73

Kisan Credit Card Scheme: Macro Impact

5.1 As already indicated in para 2.4, the cumulative number of KCC issued since

inception till 31 March 2015 comes to 14.64 crore of which operative / live KCC

stands at 7.41 crore. The total crop loan issued during the 2014-15 was Rs.

6,35,412 crore which translates into a crop loan of Rs. 85,757 per live KCC

account. Since total crop area covered by KCC loan is not reported by the banks,

although the same is recorded in the application cum appraisal form of KCC

loan by the banks, it is difficult to estimate the actual area for which KCC loan

is extended. However, the following estimates are made in order to arrive at the

total benefits accrued to the farmers on account of KCC financing.

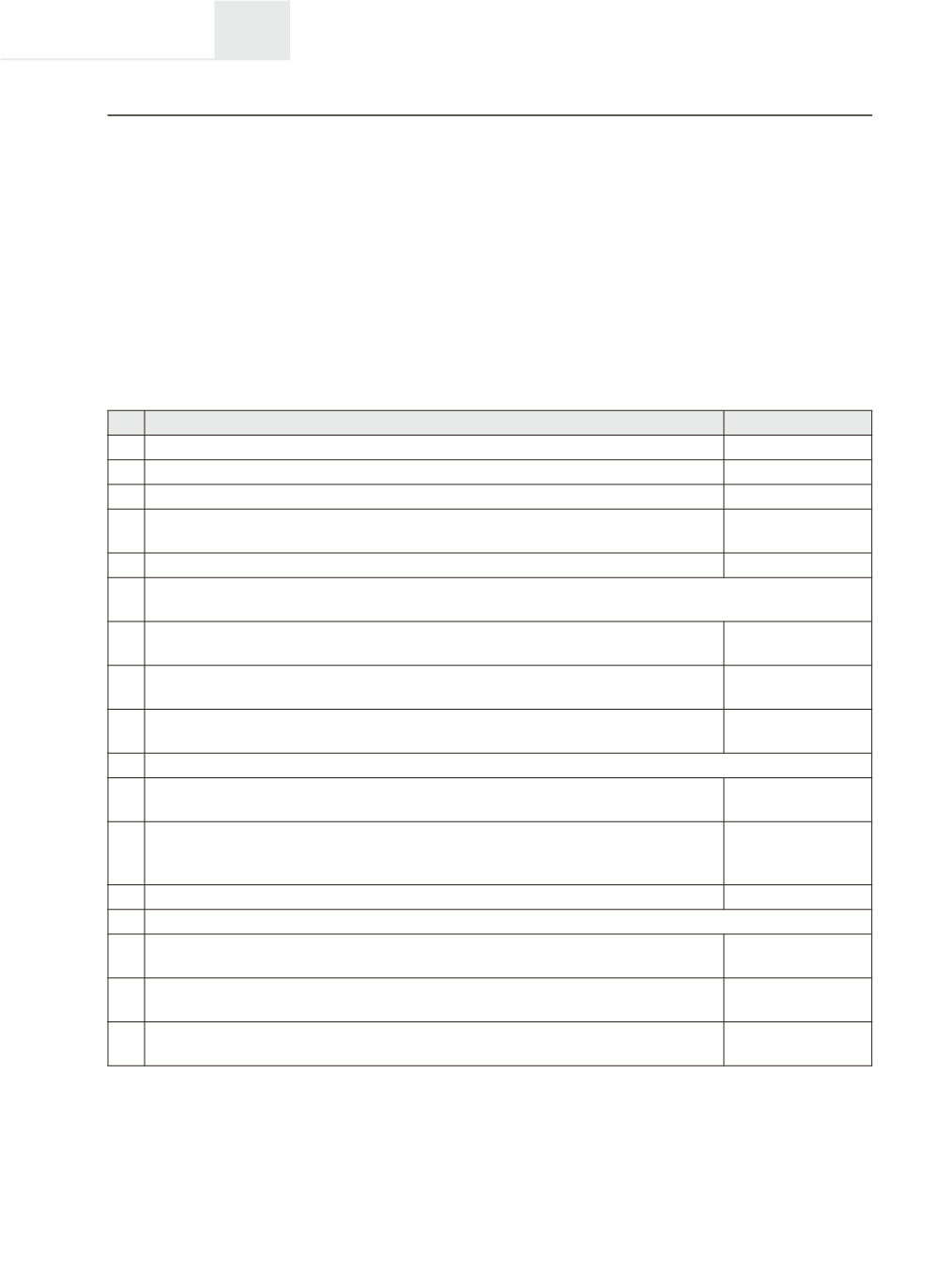

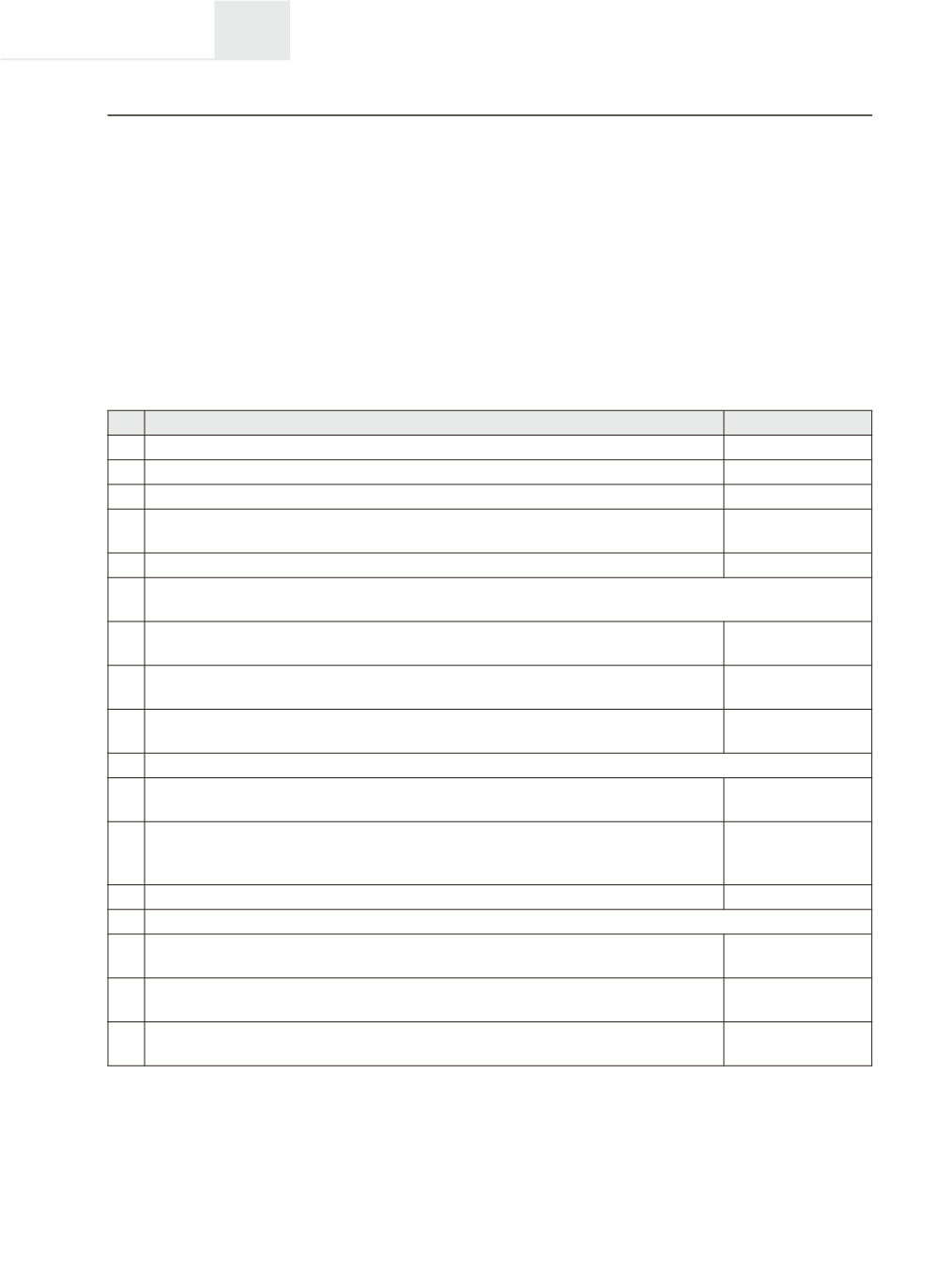

Table 5.1: Macro Estimates of benefits from KCC financing

Sl

Particulars

Estimates

1 Number of Operative/ Live KCC accounts as on 31.03.2015

7,40,94,090

2 Crop loan disbursed through KCC during 2014-15

Rs. 6,35,412 crore

3 Average crop loan disbursed per farmer during 2014-15

Rs. 85,757

4

Average crop loan disbursed per acre during 2014-15#

(Considering average size of holding in India =2.84 acres i.e. 1.15 ha)

Rs. 31923

5 Average increase in farm income per acre due to KCC

Rs. 5,463

6 Gain per acre per annum net of interest due to KCC financing (Excess of farm income of KCC

farmers over non-KCC farmers) (Pl see Table 3.10)

6 (i)

Gain net of interest burden per acre per annum–

No Subvention (i.e. 9% per annum)

Rs. 2591

6

(ii)

Gain net of interest burden per acre per annum– with interest Subvention

(i.e. 7% per annum on loan up to Rs. 3.0 lakh & 9% on above Rs 3.0 lakh)

Rs. 2974

6

(iii)

Gain net of interest burden per acre per annum– Prompt Repayment

(i.e. 4% per annum on loan up to Rs. 3.0 lakh & 9% on above Rs 3.0 lakh)

Rs. 3548

Macro Estimates:

7

Estimated agricultural cropped area covered by KCC (7.41 crore operative KCC

accounts multiplied by average size of holding 1.15 ha)

85.208 mill ha

(241.99 mill acre)

8

Estimated area eligible for Interest Subvention

(@ 84.3%- Sample data indicates

that 9.2% sample farmers with 15.7% share in land holding were sanctioned loan

above Rs. 3.0 lakh.

71.83 million ha

(204 mill acre)

9 Total increase in farm income of farmers on account of KCC financing $

Rs. 1,32,199 crore

10

Total increase in farm income ‘net of interest cost’ on account of KCC financing

10

(i)

Total increase in farm income per annum net of interest –No Subvention (i.e. 9%

per annum) on total land coved under KCC

Rs. 62,670 crore

10

(ii)

Total increase in farm income per annum net of interest – with interest Subvention

(i.e. 7% per annum on loan < Rs. 3.0 lakh & 9% on above Rs 3.0 lakh)

Rs. 71,968 crore

10

(iii)

Total increase in farm income per annum net of interest – Prompt Repayment (i.e.

4% per annum on loan up to Rs. 3.0 lakh & 9% on above Rs 3.0 lakh)

Rs. 85,858 crore

Note: (i) ** Since 2% subvention is given to banks so that they lend at 7% to the farmers, it is

assumed that banks would be lending to farmers at 9% in absence of interest subvention

scheme.

(ii) # Average loan per acre disbursed to sample farmers in the study area is Rs. 31,923 per

acre per annum.

(iv)

$ The contribution of KCC financing is calculated by taking the increase in farm income

of KCC farmers over non-KCC farmers

CHAPTER

5