126

found that, except for the initial thrust after bank nationalisation, the scheduled

commercial banks again tended to neglect rural areas in their branch banking

programmes. Therefore, the government was forced to set up regional rural

banks (RRBs) for the specified underdeveloped districts though, as the

Report

of the Working Group on Rural Banks

, July 1975 (Chairman: M. Narasimham)

had repeatedly emphasized,

“the setting up of new institutions should not in any way lead to a let up

in the pace of either rural branch expansion or extension of rural credit

by the commercial banks……..” (pp.12-13).

or

“The rural banks are not being set up as substitutes for commercial or

cooperative banks” (p.12).

The Initial Success

Alongside the opening of rural bank branches between 1970 and 1991,

shares of rural deposits and rural credit in aggregate deposits and credit had

risen. More significantly, with the prescribed targets of 60% credit-deposit

ratio, the C-D ratios of rural branches had touched 61-97% by the beginning of

the 1990s (Table 4.36).

These positive developments have uniformly suffered a setback after the

beginning of the 1990s. No doubt, rural C-D ratios appear much higher based

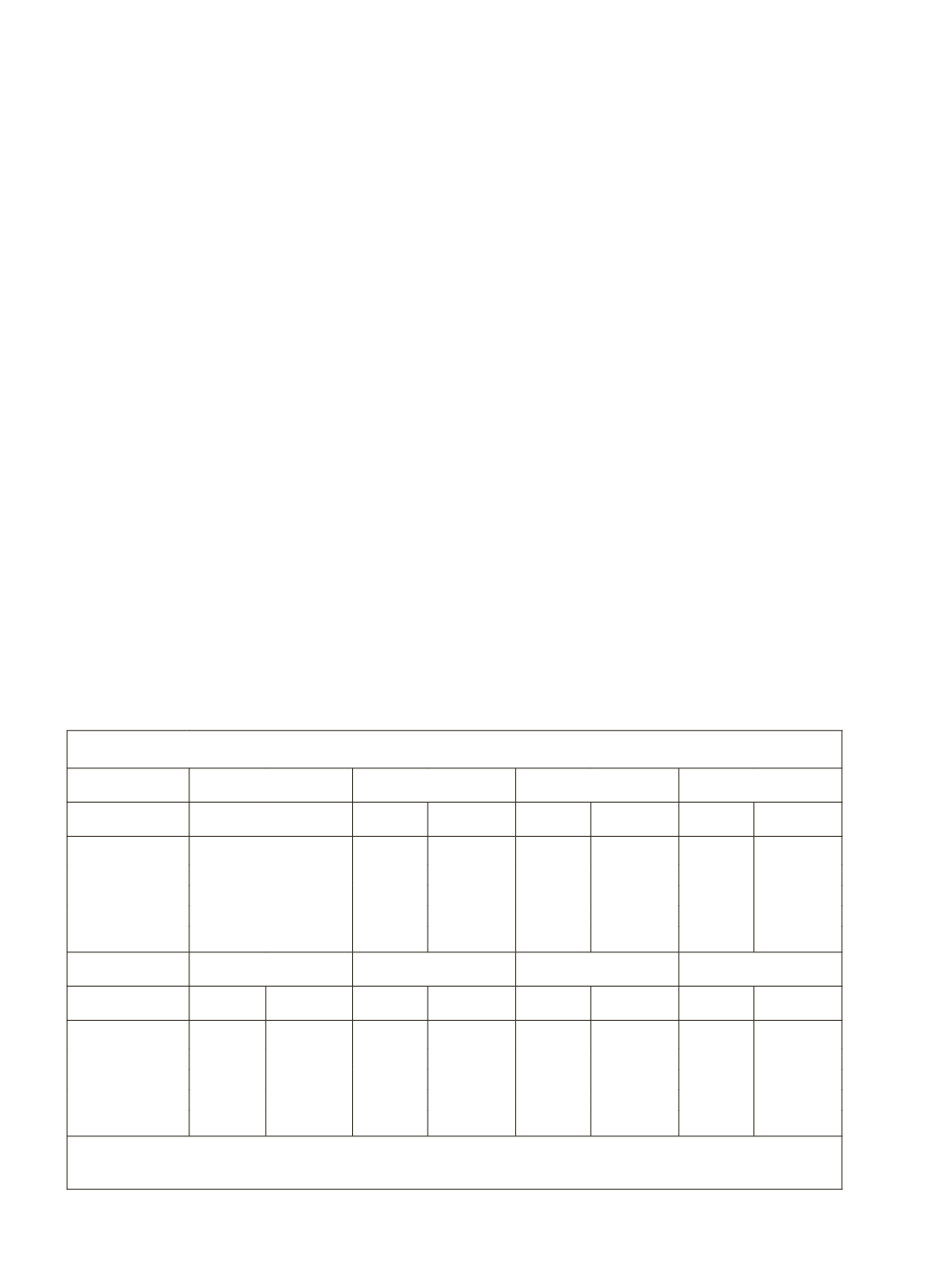

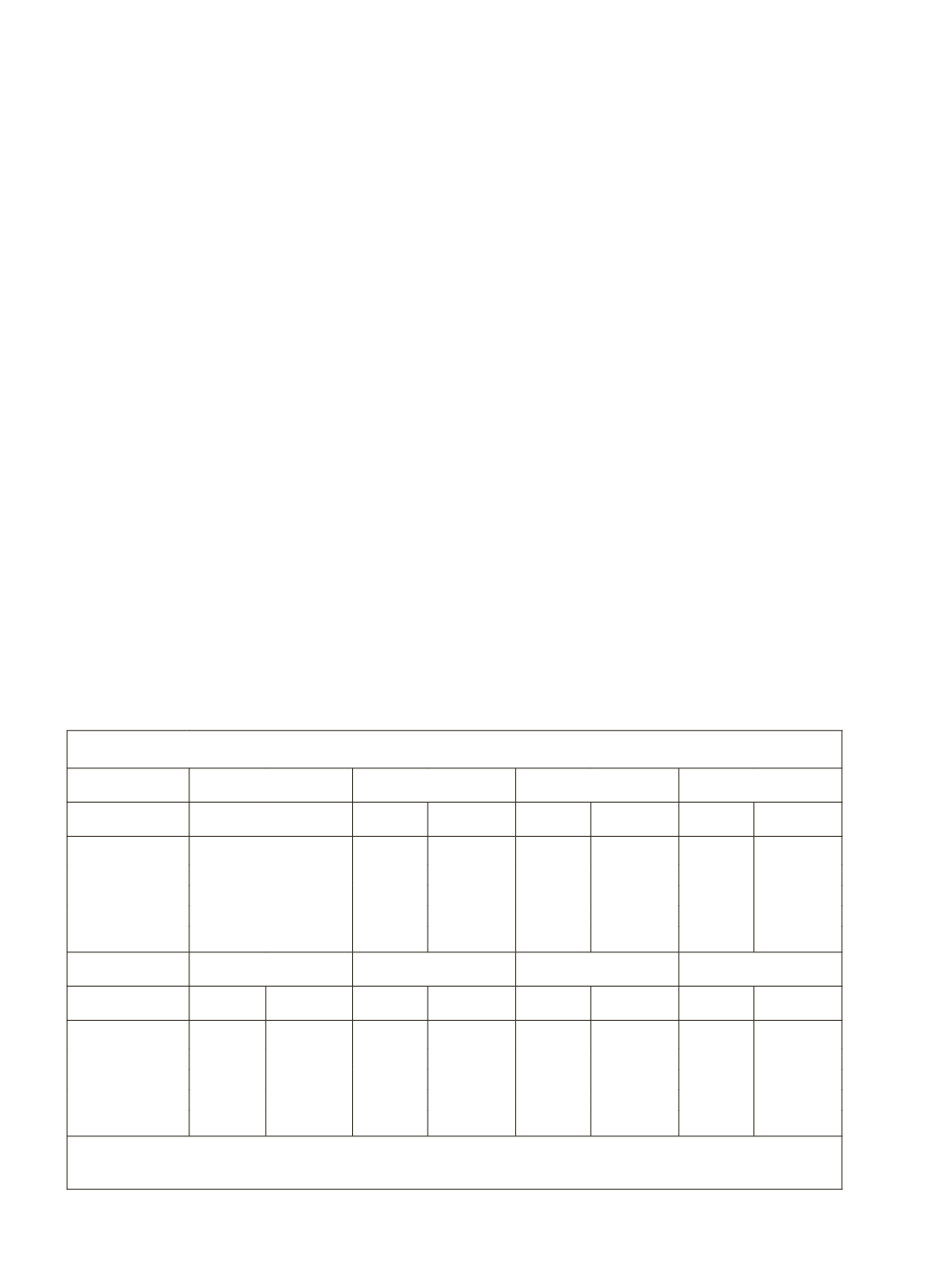

Table 4.36: Population Group-wise C-D ratio as per sanction and utilization

Year/Population

Jun-80

Mar-90

Mar-00

Mar-06

Group

Sanction

Sanction Utilization Sanction Utilization Sanction Utilization

Rural

54.5

61.2

97.1

40.4

49.3

55.8

88.2

Semi-Urban

47.2

49.1

48.5

34.7

40.0

50.1

57.8

Urban

60.0

55.6

52.9

41.9

42.1

57.0

64.1

Metropolitan

87.0

69.9

58.0

78.9

73.2

87.5

76.3

All-India

67.2

60.7

60.7

56.0

56.0

72.4

72.4

Year/Population

Mar-08

Mar-09

Mar-10

Mar-11

Group

Sanction Utilization Sanction Utilization Sanction Utilization Sanction Utilization

Rural

60.3

106.5

57.1

85.1

59.3

91.6

60.0

79.6

Semi-Urban

53.2

59.5

50.0

58.7

52.1

59.9

53.2

63.1

Urban

58.4

65.5

55.6

60.6

59.1

62.8

61.6

70.2

Metropolitan

87.2

75.7

86.9

78.4

85.9

77.4

88.4

79.9

All-India

74.4

74.4

72.6

72.6

73.3

73.3

75.6

75.6

Source:

RBI, Banking Statistics: Basic Statistical Returns of Scheduled Commercial Bank in India, March

2011 (Vol. 40) and earlier issues