70

in total agricultural credit outstandings have been presented. Instead, annual

variations presented in Table 4.6 bring out a more telling effect of the shifting

importance of the two types of agricultural loans. Initially, when the banks

generally reduced their lendings to the agricultural sector in the mid-1990s,

they chose to rely more on indirect lendings. This trend continued particularly

after the policy of doubling bank credit began in 2004. Overall, between March

2000 and March 2007, there had occurred a seven-fold expansion in indirect

credit outstandings (i.e., 729% increases) as against an experience of just

three-fold expansion in direct credit (i.e., 345%) during the same period. As

percentage of total agricultural credit, the share of indirect advances rose from

15.5% to 25.5% during the above period (earlier Table 4.6). As for the number

of loan accounts, the increase in some years under indirect finance has been

very sizeable but overall very erratic. During the last three years, the increases

have ranged from (-) 6.1% in 2007-08 to 144.2% in 2009-10. As shown in

Table 4.8, the increases in the number of accounts for certain types of

institutional accounts had been mindboggling, but they were very erratic too,

giving rise to doubts on the credibility of data. Incidentally, even for the earlier

period, the number of loan accounts and amounts outstanding have exhibited

erratic tendencies (Table 4.6). In the years since 2007, the increases in indirect

lendings have been somewhat moderate. Under the policy of financial inclusion,

there have been social pressure on the banking system to expand direct lendings

to farmers. Such direct lendings have increased by 120% between March 2007

and 2011, whereas indirect lendings have just increased by 41% during the

same period. As cited earlier, the movements in the number of accounts under

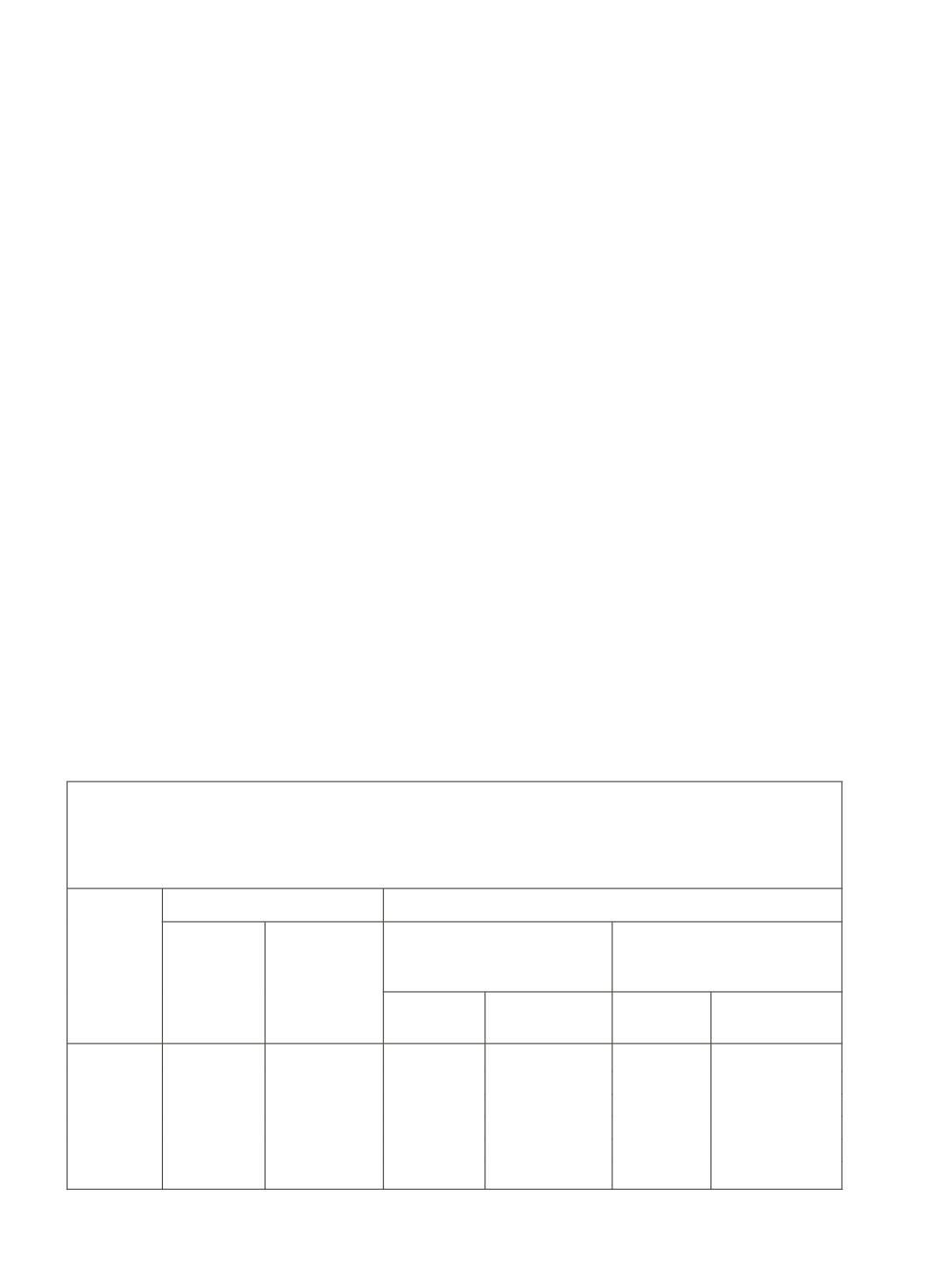

Table 4.8: Sub-Categories of Direct and Indirect Advances: Amount

Outstanding and Number of Loan Accounts

Part A: Earlier Classification

(Amount in Rupees, Crore)

Year

Ending

Mach

Direct Advances

Indirect Advances

Number of

Accounts

Amount

Outstanding

Finance for Distribution of

fertilizers and Other Inputs

Other Types of Indirect

Finance (including state

electricity boards and RIDF)

Number of

Accounts

Amount

Outstanding

Number of

Accounts

Amount

Outstanding

2001

19,035,374 40,485

80,219

2,304

202,166

16,521

2002

15,854,277 46,580

75,002

3,304

423,183

14,935

2003

17,003,304 56,858

101,289

3,241

155,855

19,501

2004

19,634,319 70,781

86,606

4,118

94,540

23,679

2005

20,932,515 95,562

80,894

5,134

628,796

30,079

2006

NA

1,34,798

NA

6,440

NA

49,965