137

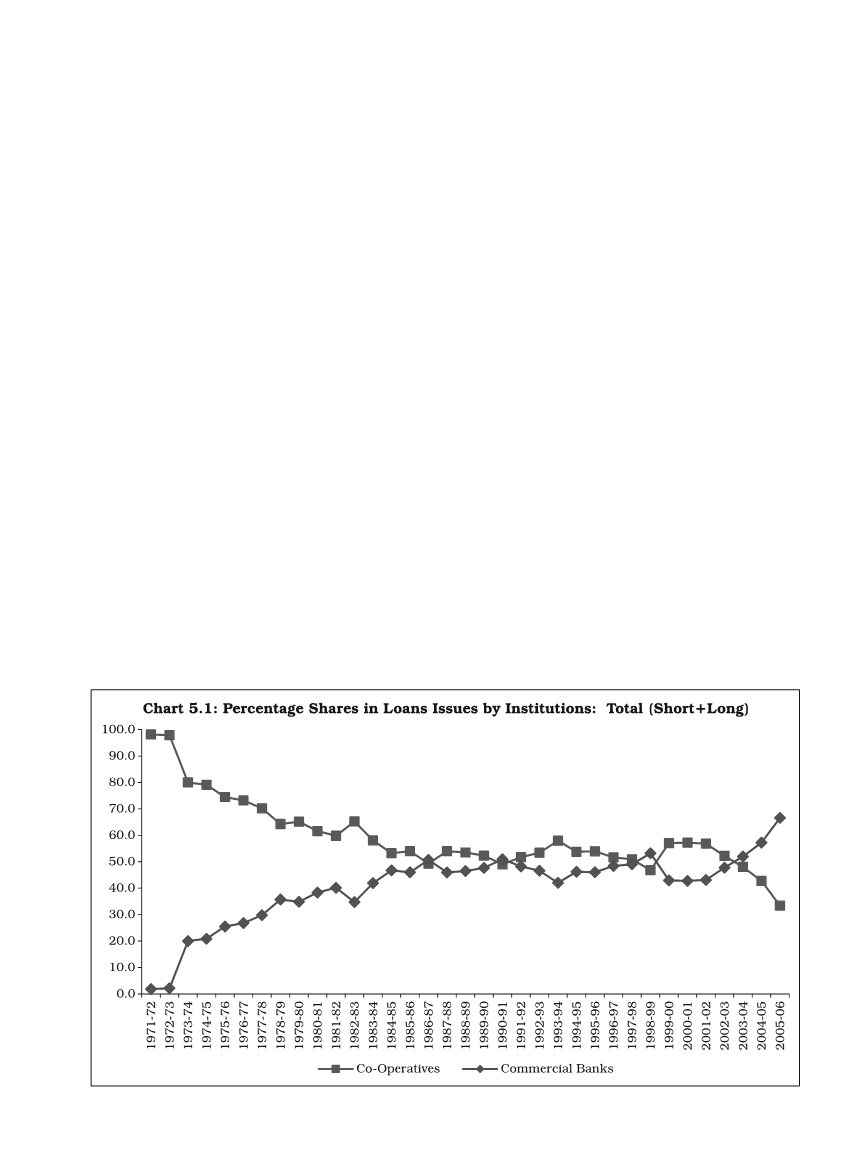

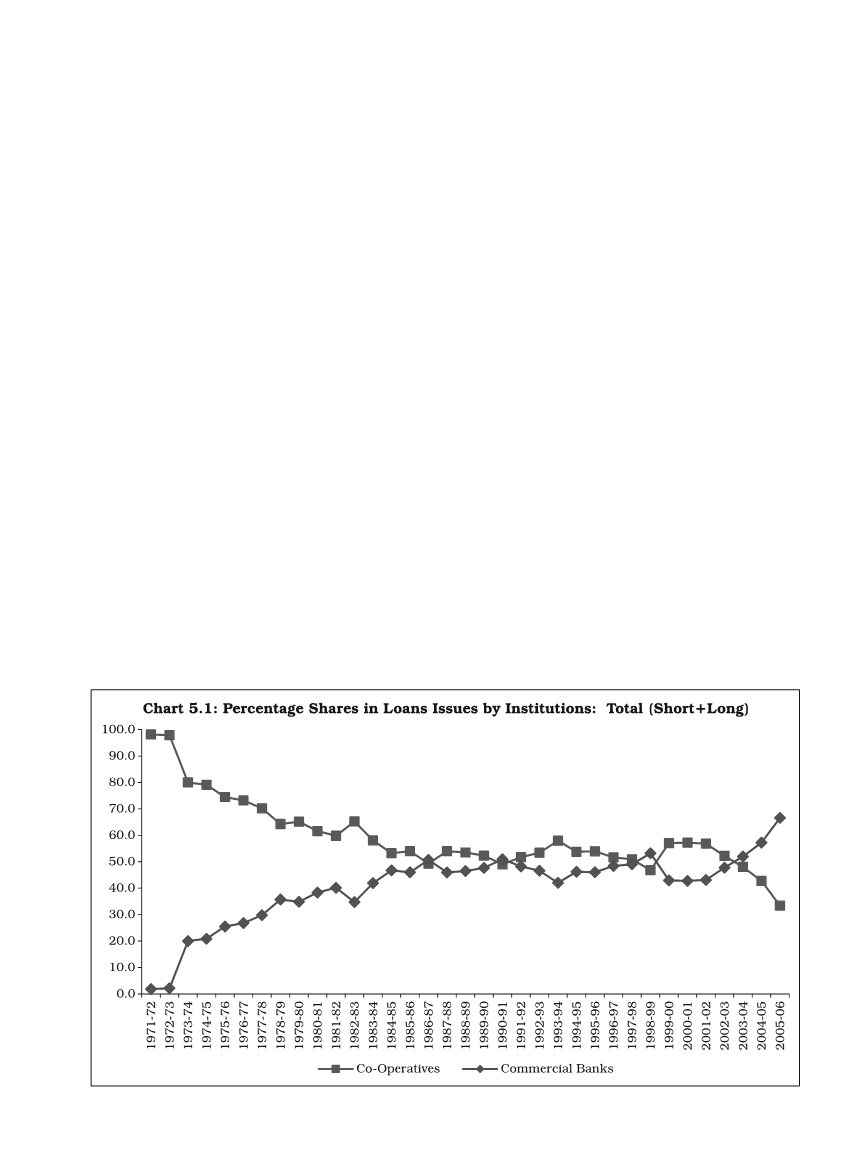

in agricultural lendings after bank nationalisation. Correspondingly, the share

of cooperatives in crop loans as well as term loans began to recede. But, it

must be said to the credit of the cooperative institutions that the decline in

their share had been rather slow and gradual until the 1990s. Also, based on

their vast institutional reach, cooperatives have retained their specialisation

in crop loans, while commercial banks, based on their vast resources and

expertise, have expanded their base in investment credit. In terms of absolute

amounts of total disbursements, cooperatives have had higher amounts than

commercial banks and RRBs put together until 1997-98. It was only thereafter

that a push to agricultural lendings by commercial banks was provided, based

on the R.V. Gupta Committee report (1997) which introduced a number of

procedural simplifications for such bank lending. This was particularly true in

crop loans. In term credit, commercial banks and RRBs together had overtaken

the cooperatives in the early 1980s; in essence that was how the commercial

banks’ involvement in agricultural lendings began. Overall, as said earlier, the

cooperatives have retained their specialisation in crop loans and commercial

banks in term loans.

To dilate a little more on the trends during the four decades after bank

nationalisation, the following key results are discernible.

First, overall growth:

After a sharp increase in total agriculture credit disbursements (i.e.

loans issued) at an annual rate of about 17% in nominal terms during the