bu i ld i ng an i nc lu s i ve f i nanc i a l s e ctor i n i nd i a

107

T

ABLE

4.21

Flow of Bank Funds to MFIs

Financing agency

Year

Loans disbursed to MFIs during the year

Loan outstanding against MFIs

No. of MFIs

Amount

No. of MFIs

Amount

(Rs. crore)

(Rs. crore)

Commercial banks

2010–11

460

7,601

2,153

10,647

2011–12

36

4,951

1,684

9,811

2012–13

368

7,423

1,769

12,468

2013–14

481

9,379

2,241

14,120

RRBs

2010–11

9

4

23

42

2011–12

113

13

128

38

2012–13

14

5

153

71

2013–14

16

163

124

222

Cooperative banks

2010–11

2011–12

4

2

19

5

2012–13

3

4

18

7

2013–14

4

4

17

8

SIDBI

2010–11

2

844

139

3,042

2011–12

12

239

129

1,597

2012–13

41

408

102

1,881

2013–14

41

646

84

1,980

All agencies

2010–11

471

8,449

2,315

13,731

2011–12

465

5,205

1,960

11,450

2012–13

426

7,840

2,042

14,426

2013–14

545

10,282

2,422

16,517

Source

: Nair and Tankha (2014); NABARD (2014).

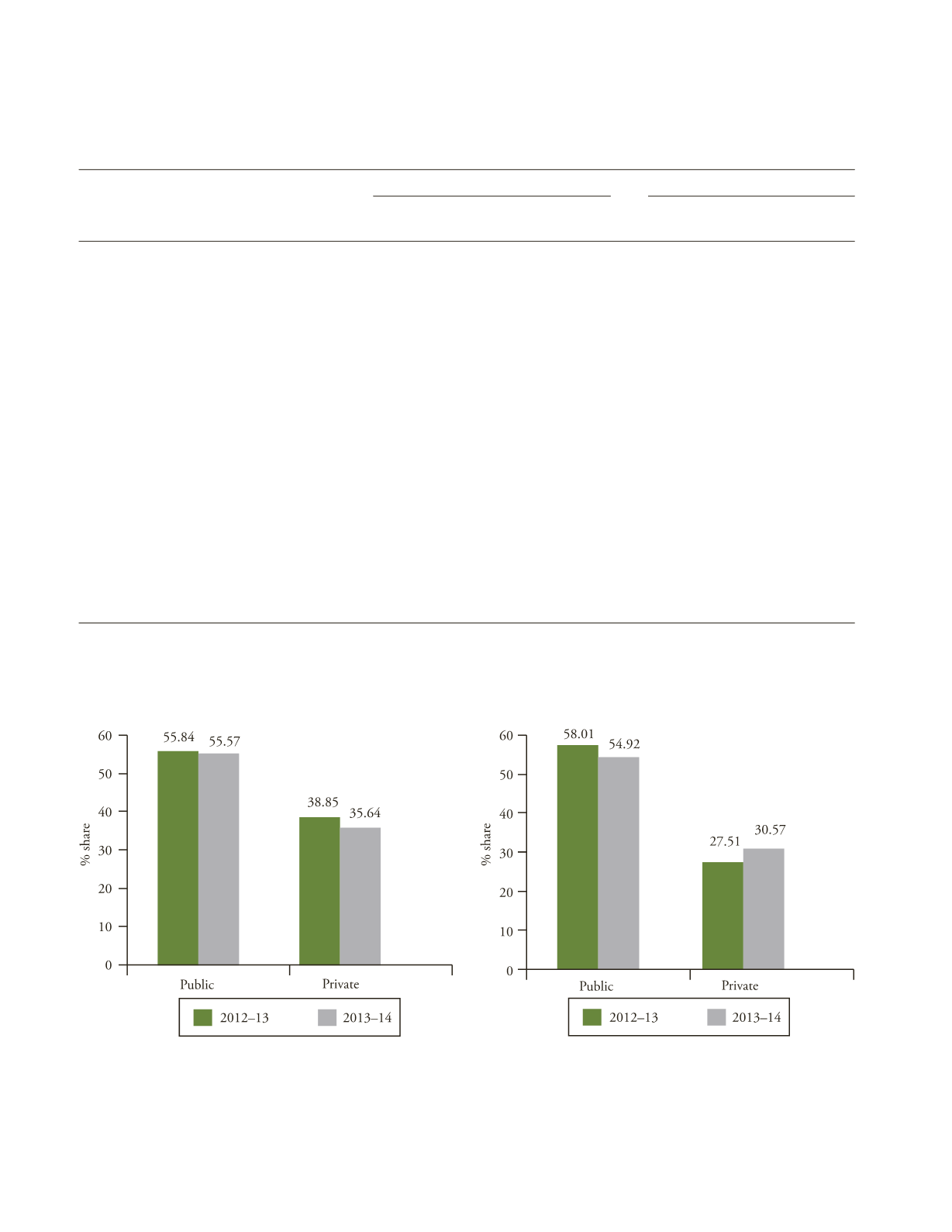

F

IGURE

4.10

Share of Public and Private Sectors in Bank Loan

Disbursed to MFIs

Source

: Same as Table 4.10.

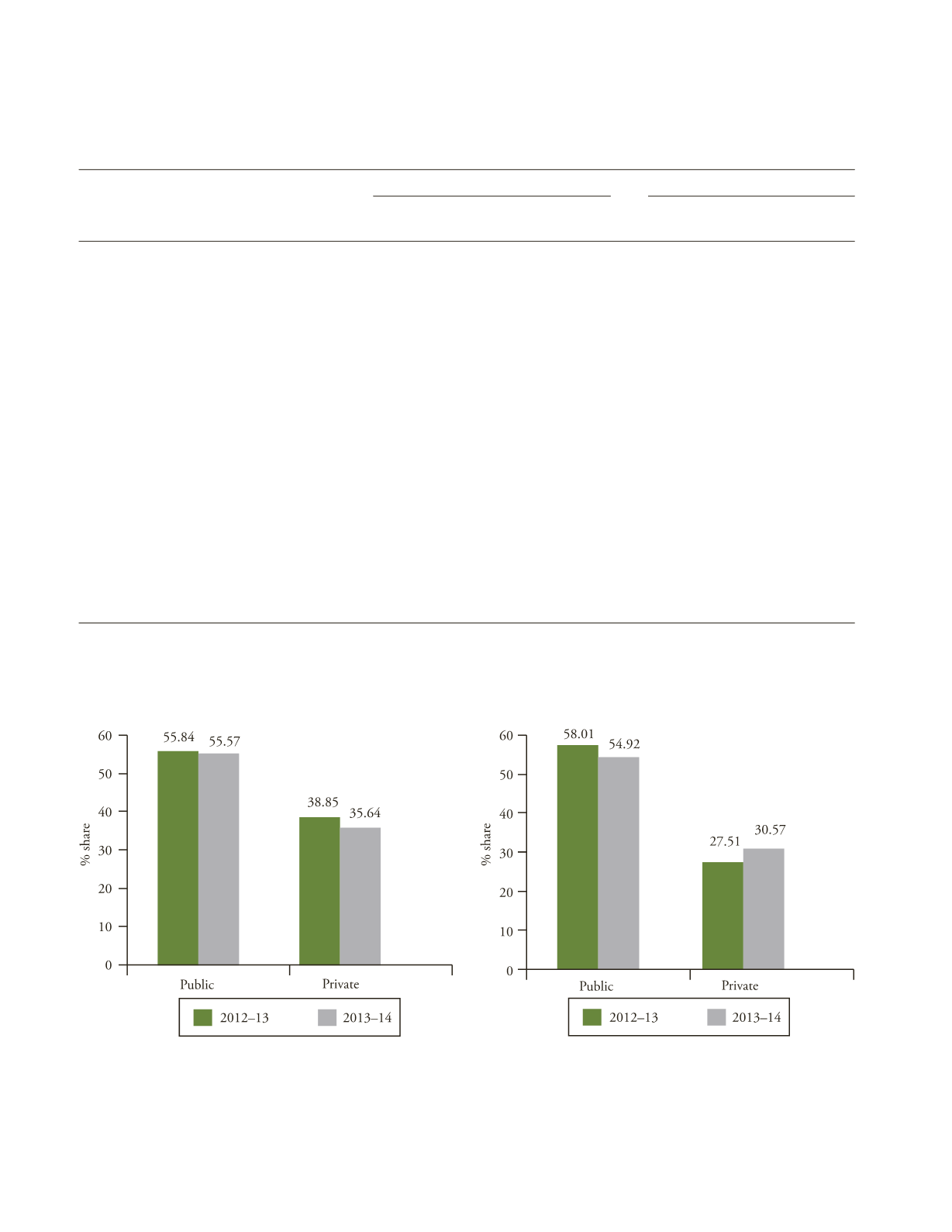

F

IGURE

4.11

Share of Public and Private Sectors in Outstanding

Bank Loans against MFIs

Source

: Same as Table 4.10.