86

small borrowal accounts with credit limits of

`

25,000 and less. On the other

hand, borrowal accounts with higher credit limits of above

`

25,000 had shown

a relatively sizeable increase of 11.8 million as compared with only 2.1 million

increase in them during the preceding decade (December 1983 to March 1992).

Even in the next period between March 2001 and March 2005, while

there has occurred an addition of 24.79 million in total loan accounts, small

borrowal accounts had experienced an absolute fall of 0.49 million until March

2004. The year 2004-05 was the first year of farm credit doubling, when there

was an increase of 1.97 million accounts of small loans but thereafter the small

loan accounts generally followed a zig-zag pattern of declines and increases in

successive years (Table 4.17).

Besides, a more revealing aspect relates to the unusually sharp decline

in the share of small borrowers in the total bank credit outstanding (see Table

4.17). The decline has been persistent and that its, even in years when there has

occurred some increase in the number of small borrowal accounts. This share

in amount has reached such a puny level as 1.2% of the aggregate, it was about

25% at the end of the 1980s. This low figure in the share of small borrowal

accounts corresponds to the loss in momentum of loans to agriculturists.

It is necessary to clarify at this stage that we have consciously avoided

applying deflators for the small borrowal size of

`

25,000 because this size itself

is quite substantial for a vast number of informal sector borrowers, farmers in

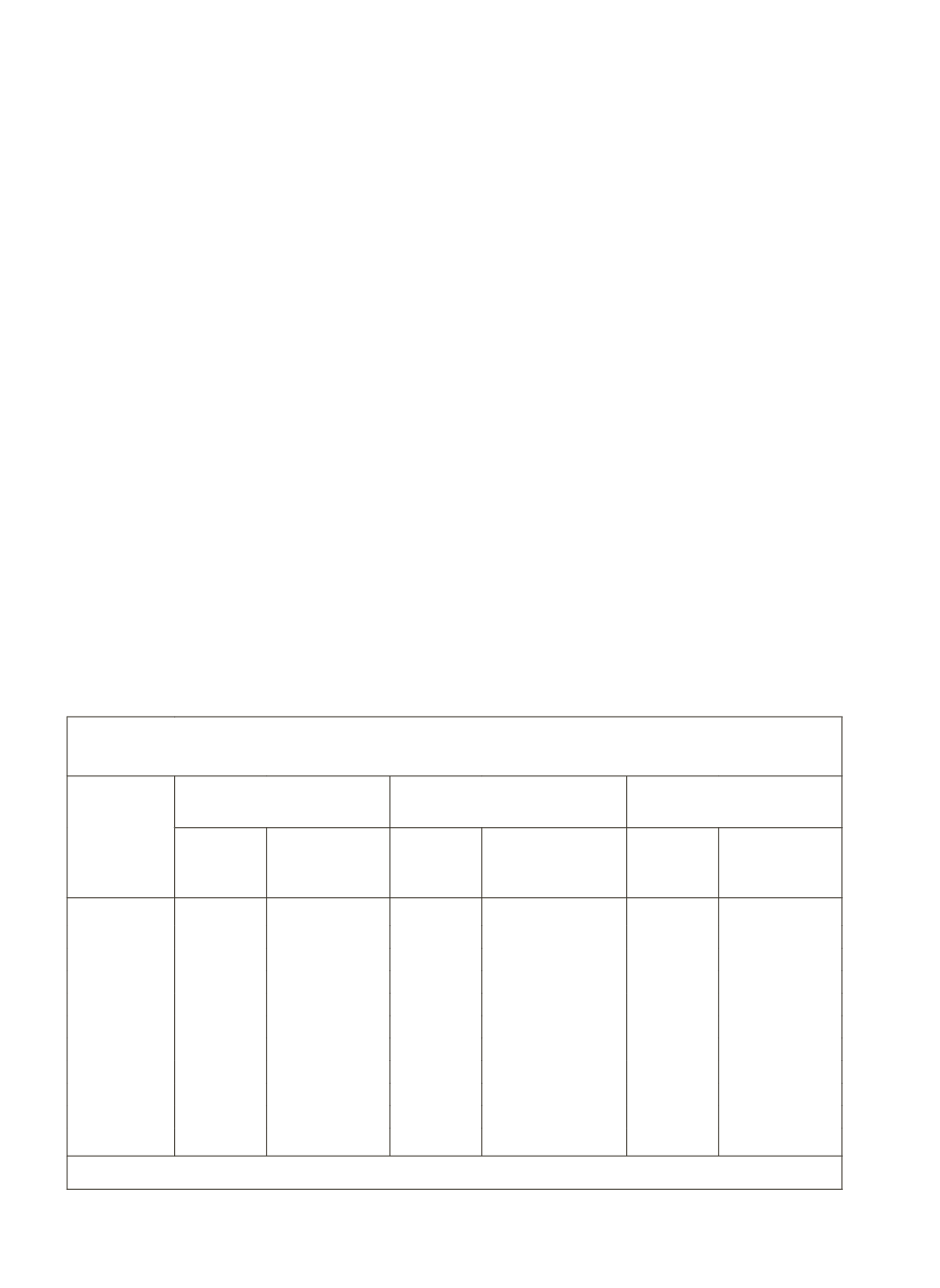

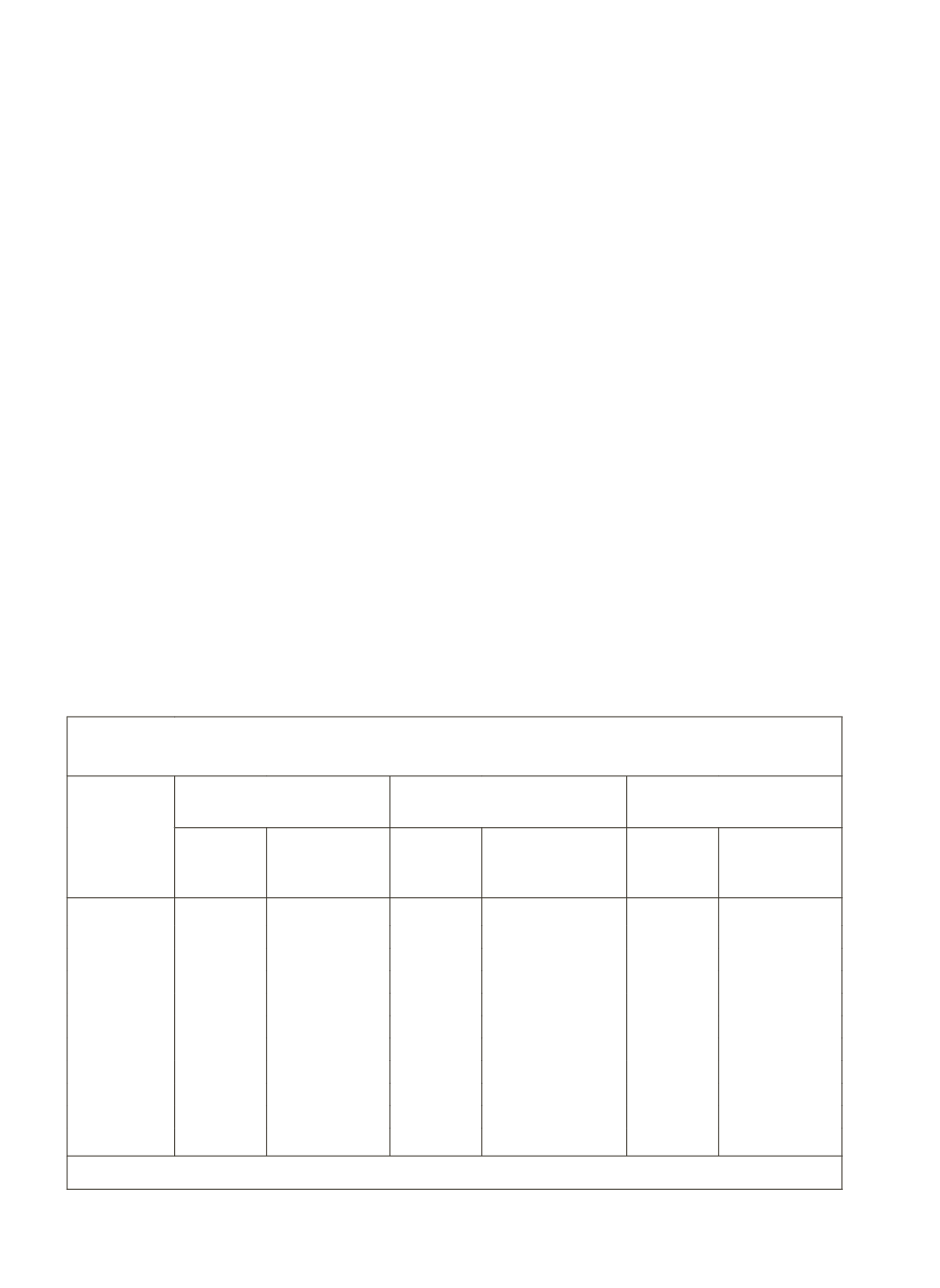

Table 4.17: Trends in the Number of Small Borrowal vis-à-vis

other Bank Loan Accounts

Period-End Total Bank Borrowal

Accounts (In Lakh)

Small Borrowal Accounts of

`

,25,000 or less (In Lakh)

Other Bigger Accounts

(In Lakh)

Number Increase over

the previous

period

Number Increase over the

previous period

Number Increase over

the previous

period

Dec-1983

277.48

-

265.21

-

12.27

-

March 1992

658.61

381.12 625.48

360.27

33.12

20.85

March 2001

523.65

(-) 134.95 372.52

(-) 252.96 151.13

118.01

March 2004

663.90

140.25 367.66

(-) 4.86 296.24

145.11

March 2005

771.51

107.61 387.33

19.67 384.18

87.94

March 2006

854.35

82.84 384.19

(-) 3.14 470.16

85.98

March 2007

944.42

90.07 386.12

1.93 558.30

88.14

March 2008 1069.90

125.48 382.98

(-) 3.14 686.92

128.62

March 2009 1100.56

30.66 392.07

9.09 708.49

21.57

March 2010 1186.48

85.93 451.80

59.73 734.68

26.19

March 2011 1207.24

20.76 433.22

(-)18.58 774.02

39.32

Source:

RBI's, Basic Statistical Returns of Scheduled Commercial Banks, various issues.