113

Third Set of Differences

In the previous section, we have made a reference to data issues

concerning bank credit outstanding against agriculture from scheduled

commercial banks. Data on total institutional flows appear to be facing much

more complex problems. In this respect, we may recall that the RBI (and later

NABARD) had instituted a system of collating a special set of data on flows (or

the same as loans issued) of institutional assistance for agriculture and allied

activities as distinguished from loans outstanding against the sector separately

for cooperatives, RRBs and commercial banks. In fact, agriculture and allied

activities was the only sector for which such separate sets of data on loans

issued and outstandings were being obtained from institutions, tabulated

and disseminated; credit data in respect of all other sectors have been made

available, as now, only in the form of bank credit outstanding.

However, in the above set of official statistics on agricultural credit issued,

there has occurred a break in the series. Earlier, the RBI, in coordination with

NABARD, was publishing such flow and stock figures of agricultural loans in

its annual publication

Handbook of Statistics on the Indian Economy,

but

this publication has discontinued the dissemination of continuous series

after 2001-02. In the sequence of events thereafter, a number of disruptive

developments in the early 1990s affected agricultural lendings and also the

accurate flow of data on the subject (

Economic Survey, 1994-95

, pp. 51-52).

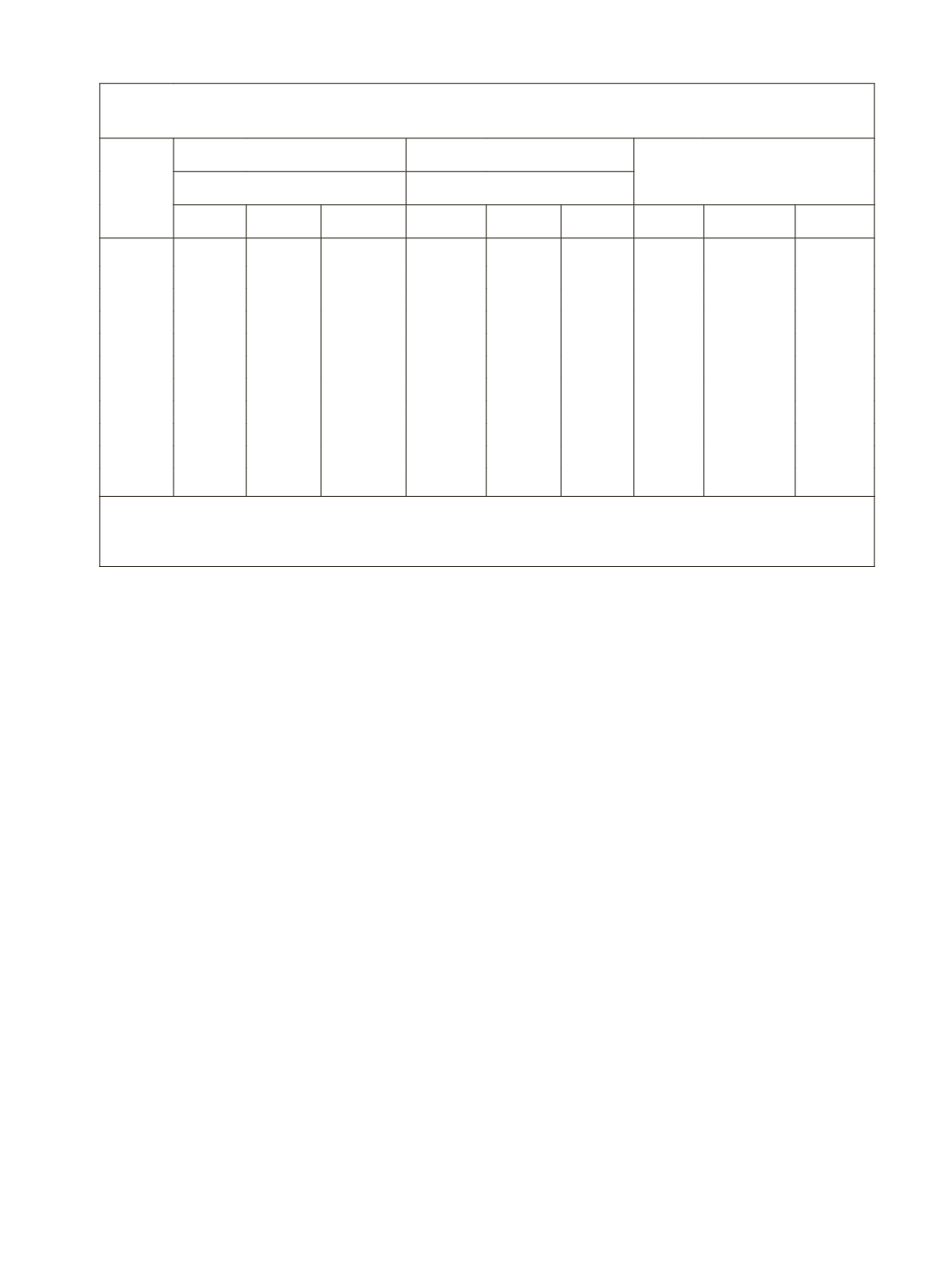

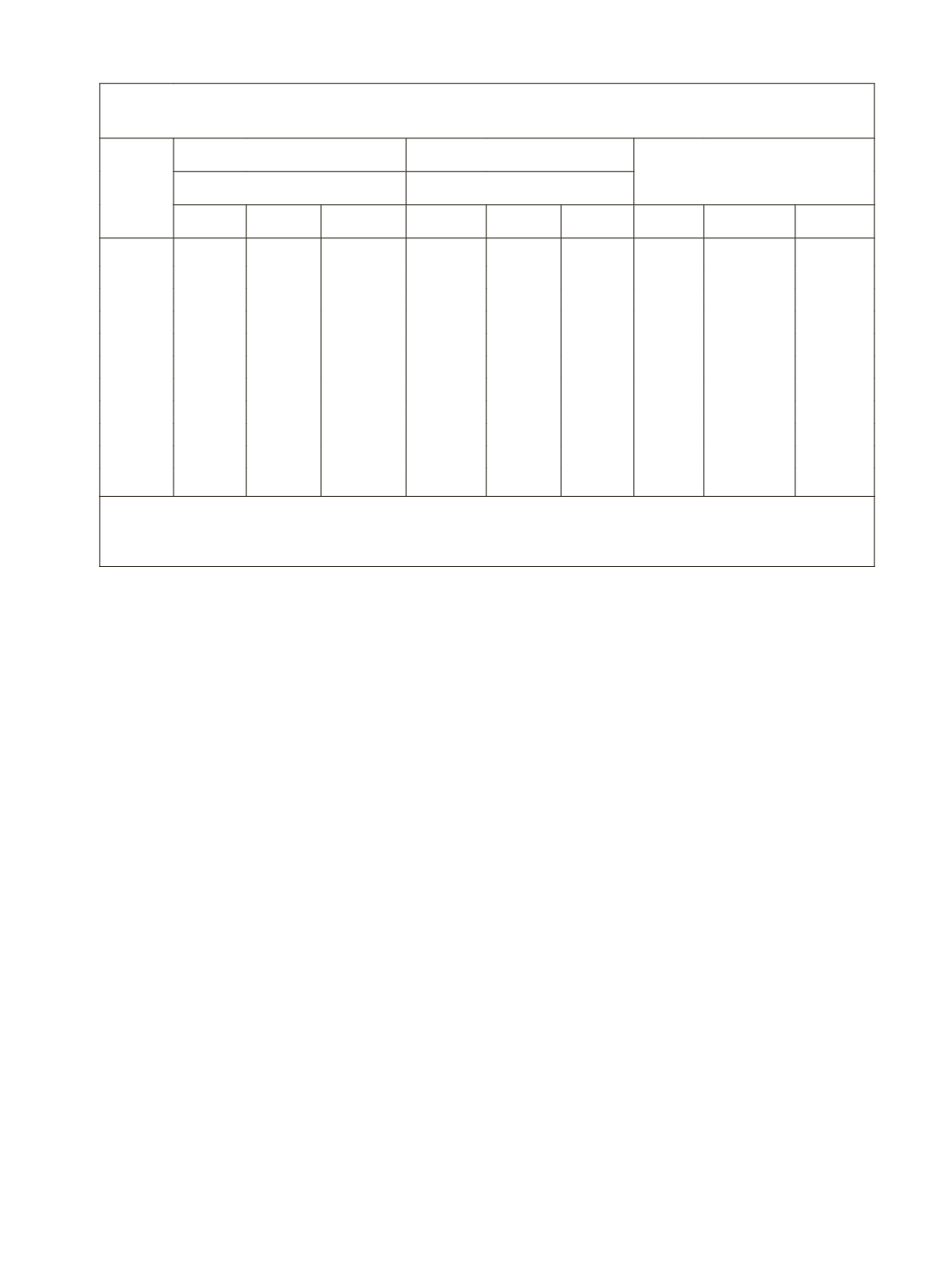

Table 4.30: Second Set of Differences: Agriculture Credit

(

`

crore)

Year

BSR Data

Handbook Data

Difference

SCBs (including RRBs)

SCBs (including RRBs)

Direct Indirect

Total

Direct Indirect Total

Direct Indirect

Total

Mar-00 38561 7077 45638 39433 12997 52430 -872

-5920 -6792

Mar-01 43420 8310 51730 45519 18825 64344 -2099 -10515 -12614

Mar-02 47430 16578 64009 53392 18238 71630 -5961

-1660 -7621

Mar-03 59058 16878 75935 64064 23690 87754 -5007

-6812 -11819

Mar-04 70099 26146 96245 79825 28520 108345 -9726

-2374 -12099

Mar-05 94635 29750 124385 112228 36071 148299 -17593

-6322 -23914

Mar-06 124563 48121 172684 157112 57175 214287 -32549

-9054 -41603

Mar-07 171497 58694 230191 196576 82564 279140 -25079 -23870 -48949

Mar-08 212567 61574 274141 236012 93443 329455 -23445 -31869 -55314

Mar-09 238703 70767 309469 293486 110702 404188 -54783 -39935 -94719

Mar-10 296850 93449 390298 361718 145554 507272 -64868 -52105 -116974

Source:

(i) RBI’s Basic Statistical Returns of Scheduled Commercial Banks in India, March 2011,

(Vol. 40).

(ii) RBI ‘s Handbook of Statistics on the Indian Economy 2011-12.