83

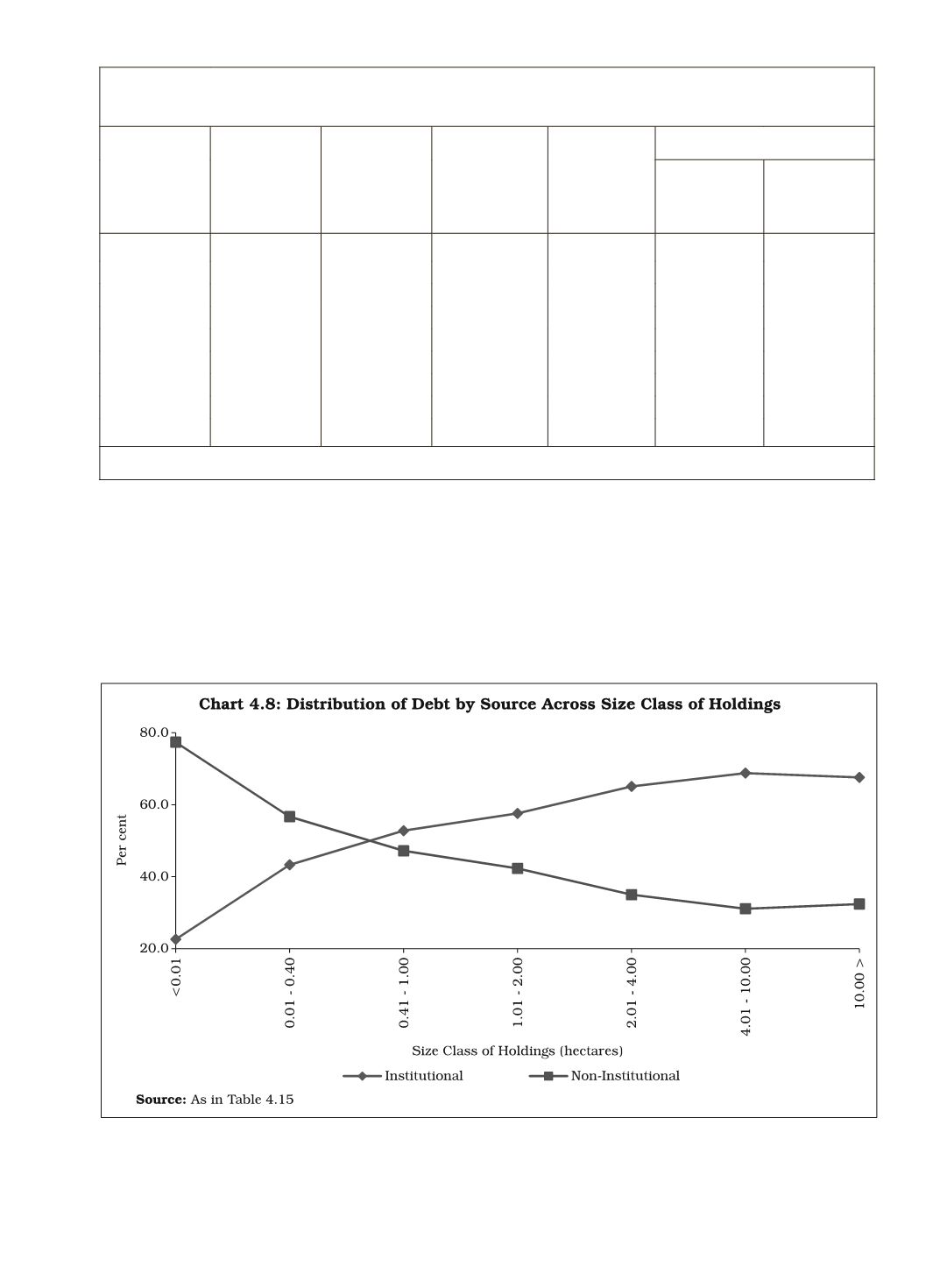

and Chat 4.9, there is a consistent rise in the share of loans from institutional

agencies with the rise in the size class of holdings, and as an obverse, there is

fall in the share of loans from non-institutional agencies. Thus, the dependence

of small and marginal farmers on non-institutional agencies was as high as

57% to 77% in 2003.

Table 4.15: Incidence, Amount and Source of Indebtedness

by Land Holding Size, 2003

Size Class of

Land

Possesses

(Hectares)

Total

Households

(%)

Total

Indebted

Households

(%)

Incidence

of

Indebtedness

(%)

Amount

Outstanding

per Farmer

Houshold

[Rupees)

Loans from

Institutional

Agencies

(%)

Non

Institutional

Agencies (%)

< 0.01

1.4

1.3

45.3

6121

22.3

77.4

001 - 0.40

32.8

30.0

44.4

6545

43.3

56.7

0.41 - 1.00

31.7

29.8

45.3

8623

52.8

47.2

1.01 - 2.00

18.0

18.9

51.0

13762

57.6

42.3

Up to 2.00

83.9

79.9

46.3

8870

51.3

49.7

2.01 - 4.00

10.5

12.5

58.2

23456

65.1

35.0

4.01 - 10.00

4.8

6.4

65.1

42532

68.8

31.1

10.00 +

0.9

1.2

66.4

76232

67.6

32.4

All Sizes

100.0

100.0

48.6

12595

57.7

42.4

Source:

NSSO,

Situation Assessment Survey of Farmers, 2003

.