124

2009-10. In the year 2009-10, apart from the above 2% subvention, an

additional subvention of 1% as an incentive to the farmers who repay their

short-term crop loans on schedule, thus reducing their interest rate to 6% per

annum. This 1% incentive for prompt payment of loans was raised to 2% in

2010-11 and again to 3% in 2011-12, thus finally reducing the effective rate of

interest for crop loans up to

`

3 lakh to 4% per annum. This interest subvention

scheme has been continued in 2012-13 and further extended to post-harvest

loans up to six months against negotiable warehouse receipts for small and

marginal farmers who have a Kisan Credit Card (KCC). RBI writes that “this is

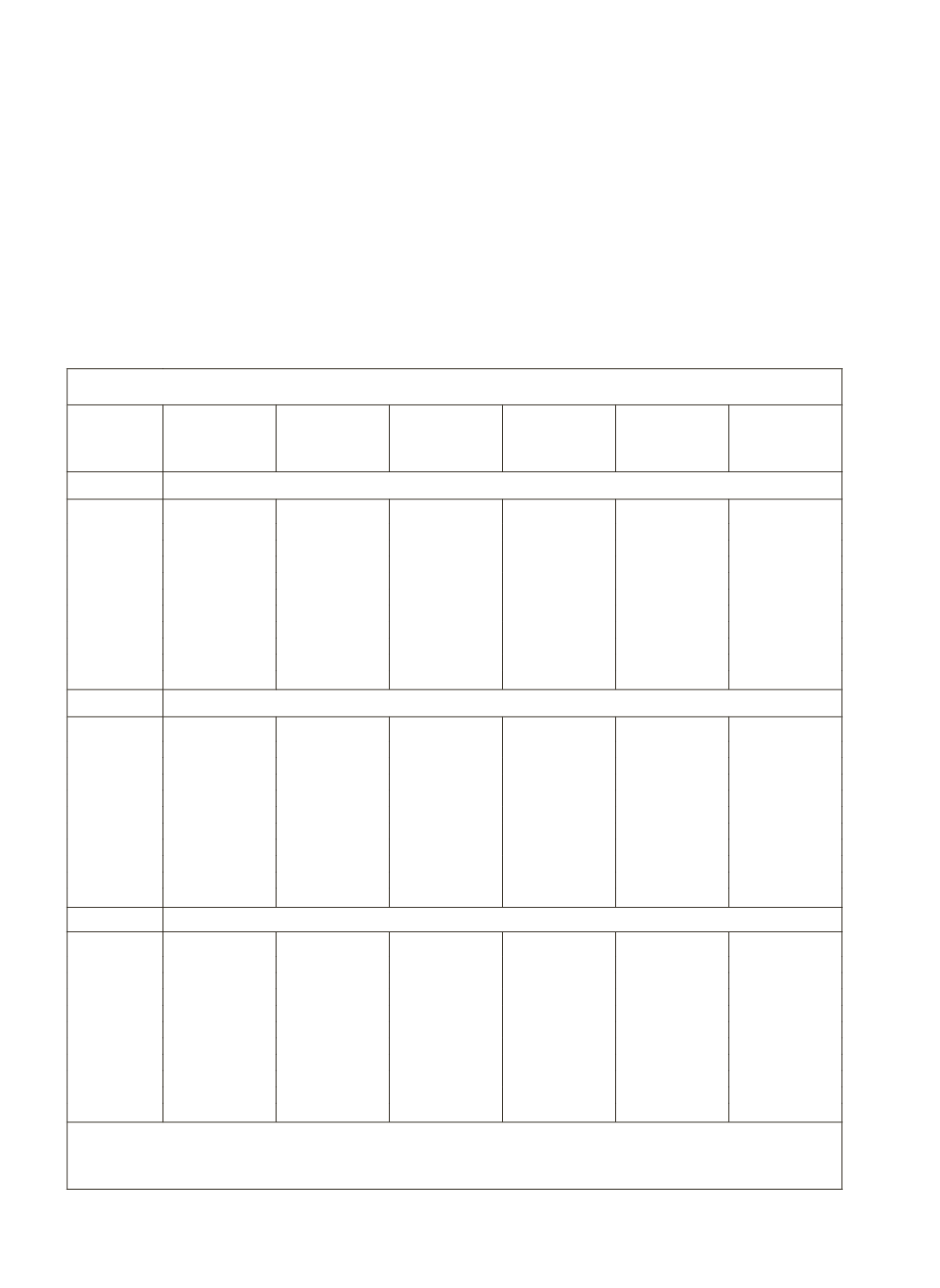

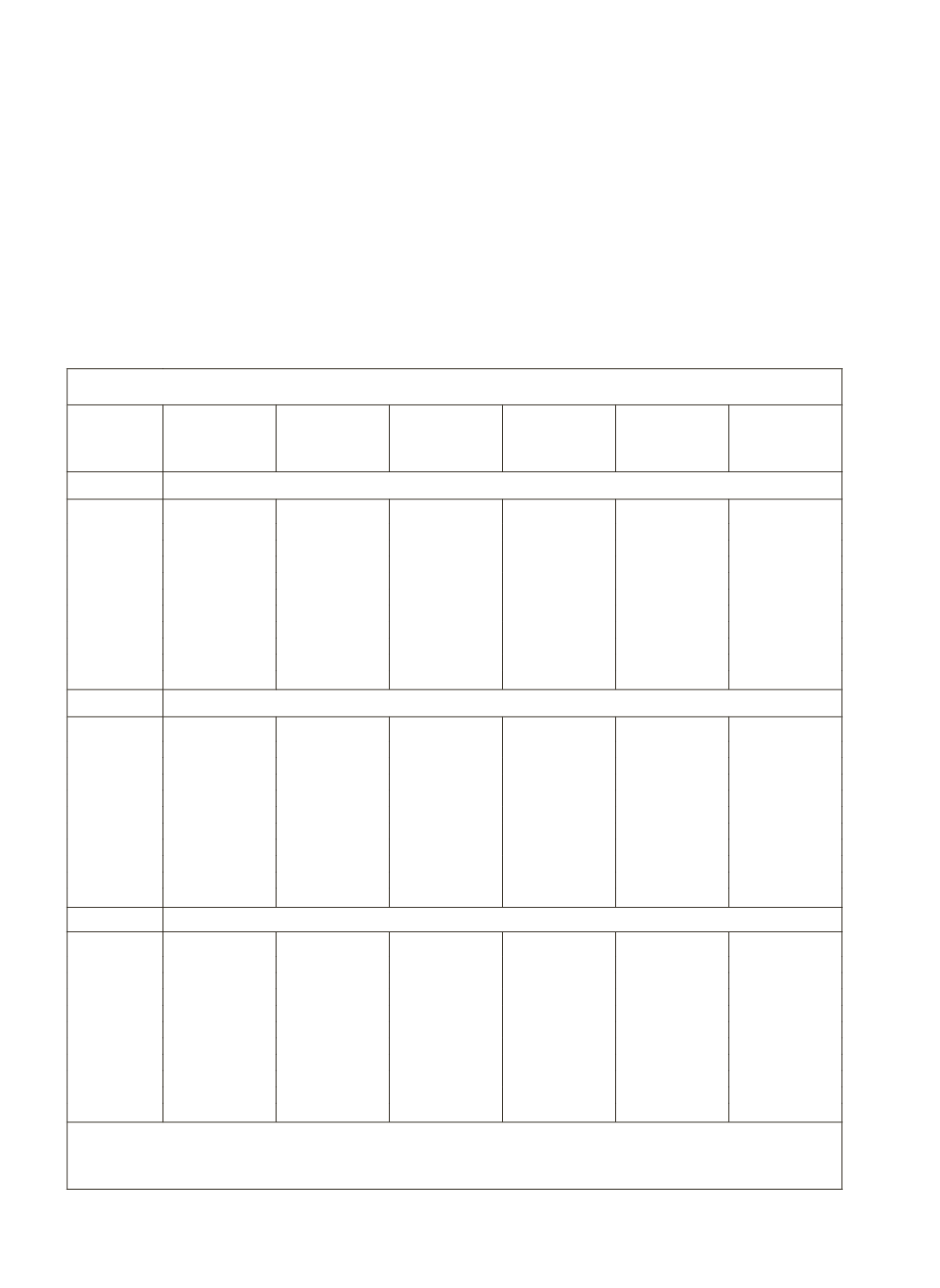

Table 4.35: Bank Group-wise and Occupation-wise Weighted Average Lending Rates

Years

(End-

March)

State Bank

Bank Group

Nationalised

Banks

Regional

Rural Banks

Other Sch.

Scheduled

Com.Banks

Foreign

Banks

All Scheduled

Com.Banks

Agriculture

2001

14.21

14.19

16.00

15.84

13.74

14.42

2002

13.52

13.81

15.51

14.74

13.55

13.87

2003

13.12

13.20

14.75

14.26

12.66

13.33

2004

12.56

12.90

14.18

14.55

13.49

13.03

2005

12.00

12.23

13.28

13.88

15.80

12.45

2006

11.34

11.76

12.49

11.75

14.77

11.70

2007

11.50

11.64

11.71

12.01

13.50

11.72

2008

11.42

11.64

12.12

12.45

12.74

11.77

2009

11.00

10.82

12.30

11.21

11.10

10.99

2010

10.16

9.66

11.88

10.41

10.72

9.99

2011

11.05

11.09

11.87

11.09

10.36

11.11

Industry

2001

13.99

14.58

16.40

15.34

14.24

14.47

2002

13.13

14.07

15.38

14.59

13.99

13.98

2003

12.60

13.73

14.51

14.17

14.74

13.68

2004

12.78

13.12

13.77

14.53

14.3

13.44

2005

12.61

12.81

13.00

14.03

15.46

13.21

2006

11.96

12.65

12.07

12.72

14.05

12.58

2007

12.10

12.43

11.70

12.37

12.77

12.36

2008

12.06

12.57

12.23

12.71

12.31

12.44

2009

11.17

11.10

12.47

12.33

12.18

11.34

2010

10.43

10.54

12.32

10.89

9.50

10.52

2011

11.75

11.81

12.25

11.59

9.96

11.68

Total

2001

13.60

14.05

15.41

15.28

14.48

14.14

2002

12.92

13.53

14.88

14.57

14.33

13.66

2003

12.44

13.20

14.21

14.05

14.68

13.31

2004

12.16

12.56

13.64

14.13

14.64

12.96

2005

11.91

12.16

12.82

13.28

14.95

12.57

2006

11.49

11.89

12.19

12.19

13.43

11.97

2007

11.64

11.89

11.70

11.91

13.03

11.92

2008

11.82

12.33

12.18

12.68

13.05

12.34

2009

11.05

11.09

12.29

12.48

13.14

11.47

2010

10.25

10.38

11.90

11.12

11.05

10.53

2011

11.31

11.49

11.86

11.54

10.93

11.44

Notes:

Data on outstanding credit relate to accounts, each with credit limit of over

`

2 lakh. Amount Outstanding

figures are used as weights for calculating average lending rates.

Source:

RBI, Statistical Tables related to Banks in India, 20011-12 and earlier issues.