75

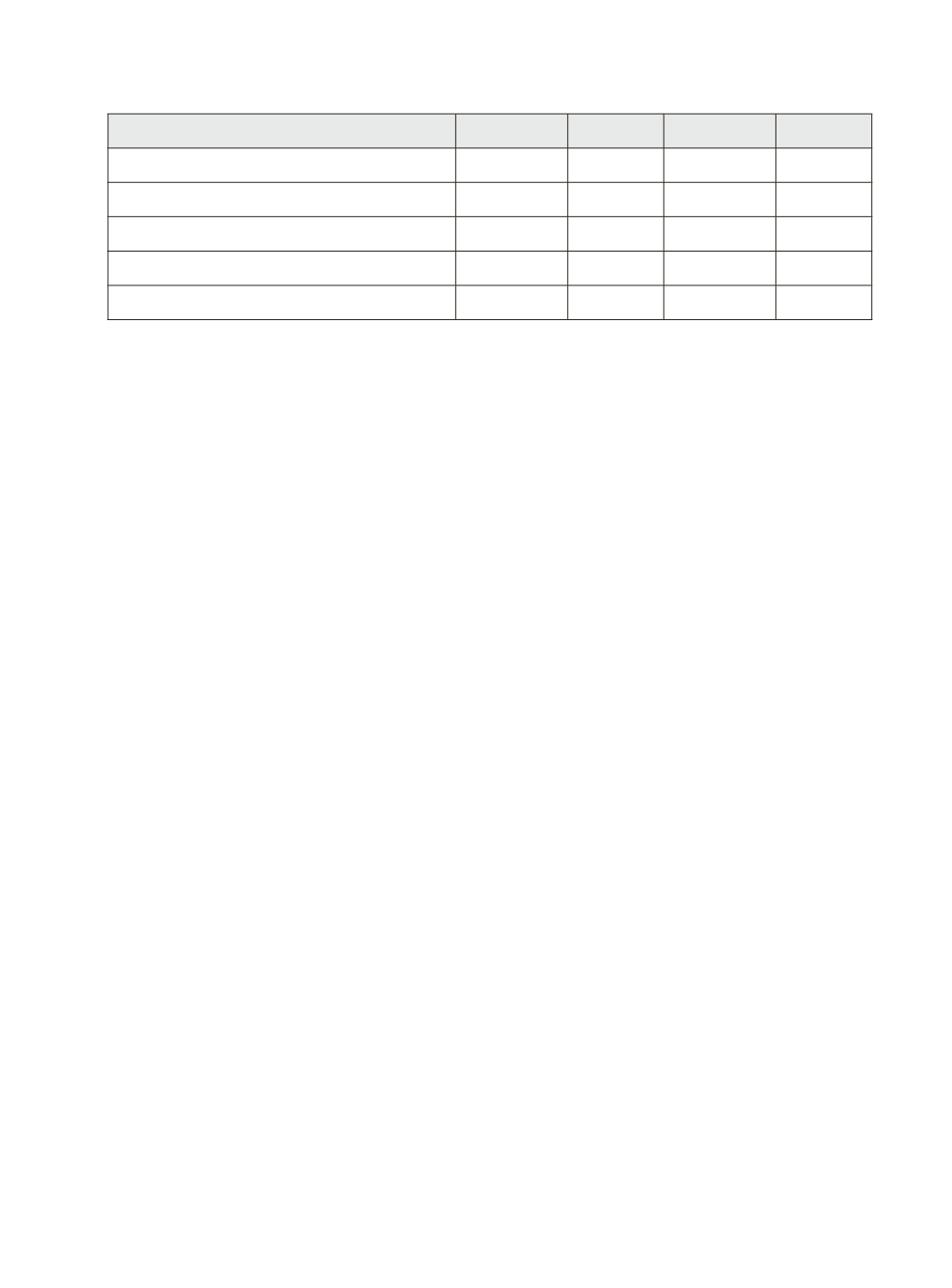

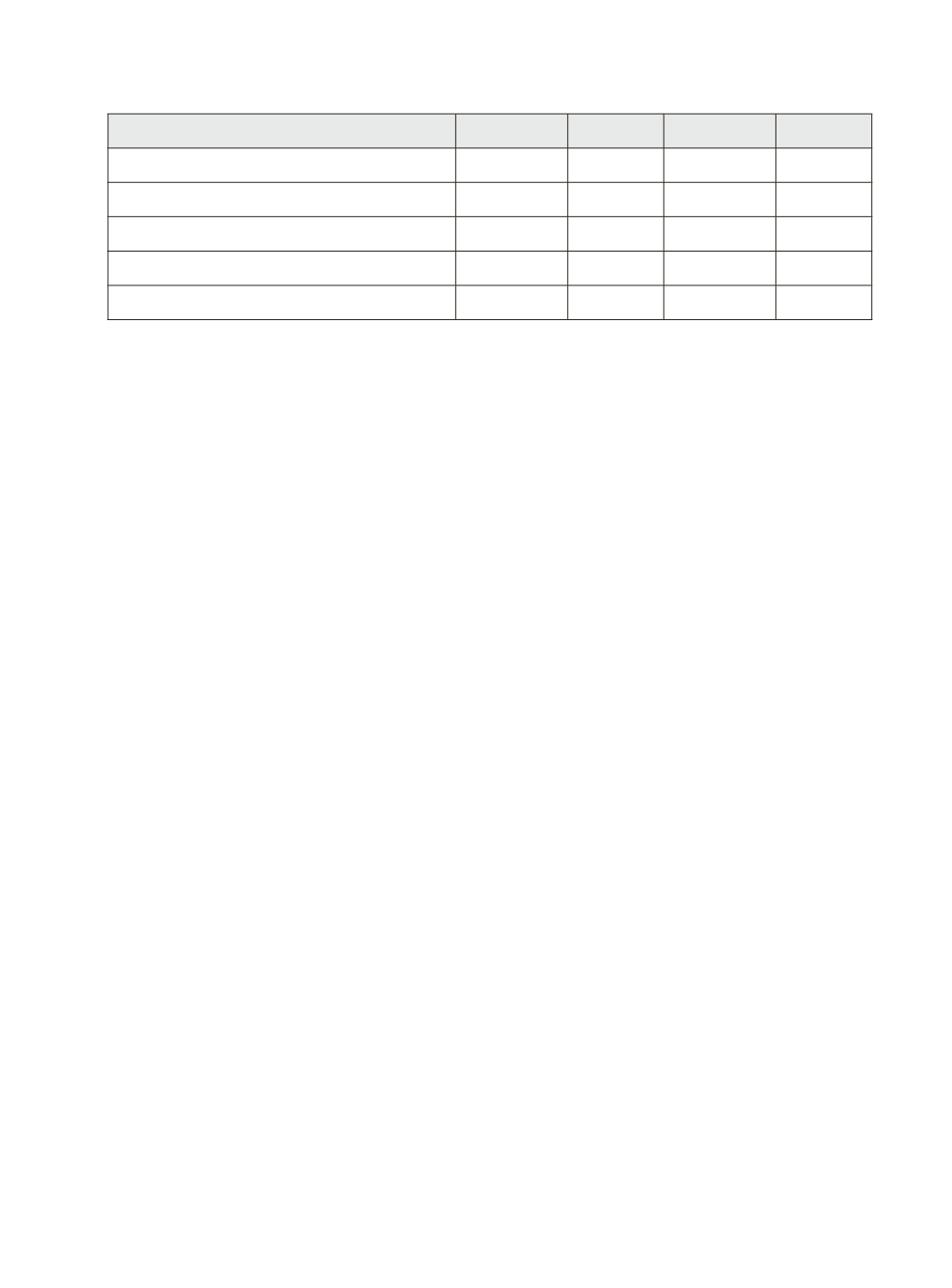

Table 5.2: Smart card issued as percentage of total operative/ live cards

Particulars

Coop Banks RRBs Comm Bank Total

Cumulative KCC Accounts (Lakh)

507.99 238.47

*******1463.98

No of Operative/ Live KCC (Lakh)

392.27 123.43

225.25 740.94

Operative Cards as % of total KCC Accounts

77.22

51.76

26.91

50.61

No of Smart Cards issued (No)

23959 1378777 7614956 9017692

Smart card issued as % of total live cards

0.06

11.17

33.81

12.17

5.7 As already explained in para 4.29, the bankers’ perception about the major

reasons for gap between the number of smart cards issued vis-à-vis number of

operative KCC accounts with the banks includes the factors like procurement

of sufficient number of RuPay cards by controlling offices and forwarding the

same to the issuing branches, non-issuance of cards to NPA and other irregular

accounts, perception of banks as well as farmers about the utility of RuPay cards

keeping in view just one or two transactions in a year, chances of misuse and

fraud restricting the farmers to accept the RuPay cards, large time being taken by

controlling offices in supplying Chip based cards, extra expenditure on the banks

who don’t own an ATM and their customer will be operating on ATMs of other

banks. The farmers’ view about the utility of RuPay has been eclipsed by their

fear of frauds and trust issues i.e. misused of cards by their family members.

Non-availability of ATMs machines in rural areas, has also been cited as a reason

for not availing RuPay card facility by the farmers. Some of the farmers had

declined the offer of availing RuPay Kisan cards as they did not find it very useful

since they were withdrawing the money just once or twice in year a year.