2

S

tate

of

I

ndia

’

s

L

ivelihoods

R

eport

2015

Finally, the forecast of near normal monsoon

is expected to boost agricultural GDP and the

overall growth impetus.

Savings rate in the economy (Table 1.1) as

a whole have been declining over the last few

years, reflecting a declining capacity to invest

in future. The gross capital formation rates

have been seen to decline during the period,

indicating that investments required to secure

future livelihood development are not taking

place at the expected pace. RBI noted

4

that

the investment rate (gross capital formation as

a proportion toGDP at current market prices)

declined in 2012–13 and 2013–14, largely

reflecting the slackening in the non-financial

corporations’ investment rate on account

of weak domestic and external demand and

other structural factors such as delay in land

acquisition and environment clearances, weak

business confidence and policy uncertainties.

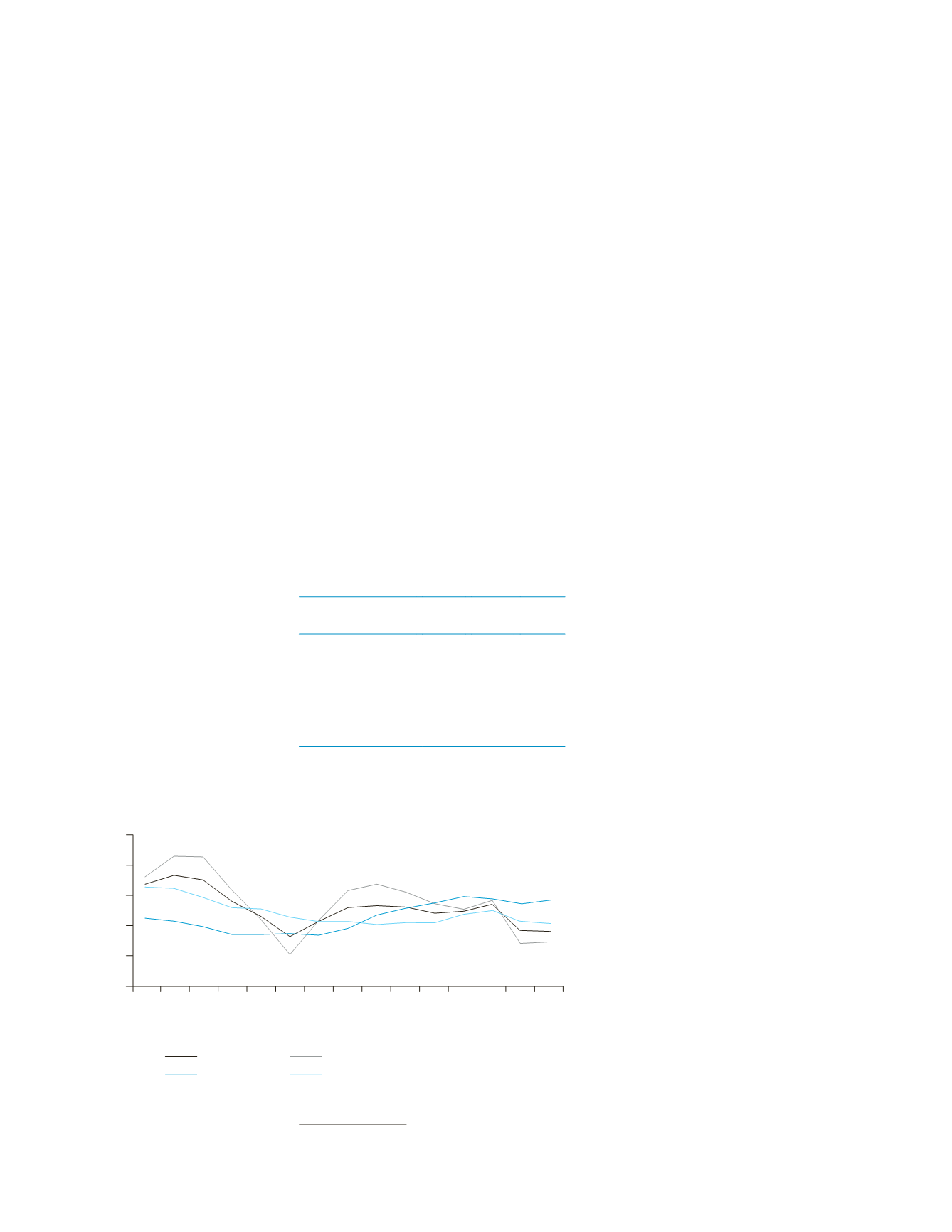

On the price front, inflation seems to be

declining steadily since the past couple of

years, thereby sustaining the value of incomes

in the hands of people and leading to better

quality livelihoods (Figure 1.1). In its latest

Monetary Policy, RBI stated that the con-

sumer price index (CPI) inflation had eased

across the board over the first five months of

2015–16. The distribution of inflation across

major sub-groups implied that the ongoing

disinflation was broad-based. The easing of

inflationary pressures was sufficient for RBI

to reduce its repo rate by 50 basis points,

bringing down the rate to 6.75 per cent.

5

Some banks have already announced a reduc-

tion in their base rate as a consequence; the

resultant decrease in interest rates is expected

to lower finance costs and induce invest-

ments. The expected investments that will

follow the rate cut will positively impact the

livelihoods situation in the country.

The votaries of trickle down theories

find it difficult to explain the weak impact

of robust macroeconomic growth on

employment and livelihoods of the poor

on the ground. While job growth has been

positive, it has been at a very low rate. The

high GDP numbers did not translate to

high levels of employment growth (jobless

growth)

6

which exacerbates the gap between

the rich and the poor. A cause for concern is

that new livelihoods, especially in the form

of jobs are not created at a rate adequate to

meet the increasing supply of labour force.

The

Economic Survey 2015

points out:

Regardless of which data source is used, it

seems clear that employment growth is lag-

ging behind growth in the labour force. For

example, according to the Census, between

2001 and 2011, labour force growth was 2.23

per cent (male and female combined). This

is lower than most estimates of employment

growth in this decade of closer to 1.4 per cent.

Creatingmore rapid employment opportuni-

ties is clearly a major policy challenge.

4

RBI Annual Report 2014–15, RBI 2015.

Table 1.1:

Savings and capital formation rates

(2011–12 Constant

prices)

2012–13 2013–14 2014–15

Gross savings rate as %

of GDP

31.1

30 Yet to be

released

by CSO

Gross fixed capital

formation as % of GDP

31.9 30.7

30

GDP growth rate % 5.1

6.9

7.3

Source:

Central Statistical Office, Ministry of Statistics

and Programme Implementation, GoI.

Per cent

0

Jun–14

All groups

Fuel and light

Food & beverages

CPI-Excluding food and fuel

Jul–14

Aug–14

Sep–14

Oct–14

Nov–14

Dec–14

Jan–15

Feb–15

Mar–15

Apr–15

May–15

Jun–15

Jul–15

Aug–15

2

4

6

8

10

5

The last time repo rate was at this level was in

March 2011.

6

‘GDP growth does not translate in to proportion-

ately more jobs’,

Economic Survey 2014–15

.

Figure 1.1:

Inflation behaviour–CPI year-on-year

Source:

Excerpted from Monetary Policy Report, September 2015, RBI.