66

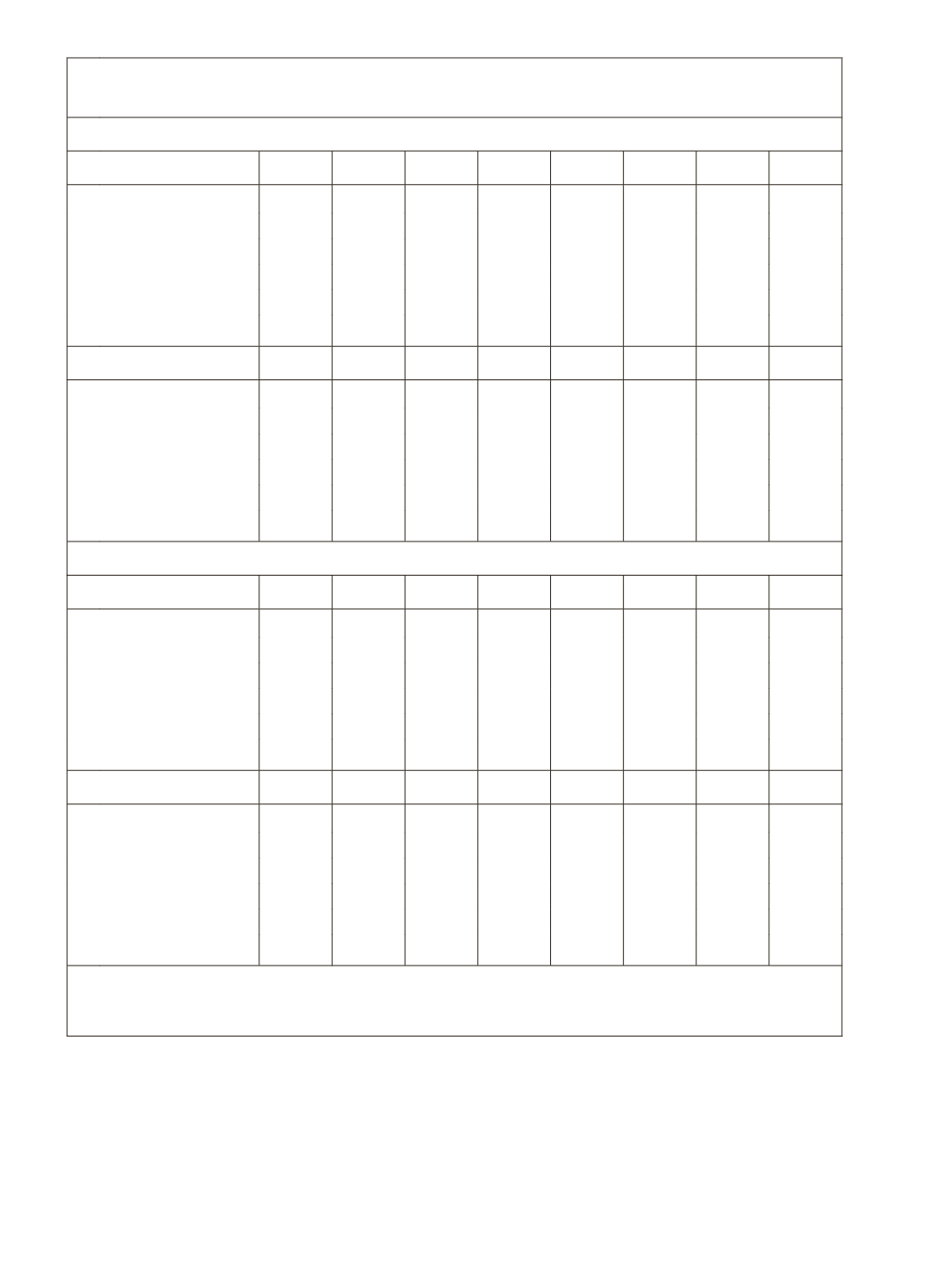

Table 4.7: Sectoral Distribution of Bank Credit and Loan Accounts of

Scheduled Commercial Banks (SCBs)

Number of Accounts (In Percentages)

Sector

Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06 Mar-05 Mar-04

I

Agriculture

38.6 36.0 36.3 35.7 35.2 34.0 34.6 32.1

(i) Direct Finance

36.7 34.6 35.7 35.1 34.4 33.3 33.7 31.2

(ii) Indirect Finance

1.9

1.5

0.7

0.6

0.8

0.8

0.8

0.9

II Industry

1.9

2.7

3.0

3.8

3.4

3.9

4.8

4.3

III Services

59.4 61.2 60.7 60.5 61.4 62.1 60.6 63.6

All Sector Accounts

100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

Sector

Mar-00 Mar-95 Mar-90 Jun-85 Jun-80 Jun-75 Dec-72

I

Agriculture

37.8 42.7 45.5 49.5 50.0 37.9 31.6

(i) Direct Finance

37.2 40.5 42.5 45.8 47.7 32.9 28.1

(ii) Indirect Finance

0.6

0.6

0.8

1.0

2.3

2.5

2.4

II Industry

9.8

8.5

7.7

6.4

6.5

5.6

5.8

III Services

52.4 48.8 46.8 44.1 43.6 56.5 62.6

All Sector Accounts

100.0 100.0 100.0 100.0 100.0 100.0 100.0

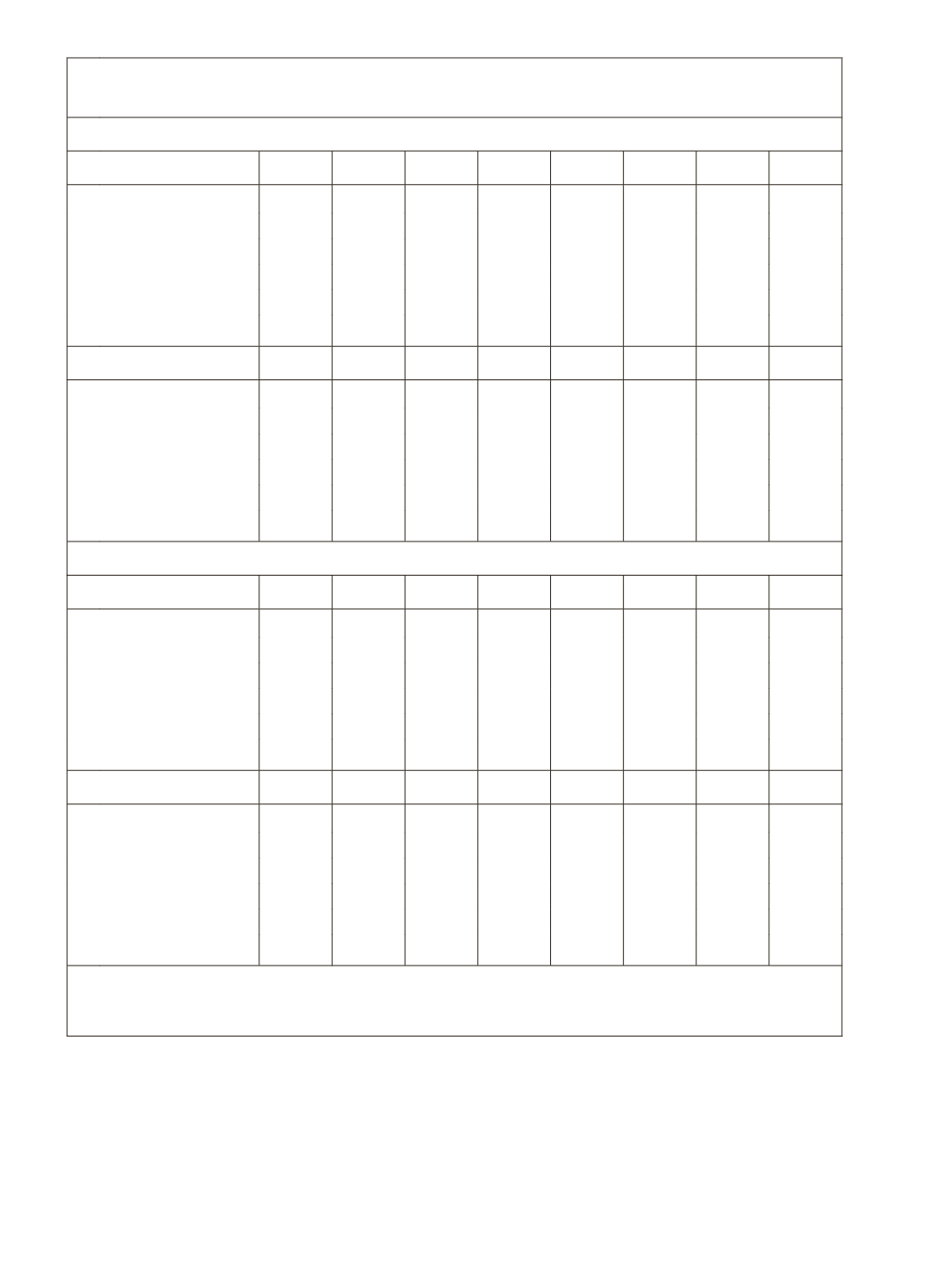

Amount Outstanding in Percentages

Sector

Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06 Mar-05 Mar-04

I

Agriculture

11.3 11.7 10.9 11.3 11.8 11.4 10.8 10.9

(i) Direct Finance

9.3

8.9

8.4

8.8

8.8

8.2

8.2

8.0

(ii) Indirect Finance

2.0

2.8

2.5

2.5

3.0

3.2

2.6

3.0

II Industry

39.6 40.5 39.8 38.4 38.1 37.4 38.8 38.0

III Services

49.1 47.8 49.3 50.2 50.1 51.2 50.4 51.0

Total Bank Credit

100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

Sector

Mar-00 Mar-95 Mar-90 Jun-85 Jun-80 Jun-75 Dec-72

I

Agriculture

9.9 11.8 15.9 17.6 14.8 10.8

9.0

(i) Direct Finance

8.4

9.5 12.9 13.8 11.3

5.0

4.3

II (ii) Indirect Finance

1.5

1.7

2.1

3.0

3.4

3.4

2.3

III Industry

46.5 45.6 48.7 41.3 48.3 58.5 61.2

Services

43.6 42.6 35.3 41.0 36.9 30.7 29.7

Total Bank Credit

100.0 100.0 100.0 100.0 100.0 100.0 100.0

Source:

Percentage Distribution of loan amounts and amount outstanding derived from data provided in

RBI's

Banking Statistics: Basic Statistical Returns of Scheduled Commercial Banks in India

,

March 2011 and earlier issues.

behaviour which we have addressed separately in this study, what stands

out in these charts are the expansions in the post-nationalisation periods of

the 1970s and 1980s and the contractions thereafter, both in the number of

accounts and the percentage share of agricultural credit. Charts also depict the