bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

111

the credit risk. With the credit bureau information now

available it is easier to keep track of loan repayment.

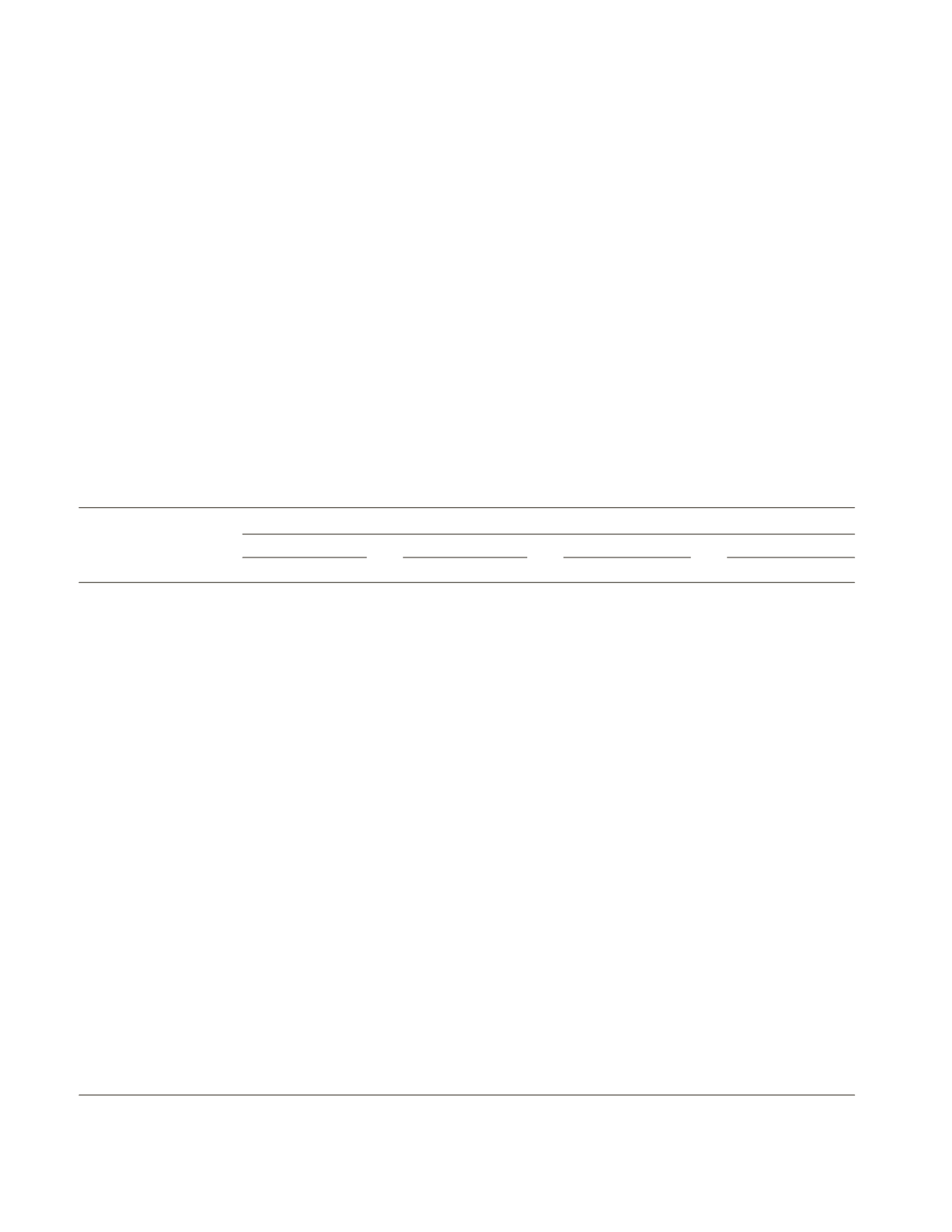

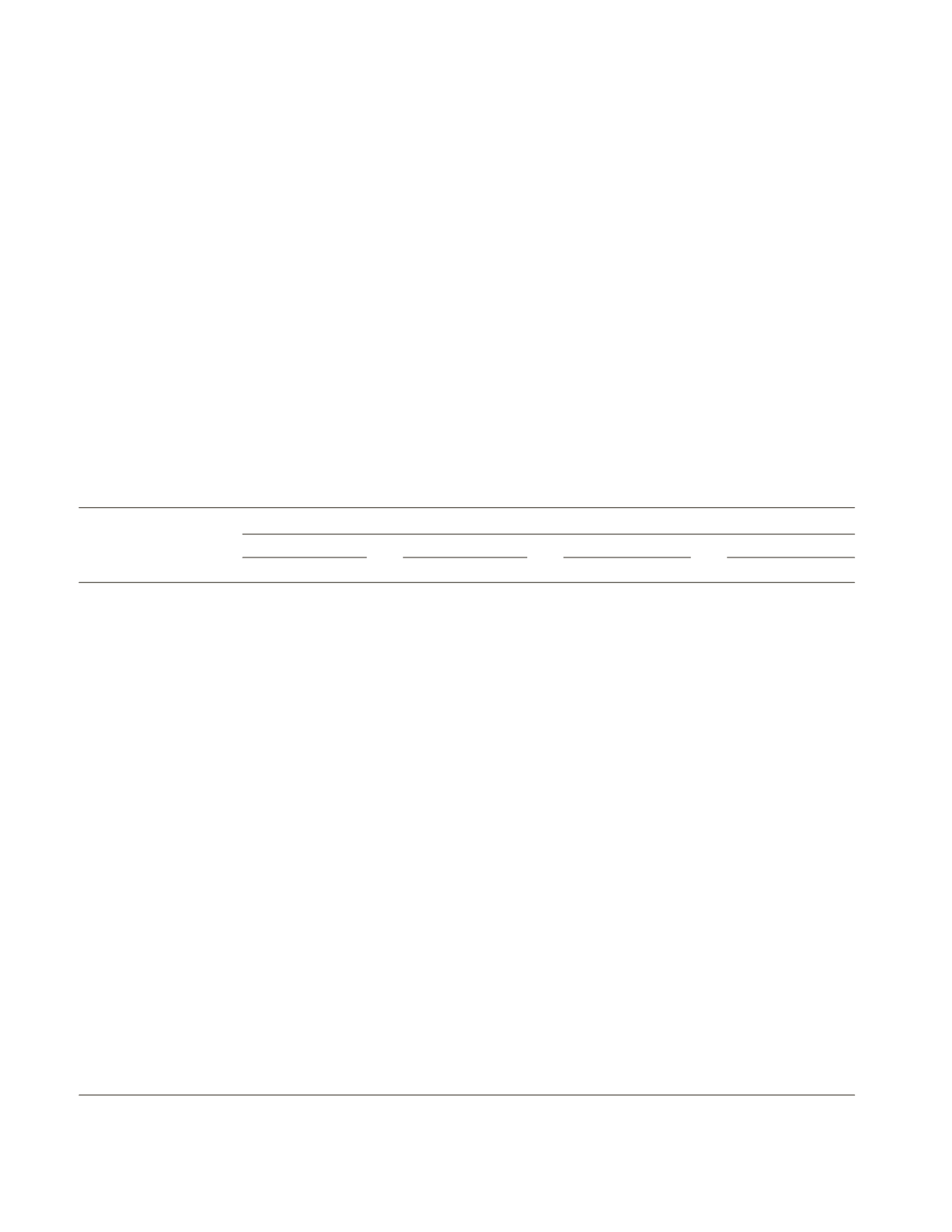

In Table 4.25 is presented the delinquency percentage

of different size classes of MFI across major states. The

general inference from the data is that delinquency is

an issue across states. The smaller MFIs appear as more

seriously affected by delinquency.

However, the delinquency rates by the number of

accounts that are more than 30 days outstanding has

been on a decline. They declined from 1 per cent in April

to 0.8 per cent in October 2013 (i.e., by 20 per cent).

Keeping Andhra Pradesh aside, the delinquency across all

size classes is the highest in Delhi, followed by Manipur.

Tamil Nadu, Rajasthan and Kerala too have reported

relatively higher delinquency rates. The specific reasons

for delinquency in different states warrants detailed

enquiry. The smaller states have reported low incidence

of delinquency.

4.14 MFIs AND FINANCIAL INCLUSION:

THE EMERGING DISCOURSE

MFIs and Urban Financial Exclusion

The market potential for microfinance in urban pov-

erty pockets like slums and low income neighbourhoods

caught the attention of MFIs since the mid 2000s. Urban

focused MFIs like Ujjivan, Janalakshmi, Satin Credit-

T

ABLE

4.25

Delinquency in MFIs

State

% of 30 + delinquency (31–179 DPD)

All

GLP > 5 billion

GLP 1–5 billion

GLP < 1 billion

Volume

Value

Volume

Value

Volume

Value

Volume

Value

Andhra Pradesh

74.38

127.79

0.55

0.50

8.62

81.50

65.21

45.79

Delhi

9.86

4.54

0.88

0.43

5.65

3.24

0.37

0.22

Manipur

8.74

9.29

0.00

0.00

8.74

9.29

Tamil Nadu

5.68

1.61

0.15

0.06

0.54

0.36

4.99

1.19

Rajasthan

5.36

1.94

0.86

0.83

0.20

0.13

4.30

0.98

Kerala

5.20

5.64

0.67

0.19

0.01

0.01

4.52

5.44

Jharkhand

4.93

5.38

0.43

0.25

0.35

0.25

4.15

4.88

Madhya Pradesh

4.44

2.32

0.13

0.07

1.30

0.53

3.01

1.72

Odisha

4.07

1.95

0.27

0.18

2.23

0.91

1.57

0.86

West Bengal

3.72

3.49

0.49

0.29

1.14

0.78

2.09

2.42

Karnataka

2.18

1.43

0.10

0.10

0.60

0.41

1.48

0.92

Haryana

1.98

1.03

0.35

0.22

0.00

0.00

1.63

0.81

Maharashtra

1.97

1.03

0.22

0.10

1.53

0.85

0.13

0.06

Gujarat

1.51

0.51

0.23

0.13

0.61

0.33

0.66

0.06

Bihar

1.13

1.16

0.18

0.10

0.29

0.10

0.29

0.31

Uttar Pradesh

0.84

0.70

0.17

0.08

0.02

0.01

0.65

0.60

Tripura

0.79

0.33

0.11

0.04

0.66

0.28

0.03

0.01

Chandigarh

0.76

0.51

0.28

0.26

Dadra and Nagar Haveli

0.72

0.29

0.72

0.29

Uttarakhand

0.72

0.45

0.15

0.08

0.23

0.33

0.33

0.04

Chhattisgarh

0.68

0.45

0.28

0.06

0.12

0.13

0.01

0.00

Sikkim

0.56

0.21

0.56

0.21

0.00

0.00

Punjab

0.46

0.37

0.46

0.37

0.00

0.00

Pondicherry

0.30

0.04

0.00

0.00

0.30

0.04

Goa

0.29

0.05

0.00

0.00

Meghalaya

0.21

0.26

0.12

0.09

0.09

0.17

Assam

0.00

0.00

0.17

0.07

0.20

0.18

0.76

0.91

Source

: Equifax records.