bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

103

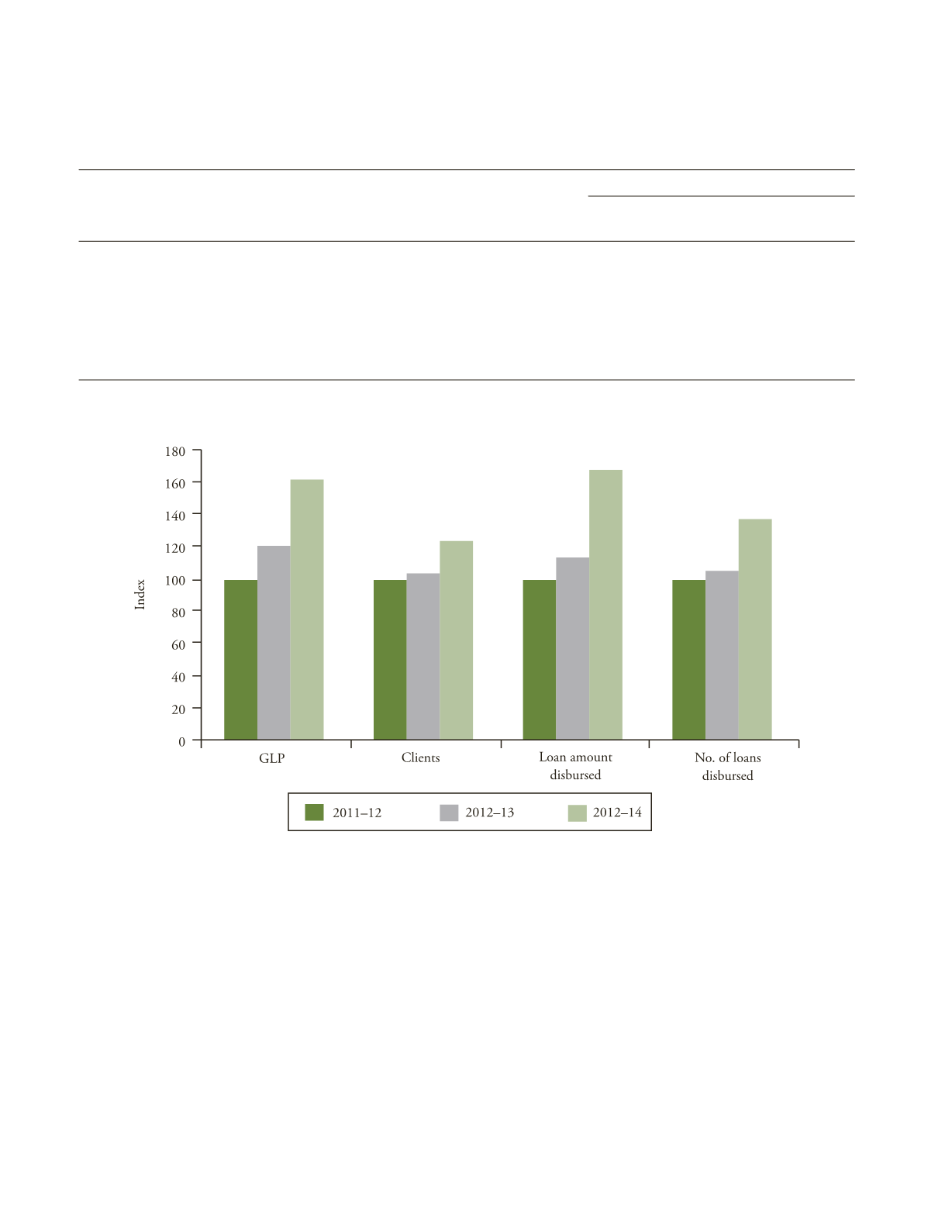

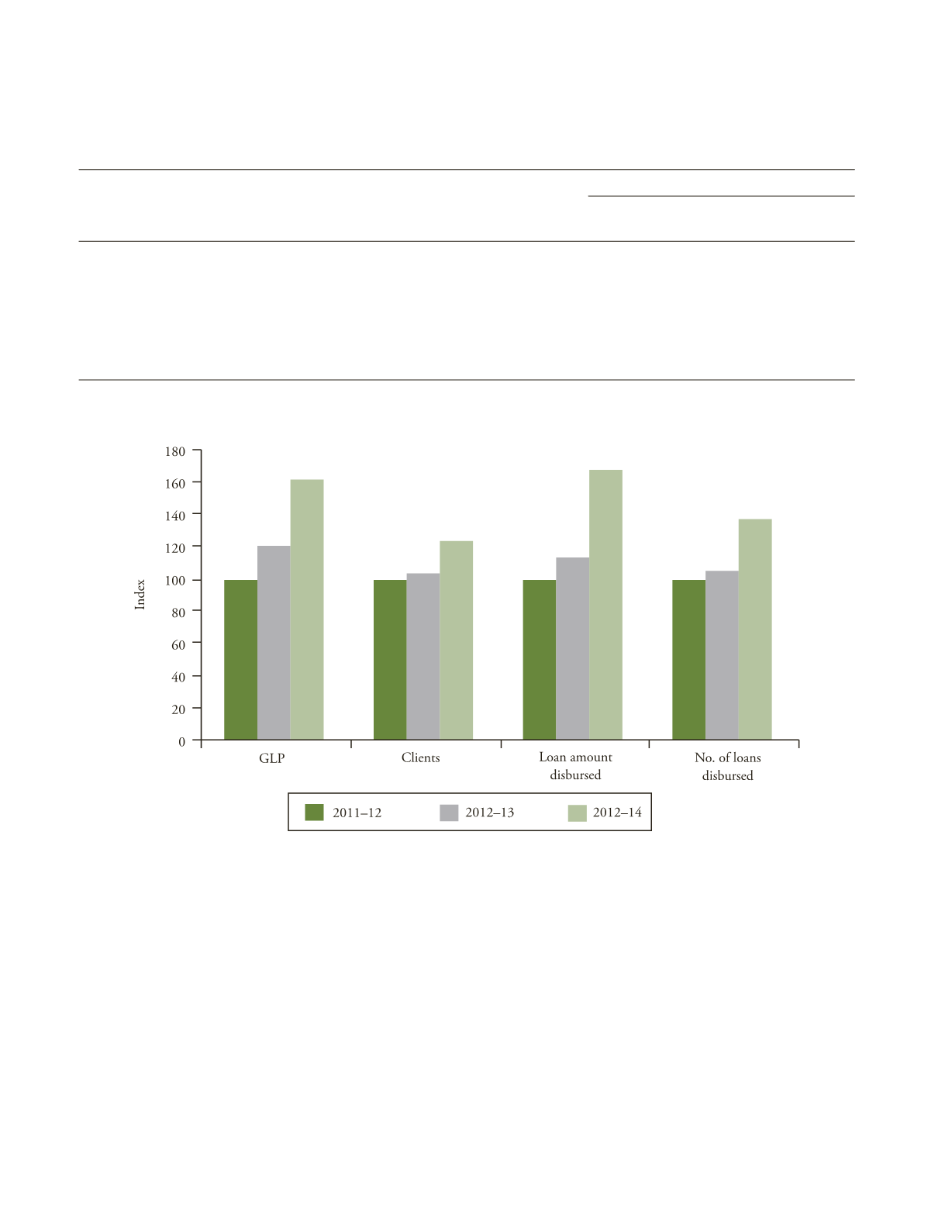

Figure 4.9 presents the direction of growth in NBFCs

over the triennium 2011/12–2013/14 captured through

index numbers with 2011–12 as the base year.

The structure of the NBFC-MFI sector is clearly

top heavy. The smaller NBFCs (having GLP below one

billion) with 70 per cent share in number has only 14 per

cent share in GLP (Table 4.17 and Figure 4.10). The nine

NBFCs with portfolio above Rs. 1000 crore make up for

75 per cent of the sector’s overall GLP, with the top two—

Bandhan and SKS—accounting for about 45 per cent.

In terms of growth as Figure 4.10 shows the medium

sized MFIs (GLP 1–5 billion) are found to be the most

dynamic. Those with GLP below 1 billion have grown at

constant rates over the period 2011/12–2013/14.

It is difficult to have such standardized data for the

non-profit segment of the microfinance industry. The

MIX has data relating to more than 160 MFIs. The data

on MFIs presented here has been compiled from the MIX

database for the reporting periods 2012–13 and 2013–

14. Since annual data was not available for all MFIs for

T

ABLE

4.16

Growth of NBFC-MFIs: Major Indicators

Parameters

2011–12

2012–13

2013–14

Growth rate

2011–12 to

2012–13 to

2011–12 to

2012–13

2013–14

2013–14

Gross loan portfolio (Rs. bn)

173.83

207.26

279.31

19.23

34.76

60.68

Clients (mn)

22.74

23.3

28.04

2.46

20.34

23.31

Loan amount disbursed (Rs. bn)

209.51

236.86

349.68

13.05

47.63

66.90

Number of Loans disbursed (mn)

17.65

18.57

24.38

5.21

31.29

38.13

Branches

9,777

9,103

9,780

–6.89

7.44

0.03

Employees

72,985

61,746

67,838

–15.40

9.87

–7.05

Loan officers

45,556

40,280

44,400

–11.58

10.23

–2.54

Source

: MFIN (2014).

F

IGURE

4.8

Growth in NBFC-MFIs: 2011–12 to 2013–14