142

demand and supply-side factors affecting bank credit expansion. Even so,

there was the acutely-felt financial exclusion phenomenon prevailing then and

hence, the Government introduced the policy of doubling of bank credit.

There has been a more rapid growth in agricultural credit disbursals

since 2004-05 but the real GDP growth in agriculture has remained moderate.

In many such blocks of years, supply-side factors have played a dominant role

in bank credit disbursals.

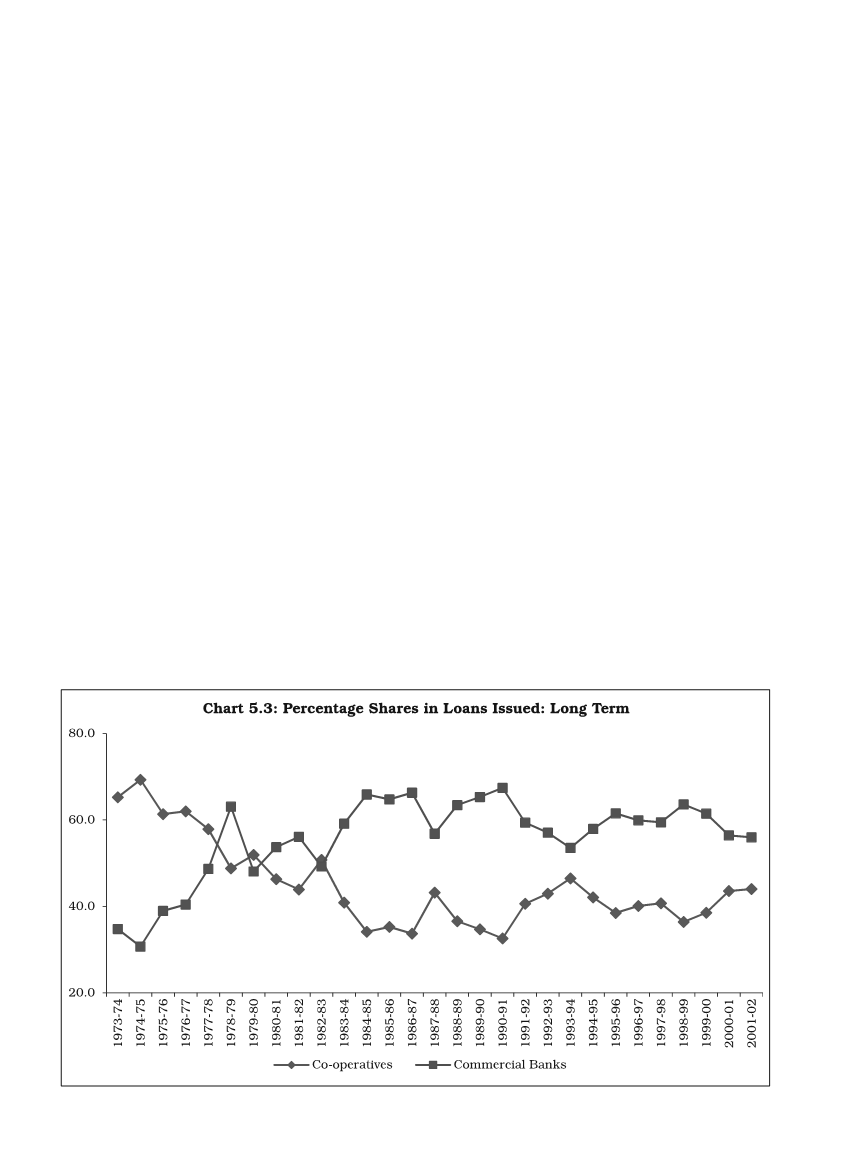

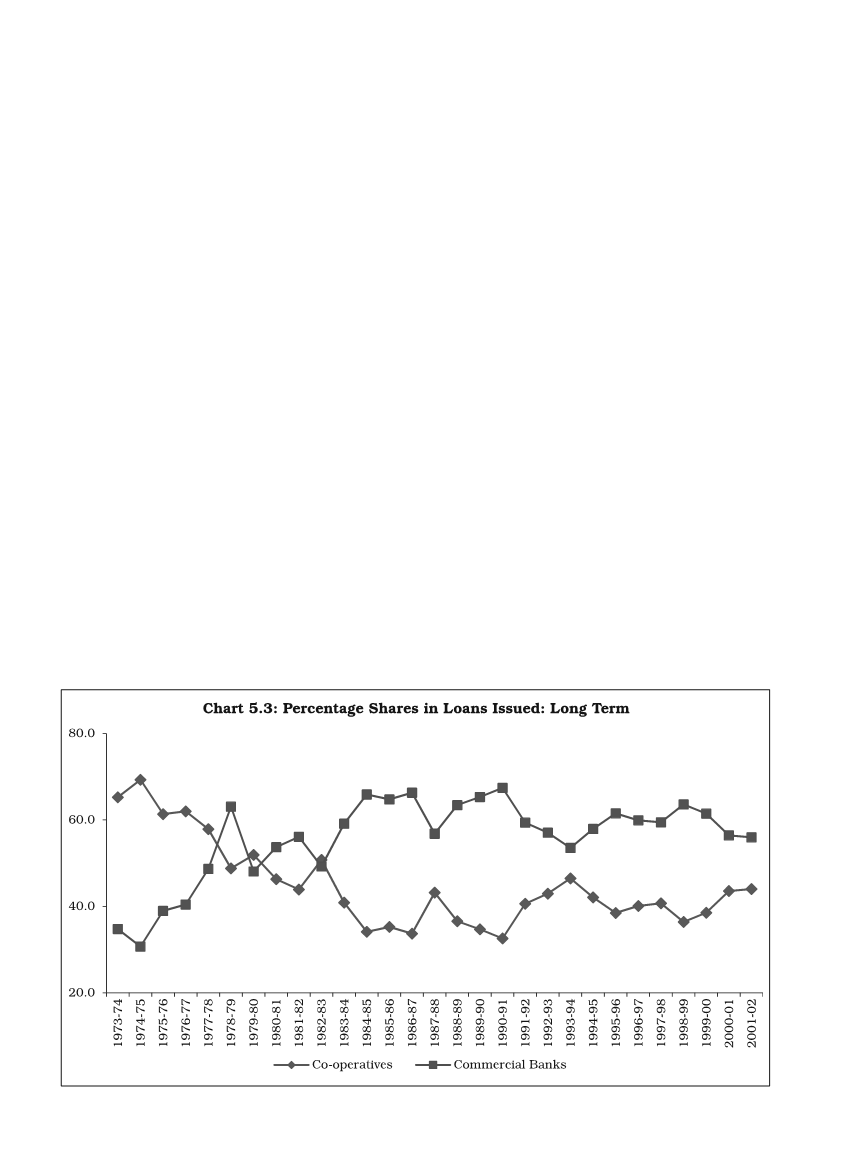

Finally, despite differing growth rates, the relative shares of different

agencies in crop loans, in term loans and in total agricultural loans have

generally produced a distinct pattern (See Annexures I and J and Table 5.3).

To begin with, in short-term loans, there occurred a steady fall in the shares

of cooperatives accompanied by corresponding increases in the shares of

commercial banks and RRBs together. In term loans, commercial banks did

make a headway in the 1970s and until the mid-1980s, but thereafter they

slackened which is reflected in their share falling in 1992-93 and 2001-02;

cooperatives’ share fell until 1985-86 but increased thereafter (Table 5.3 and

also Chart 12).

However, after the policy of doubling of bank credit began to be

implemented, commercial banks have expanded their share of term loans

issued quite dramatically, with an equally dramatic fall in the term loans share

of cooperatives. The share of commercial banks has shot up from 43% in

2001-02 to 75.0% in 2005-06 and further to 83.1% in 2009-10, thus dwarfing