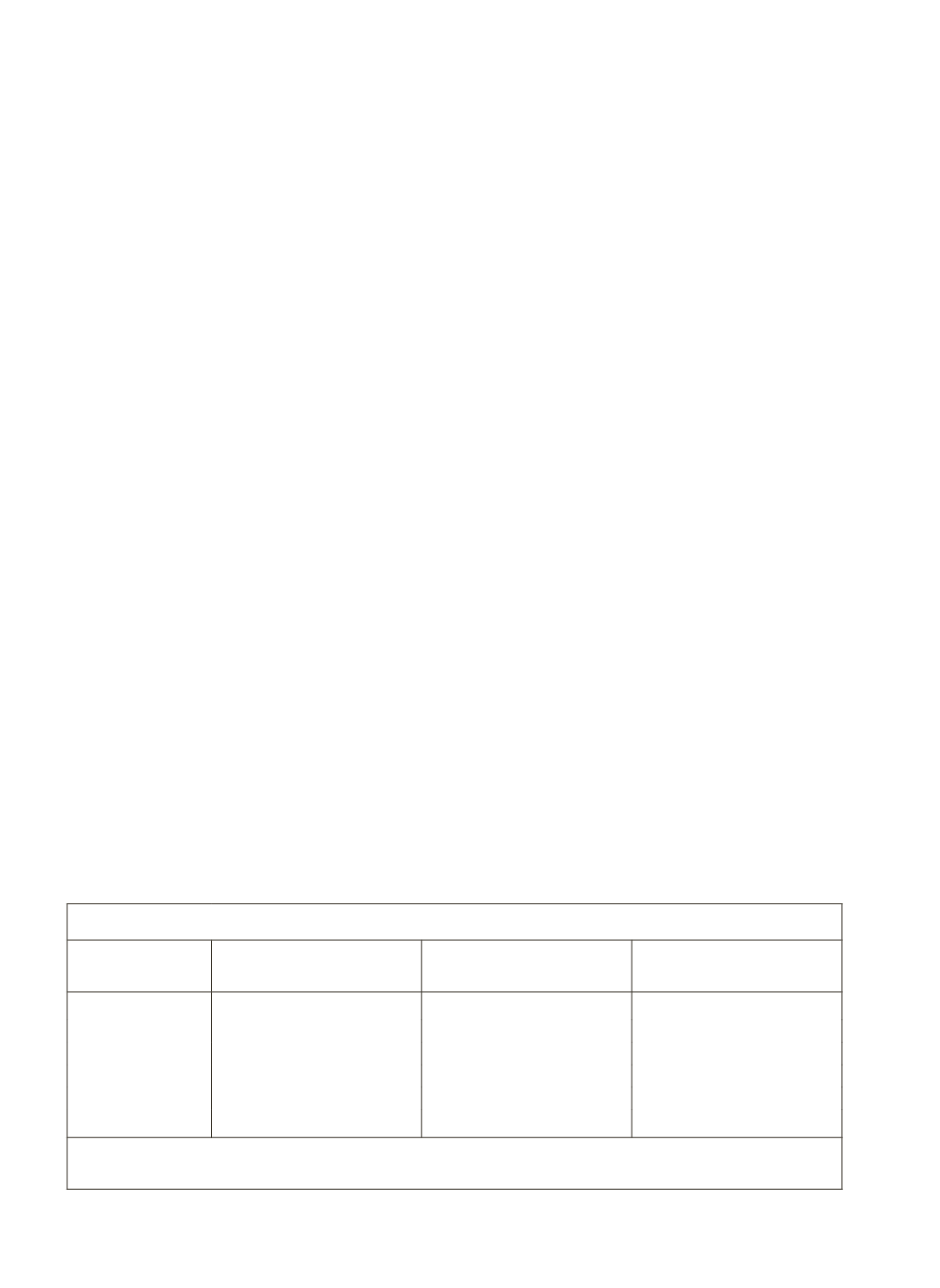

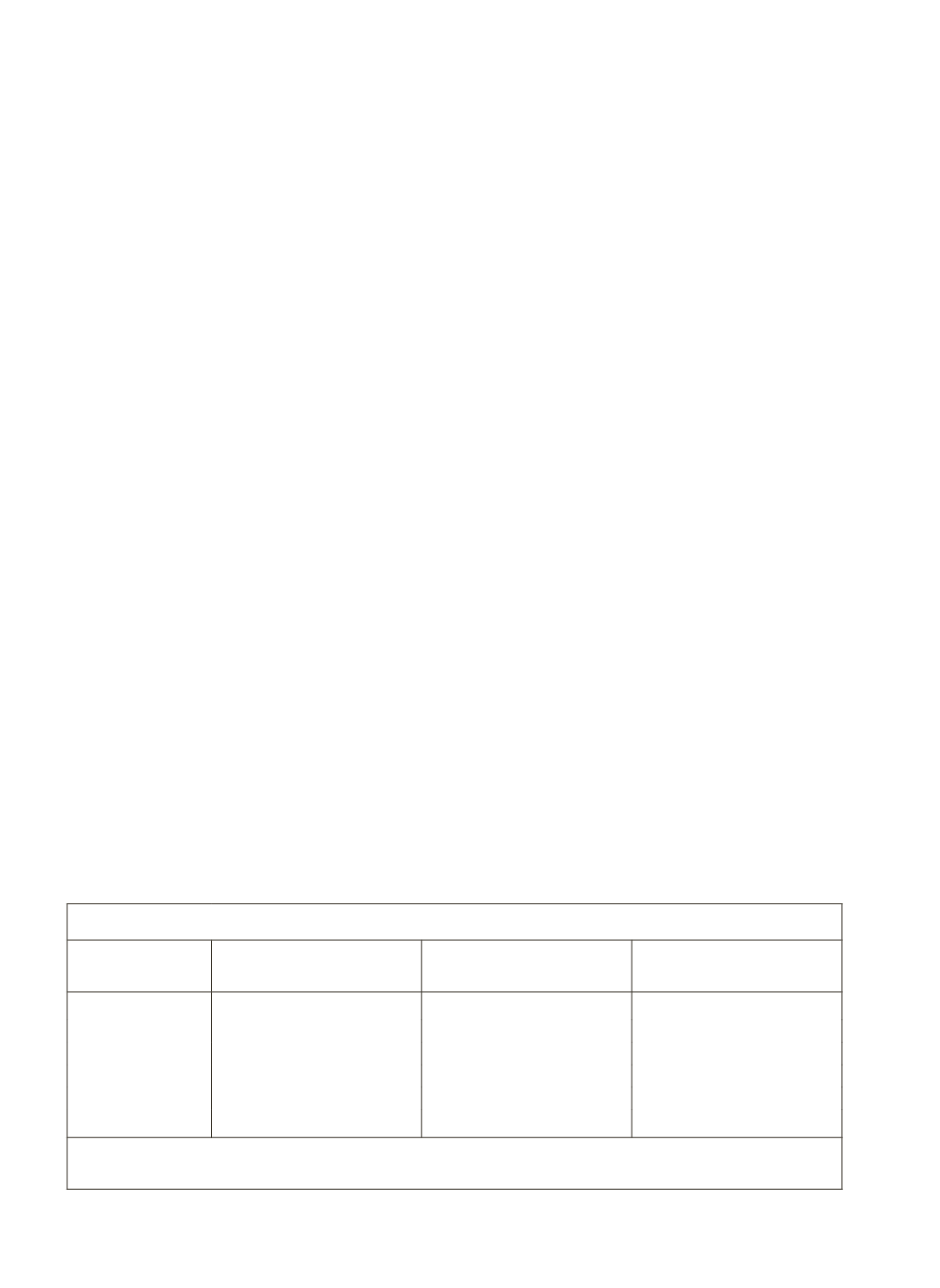

Table: 4.25: Number of Banks Not Achieving Priority Sector Target

Year-End

Public Sector Banks (27)

Target: 40%

Private Sector Banks (22)

Target: 40%

Foreign Banks (28)

Target: 32%

2006-07

-

-

-

2007-08

15 (28)

8(23)

-

2008-09

6 (27)

-

-

2009-10

3 (27)

2(22)

4(28)

2010-11

7(26)

1(22)

-

2011-12

16(26)

6(20)

-

Note: Figures within brackets are the total numbers of respective banks

Source: RBI (2012):

Trend and Progress of Banking in India, 2011-12,

p.73 and earlier issues.