i nc lu s i ve f i nanc e i nd i a re port 2014

104

2013–14, only those MFIs are included in the analysis

for which (a) the latest data available was for the quarter

ending 31 December 2013; and (b) annual data is

available as on 31 March 2014. In one case—that of

BISWA—the data for the second quarter of 2013 has

been used.

Importantly, the NGO MFI segment too is heavily

skewed with just one MFI—Shree Kshetra Dharmasthala

Rural Development Project (SKDRDP)—accounting for

about half of all the borrowers and almost 60 per cent of

the portfolio. Since we have considered SKDRDP along

with the other major players—Cashpor, BISWA and

Sanghamitra—in both the years, the data can be said to

represent the actual trends quite closely.

Table 4.18 indicates that the non-profit MFIs grew

their GLP by 40 per cent and borrower base by 23

per cent. There has been some growth in human resources

and physical infrastructure too. What is critical about

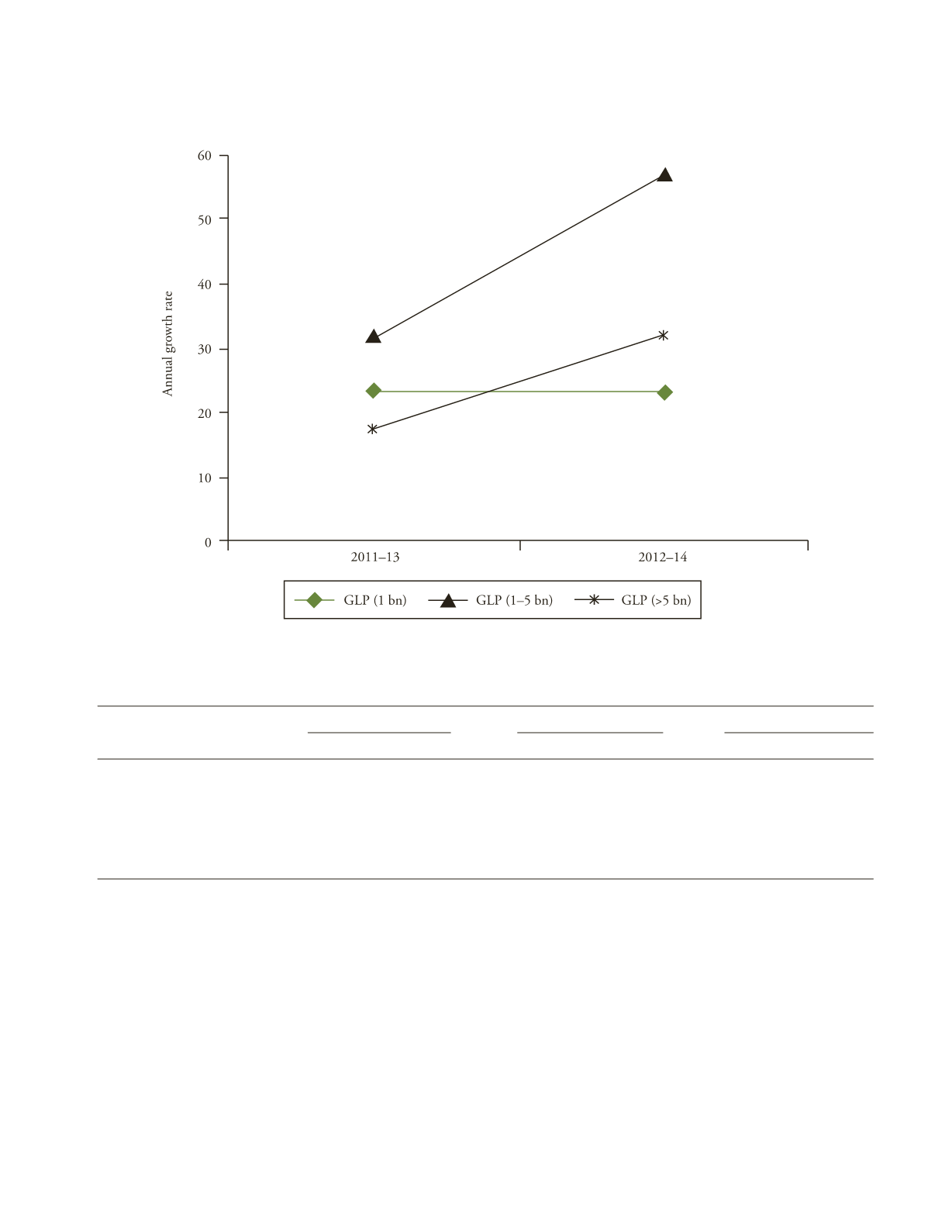

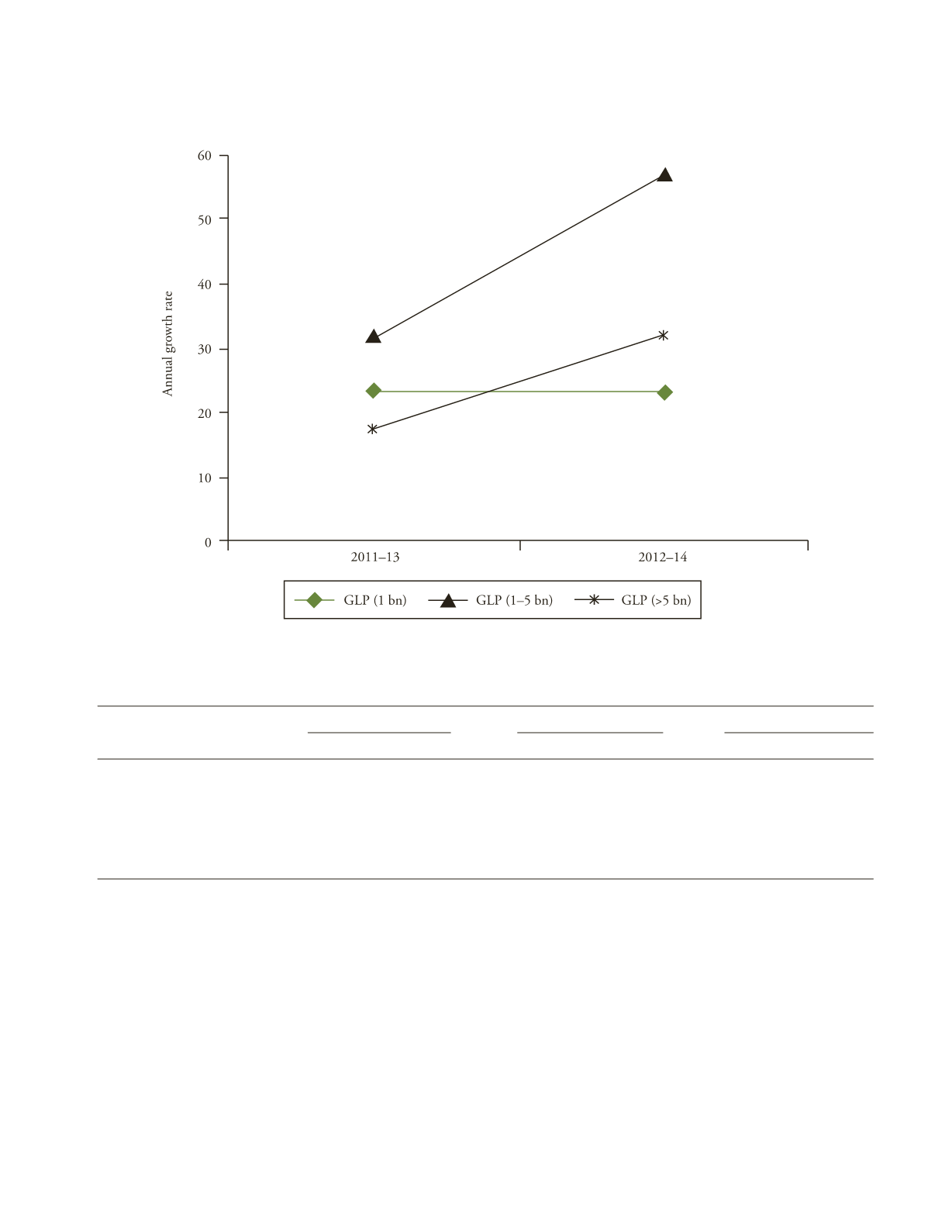

F

IGURE

4.9

Growth Rates by GLP Size Class

Table 4.17

Structure of the NBFC-MFI Sector

Year

<1 bn

1 to 5 bn

> 5 bn

GLP

Clients

GLP

Clients

GLP

Clients

2011–12

3.91

0.68

19.35

3.13

150.56

18.94

2012–13

4.82

0.77

25.55

2.99

176.89

19.55

2013–14

5.93

0.73

40.06

4.09

233.32

23.22

Growth rate

2011–13

23.27

13.24

32.04

–4.47

17.49

3.22

2012–14

23.03

–5.19

56.79

36.79

31.90

18.77

Source

: MFIN (2014).