84

D. Neglect of Small Borrowers and other Vulnerable Groups in the

Distribution of Bank Credit

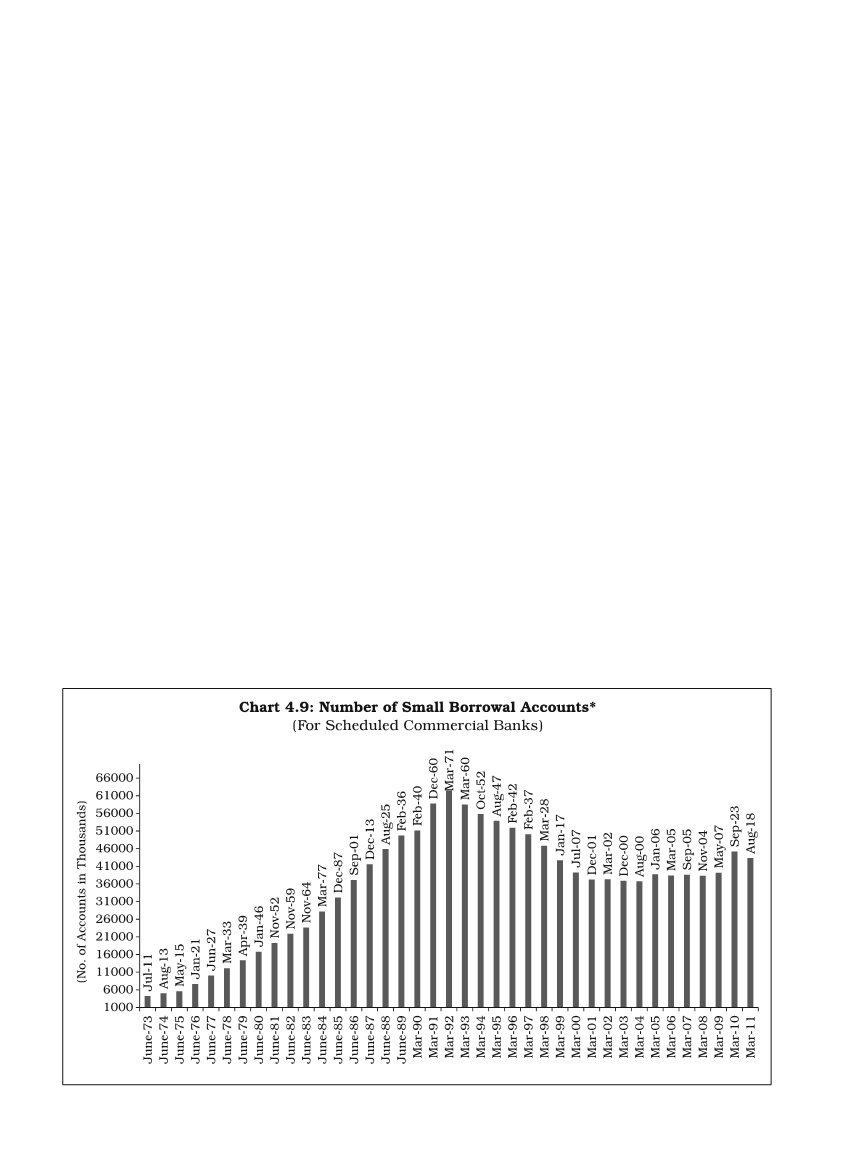

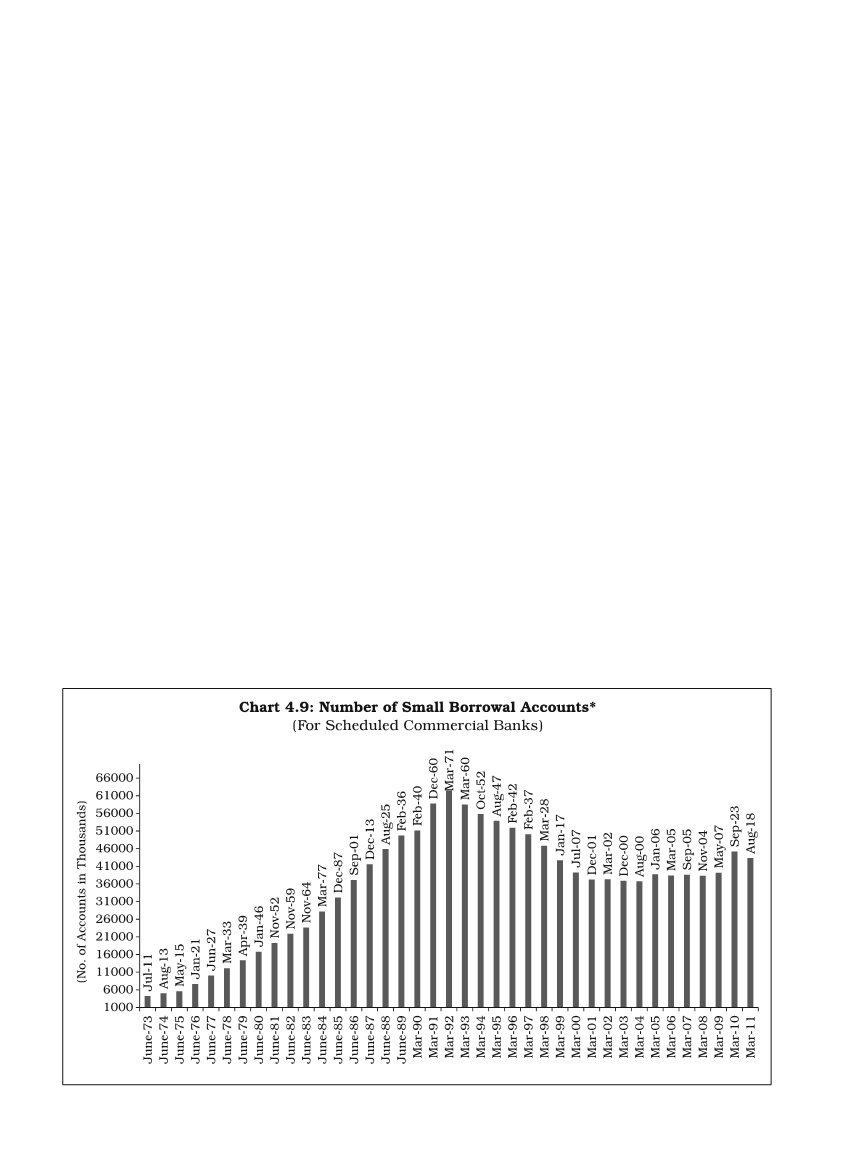

An overwhelming proportion of agricultural loans is of small size and

hence the neglect of agriculture and other informal sectors in bank credit

dispensation is also reflected in a steady decline in the number and share in

total bank credit of small borrowal accounts. Following bank nationalisation

and for the next two decades, there was an upsurge in such small loan

accounts. Between December 1972 and June 1983, there were 21.2 million

additional bank loan accounts in the aggregate added and nursed by the

scheduled commercial banks, of which 19.8 million or 93.1% were accounts

with

`

10,000 or less of credit limits. This trend of focusing on small borrowal

accounts continued for another decade up to March 1992 (despite the loan

waiver scheme effective March 15, 1990). Between December 1982 and March

1992, there were 38.1 million additional bank accounts, of which 36.0 million

(94.5%) were the redefined small borrowal accounts with credit limits of

`

25,000 and less (to account for the impact of inflation).

But, after the beginning of the 1990s, there was a sudden shift of focus

away from small loan accounts. Table 4.16 and Chart 4.10 depict the declining

trend in such small loan accounts. As summarised in Table 4.17, between

March 1992 and March 2001, there had been an absolute decline of about 13.5

million in the aggregate bank loan accounts and this has happened entirely

because of a much larger decline of 25.3 million accounts for the redefined