i nc lu s i ve f i nanc e i nd i a re port 2014

108

been sympathetic to innovations like the partnership

model of the mid 2000s. It has allowed raising of capital

through ECB route and been liberal with respect to

equity investments in microfinance.

Equity investments continue to be reported by MFIs

in 2013–14. We have compiled information relating to

11 investment deals involving as many MFIs between

April 2013 and July 2014. These investments add up to

Rs. 7.48 billion (Table 4.22). A range of overseas and do-

mestic investors bought stakes in the MFIs through these

deals, while some have divested theirs. In a few cases, the

MFIS used non-convertible debentures (NCD) to raise

equity. For instance, Ujjivan, Bandhan, Utkarsh and

Grameen Koota raised about Rs. 2.76 billion through

NCDs (

.

SKS was the most active on the securitization front.

During 2013–14 it completed 12 securitization deals

worth Rs. 16.46 billion

19

. As per MFIN data, its

members have done securitization/asset sales worth

Rs. 5.14 billion during 2013–14, which is 54 per cent

more than the previous year. This works out to be

18 per cent of the overall portfolio size of NBFC-MFIs

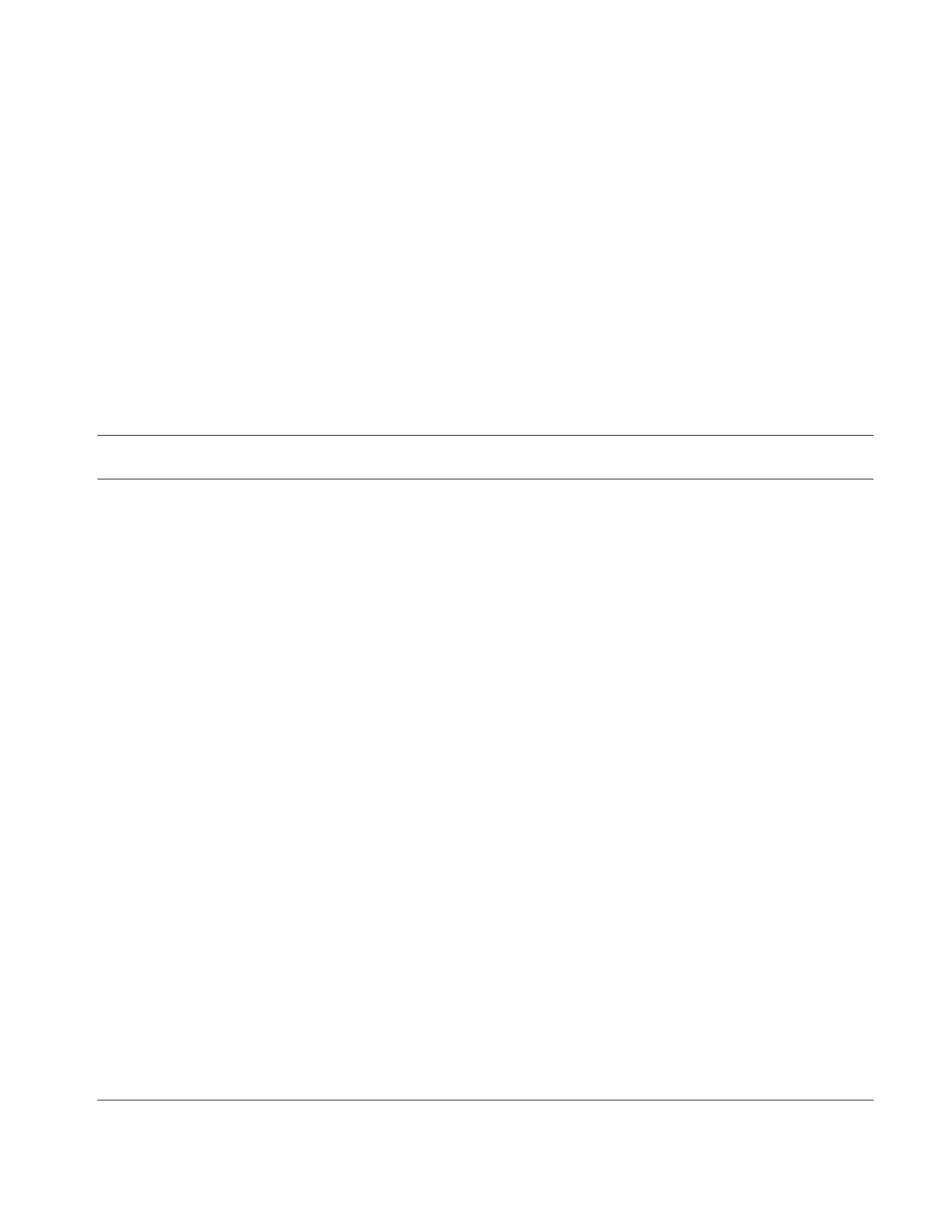

TABLE 4.22

Equity Infusion in MFIs—April 2013 to July 2014

Month of

announcement

MFI name

Size of equity infusion

(Rs. Billion)

Investors

April 2013

Satin Credit Care Network

Limited

0.31

Microvest II

Shore Cap II Ltd.

Danish Microfinance Partners K/S

April 2013

Utkarsh

0.20

Aavishkar Goodwell

IFC

Incofin Investment Management

August 2013

Janalakshmi Financial Services

Pvt. Ltd.

3.50

Morgan Stanley Pvt. Equity Asia

Tata Capital Growth Fund

QRG Enterprises

Citi Venture Capital

India Financial Inclusion Fund

Vallabh Bhanushali

October 2013

Arohan

0.22

Aavishkar Goodwell II

Michael & Susan Dell Foundation

Swaminathan Anklesaria Aiyar

November 2013

Ananya Finance

0.18

WWB ISIS Fund

IDBI

December 2013

Equitas

0.996

CDC Group

March 2014

Annapurna Microfinance Private

limited

0.30

Incofin Investment Management’s Rural Impulse

Fund I

Belgian Investment Company for Developing

Countries (BIO)

April 2014

Satin Creditcare Network Limited

0.2844

Norwegian Microfinance Initiative (NMI) Fund

III KS

May 2014

Grameen Financial Services Ltd

(Grameen Koota)

0.80

Micro Ventures

June 2014

Suryoday

0.27

IFC

Aavishkar

Lok Capital

July 2014

RGVN

0.418

NMI

Oiko credit

All

7.4784

Source

:

MIX Premium Services