67

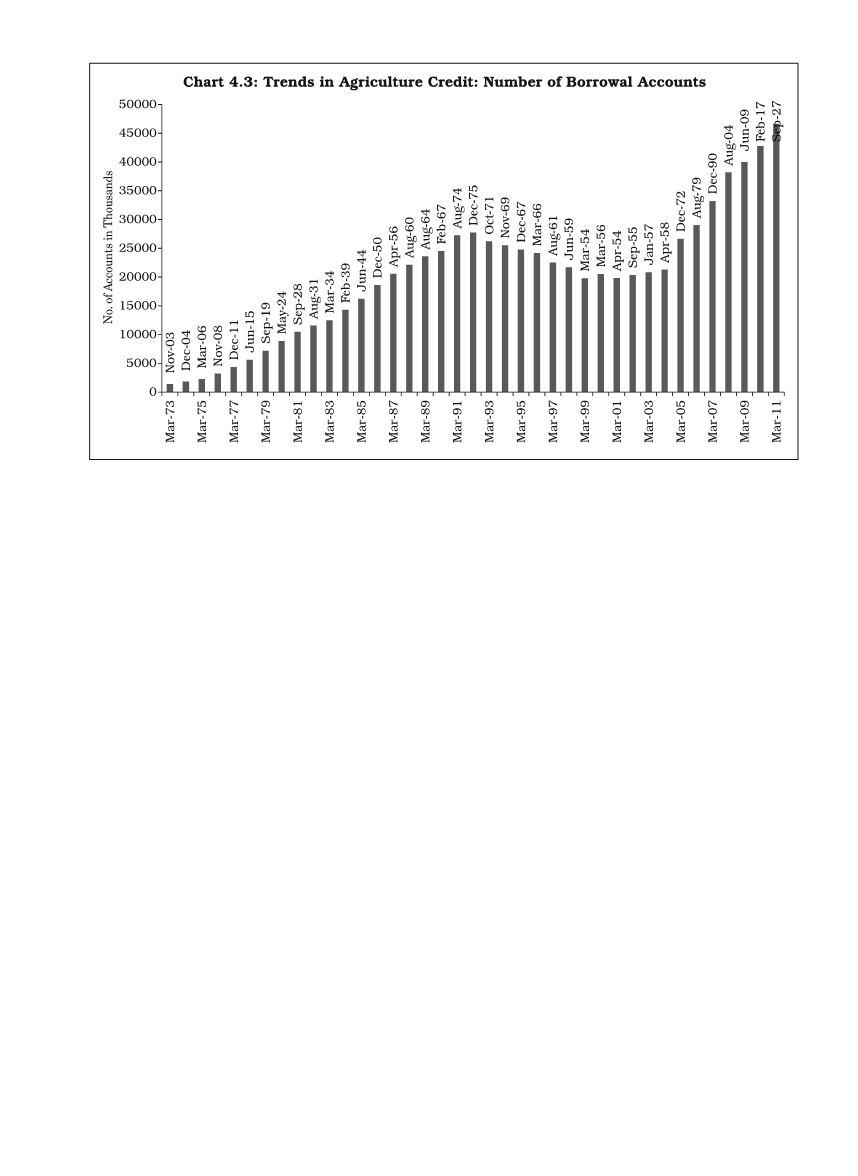

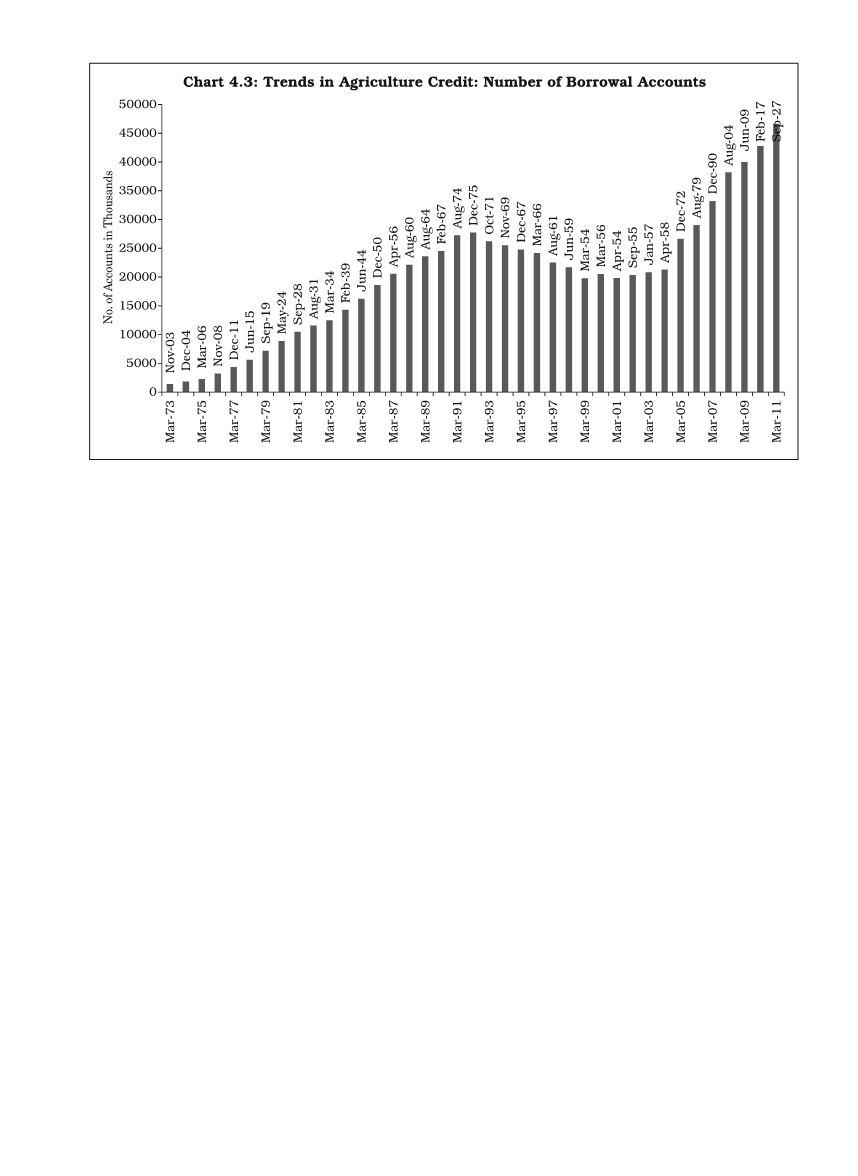

edging up in both the indicators in the latest phase of the policy of doubling

of farm credit flows in three years between the year-ending March 2004 to

March 2011; the latest phase have not been one of continuous rise. After some

steep increase following the policy announcement of credit doubling in there

years, which continued for about six years until 2006-07, there was a relative

slowdown. Of course, this slowdown was better reflected in the data presented

earlier of annual growth rates of bank credit against agriculture, particularly

in

real

terms. On the other hand, the shares of agricultural accounts and

amounts outstanding in total bank loan accounts and amounts did not reflect

this slowdown (Tables 4.5 and 4.7).

There are two additional distinctive features in data presented in Tables

4.5 and 4.6. First, the average loan per account jumped up after the 1990s

implying that the loan sizes have risen rather significantly – a feature which has

been analysed in-depth in the context of the size distribution of agricultural

loans. As shown in Table 4.5, between 1972 and 1994, the average loan per

account ranged from

`

3,651 to

`

8,957 but thereafter, with banks’ focus on

large-size loans, the average loan size has shot up to a range of

`

10,054 to

`

98,849 per loan account. While both direct and indirect lendings have shown

such large average loans, the indirect loans have shot up rather phenomenally.

Secondly, Tables 4.6 and Chart 4.4 present details of direct and indirect

finance in agriculture. As indicated above, indirect finance has a commercial

angle though ultimately intended to serve agriculture. When the phase of