78

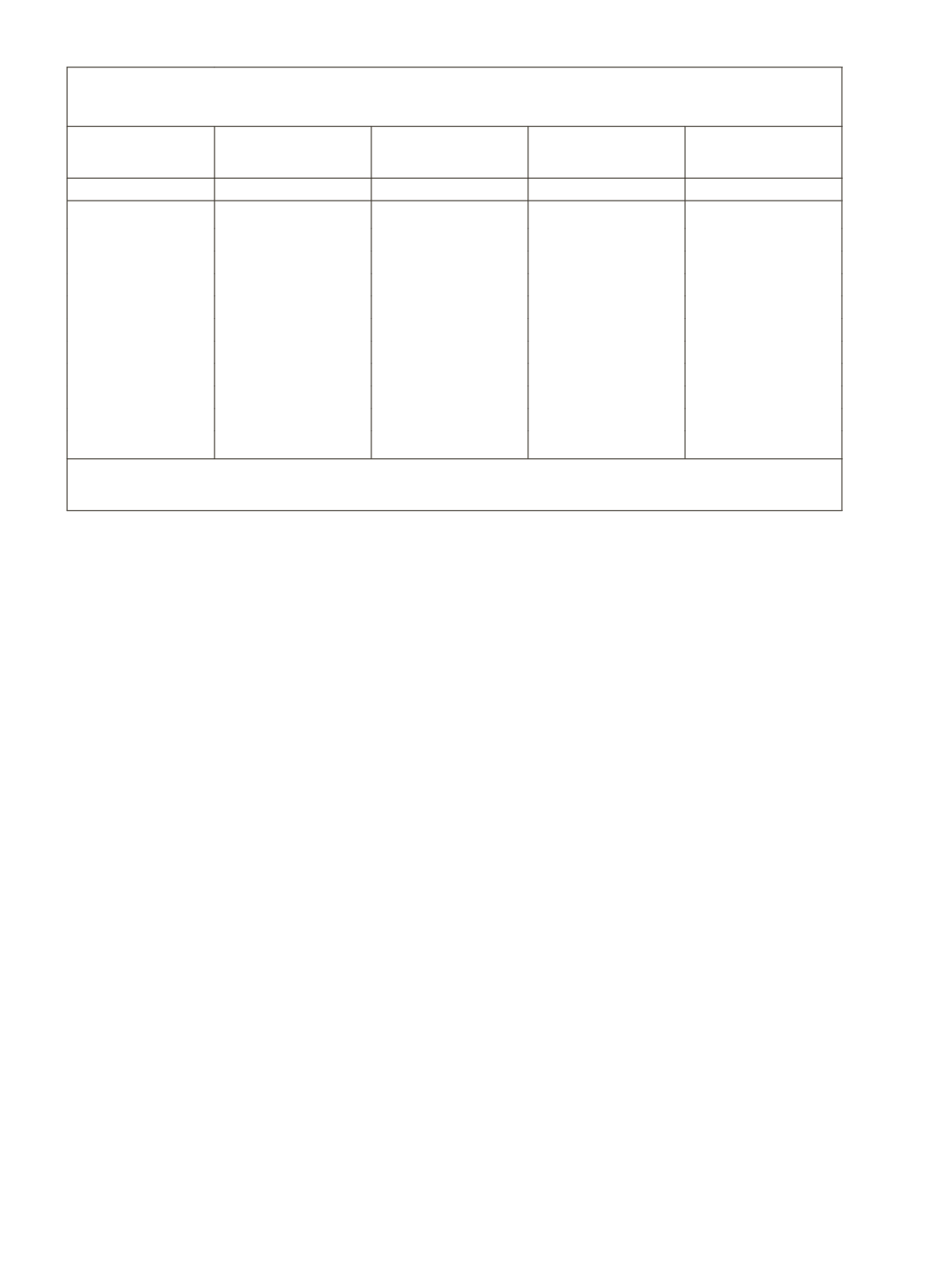

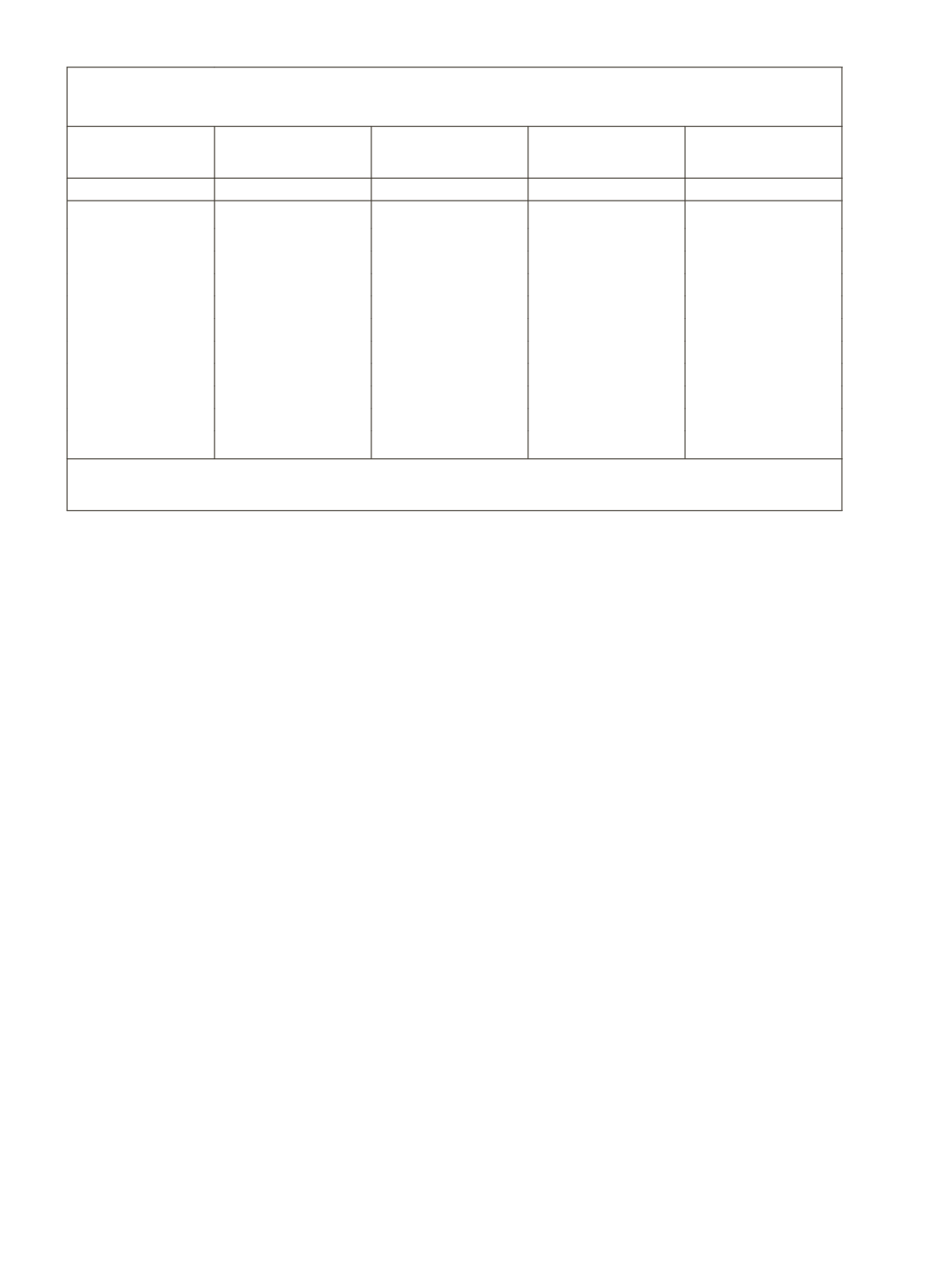

Table 4.11 provides a summary of the evolution of changes over the

period covered. As may be seen therein, the percentage share of loan accounts

above

`

2 lakh has consistently risen froma low of 10.3% inMarch 1992 to 34.1%

in March 2004. This change had been very rapid in the 1990s. Interestingly,

the period since doubling of bank credit, which has seen an expansion in the

number of loan accounts, has also experienced an equally rapid jump in the

share of large size loans deterioration in the distribution of agricultural credit.

The proportion of loan accounts with limit of

`

2 lakh and above has further

shot up from 34,1% in March 2004 to 52.0% in March 2011.

The recent period seems to have transformed the banks – farmer

relationship beyond recognition. Between March 2004 and March 2011, the

number of agricultural loan account holders having credit limits of

`

1 crore and

above has increased near eight fold from 4,652 to 17,216; their loan amounts

have likewise risen from

`

25,238 crore to

`

122,860 crore.

C. Bank Credit and Land Size

An important aspect of public policy has been to goad banks to provide

special focus on small andmarginal farmers in their credit delivery programmes.

As explained in a subsequent section, such vulnerable sections of farmers, along

with agricultural labourers, are covered under ‘weaker sections’ for which there

is a separate target of 10% of net bank credit. Besides, there were instructions

Table 4.11: A Summary of Size-Distribution of Agricultural Credit

(As Percentage of Total Direct Finance for Agriculture)

Year/Range

`

25,000 & Less Above

`

25,000 &

upto

`

2 lakh

`

2 lakh and less

Above

`

2 lakh

(1)

(2)

(3)

(4)=(2+3)

(5)

March 2011

6.7

41.3

48.0

52.0

March 2010

8.1

44.9

53.0

47.0

March 2009

10.7

46.1

56.8

43.2

March 2008

13.0

44.0

57.0

43.0

March 2007

14.3

41.8

56.1

43.9

March 2006

18.1

42.7

60.8

39.2

March 2005

22.9

43.8

66.7

33.3

March 2004

2.52

40.7

6.59

34.1

March 2002

34.3

42.7

77.0

23.0

March 1997

53.9

29.4

83.3

16.7

March 1992

61.3

28.4

89.7

10.3

Source:

RBI,

Banking Statistics: Basic Statistical Returns of Scheduled Commercial Banks in India,

March 2011 (Vol. 40) and earlier issues. See also Annexure B.